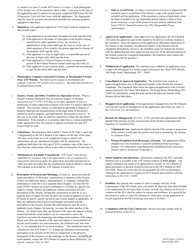

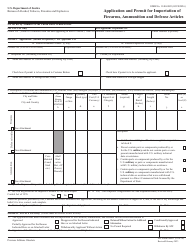

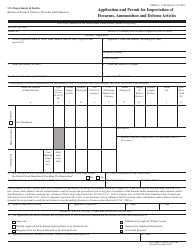

This version of the form is not currently in use and is provided for reference only. Download this version of

ATF Form 5 (5320.5)

for the current year.

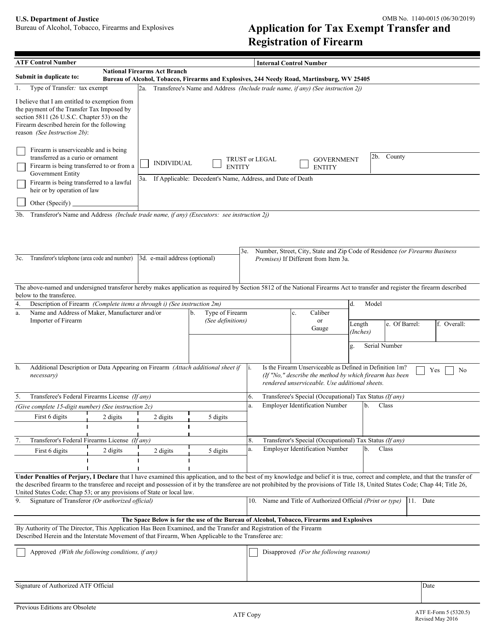

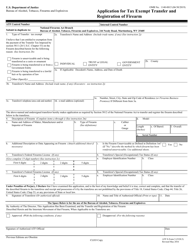

