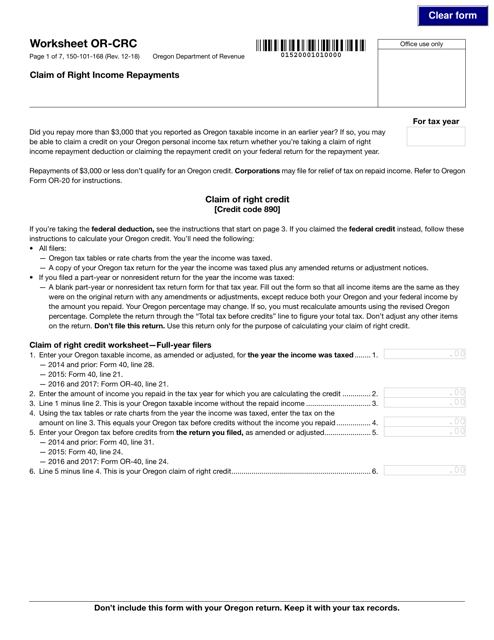

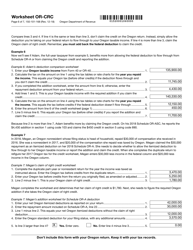

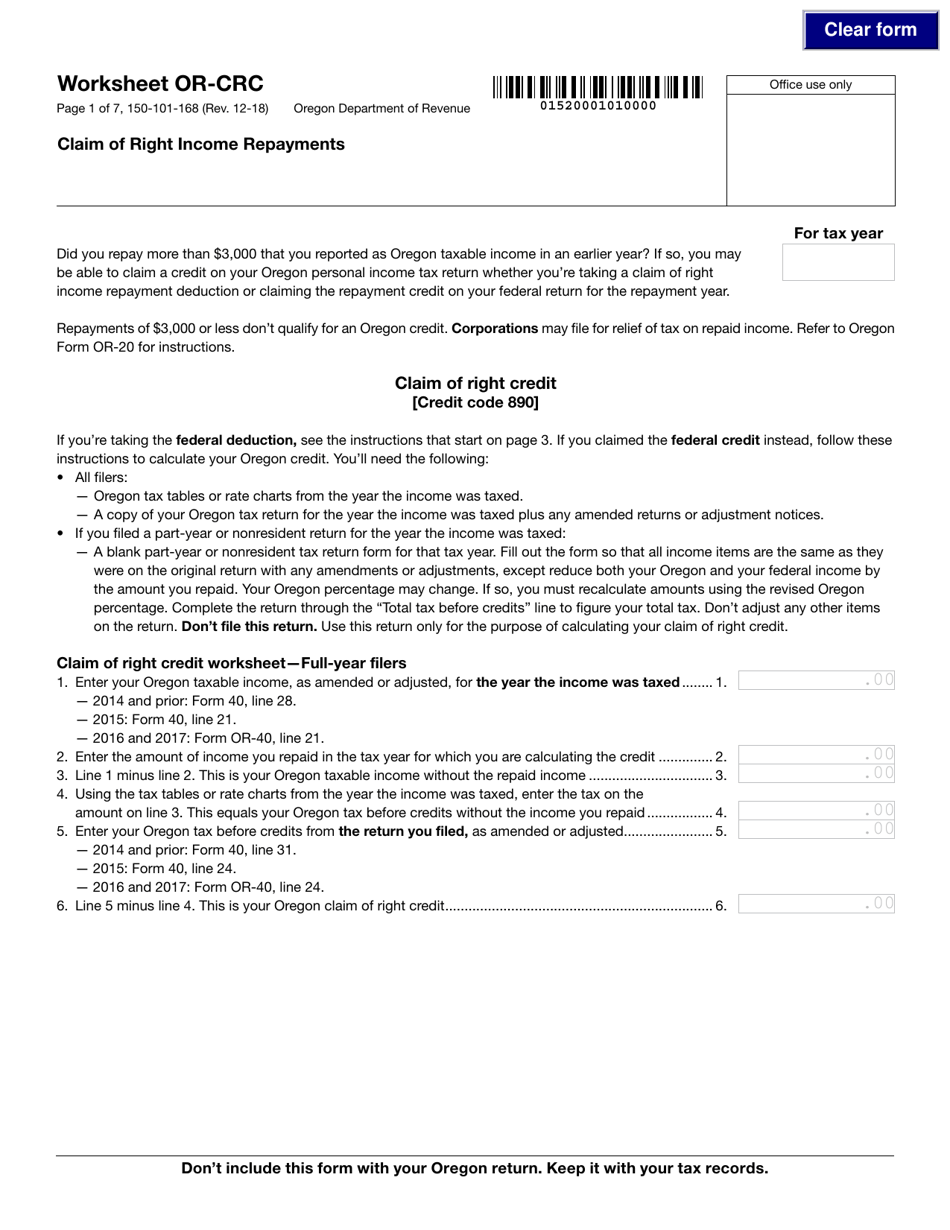

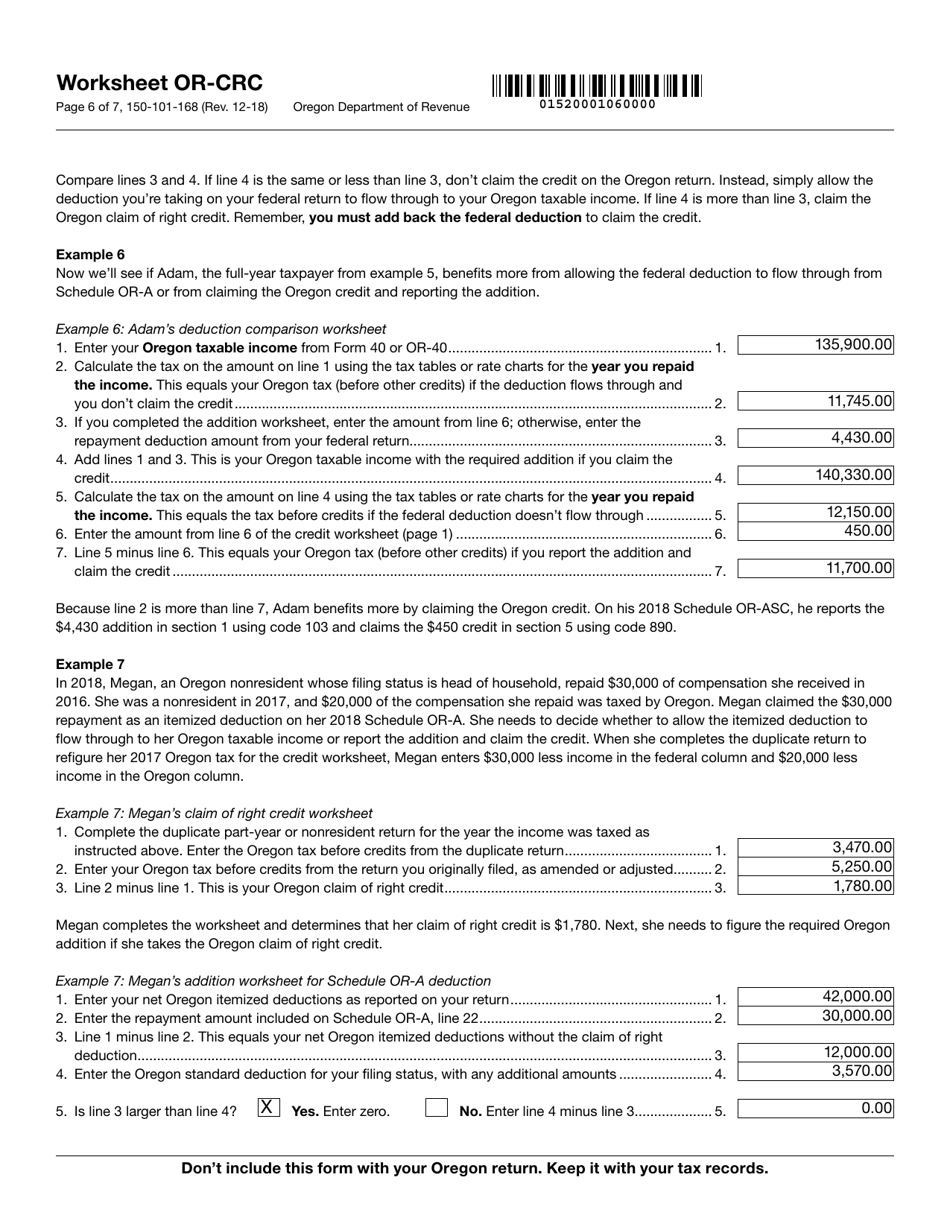

