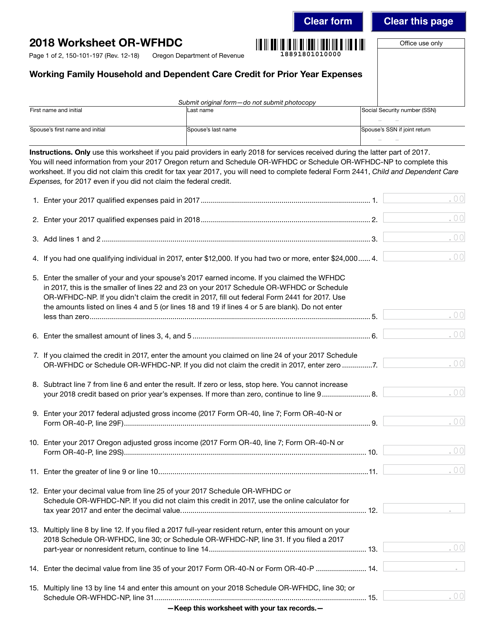

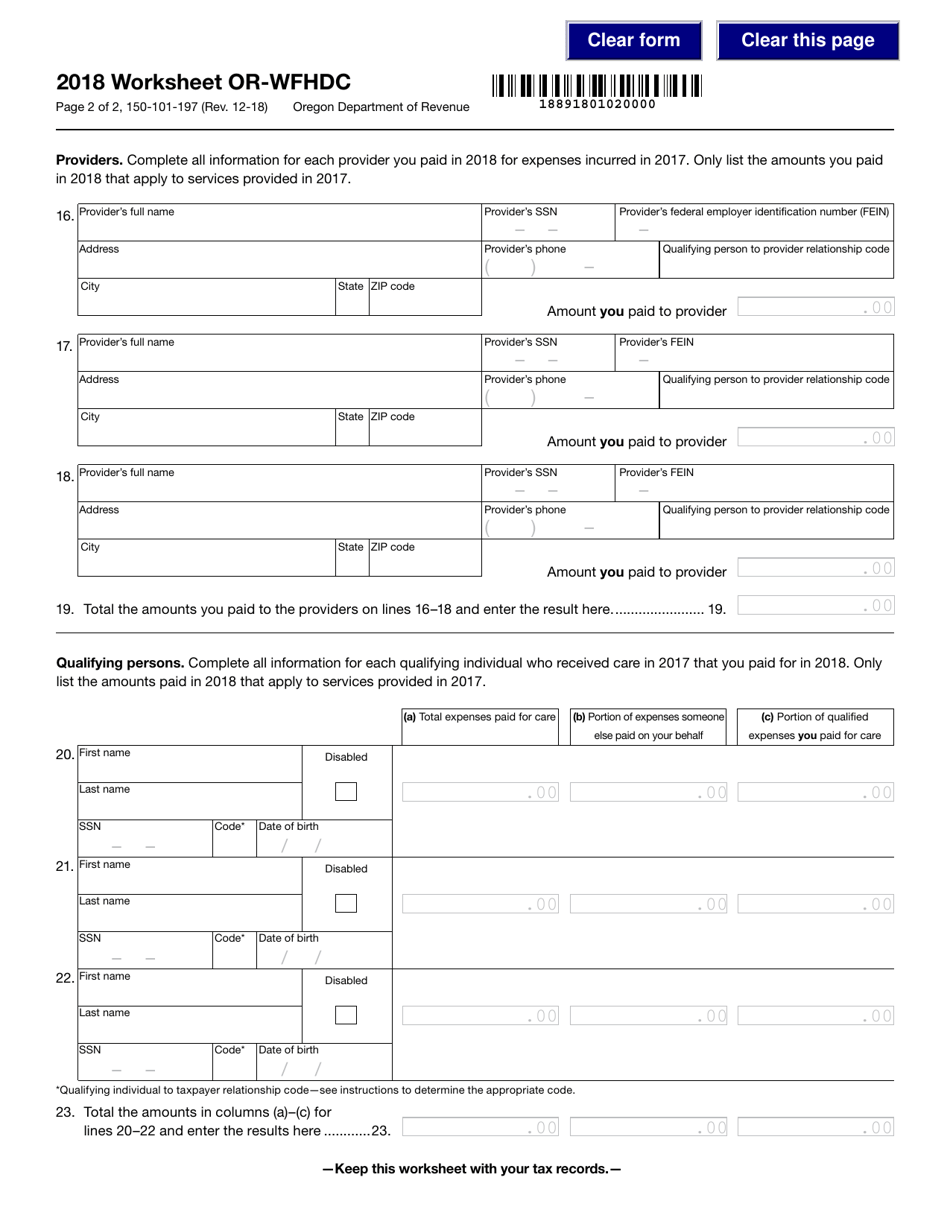

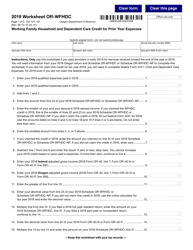

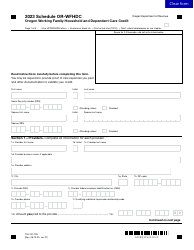

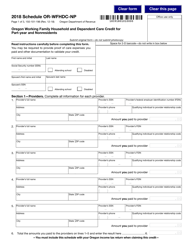

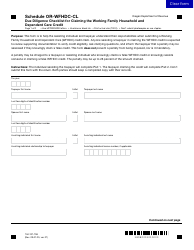

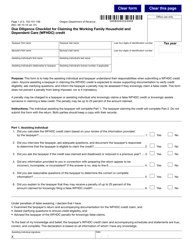

Form 150-101-197 Worksheet or-Wfhdc - Working Family Household and Dependent Care Credit for Prior Year Expenses - Oregon

What Is Form 150-101-197?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-197?