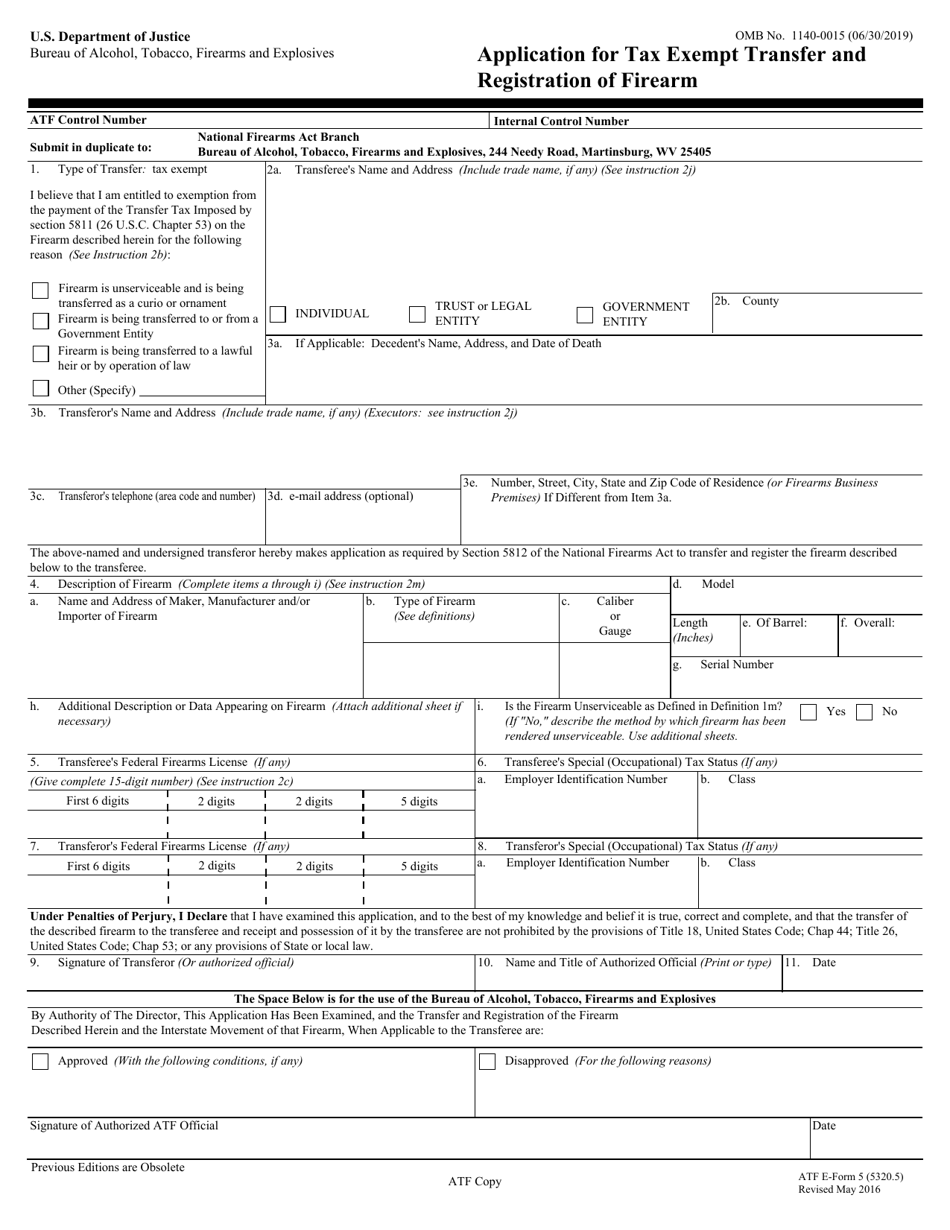

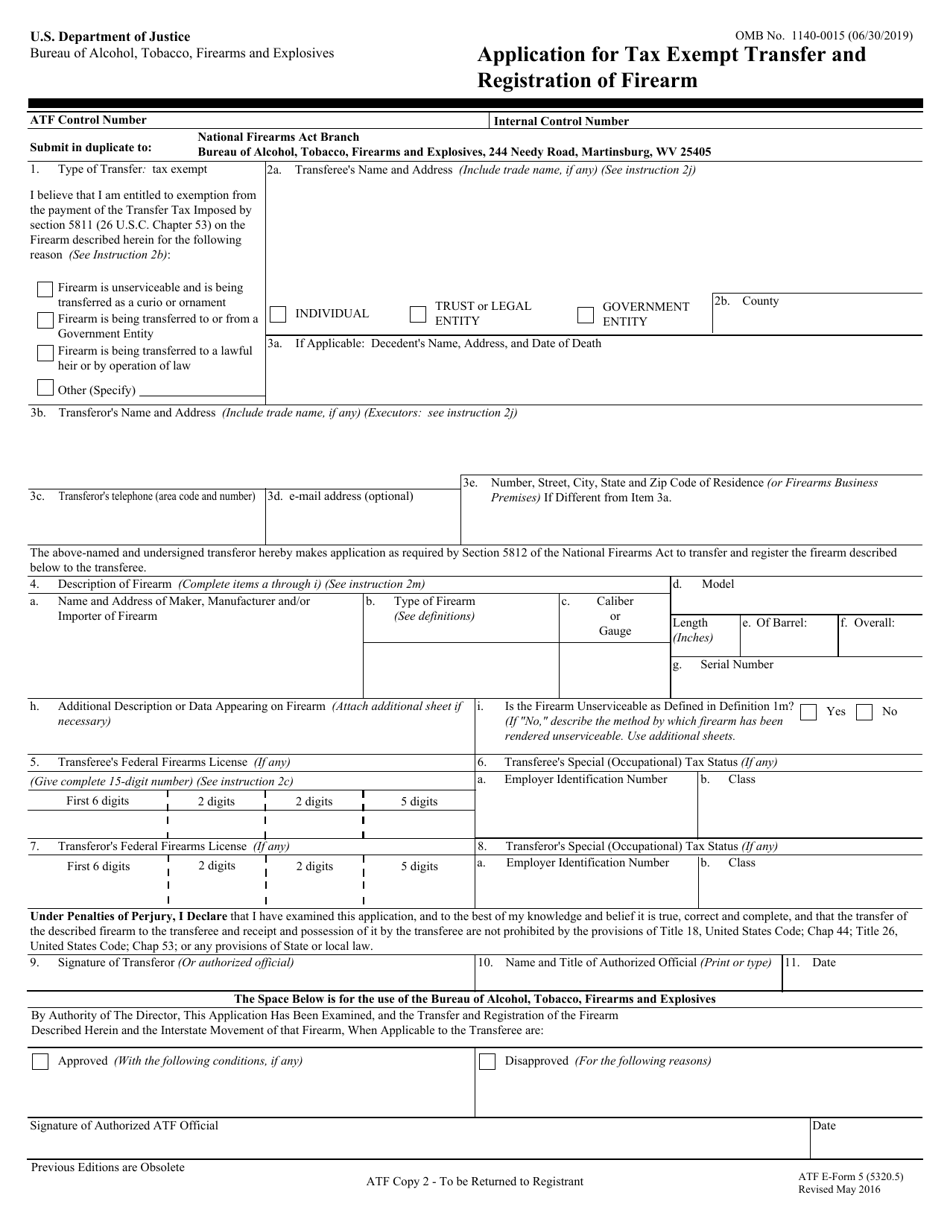

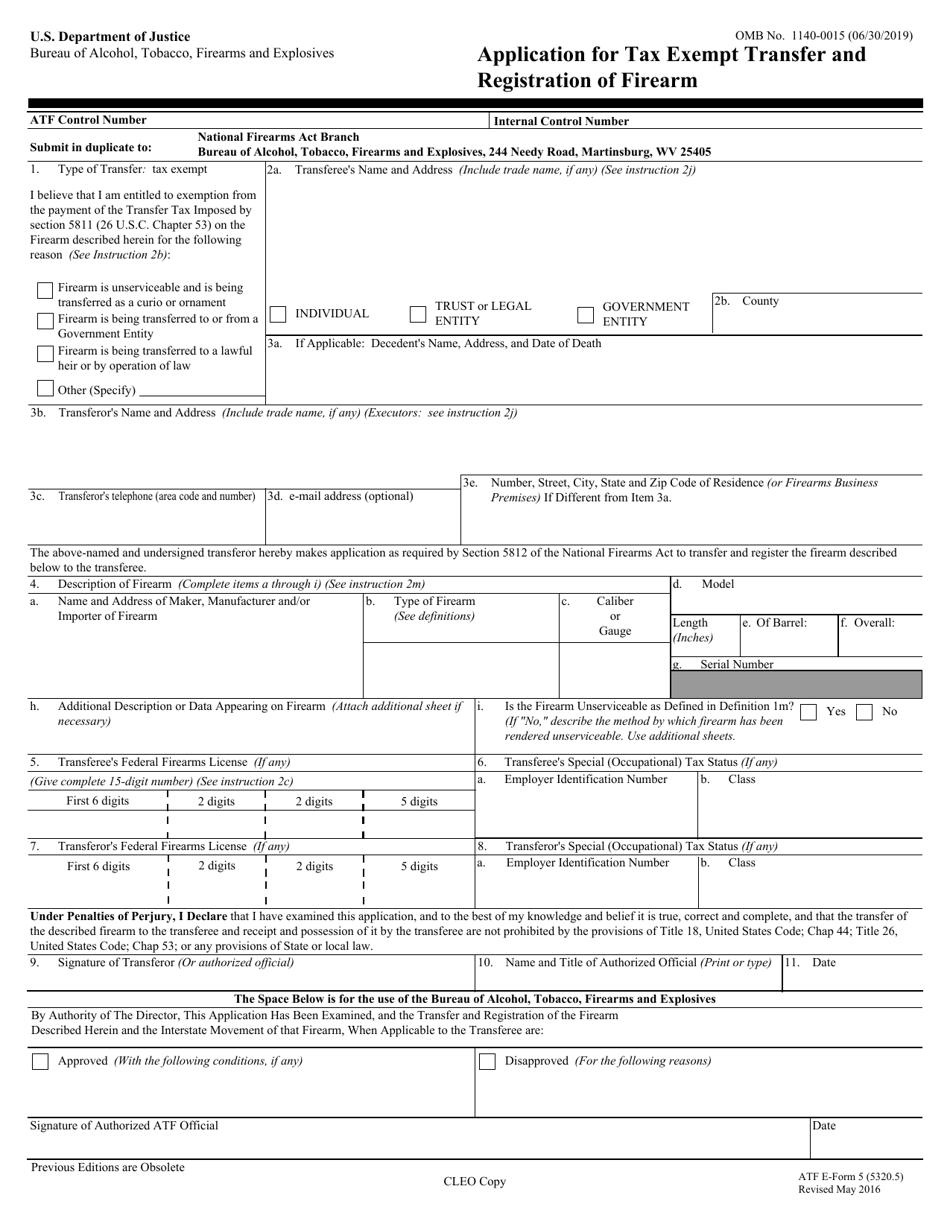

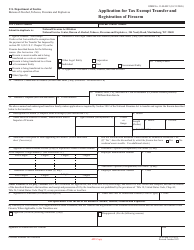

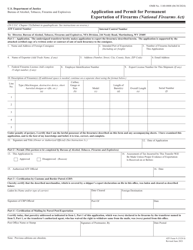

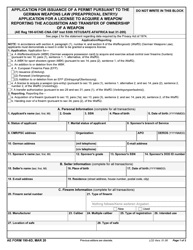

ATF Form 5 (5320.5) Application for Tax Exempt Transfer and Registration of Firearm

What Is ATF Form 5?