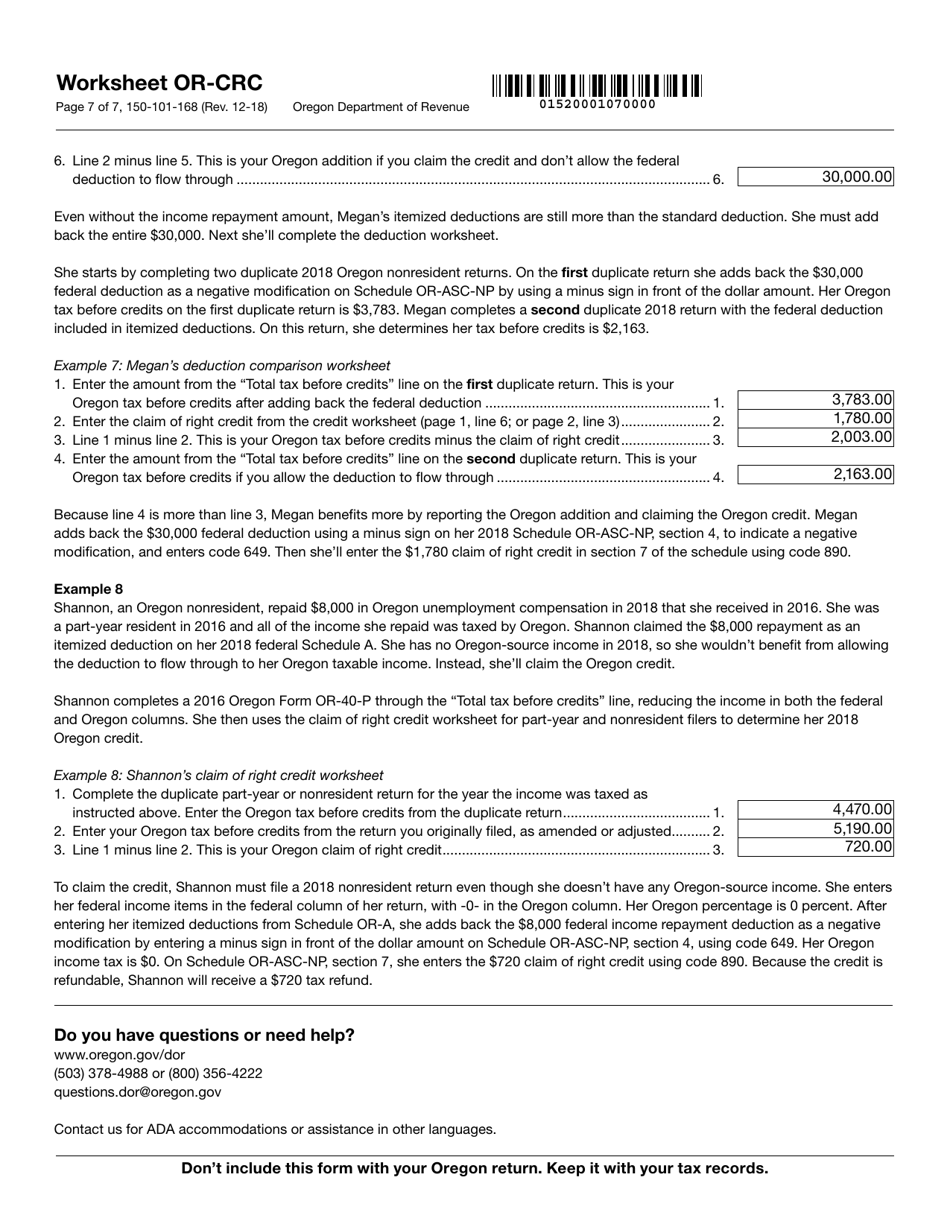

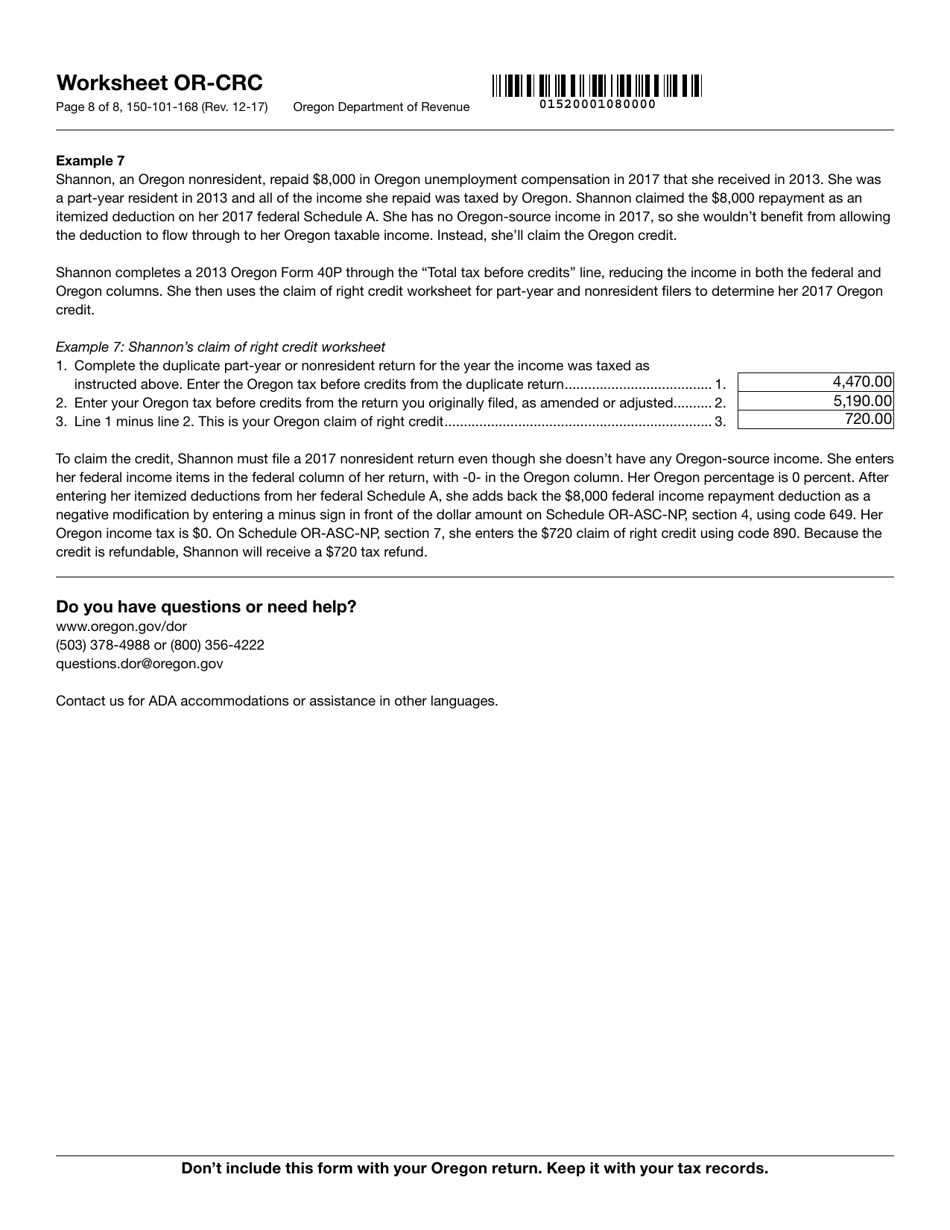

Form 150-101-168 Worksheet or-Crc - Claim of Right Income Repayments - Oregon

