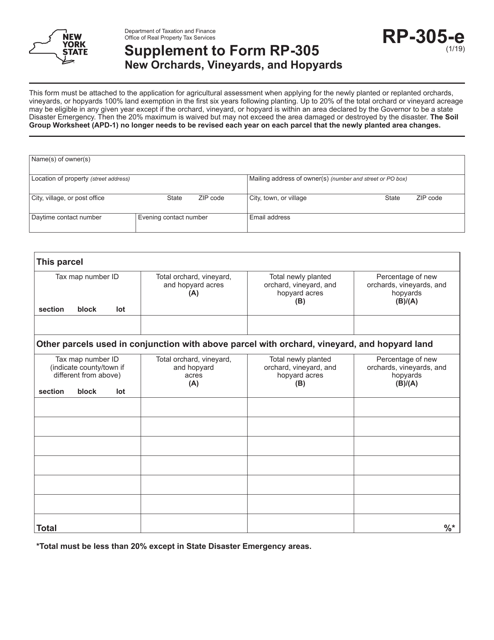

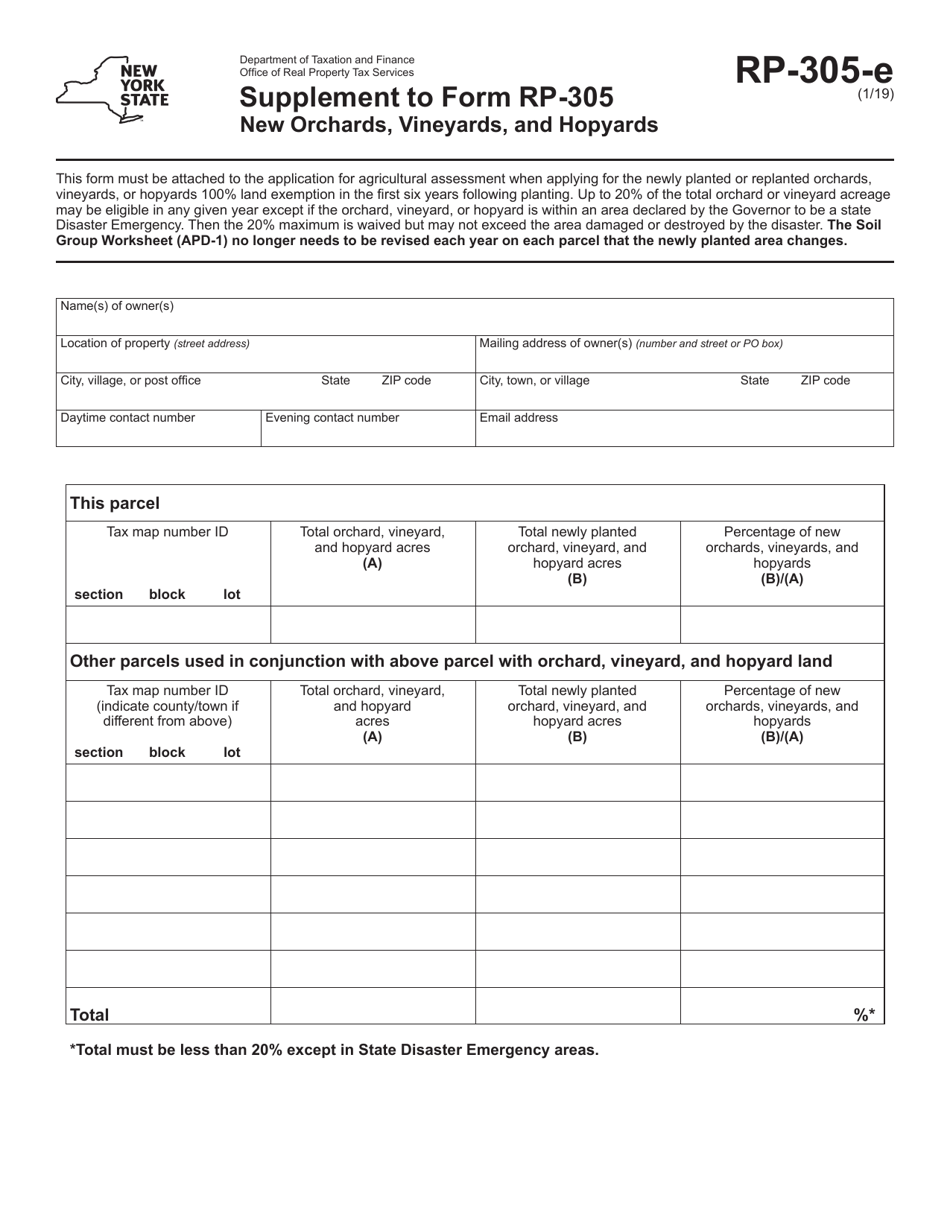

Form RP-305-E Supplement to Form Rp-305 - New Orchards, Vineyards, and Hopyards - New York

What Is Form RP-305-E?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-305-E?

A: Form RP-305-E is a supplement to Form RP-305.

Q: What is the purpose of Form RP-305-E?

A: Form RP-305-E is used for reporting new Orchards, Vineyards, and Hopyards in New York.