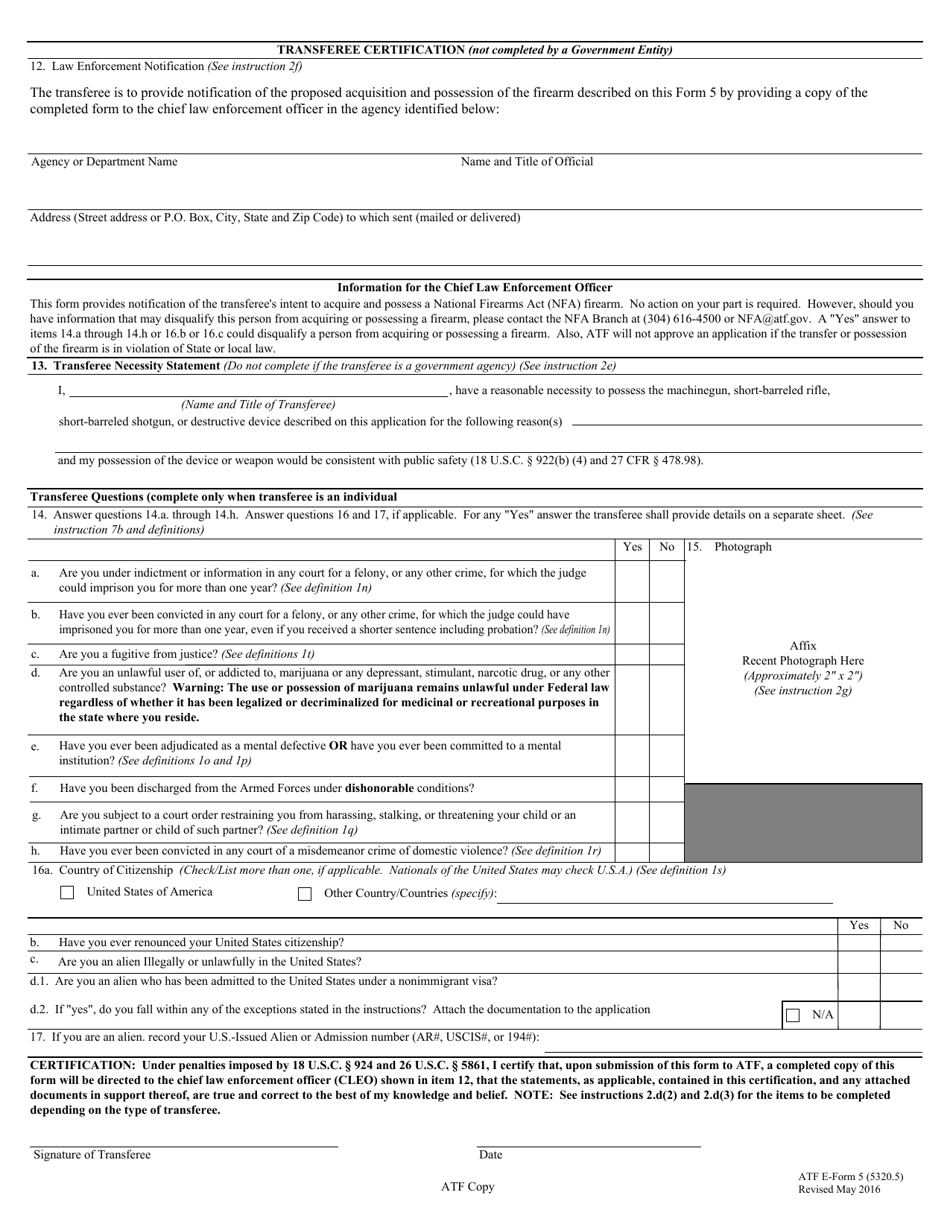

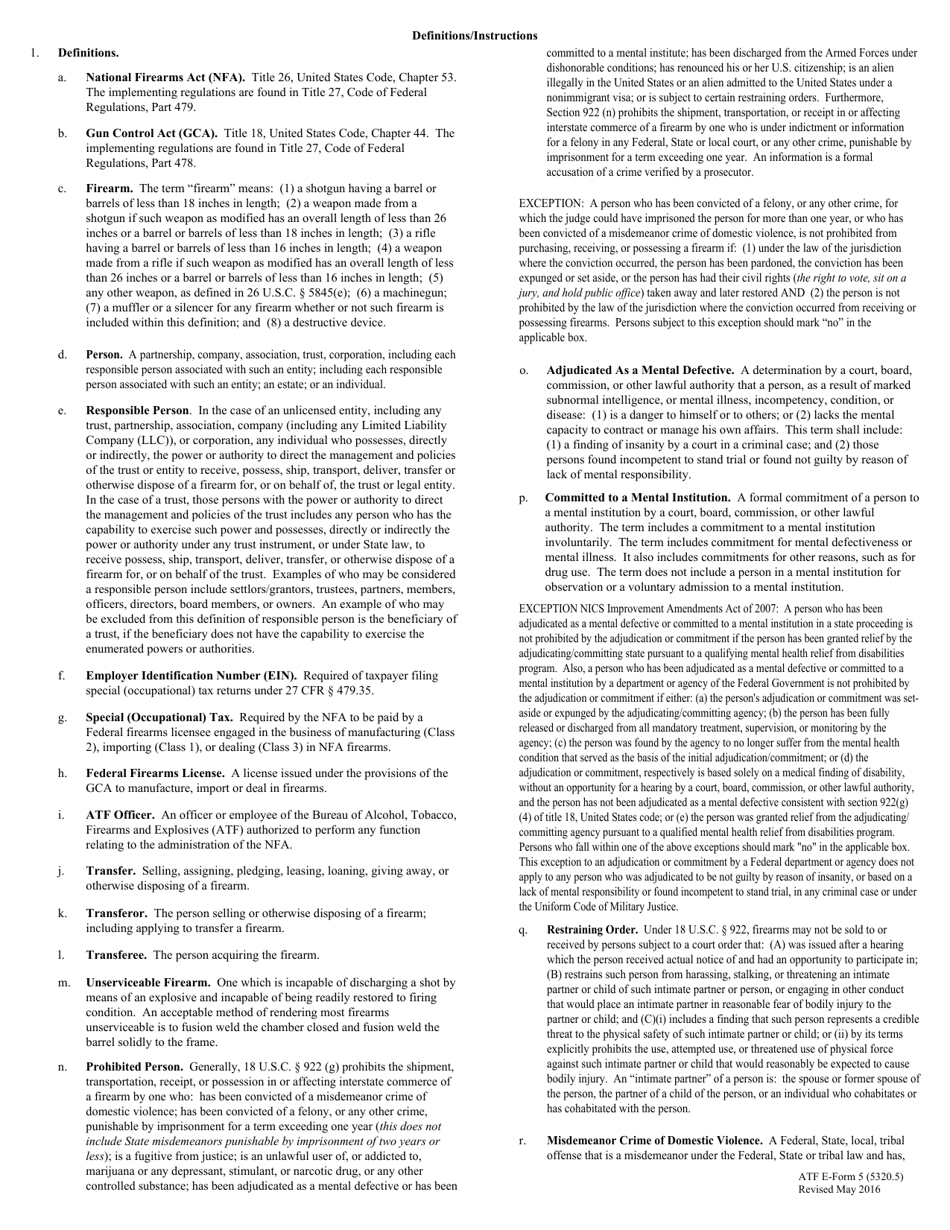

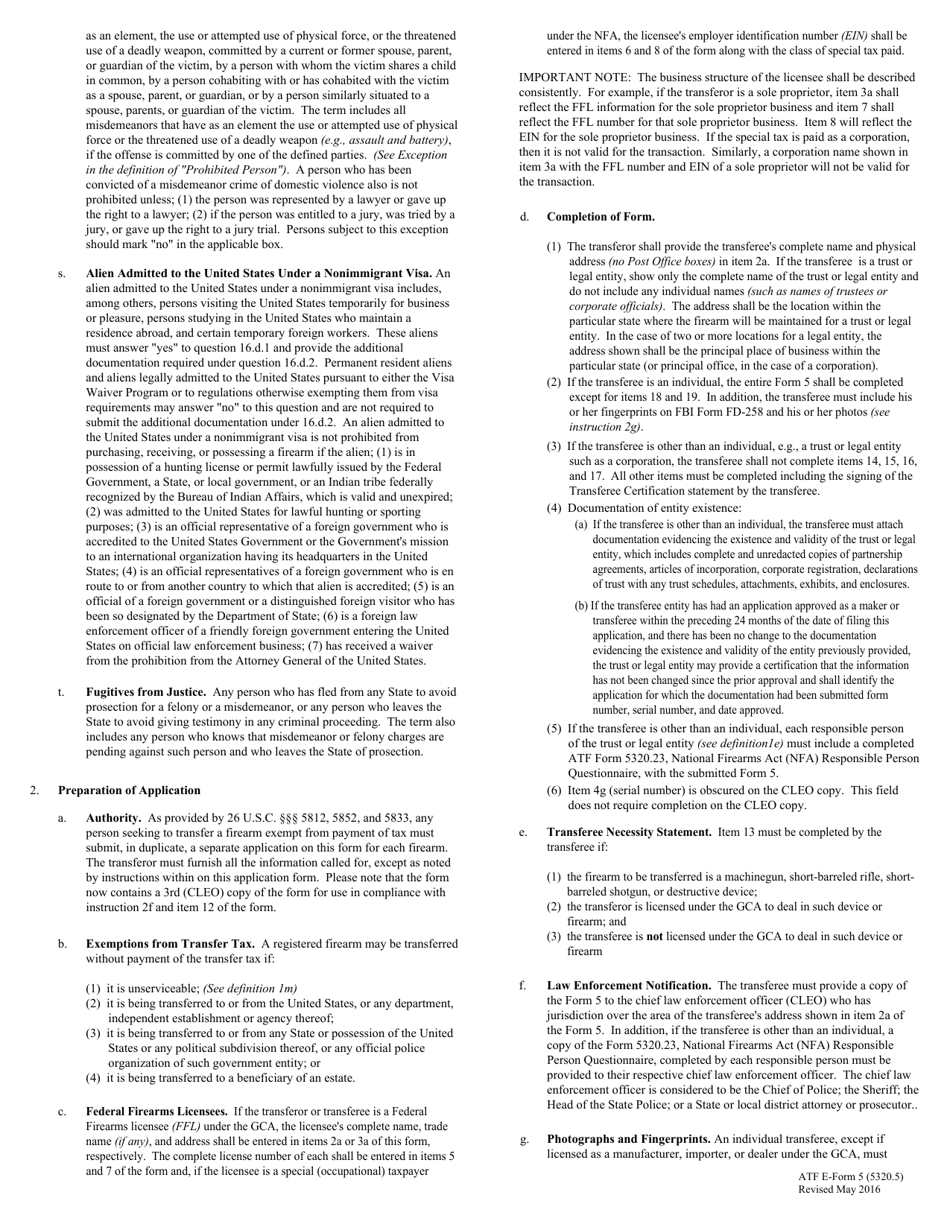

ATF Form 5, Application for Tax Exempt Transfer and Registration of Firearm - also known as the ATF Form 5320.5 or the ATF E-Form 5 - is a form you fill out to request a tax-free transfer of a firearm. The information provided on this form is used by the Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) to verify that the proposed transfer can be exempted from tax and complies with federal, state, and local law.

The latest version of the form was issued by the ATF on May 1, 2016 . Download the fillable ATF Form 5 by clicking the link below.

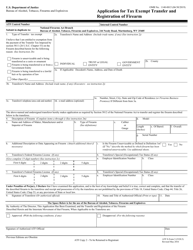

An ATF Form 5320.5 applicant can be a company, trust, individual, or licensed dealer. This form is applicable for the tax-exempt firearm transfer in several cases:

- The firearm is unserviceable and is transferred as a curio to be used for decoration purpose;

- The firearm is transferred to a lawful heir;

- The firearm is transferred to or from a government agency.

