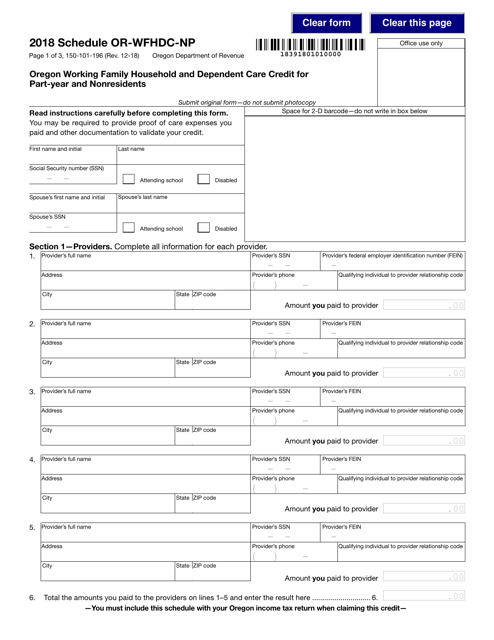

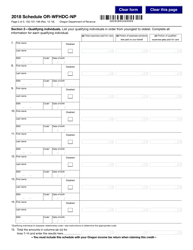

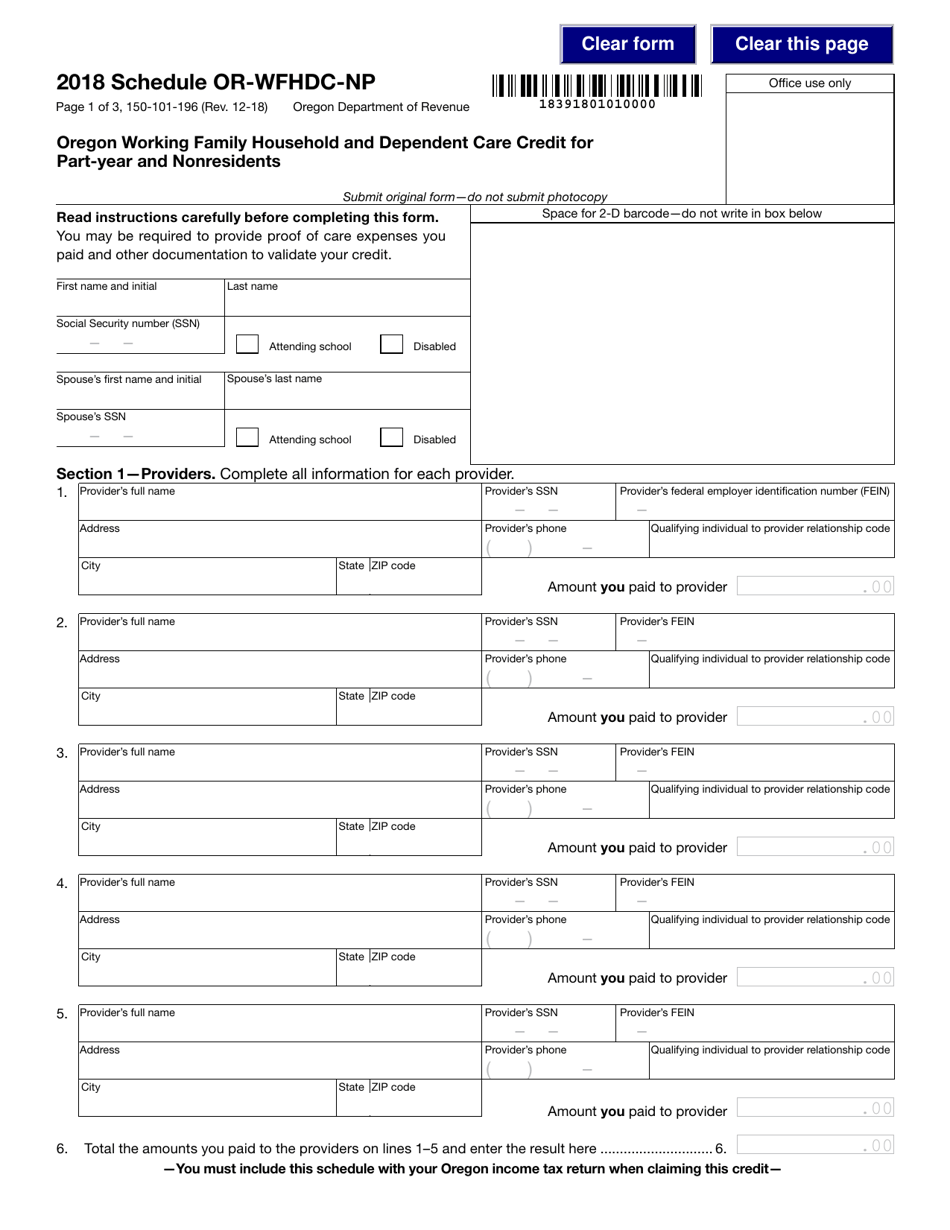

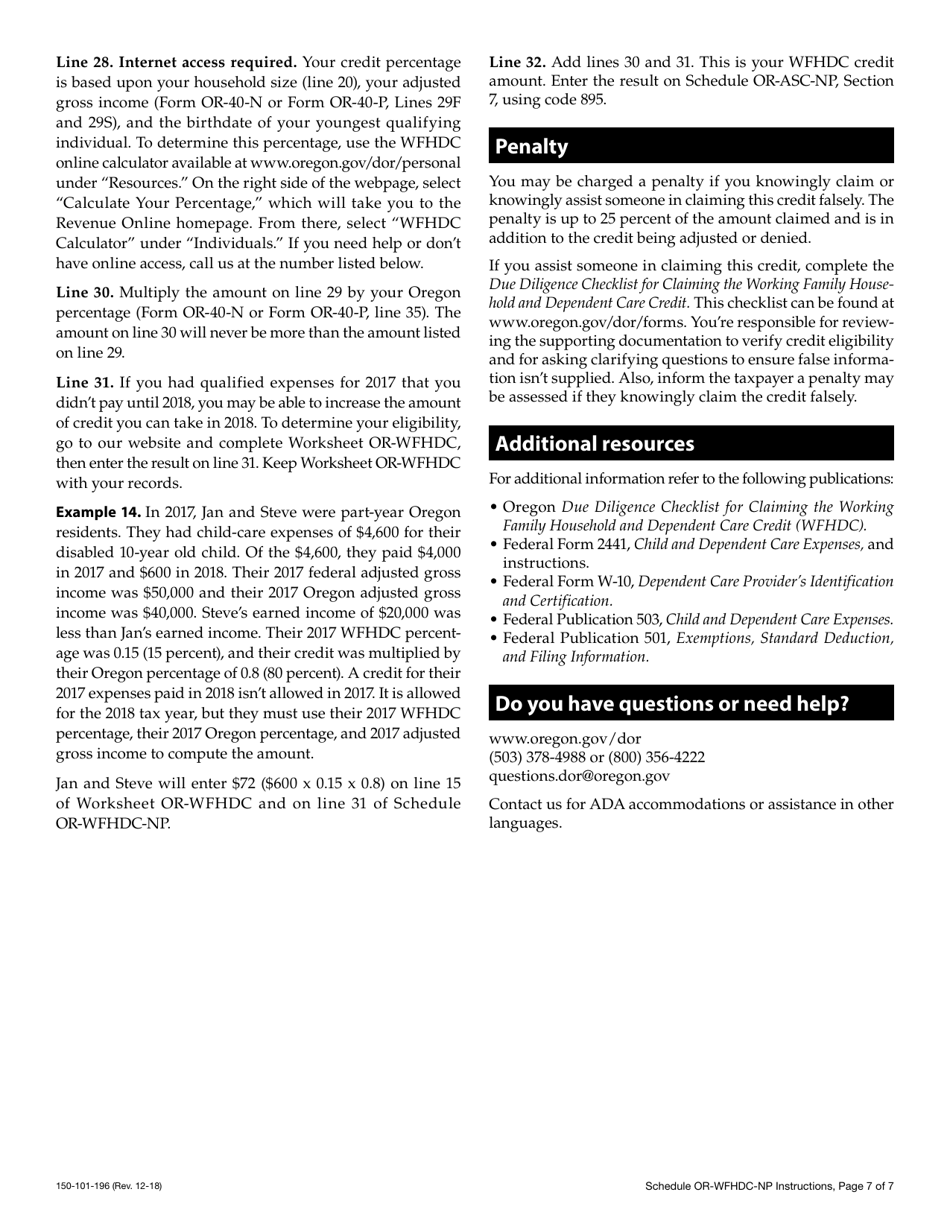

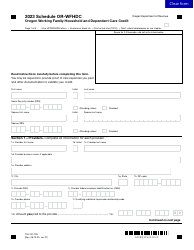

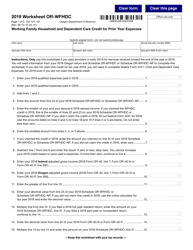

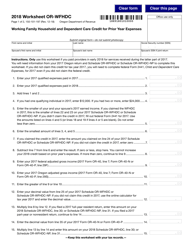

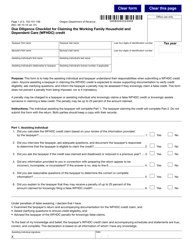

Form 150-101-196 Schedule OR-WFHDC-NP Oregon Working Family Household and Dependent Care Credit for Part-Year and Nonresidents - Oregon

What Is Form 150-101-196 Schedule OR-WFHDC-NP?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-196?

