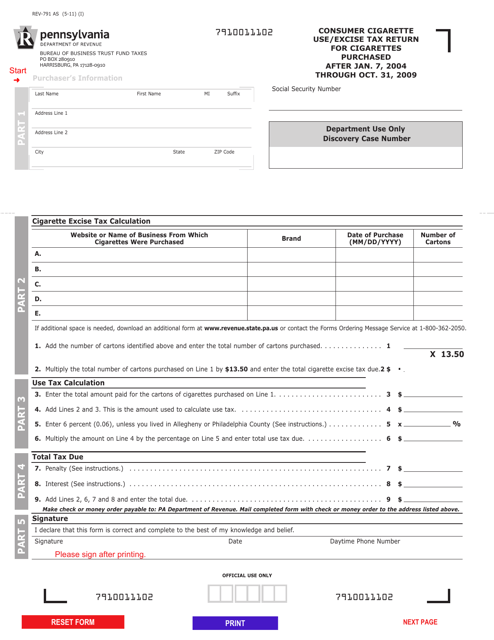

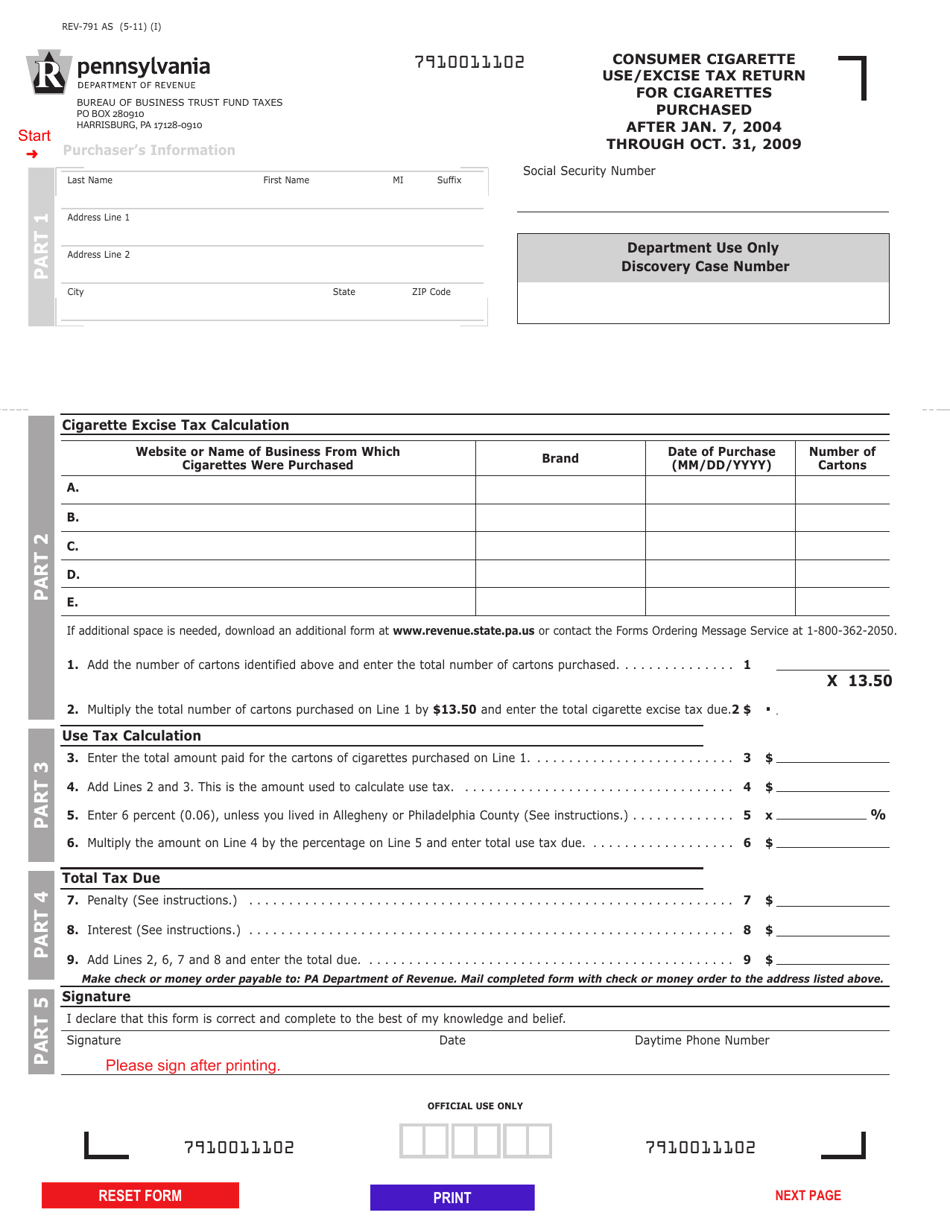

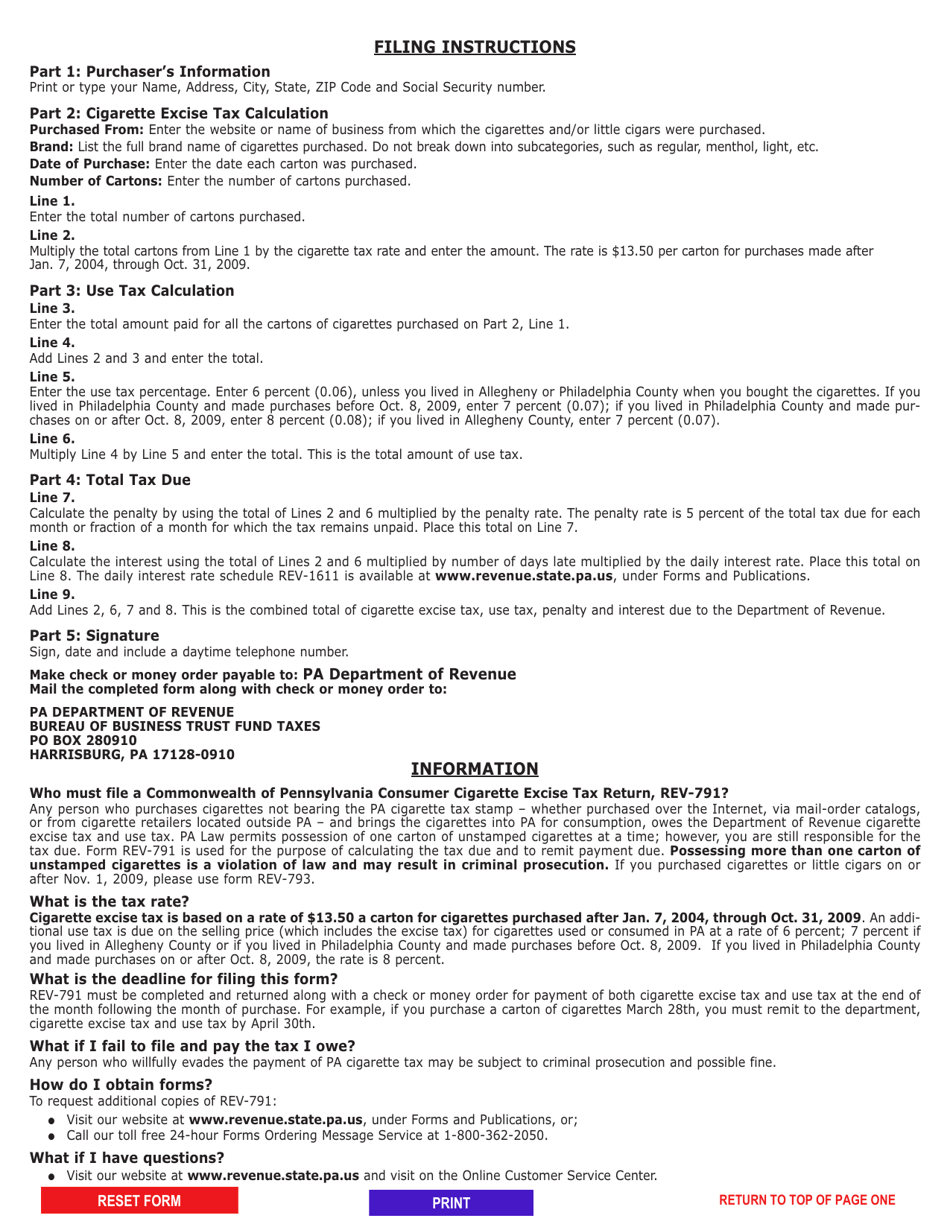

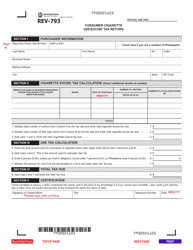

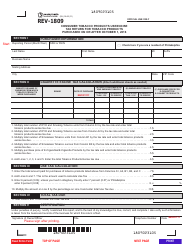

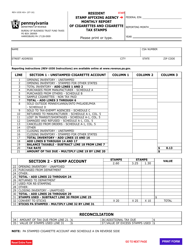

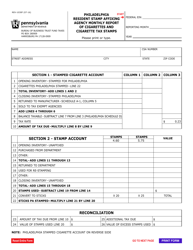

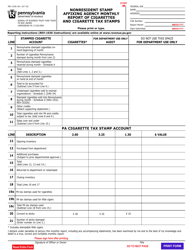

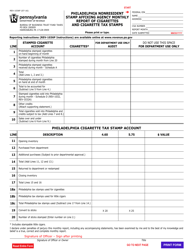

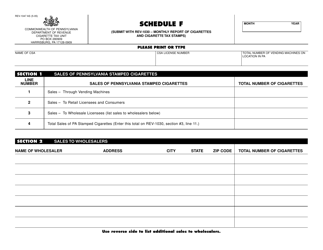

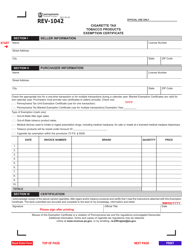

Form REV-791 Consumer Cigarette Use / Excise Tax Return for Cigarettes Purchased After Jan. 7, 2004 Through Oct. 31, 2009 - Pennsylvania

What Is Form REV-791?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-791?

A: Form REV-791 is the Consumer Cigarette Use/Excise Tax Return for Cigarettes Purchased After Jan. 7, 2004 Through Oct. 31, 2009 in Pennsylvania.

Q: Who needs to file Form REV-791?

A: Anyone who purchased cigarettes in Pennsylvania between Jan. 7, 2004 and Oct. 31, 2009 needs to file Form REV-791.

Q: What is the purpose of Form REV-791?

A: Form REV-791 is used to report and pay the excise tax on cigarettes purchased during the specified period.

Q: When is the due date for Form REV-791?

A: The due date for Form REV-791 is determined by the Department of Revenue and will be indicated on the form.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-791 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.