Q: Who needs to file Form RP-305-E?

A: Anyone who has established new Orchards, Vineyards, or Hopyards in New York needs to file Form RP-305-E.

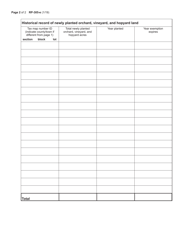

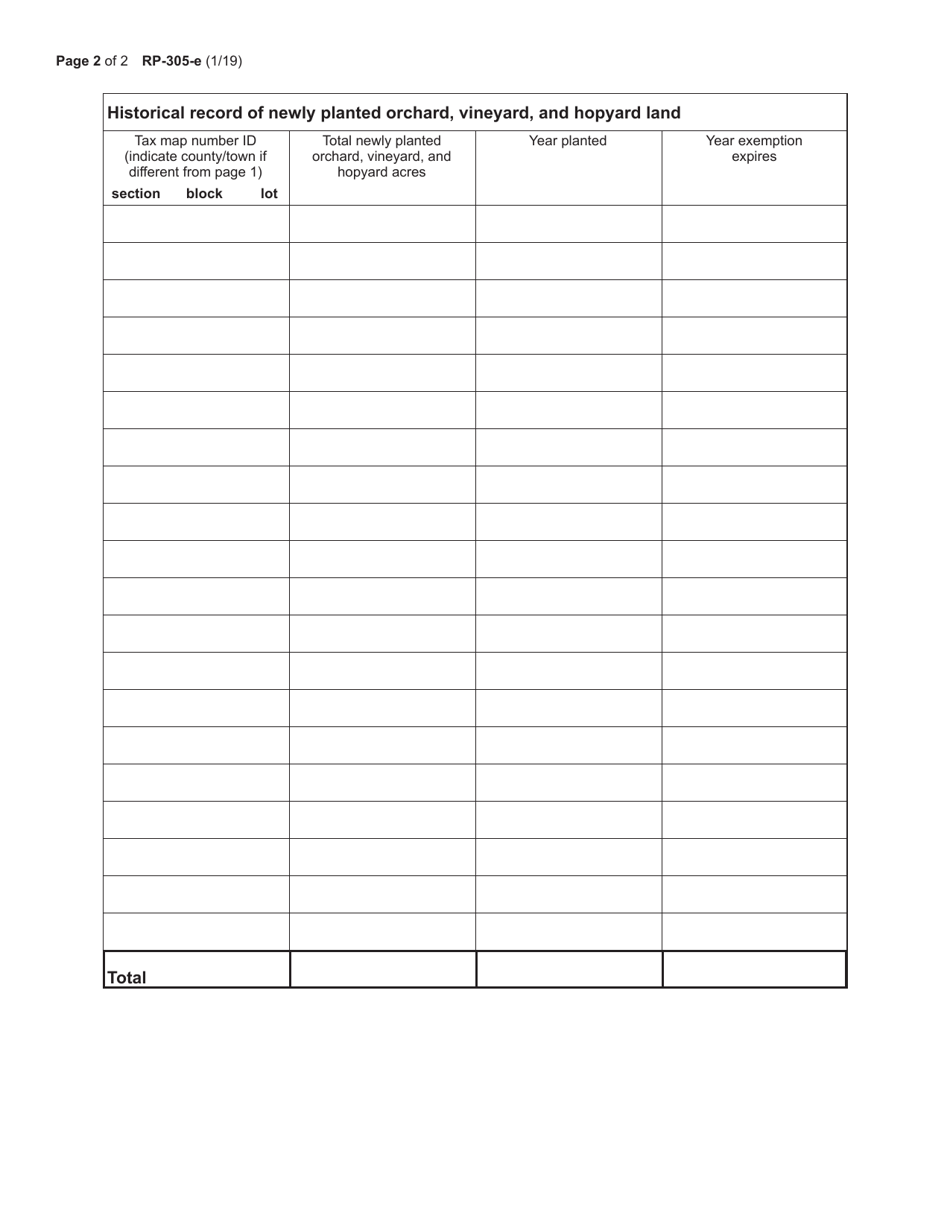

Q: What information is required in Form RP-305-E?

A: Form RP-305-E requires detailed information about the new orchards, vineyards, or hopyards, including their location and size.

Q: When is Form RP-305-E due?

A: Form RP-305-E is due on or before May 1st of the year following the establishment of the new orchards, vineyards, or hopyards.

Q: Is there a fee for filing Form RP-305-E?

A: No, there is no fee for filing Form RP-305-E.

Q: What happens if I don't file Form RP-305-E?

A: Failure to file Form RP-305-E may result in penalties or fines imposed by the New York State Department of Taxation and Finance.

Q: Can I file Form RP-305-E by mail?

A: Yes, you can file Form RP-305-E by mail if you prefer to do so.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-305-E by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.

![Document preview: Form RP-491 [ORCHARD PARK] Application for Conservation Easement Agreement Exemption. Certain Towns - New York](https://data.templateroller.com/pdf_docs_html/1733/17339/1733934/form-rp-491-orchard-park-application-conservation-easement-agreement-exemption-certain-towns-new-york.png)