This version of the form is not currently in use and is provided for reference only. Download this version of

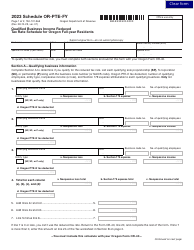

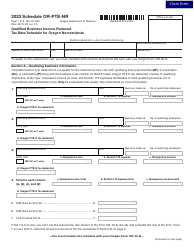

Form 150-101-366 Schedule OR-PTE-PY

for the current year.

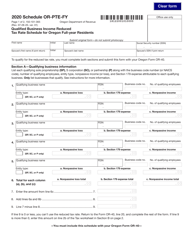

Form 150-101-366 Schedule OR-PTE-PY Qualified Business Income Reduced Tax Rate Schedule for Oregon Part-Year Residents - Oregon

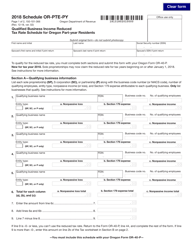

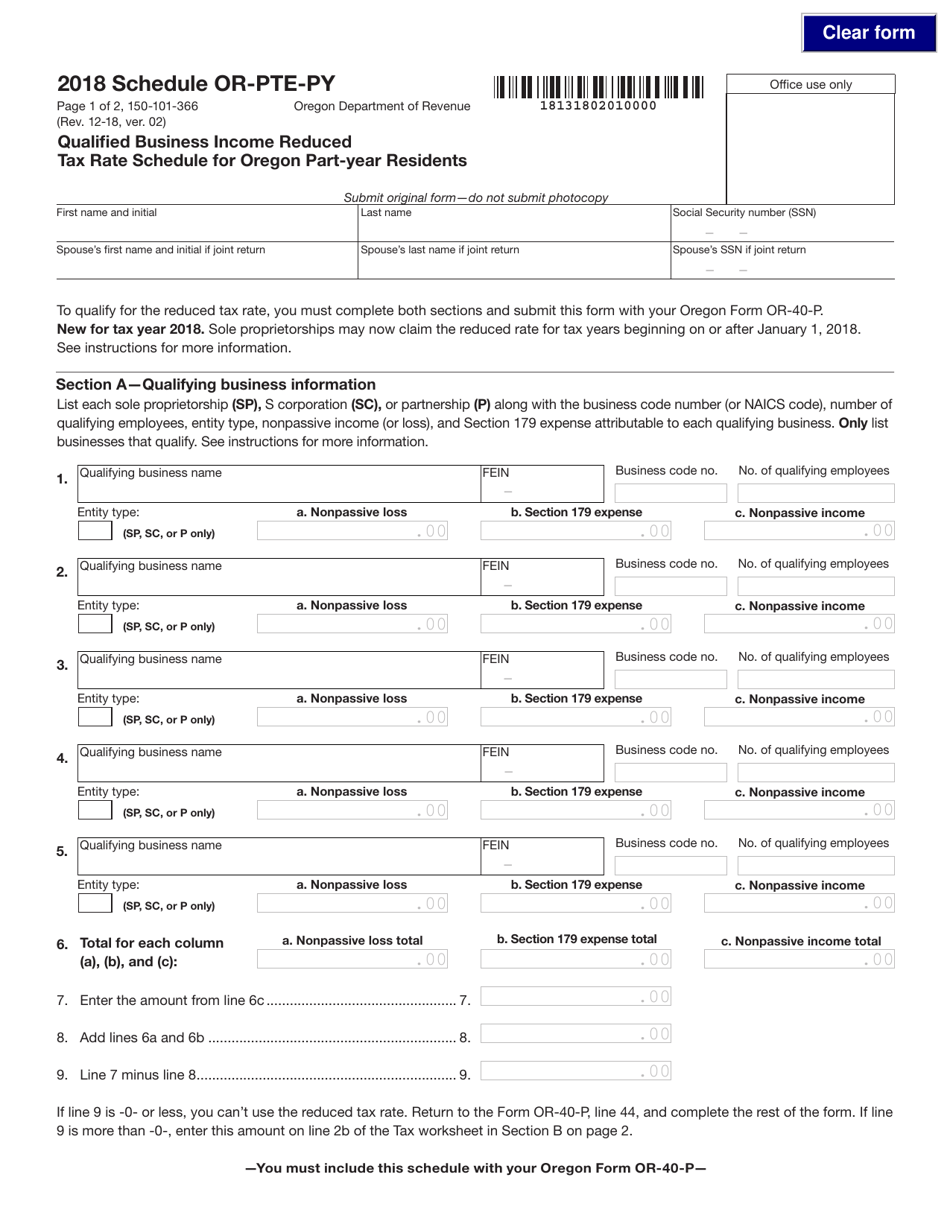

What Is Form 150-101-366 Schedule OR-PTE-PY?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-366?

A: Form 150-101-366 is the Schedule OR-PTE-PY, which is used for calculating the Qualified Business Income Reduced Tax Rate for Oregon part-year residents.

Q: Who can use Form 150-101-366?

A: Form 150-101-366 is specifically designed for Oregon part-year residents who have qualified business income.

Q: What is the purpose of Form 150-101-366?

A: The purpose of Form 150-101-366 is to determine the reduced tax rate for qualified business income for Oregon part-year residents.

Q: How does Form 150-101-366 work?

A: Form 150-101-366 calculates the qualified business income reduced tax rate by applying the appropriate percentages to the allocated income for Oregon part-year residents.

Q: Do I need to file Form 150-101-366?

A: Only Oregon part-year residents with qualified business income need to file Form 150-101-366 to determine their reduced tax rate.

Q: Are part-year residents eligible for a reduced tax rate on qualified business income in Oregon?

A: Yes, part-year residents in Oregon can potentially qualify for a reduced tax rate on their qualified business income using Form 150-101-366.

Q: Can I use Form 150-101-366 if I am not a part-year resident of Oregon?

A: No, Form 150-101-366 is specifically for Oregon part-year residents. Other taxpayers should consult the appropriate tax forms for their residency status.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-366 Schedule OR-PTE-PY by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.