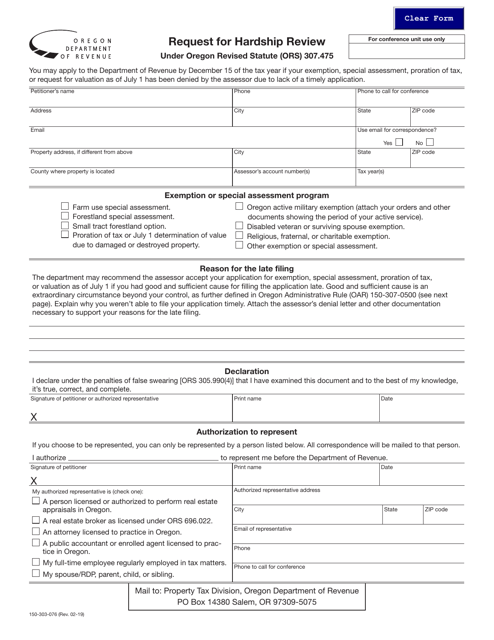

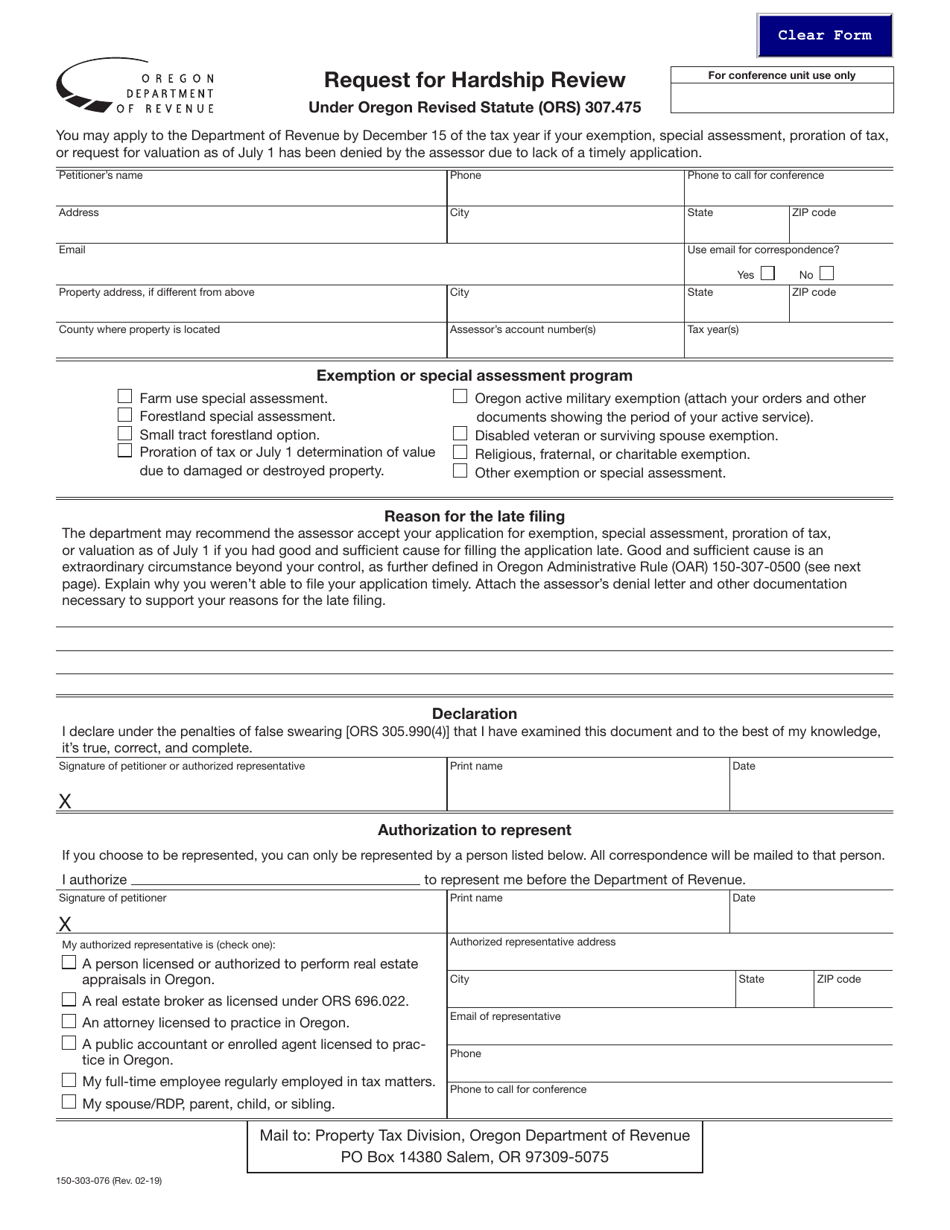

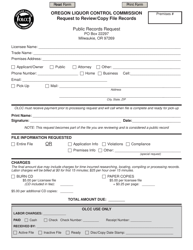

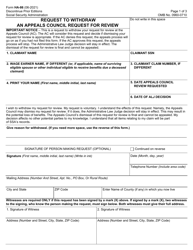

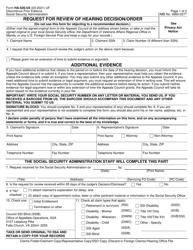

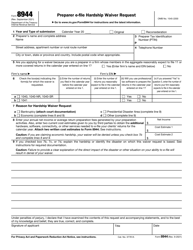

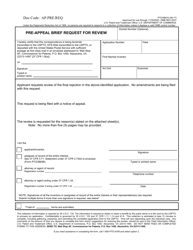

Form 150-303-076 Request for Hardship Review - Oregon

What Is Form 150-303-076?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

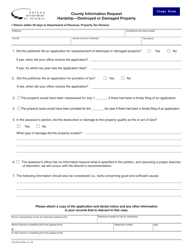

Q: What is Form 150-303-076?

A: Form 150-303-076 is a document used in Oregon to request a hardship review.

