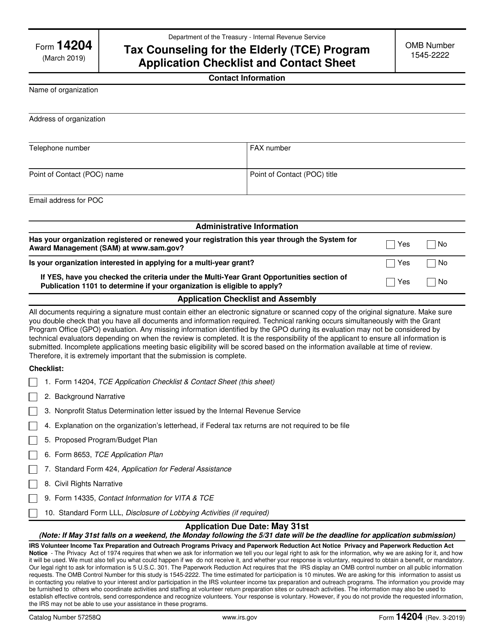

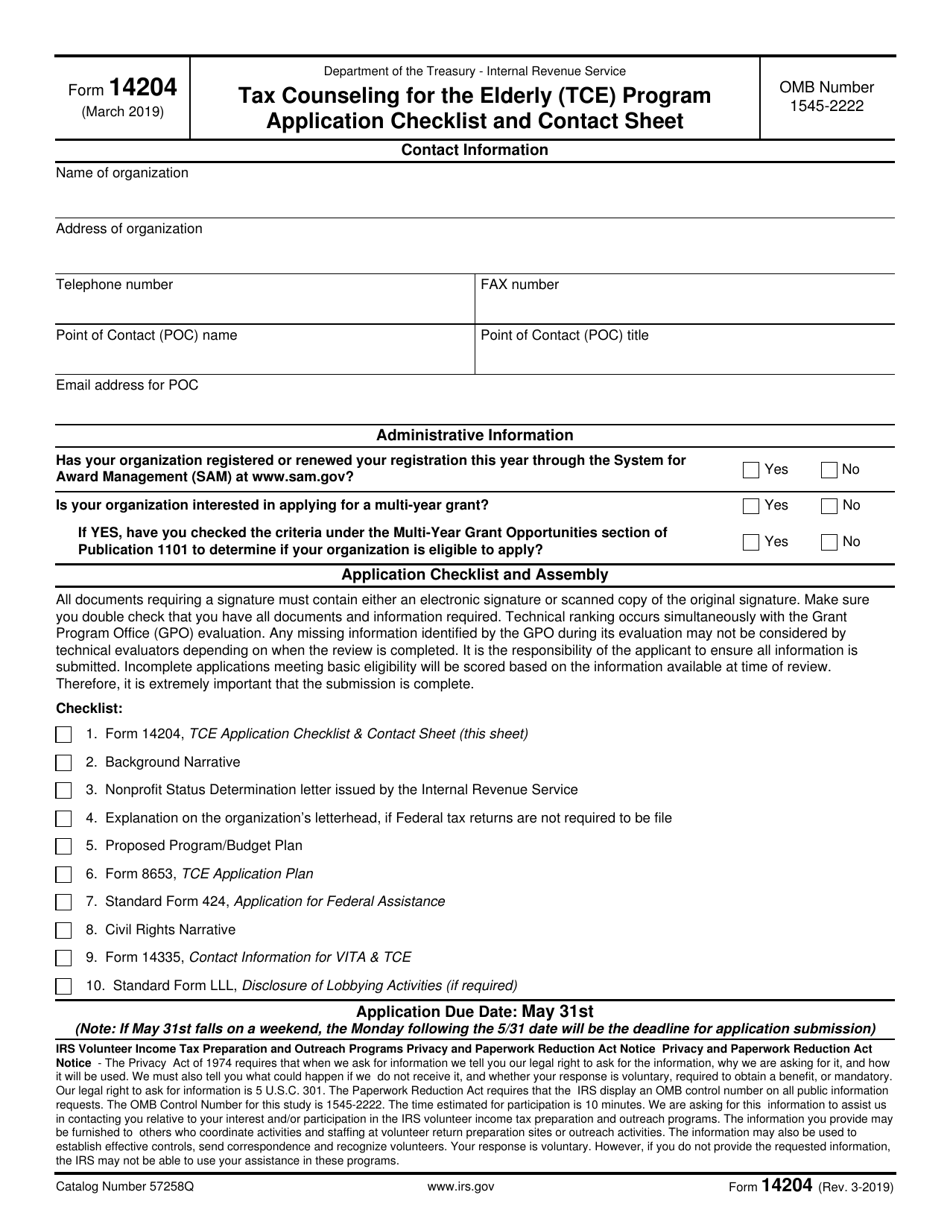

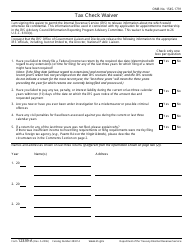

IRS Form 14204 Tax Counseling for the Elderly (Tce) Program Application Checklist and Contact Sheet

What Is IRS Form 14204?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2019. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is Form 14204?

A: Form 14204 is the Tax Counseling for the Elderly (TCE) Program Application Checklist and Contact Sheet.

Q: What is the TCE program?

A: The TCE program provides free tax help to individuals who are 60 years of age or older.

Q: Who can use Form 14204?

A: Form 14204 is used by organizations that are applying to become TCE program sites.

Q: What information is included in the checklist?

A: The checklist includes the required documentation and forms that organizations must submit with their TCE program application.

Q: How can I contact the TCE program?

A: You can contact the TCE program by calling the toll-free number provided on the Form 14204.

Q: Is the TCE program available in all states?

A: Yes, the TCE program is available in all 50 states, the District of Columbia, and Puerto Rico.

Q: Is there an income limit to receive assistance from the TCE program?

A: There is no specific income limit to receive assistance from the TCE program.

Q: Are TCE program volunteers trained?

A: Yes, TCE program volunteers receive training to provide tax assistance and answer tax-related questions for elderly individuals.

Q: Can I file my taxes through the TCE program?

A: Yes, TCE program volunteers can help eligible individuals prepare and file their tax returns.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14204 through the link below or browse more documents in our library of IRS Forms.