This version of the form is not currently in use and is provided for reference only. Download this version of

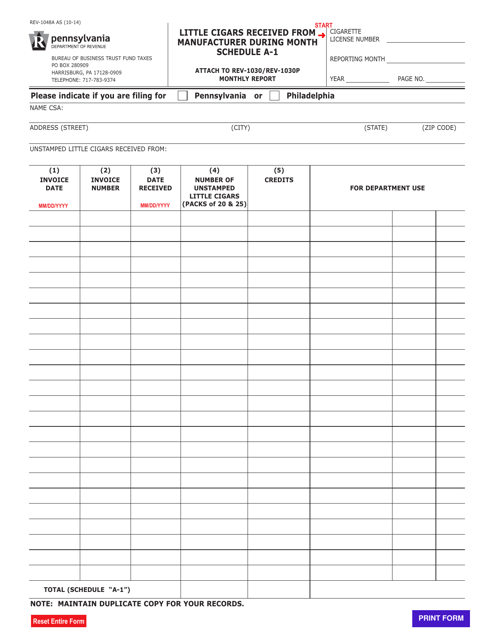

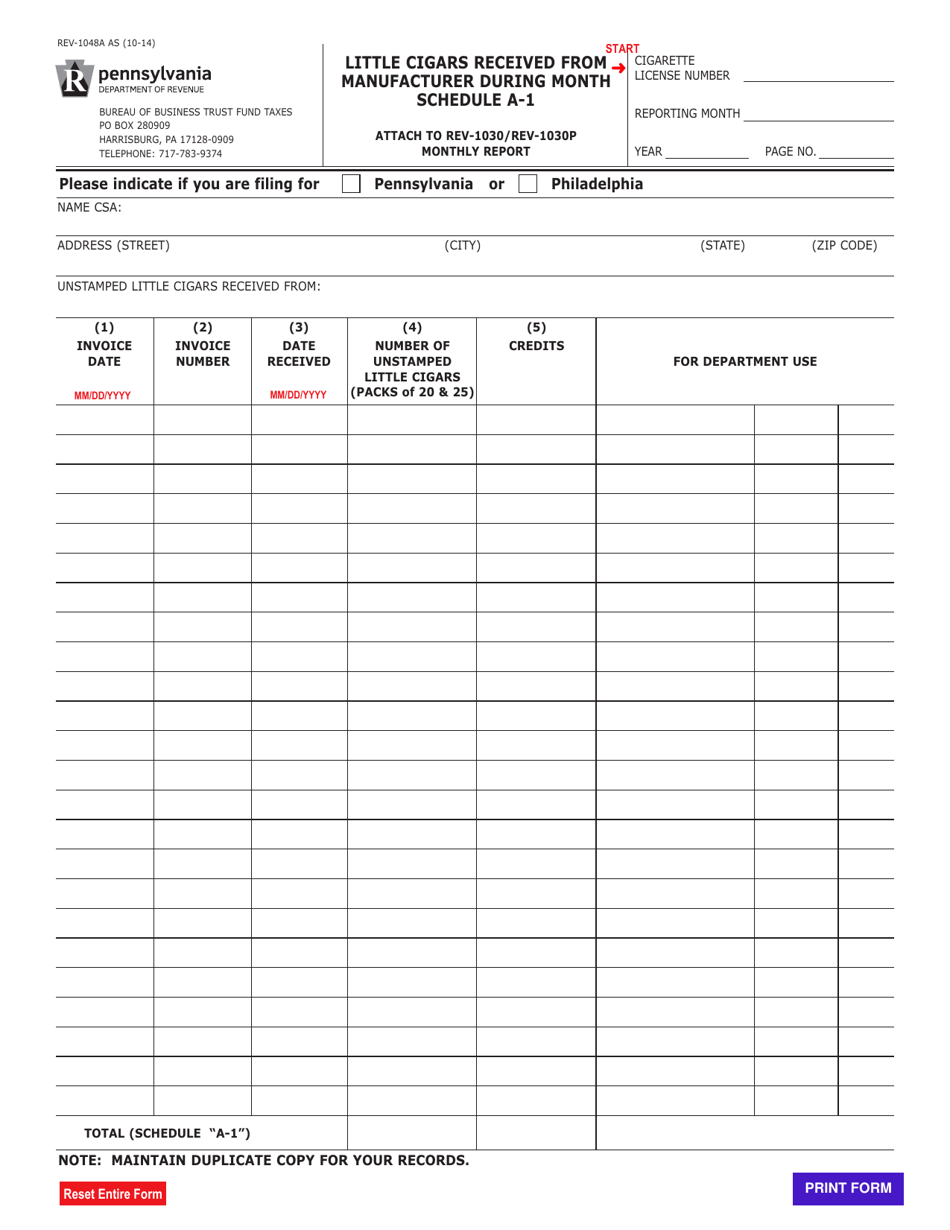

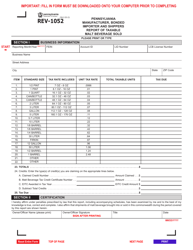

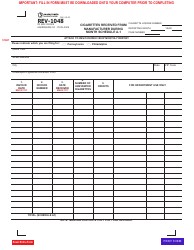

Form REV-1048A Schedule A-1

for the current year.

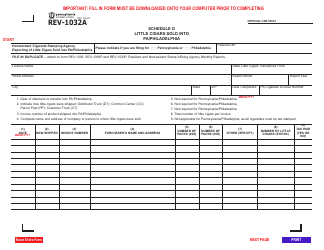

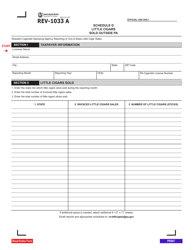

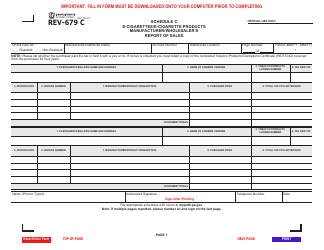

Form REV-1048A Schedule A-1 Little Cigars Received From Manufacturer During Month - Pennsylvania

What Is Form REV-1048A Schedule A-1?

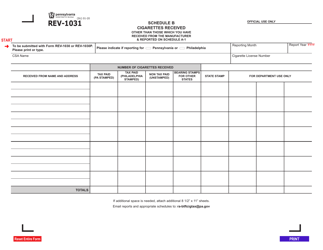

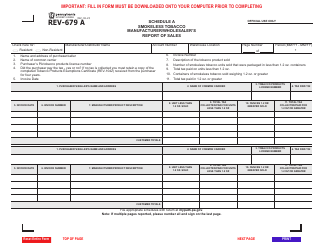

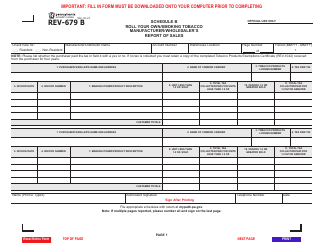

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1048A?

A: Form REV-1048A is a schedule used in Pennsylvania to report little cigars received from manufacturers during a specific month.

Q: What is Schedule A-1?

A: Schedule A-1 is the specific section on Form REV-1048A that is used to report little cigars received from manufacturers.

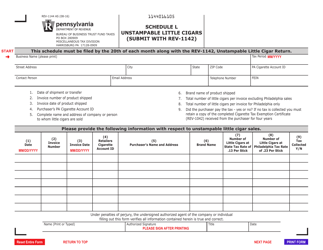

Q: What are little cigars?

A: Little cigars are small cigars that resemble cigarettes but are classified as cigars for tax purposes.

Q: Who is required to file Form REV-1048A?

A: Any person or entity in Pennsylvania who receives little cigars directly from manufacturers is required to file Form REV-1048A.

Q: What information is required on Form REV-1048A?

A: Form REV-1048A requires information such as the name of the manufacturer, the number of little cigars received, and the date of receipt for each month.

Q: When is Form REV-1048A due?

A: Form REV-1048A is generally due on or before the 20th day of the month following the month being reported.

Q: Are there any penalties for late filing of Form REV-1048A?

A: Yes, penalties may apply for late or incorrect filing of Form REV-1048A. It is important to file the form on time and ensure the information is accurate.

Form Details:

- Released on October 1, 2014;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1048A Schedule A-1 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.