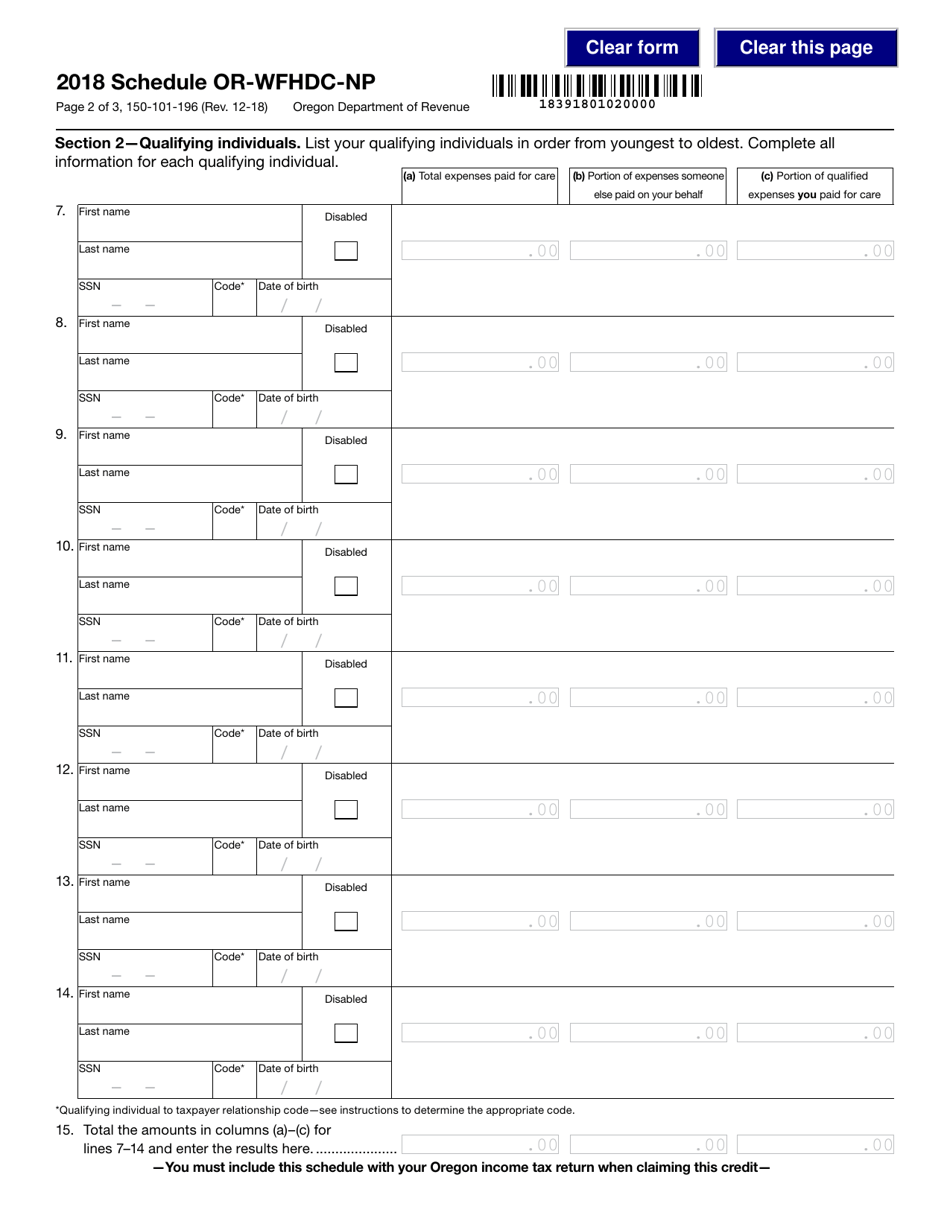

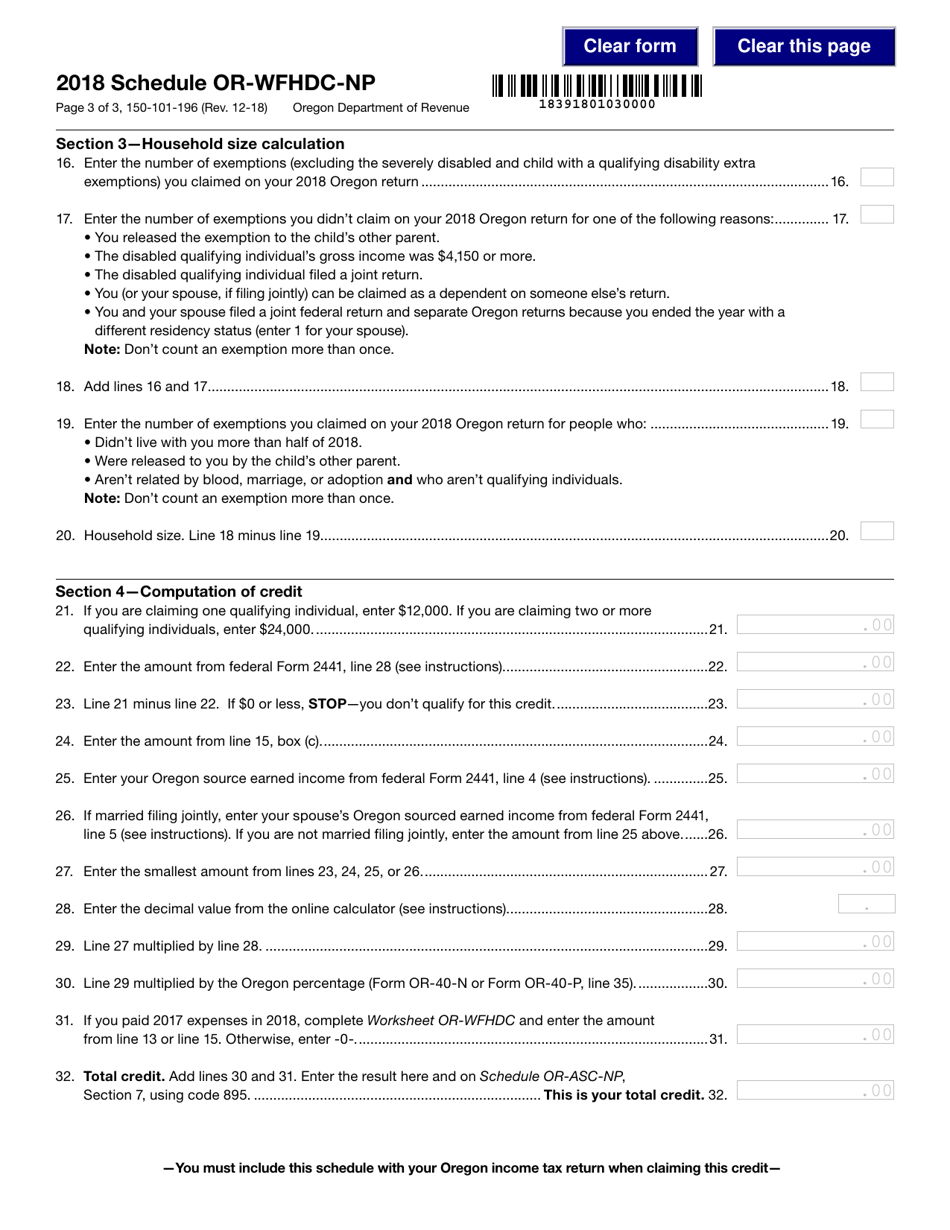

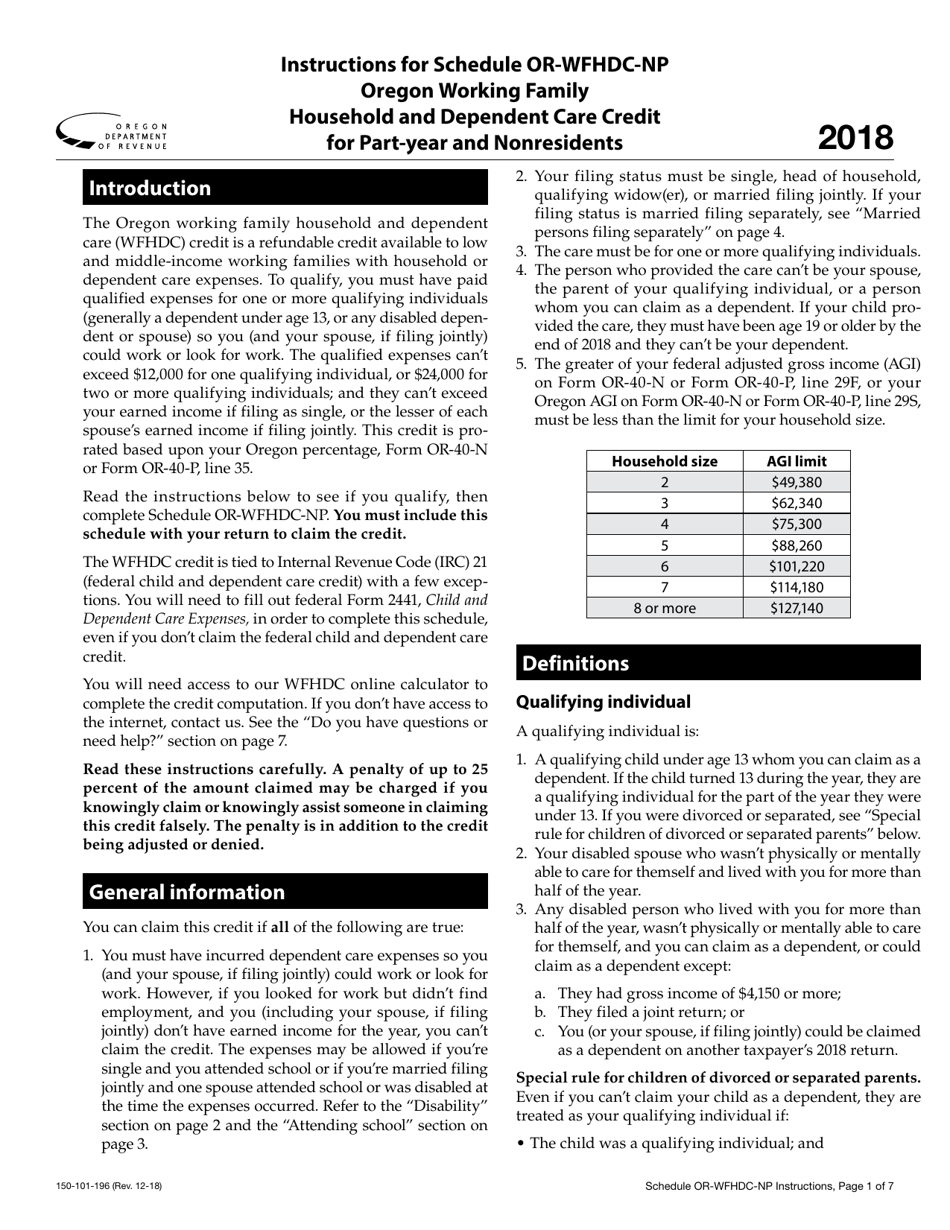

A: Form 150-101-196 is the schedule used for claiming the Oregon Working Family Household and Dependent Care Credit for part-year and nonresidents in Oregon.

Q: Who can use Form 150-101-196?

A: Form 150-101-196 is for taxpayers who are part-year residents or nonresidents of Oregon and want to claim the Working Family Household and Dependent Care Credit.

Q: What is the Oregon Working Family Household and Dependent Care Credit?

