This version of the form is not currently in use and is provided for reference only. Download this version of

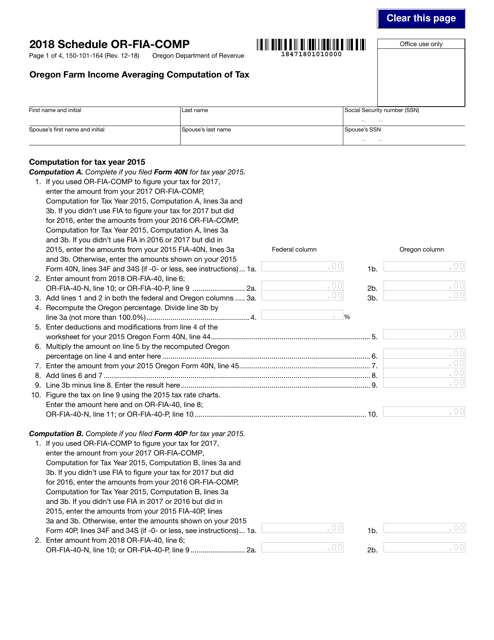

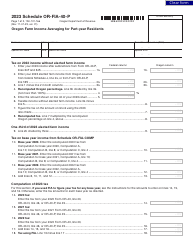

Form 150-101-164 Schedule OR-FIA-COMP

for the current year.