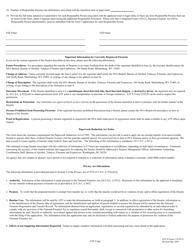

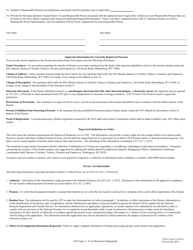

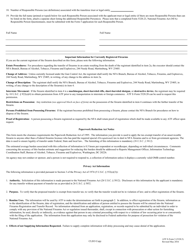

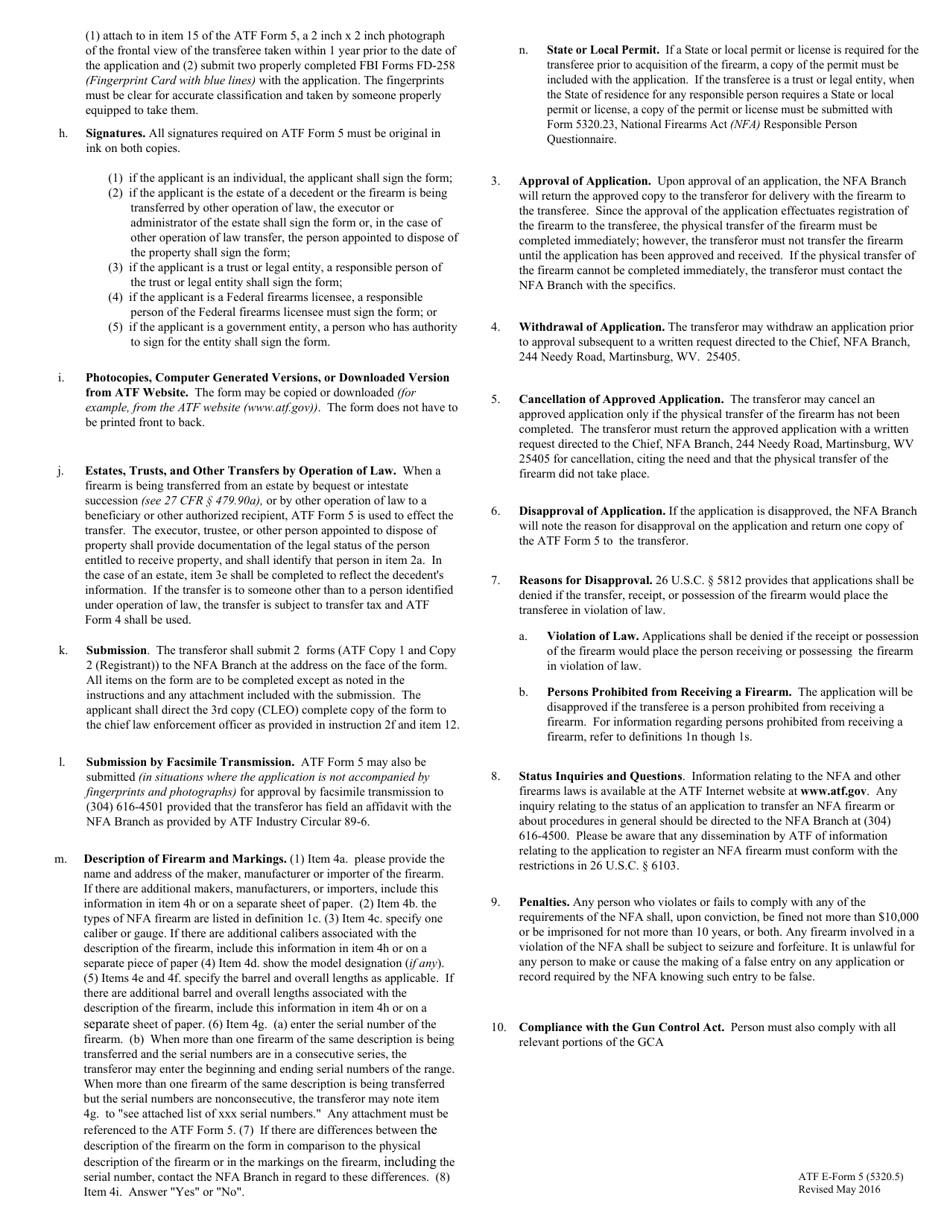

ATF Form 5 Instructions

The ATF distributes the form with a set of attached guidelines. These guidelines contain the definitions of all terms you need to understand in order to complete the form properly, including the term "Unserviceable Firearm". They also provide an explanation of the cases when a person may be considered as ineligible to possess or ship a firearm. Additional step-by-step filing instructions are provided below.

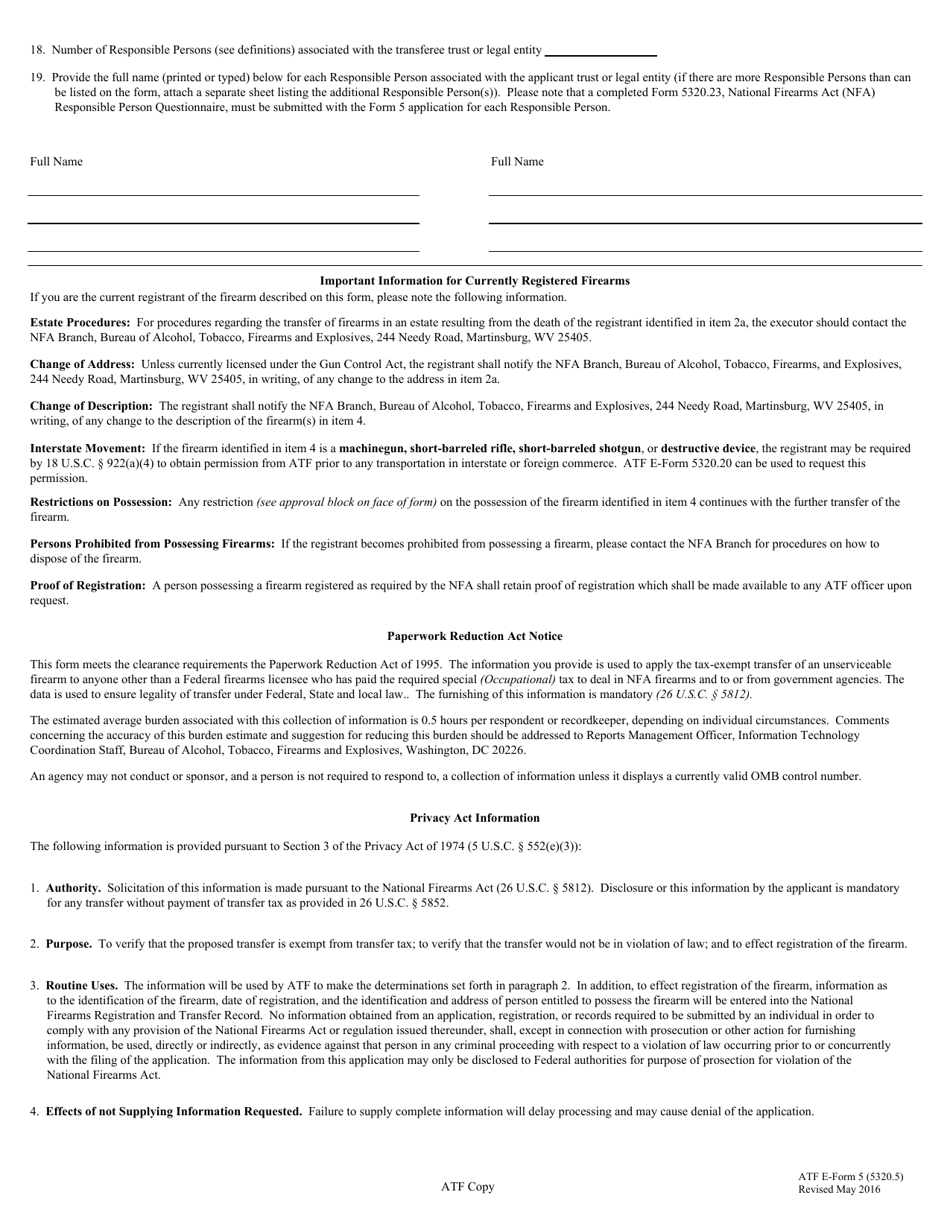

How to Update Trust Name on ATF Form 5?