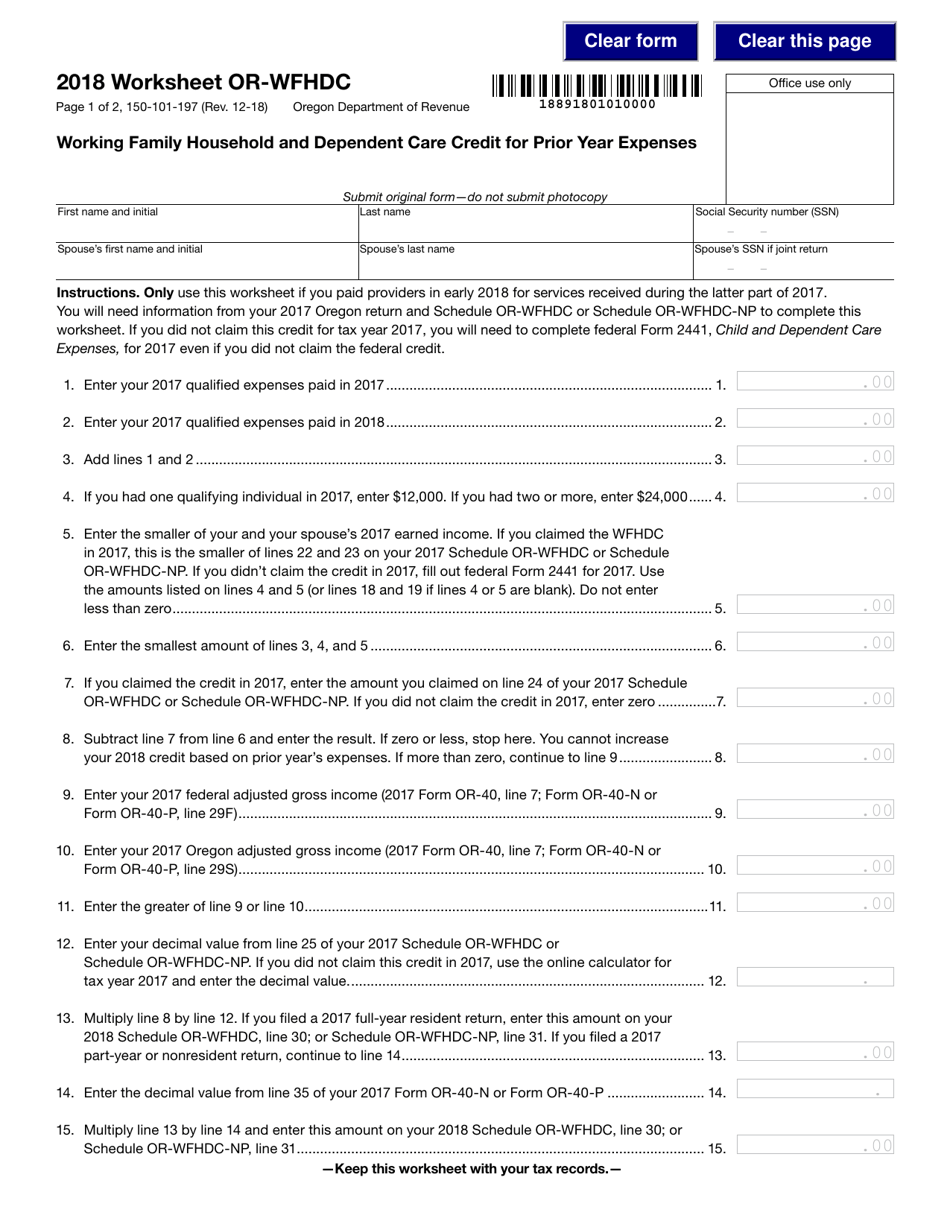

A: Form 150-101-197 is a worksheet for the Working Family Household and Dependent Care Credit for Prior Year Expenses in Oregon.

Q: What is the purpose of Form 150-101-197?

A: The purpose of Form 150-101-197 is to calculate the Working Family Household and Dependent Care Credit for prior year expenses in Oregon.

Q: What does the Working Family Household and Dependent Care Credit cover?

A: The Working Family Household and Dependent Care Credit covers expenses incurred for the care of dependents while the taxpayer or their spouse was working or looking for work.

Q: Who is eligible for the Working Family Household and Dependent Care Credit?

A: Taxpayers in Oregon who have incurred expenses for the care of dependents while working or looking for work are eligible for the credit.

Q: How do I calculate the Working Family Household and Dependent Care Credit?

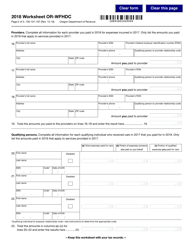

A: You can calculate the credit by following the instructions on Form 150-101-197 and entering the relevant information regarding your prior year expenses.

Q: Is the Working Family Household and Dependent Care Credit refundable?

A: No, the Working Family Household and Dependent Care Credit is not refundable in Oregon. It can only be used to offset your tax liability.

Q: Are there any income limits for the Working Family Household and Dependent Care Credit?

A: Yes, there are income limits for the credit. The limits vary based on your filing status and number of dependents.

Q: Can I claim the Working Family Household and Dependent Care Credit for expenses incurred in a previous year?

A: Yes, you can claim the credit for prior year expenses by using Form 150-101-197.

Q: Are there any restrictions on the type of care expenses that can be claimed?

A: Yes, there are restrictions on the type of care expenses that can be claimed. Only expenses related to the care of eligible dependents are eligible for the credit.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-197 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.