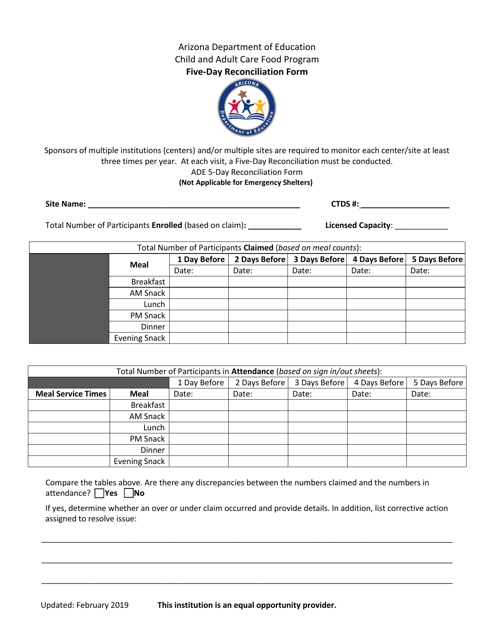

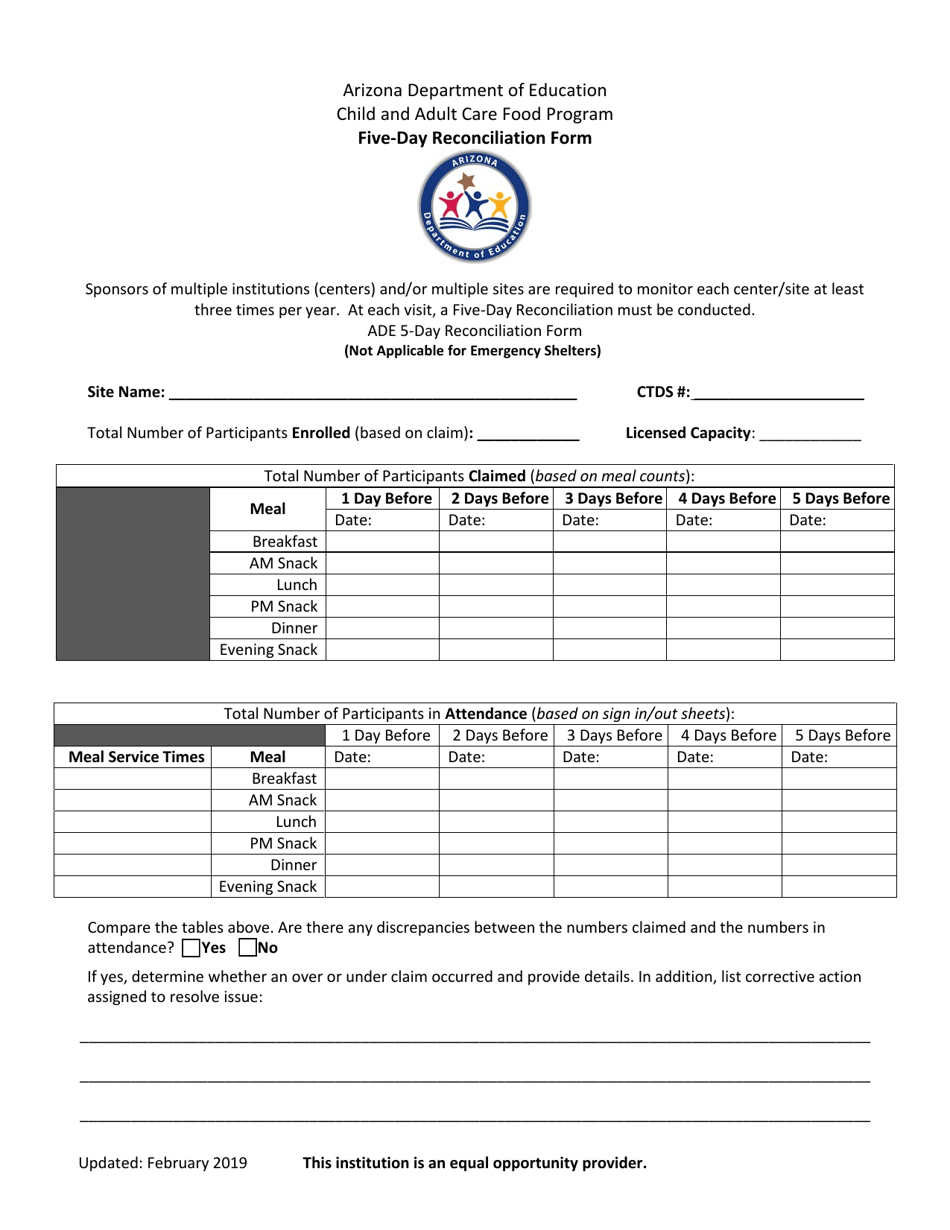

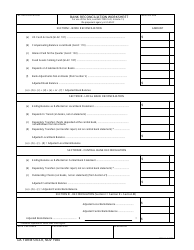

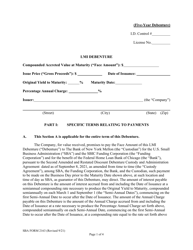

Five-Day Reconciliation Form - Arizona

Five-Day Reconciliation Form is a legal document that was released by the Arizona Department of Education - a government authority operating within Arizona.

FAQ

Q: What is a Five-Day Reconciliation Form?

A: The Five-Day Reconciliation Form is a document used in Arizona to report sales and other transactions made by a business.

Q: Why is the Five-Day Reconciliation Form important?

A: The form helps ensure that businesses are reporting their sales accurately and paying the correct amount of taxes.

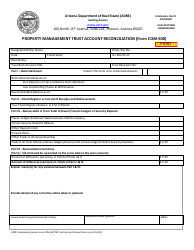

Q: Who needs to file a Five-Day Reconciliation Form?

A: Businesses in Arizona that have a transaction privilege tax (TPT) license need to file this form.

Q: When should the Five-Day Reconciliation Form be filed?

A: The form should be filed within five days after the end of the reporting period, which is typically a month.

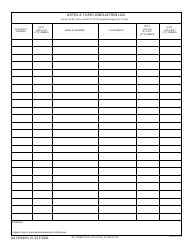

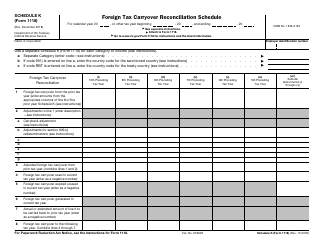