Pay attention when entering a gun trust name on the form, since it cannot be changed. A firearm is registered to the trust in the National Firearms Registration and Transfer Record by name. Therefore, if you need to change the name of the gun trust, you will need to find a new trust with the name you want first. After that, you can transfer the firearms to that trust.

How to Fill Out ATF Form 5?

- Item 1. Type of Transfer: Tax Exempt. Specify the reason for a tax-free transfer;

- Item 2A. Transferee's Name and Address. Provide the name of the new firearm owner. If the firearm is transferred to the trust, enter the name of the trust (no individual name has to be included). Provide the physical address of the place where the firearm will be stored after the transfer;

- Item 2B. County. Specify the county, parish, or borough the firearm will be stored at;

- Item 3A. If Applicable: Decedent's Name, Address, and Date of Death. Fill out this item if the firearm is transferred to the lawful heir and the appropriate box is checked in Item 1;

- Item 3B. Transferor's Name and Address. Indicate the address and the name of the transferor;

- Items 3C and D. Transferor's Telephone and E-mail Address. Self-explanatory;

- Item 3E. Number, Street, City, State and Zip Code of Residence if Different from Item 3a. If the firearm is transferred to a lawful heir, enter here the decedent's information;

- Items 4A - 4I. Description of Firearm. Use these items to provide an accurate description of the firearm to be transferred. If the space provided is not enough, continue description on a separate sheet and attach it to the form. Do not use any slang terms, like .338 Lapua or 300 Blackout. If the transferred item is a machine gun sear, enter "N/A" in Item 4C "Caliber or Gauge";

- Item 5. Transferee's Federal Firearms License. If the transferee is a Federal Firearms licensee (FFL), enter the 15-digit license number in this item. If the transferee is a gun trust, leave this item blank;

- Items 6A and 6B. Transferee's Special (Occupational) Tax Status. Provide the employer identification number (EIN) and a class of the transferee, if applicable;

- Item 7. Transferor's Federal Firearms License. If the firearm to be transferred is already owned, skip this part. Otherwise, provide a 15-digit FFL number of the dealer;

- Items 8A and 8B. Transferor's Special (Occupational) Tax Status. Indicate the EIN and class of the transferor if applicable;

- Item 9. Signature of Transferor. The signatures on all copies of the form must be original in ink. If the applicant is the beneficiary of the decedent's estate, the form should be signed by an executor or administrator of the estate;

- Items 10 and 11. Name and Title of Authorized Official and Date. Self-explanatory;

