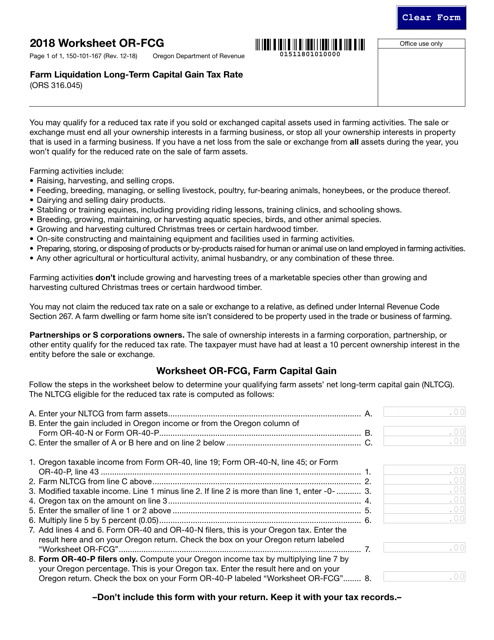

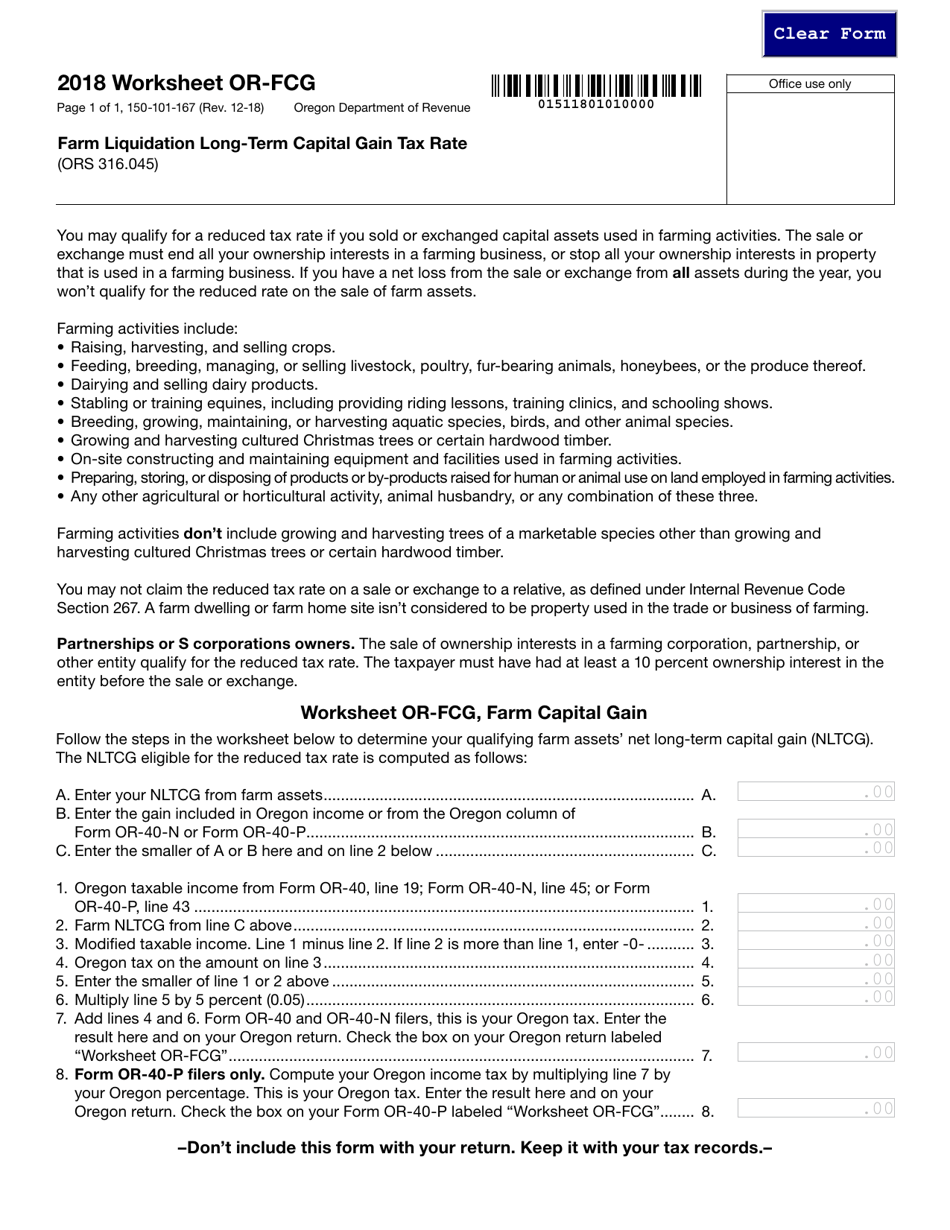

Form 150-101-167 Worksheet or-Fcg - Farm Liquidation Long-Term Capital Gain Tax Rate - Oregon

What Is Form 150-101-167?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-167?

A: Form 150-101-167 is a worksheet provided by the state of Oregon for calculating the Farm Liquidation Long-Term Capital Gain Tax Rate.

Q: What is the purpose of Form 150-101-167?

A: The purpose of Form 150-101-167 is to determine the tax rate on long-term capital gains from farm liquidation in Oregon.

Q: What is a long-term capital gain?

A: A long-term capital gain is a profit from the sale of an asset that has been owned for more than one year.

Q: What is a farm liquidation?

A: A farm liquidation is the process of selling off assets and closing down a farm.

Q: What is the tax rate for long-term capital gains from farm liquidation in Oregon?

A: The tax rate for long-term capital gains from farm liquidation in Oregon can be calculated using Form 150-101-167.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-167 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.