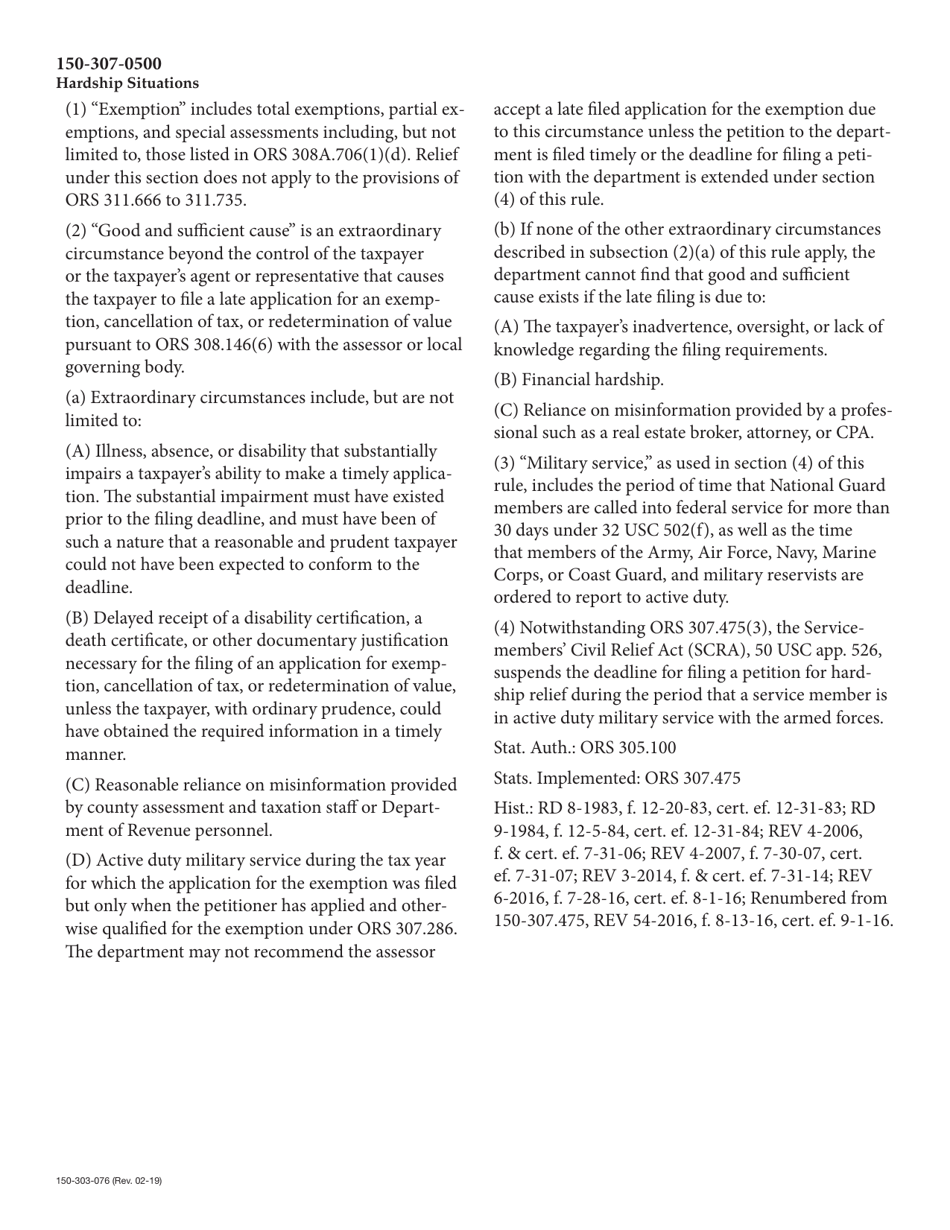

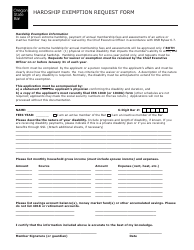

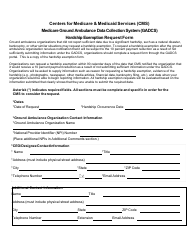

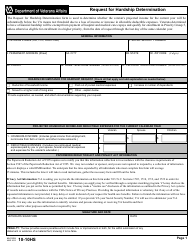

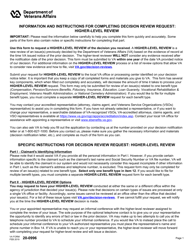

Q: What is a hardship review?

A: A hardship review is a process where you ask the state of Oregon to review your ability to pay your tax debt.

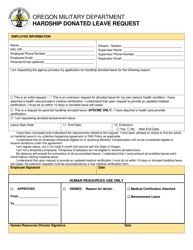

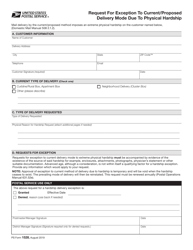

Q: Who can use this form?

A: This form can be used by individuals or businesses in Oregon who are experiencing financial hardship and are unable to pay their tax debt.

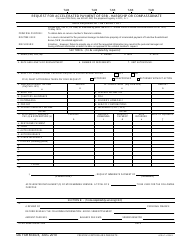

Q: What should I include with the form?

A: You should include supporting documentation that demonstrates your financial hardship, such as income statements, bank statements, and expenses.

Q: What happens after I submit the form?

A: The Oregon Department of Revenue will review your form and supporting documentation to determine if you qualify for a hardship review.

Q: What are the possible outcomes of a hardship review?

A: If you qualify, the department may offer you a payment plan or reduce your tax debt based on your financial situation.

Q: Is there a fee for requesting a hardship review?

A: No, there is no fee to request a hardship review in Oregon.

Q: Can I request a hardship review for other types of debt?

A: No, this form is specifically for requesting a hardship review for tax debt owed to the state of Oregon.

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-076 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.