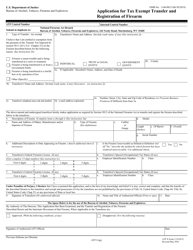

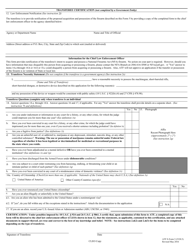

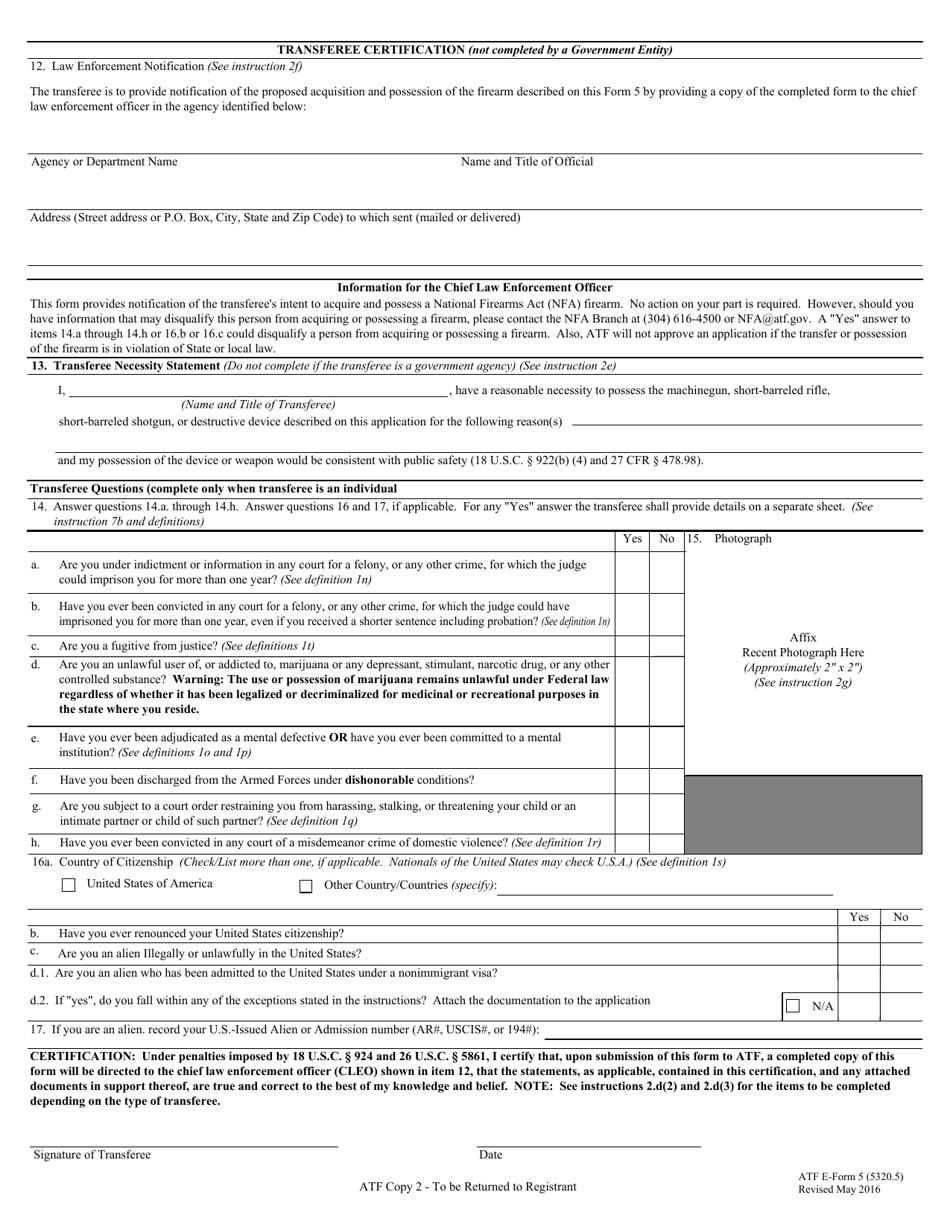

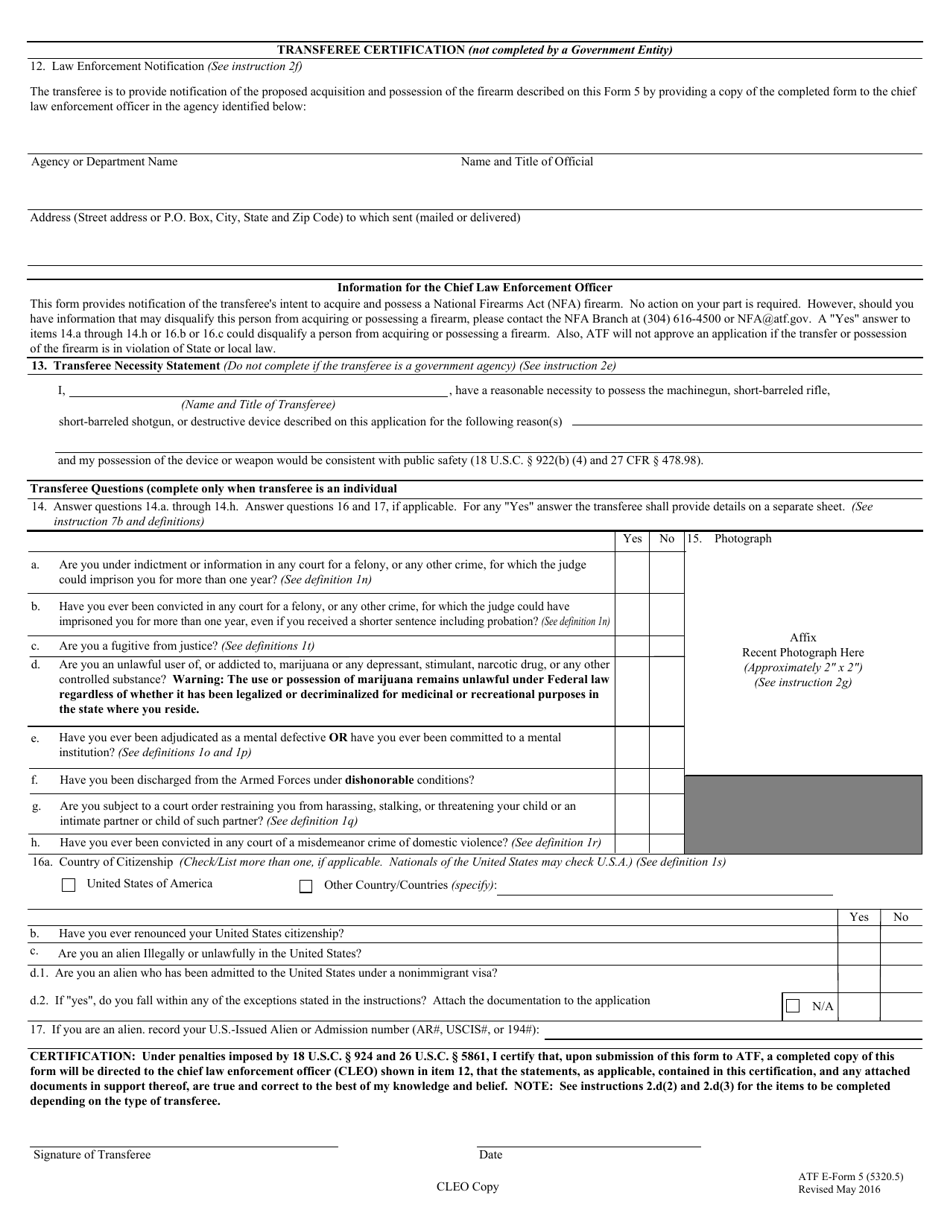

- Item 12. Law Enforcement Notification. Indicate the name of the agency or department, title, and the name of the official, as well as the address where the chief law enforcement officer (CLEO) copy was submitted;

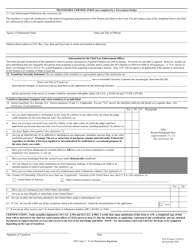

- Item 13. Transferee Necessity Statement. Skip this part if the transferee is a government agency. Otherwise, provide here the name of the individual or settlor of the trust to which the firearm is transferred. For reason enter "Any Lawful Purpose";

- Item 14. If the transferee is an individual, answer the questions provided in this item;

- Item 15. Photograph. Affix the transferee photograph here if the transferee is an individual;

- Item 16A - 16D. Country of Citizenship. Self-explanatory;

