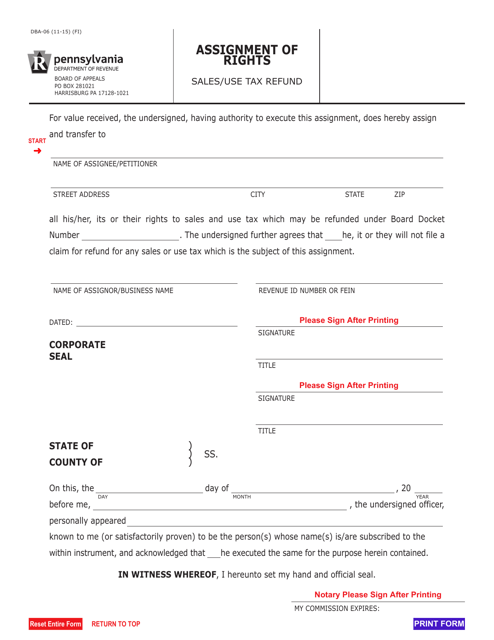

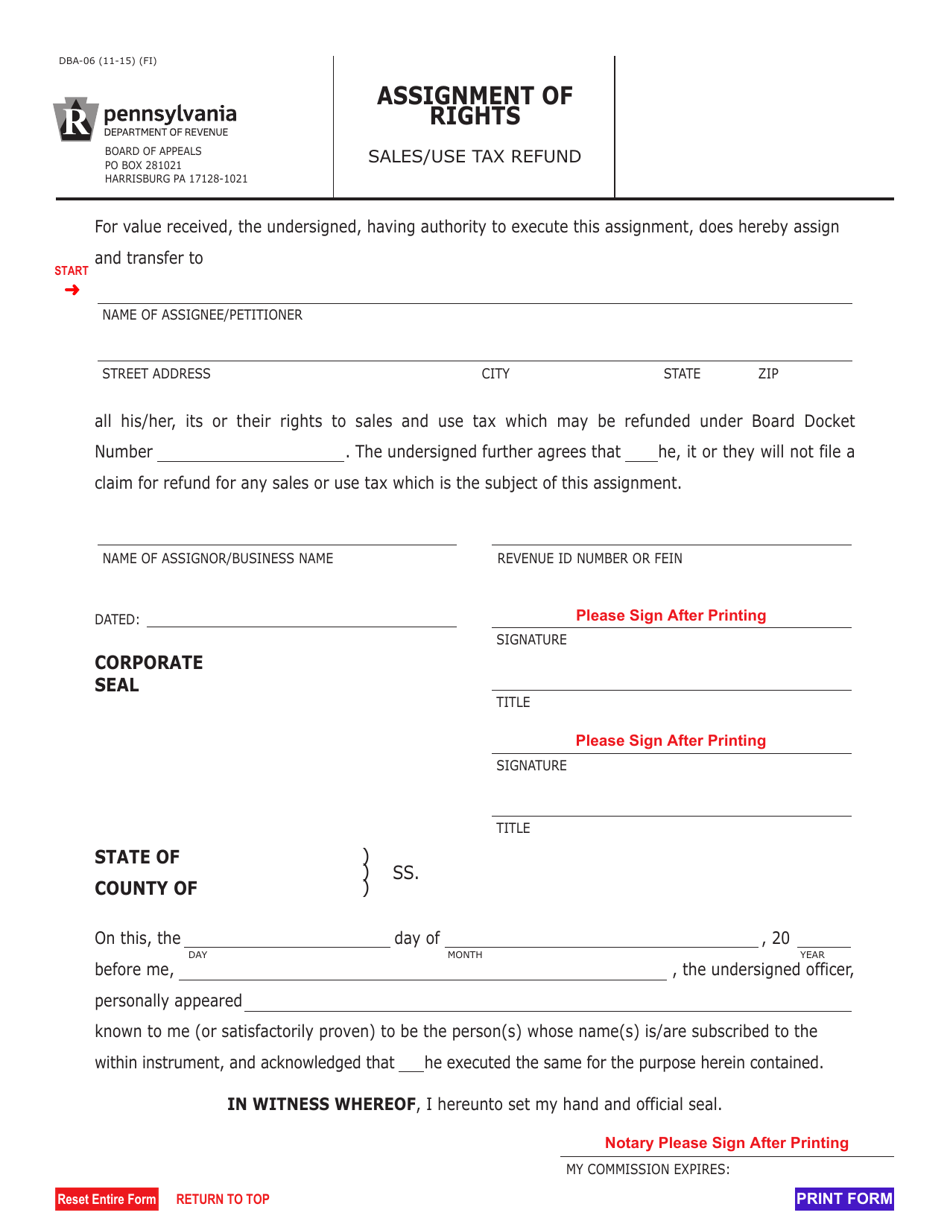

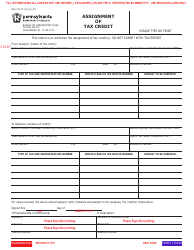

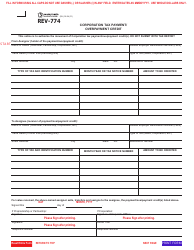

Form DBA-06 Assignment of Rights - Sales / Use Tax Refund - Pennsylvania

What Is Form DBA-06?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DBA-06 used for?

A: Form DBA-06 is used for the assignment of rights regarding sales/use tax refund in Pennsylvania.

Q: What is a sales/use tax refund?

A: A sales/use tax refund is a refund of the tax paid on certain goods or services.

Q: Who can use Form DBA-06?

A: Form DBA-06 can be used by individuals or businesses who wish to assign their rights to a sales/use tax refund to another party.

Q: What information is required on Form DBA-06?

A: Form DBA-06 requires information such as the assignor's name and address, the assignee's name and address, and details of the sales/use tax refund being assigned.

Q: Is there a fee to file Form DBA-06?

A: As of the time of this document, there is no fee to file Form DBA-06.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DBA-06 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.