What Is Form 150-101-168?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

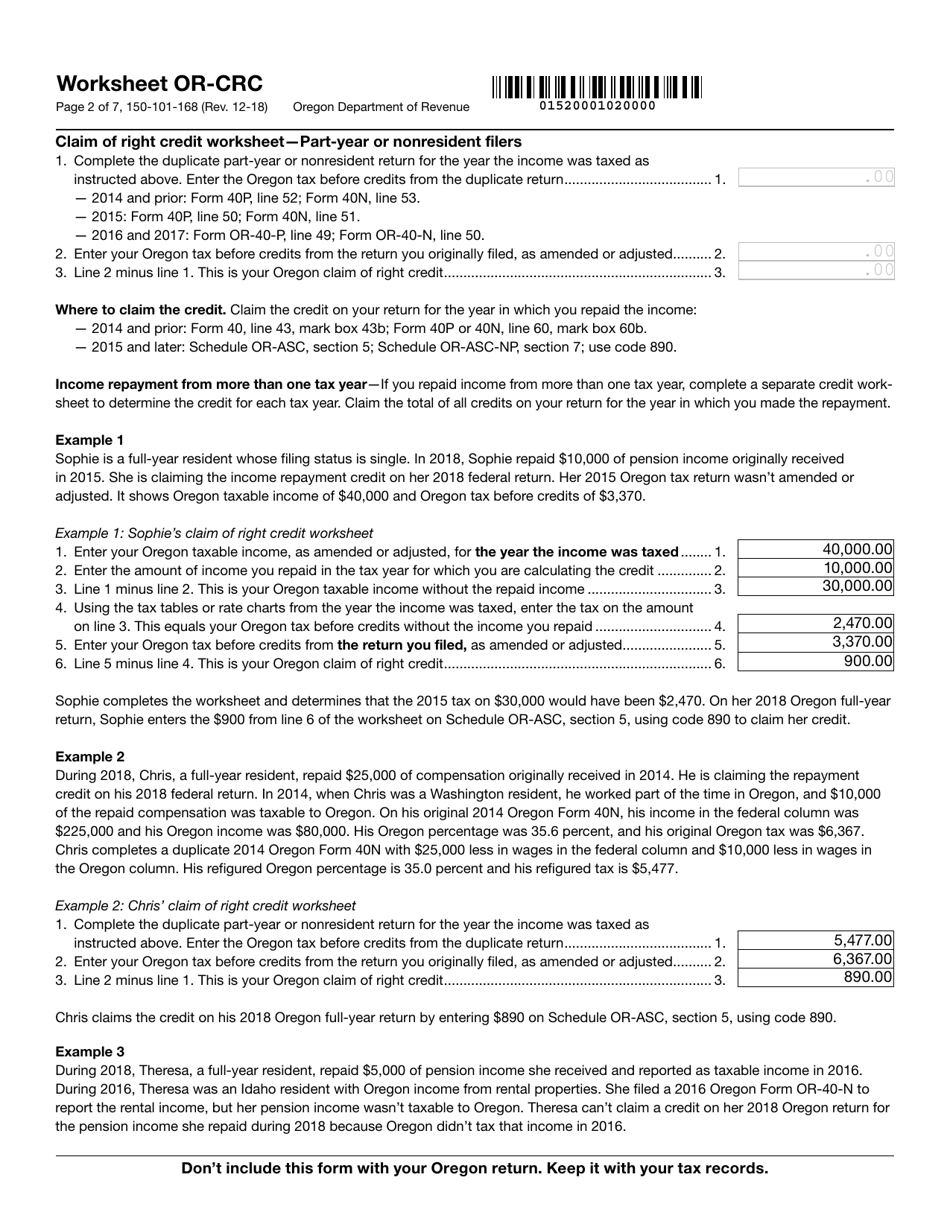

Q: What is Form 150-101-168?

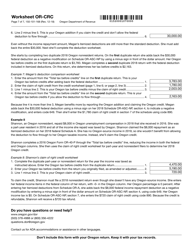

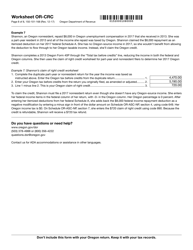

A: Form 150-101-168 is a worksheet used for claiming repayments of income under the Claim of Right doctrine in Oregon.

Q: What is the Claim of Right doctrine?

A: The Claim of Right doctrine allows taxpayers to claim a repayment of income that was reported in a previous year but is later deemed not taxable.