- Item 17. Self-explanatory; and

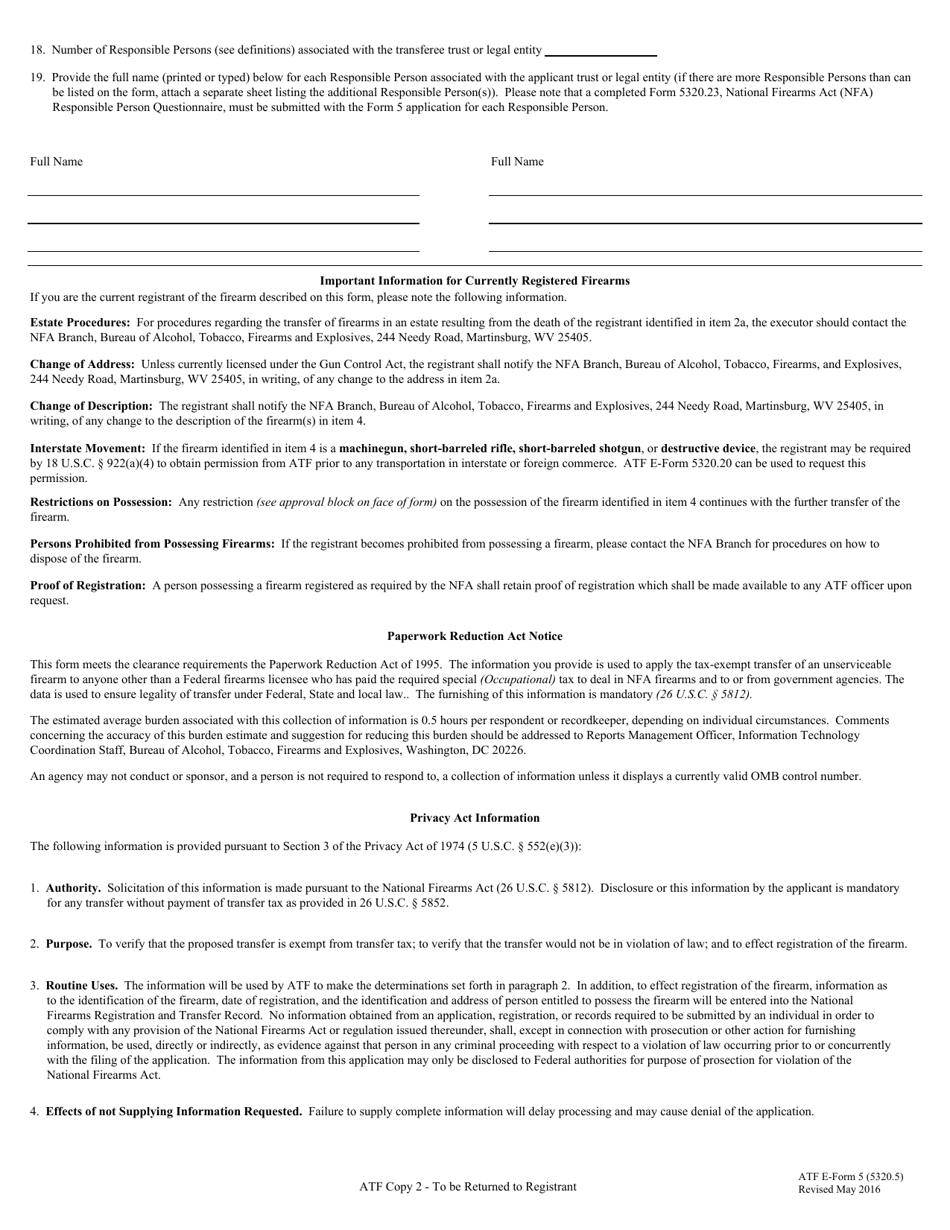

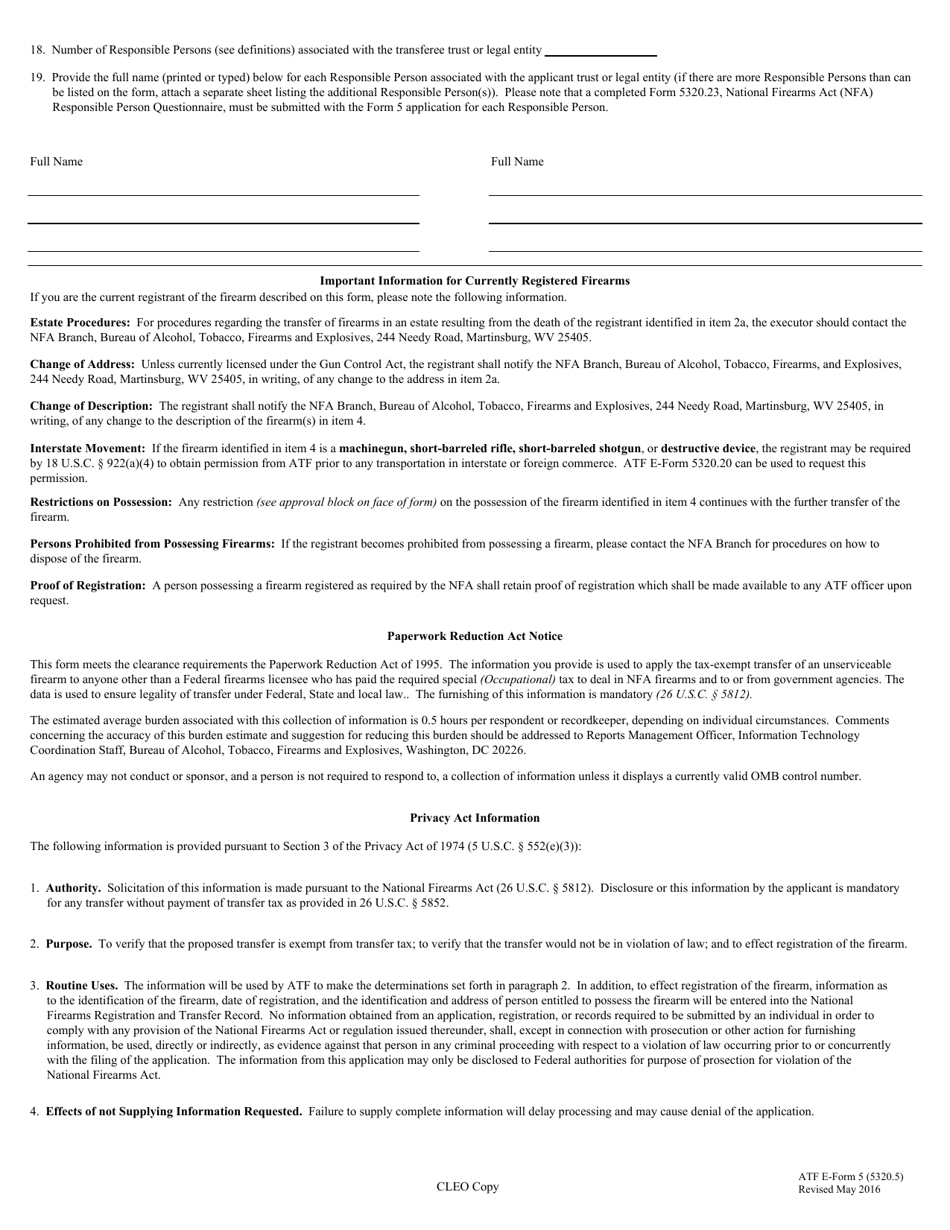

- Items 18 and 19. Fill out if the transferee is a trust or legal entity.

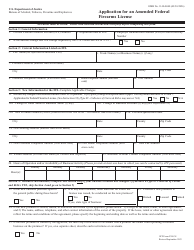

Where to Mail ATF Form 5?

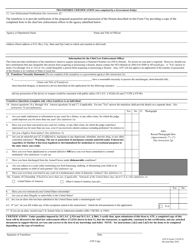

The main recipient of the form is the National Firearms Act (NFA) Branch. The ATF Copy and the ATF Copy 2 should be mailed to this branch at the address provided on the face of the form. The third copy (the CLEO copy of the form) must be submitted to the local chief of police, head of the state police, sheriff, state or local district attorney, or prosecutor.

The wait time is around one month. If you want any updates regarding the status of your application, contact the NFA Branch at (304) 616-4500.