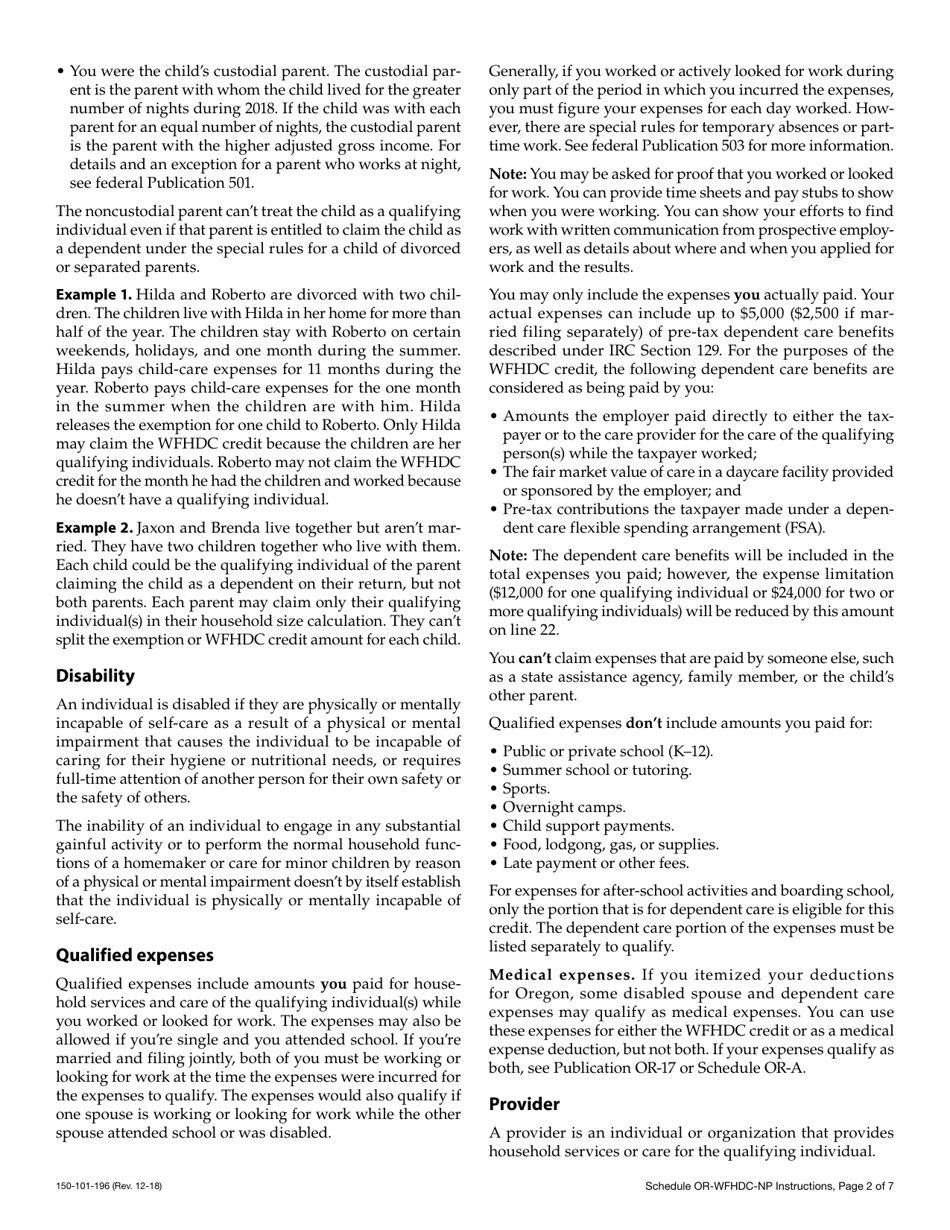

A: The Oregon Working Family Household and Dependent Care Credit is a tax credit available to eligible taxpayers who have qualifying expenses for the care of dependent household members.

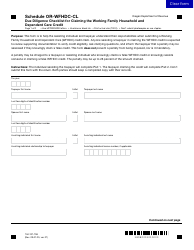

Q: What expenses are eligible for the credit?

A: Expenses related to the care of dependent household members, such as child care expenses or care for a disabled adult, may be eligible for the credit.

Q: How do I claim the credit?

A: To claim the credit, you need to complete Form 150-101-196 and include it with your Oregon income tax return.

Q: Are there any eligibility requirements?

A: Yes, there are eligibility requirements for the Working Family Household and Dependent Care Credit. You must meet certain criteria related to household income and the type of care expenses incurred.

Q: When is the deadline to file Form 150-101-196?

A: The deadline to file Form 150-101-196 is the same as the deadline for filing your Oregon income tax return, which is generally April 15th.

Q: Can I claim the credit if I am a full-year resident of Oregon?

A: No, Form 150-101-196 is specifically for part-year residents and nonresidents of Oregon. Full-year residents should use a different form to claim the credit.

Q: Is the credit refundable?

A: Yes, the Working Family Household and Dependent Care Credit is refundable, which means you may still receive a refund even if you have no tax liability.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-196 Schedule OR-WFHDC-NP by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.