Q: Who can use Form 150-101-168?

A: Individuals who meet the criteria for claiming a repayment of income under the Claim of Right doctrine in Oregon can use Form 150-101-168.

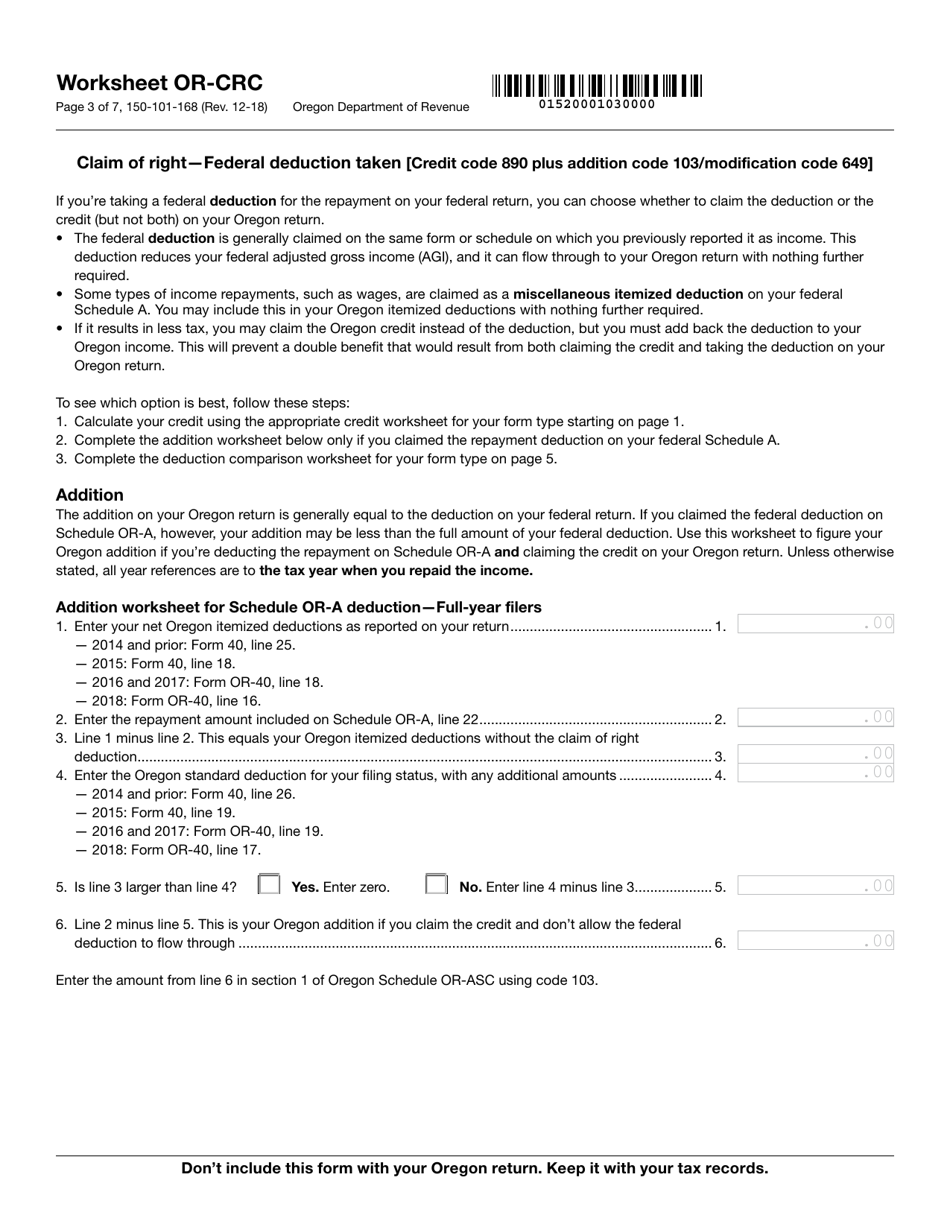

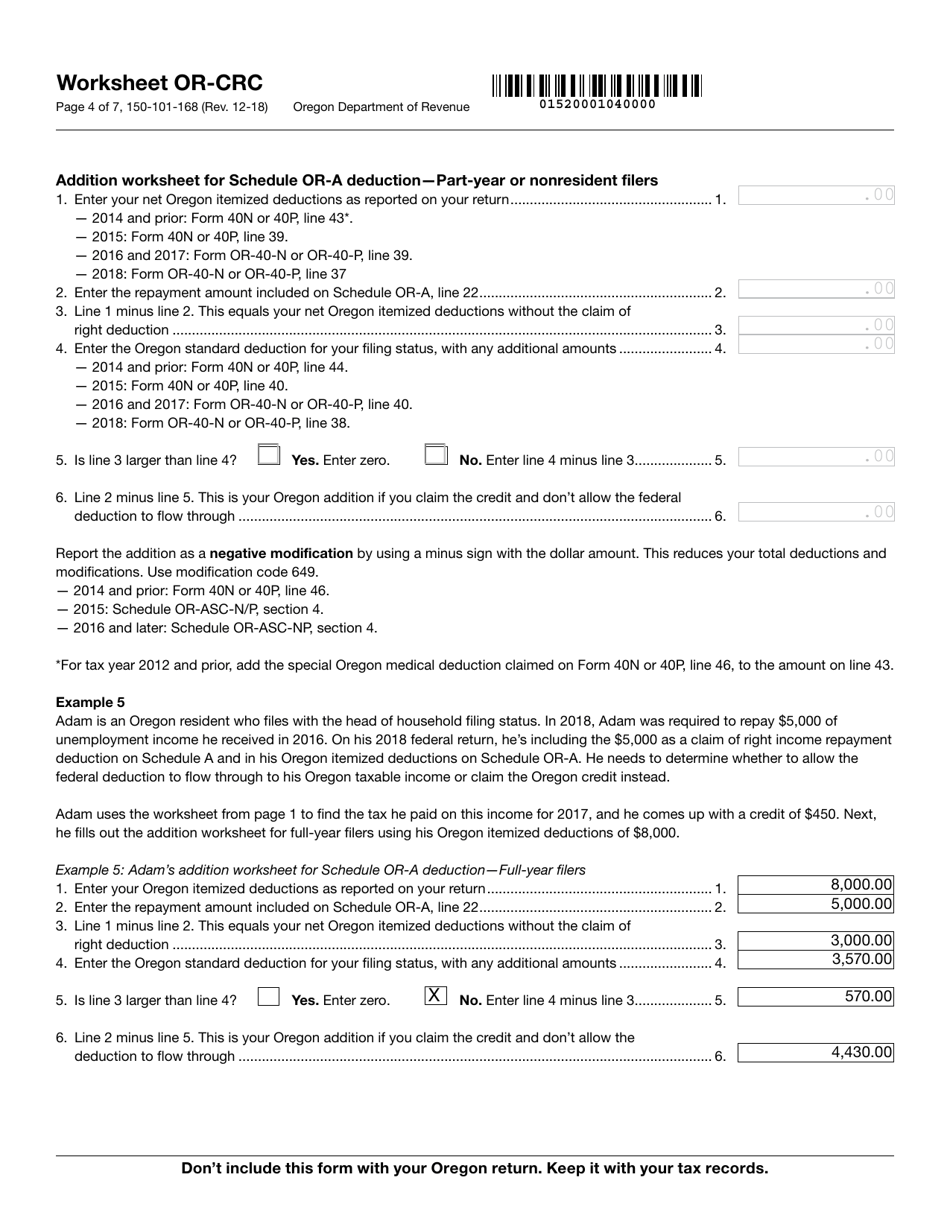

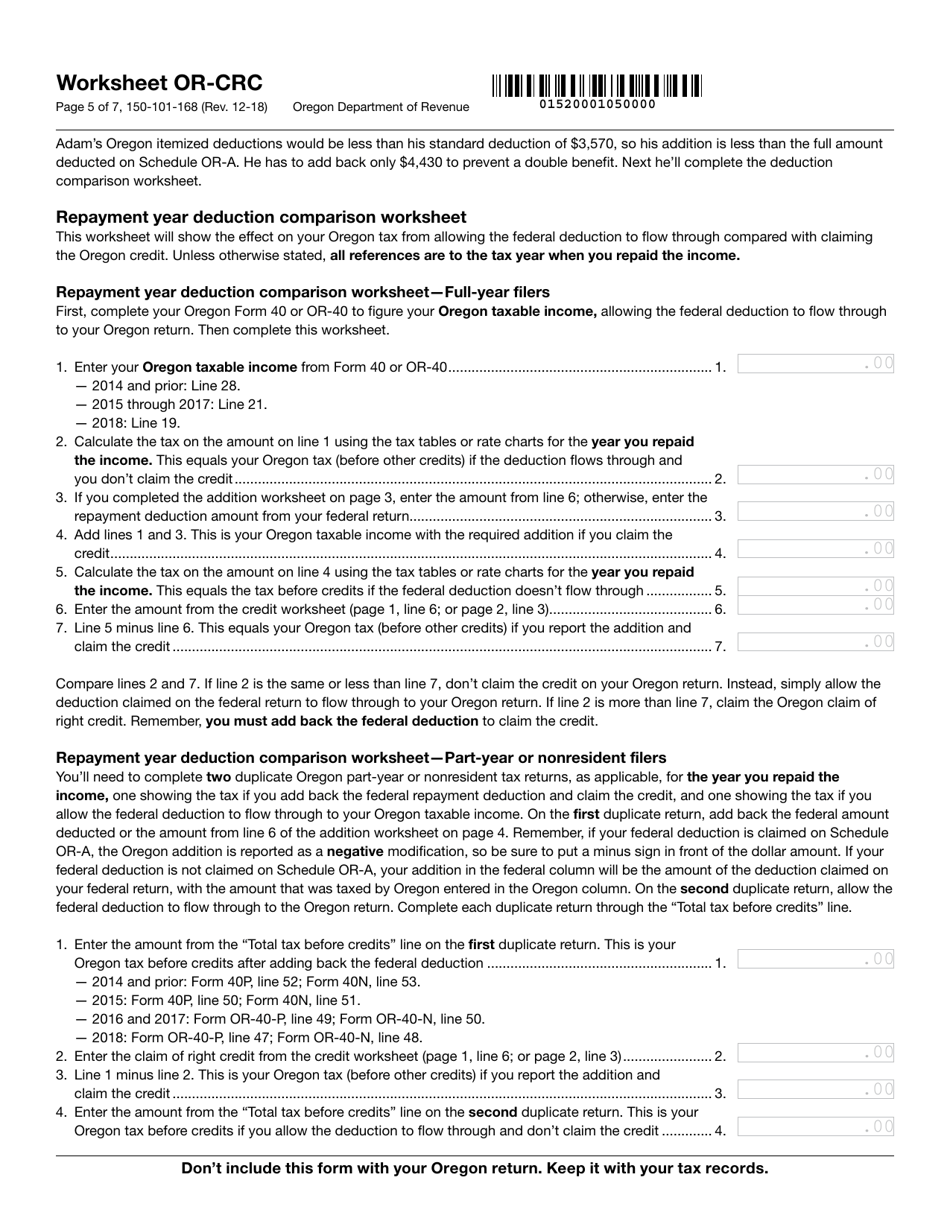

Q: How do I complete Form 150-101-168?

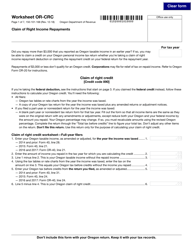

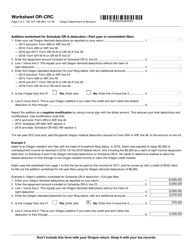

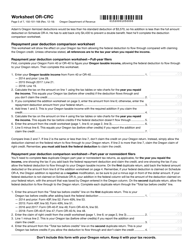

A: You need to provide information about the income you are claiming as a repayment, the tax year in which it was reported, and the amount of tax paid on that income.

Q: Is there a deadline for filing Form 150-101-168?

A: Yes, the deadline for filing Form 150-101-168 is the same as the deadline for filing your Oregon income tax return for that tax year.

Q: What should I do if I have questions about Form 150-101-168?

A: If you have questions about Form 150-101-168 or need assistance in completing it, you should contact the Oregon Department of Revenue for guidance.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-168 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.