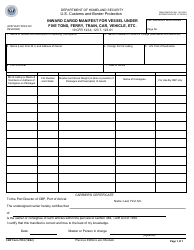

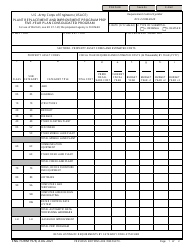

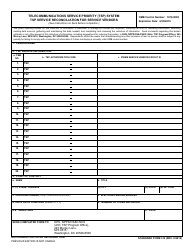

Q: What information is required on the Five-Day Reconciliation Form?

A: The form requires detailed information about the sales made by the business during the reporting period, including taxable and nontaxable sales.

Q: Are there any penalties for not filing the Five-Day Reconciliation Form?

A: Yes, failure to file the form or filing it late can result in penalties and interest charges.

Q: Is the Five-Day Reconciliation Form the same as a sales tax return?

A: No, the form is used to report sales made in Arizona, but businesses may still need to file a separate sales tax return.

Q: Is professional assistance required to fill out the Five-Day Reconciliation Form?

A: While professional assistance is not required, it may be helpful for businesses to consult with a tax professional or use accounting software to ensure accurate reporting.

Form Details:

- Released on February 1, 2019;

- The latest edition currently provided by the Arizona Department of Education;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arizona Department of Education.