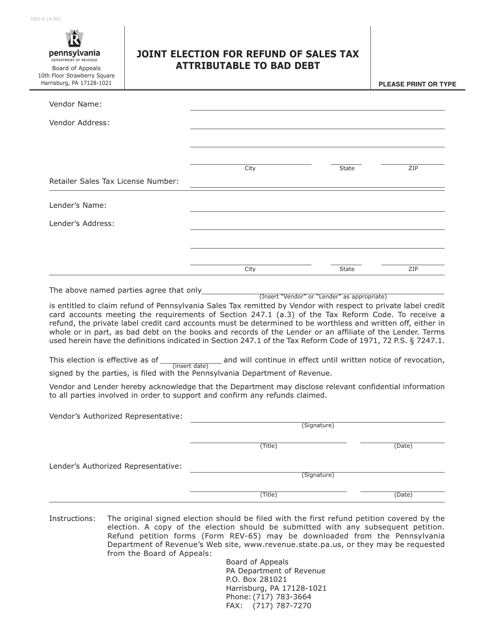

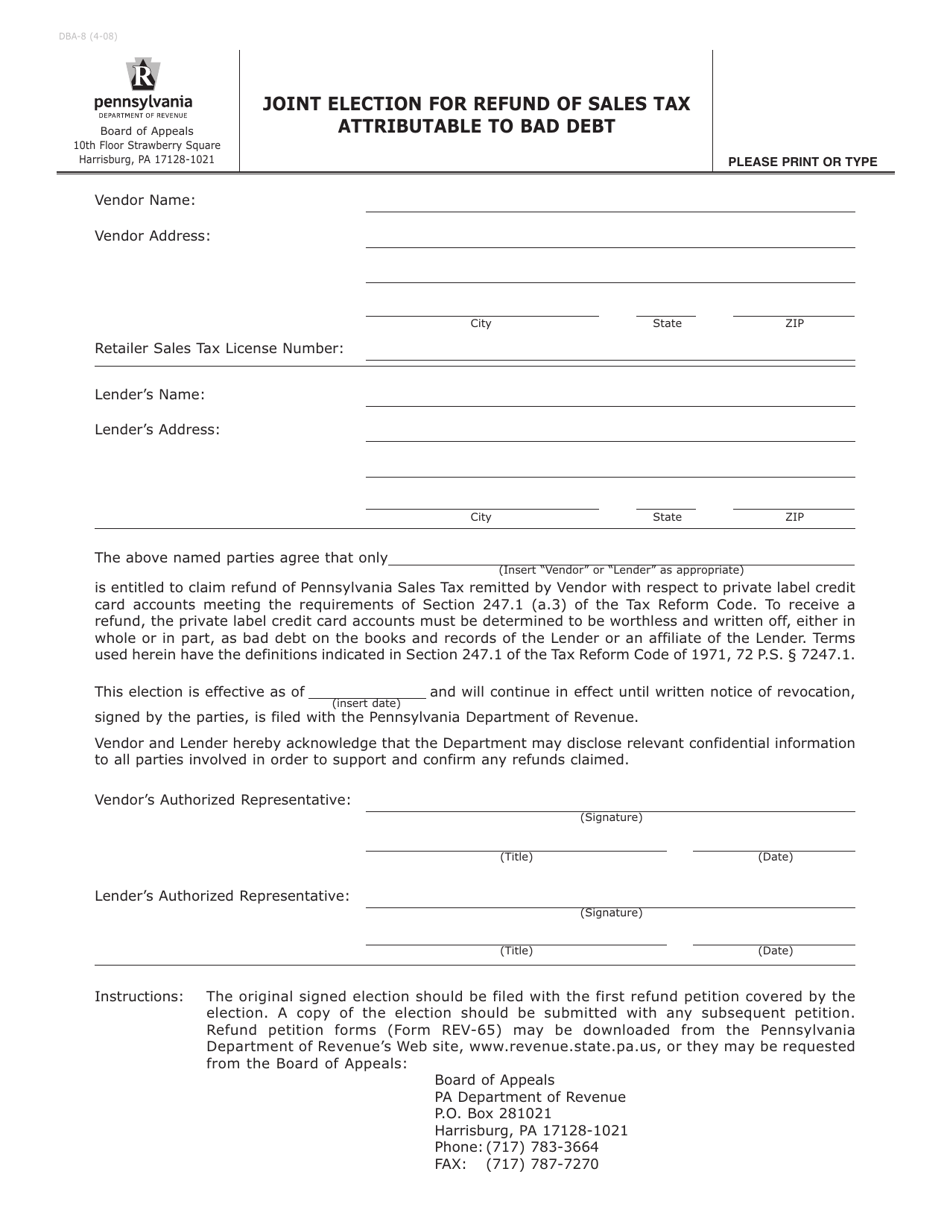

Form DBA-8 Joint Election for Refund of Sales Tax Attributable to Bad Debt - Pennsylvania

What Is Form DBA-8?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DBA-8?

A: DBA-8 is a form used for a joint election for refund of sales tax attributable to bad debt in Pennsylvania.

Q: What is the purpose of DBA-8?

A: The purpose of DBA-8 is to claim a refund of sales tax that was previously paid on bad debts.

Q: Who can use DBA-8?

A: DBA-8 can be used by businesses in Pennsylvania who have paid sales tax on bad debts.

Q: How do I fill out DBA-8?

A: You need to provide information about the bad debt and the related sales tax paid on the form.

Form Details:

- Released on April 1, 2008;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DBA-8 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.