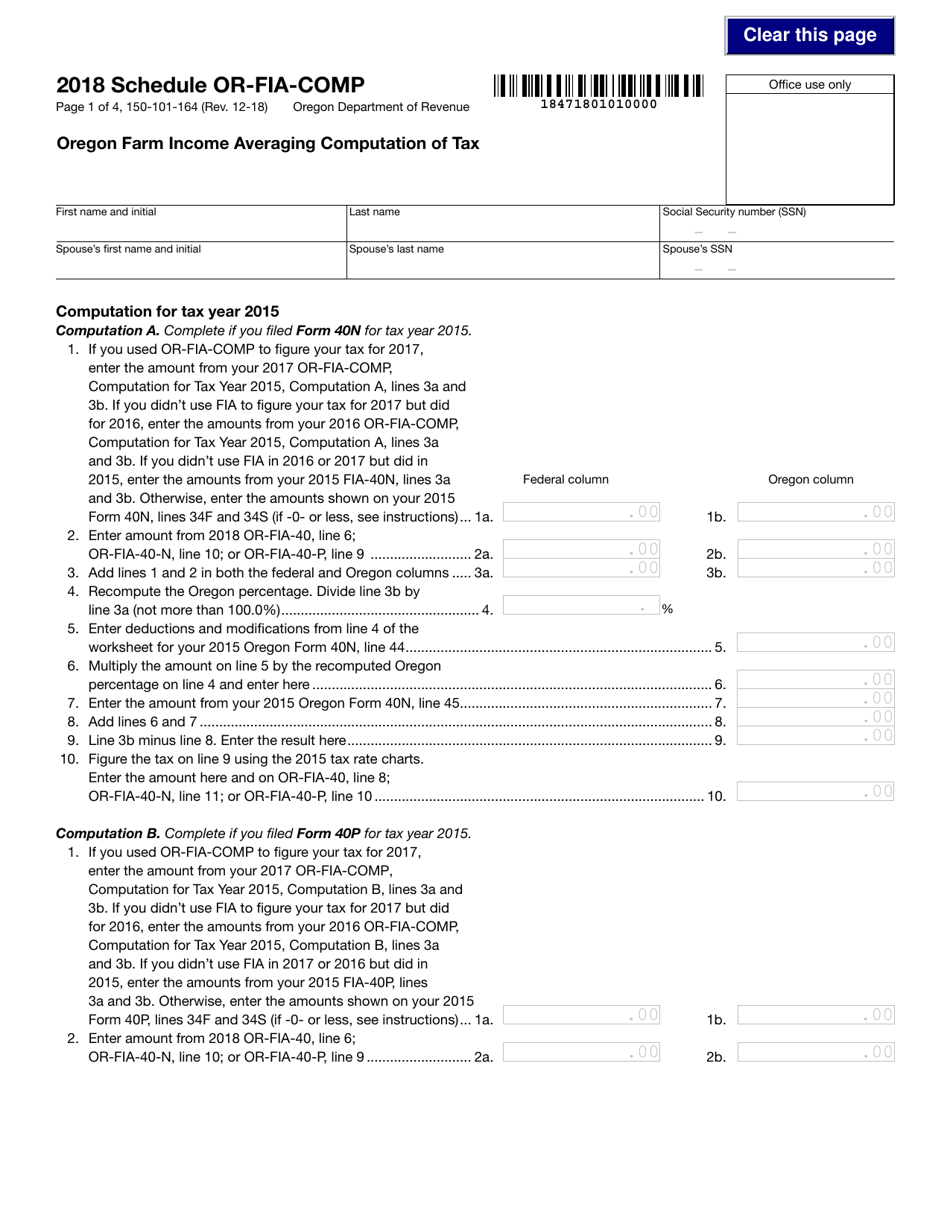

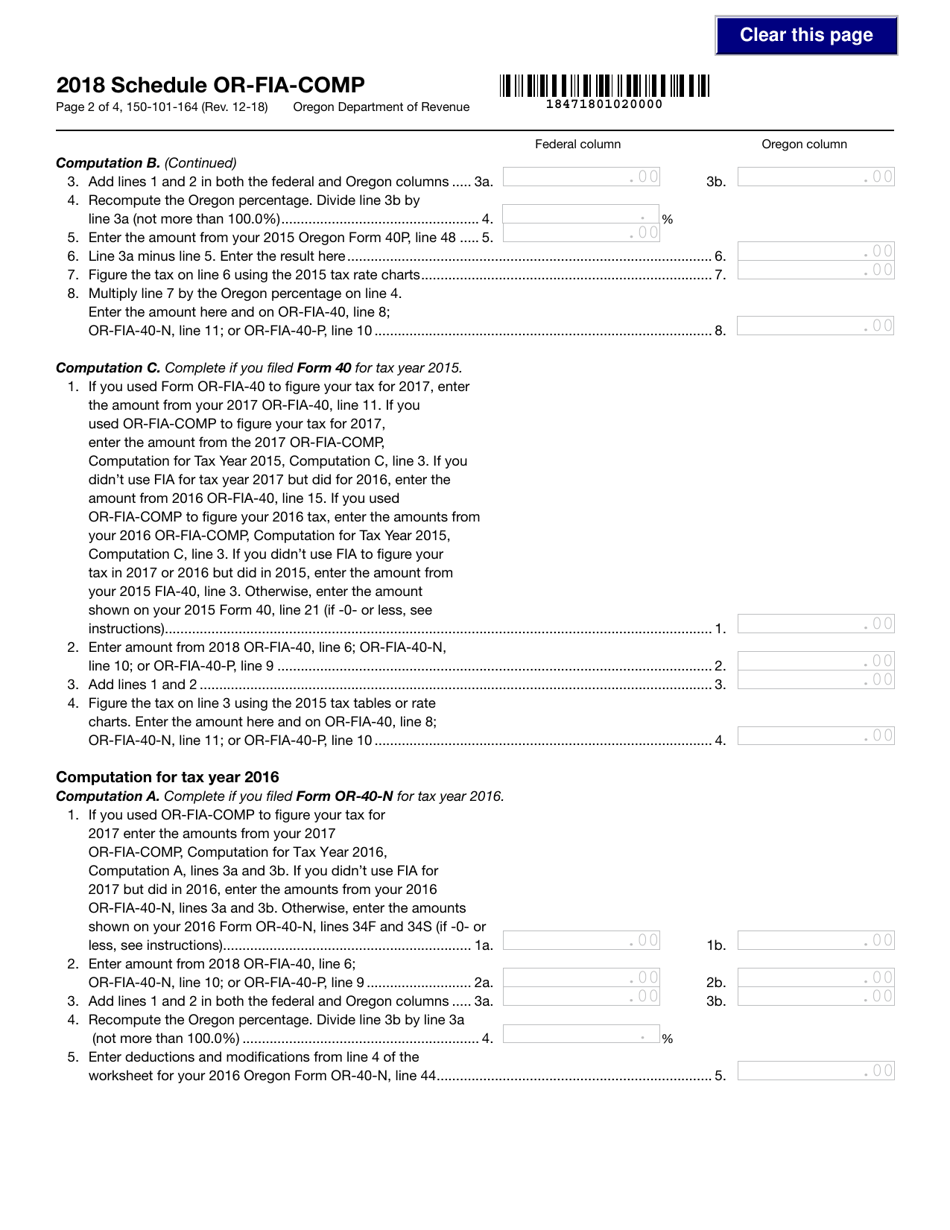

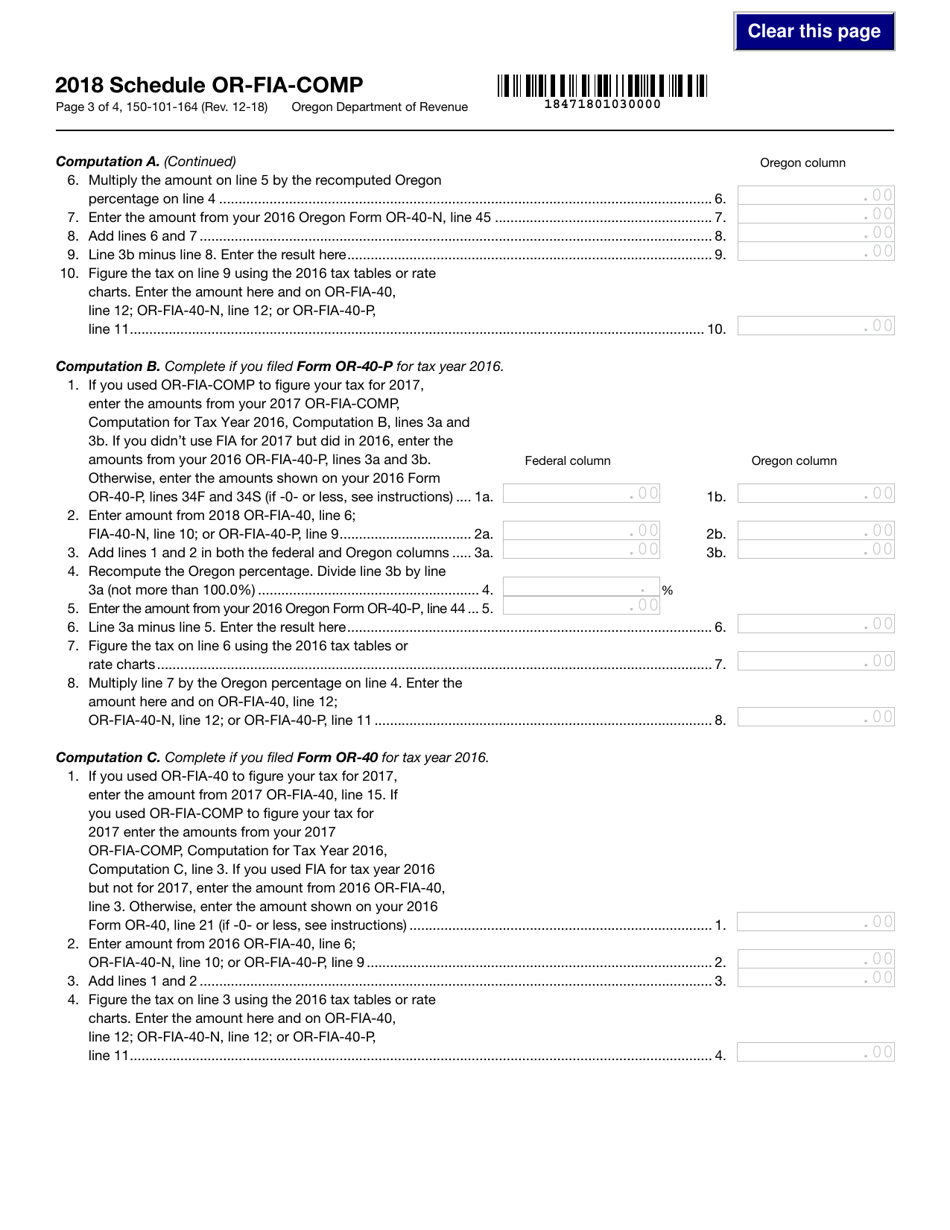

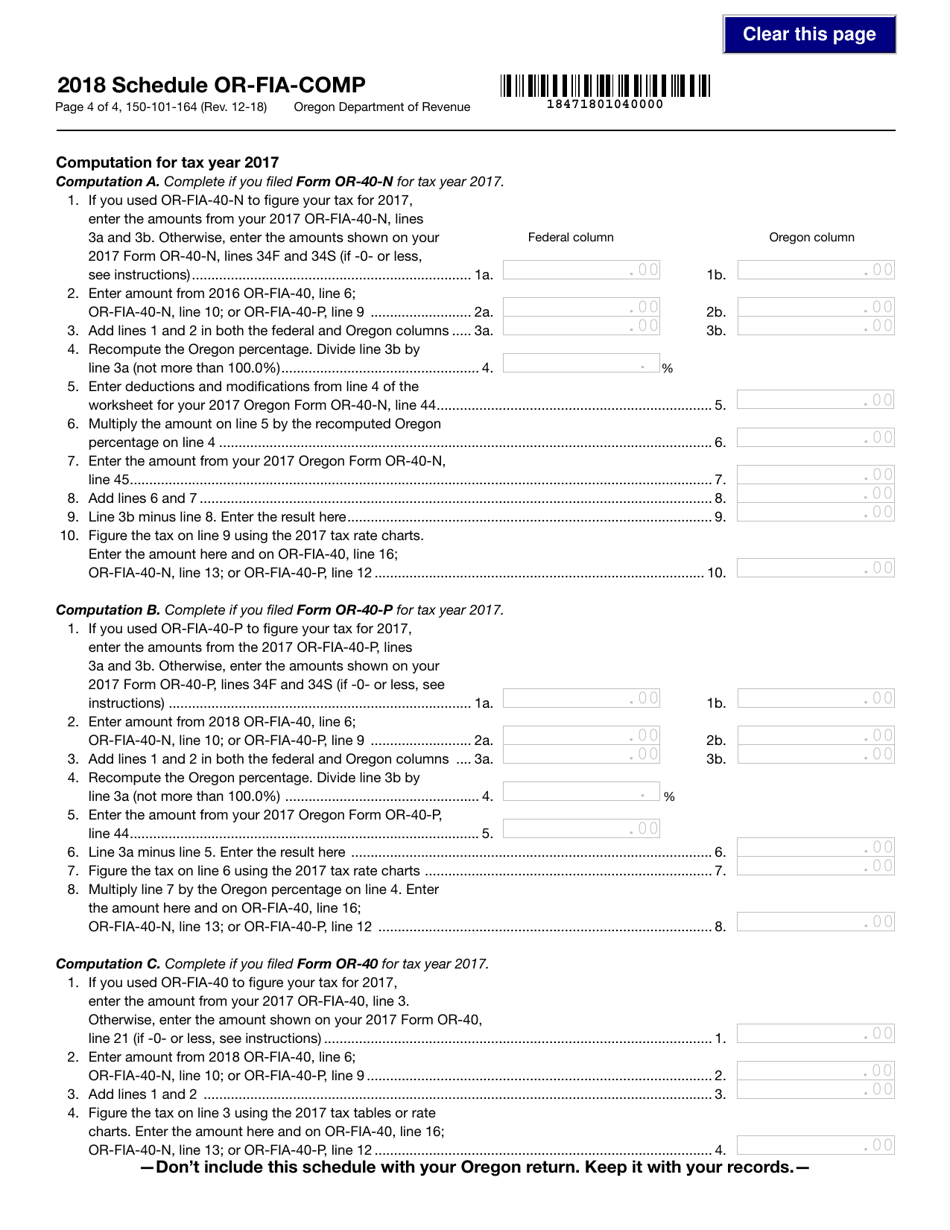

Form 150-101-164 Schedule OR-FIA-COMP Oregon Farm Income Averaging Computation of Tax - Oregon

What Is Form 150-101-164 Schedule OR-FIA-COMP?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-164 Schedule OR-FIA-COMP?

A: Form 150-101-164 Schedule OR-FIA-COMP is a tax form used in Oregon to calculate farm income averaging.

Q: What is farm income averaging?

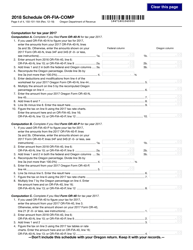

A: Farm income averaging is a method used by farmers to reduce their tax liability by averaging their income over several years.

Q: Who is eligible to use Form 150-101-164 Schedule OR-FIA-COMP?

A: Farmers in Oregon who have qualifying farm income can use this form to calculate their tax.

Q: What is qualifying farm income?

A: Qualifying farm income includes income from farming operations, such as crops, livestock, and dairy products.

Q: How does farm income averaging work?

A: Farm income averaging allows farmers to spread their income over a period of years, which can help reduce their tax liability.

Q: Are there any limitations or restrictions on using Form 150-101-164 Schedule OR-FIA-COMP?

A: Yes, there are certain limitations and restrictions, such as a minimum income requirement and the need to meet specific farming criteria.

Q: When is Form 150-101-164 Schedule OR-FIA-COMP due?

A: The due date for this form is typically the same as the due date for your Oregon state tax return.

Q: Is Form 150-101-164 Schedule OR-FIA-COMP available for both individuals and businesses?

A: No, this form is specifically for individual farmers in Oregon.

Q: Can I use farm income averaging if I am not a farmer?

A: No, farm income averaging is only available for individuals engaged in farming operations.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-164 Schedule OR-FIA-COMP by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.