This version of the form is not currently in use and is provided for reference only. Download this version of

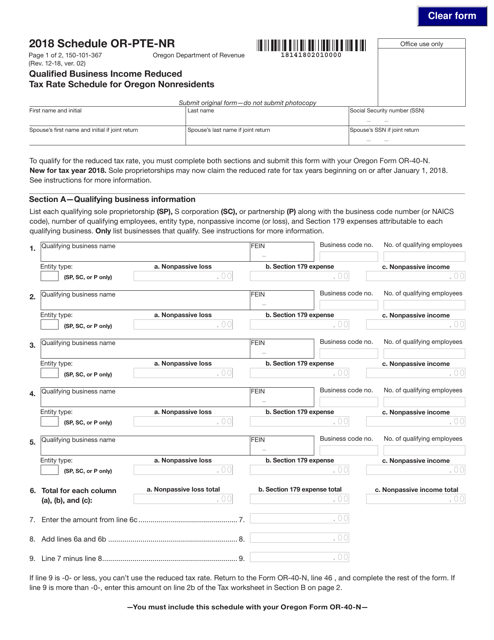

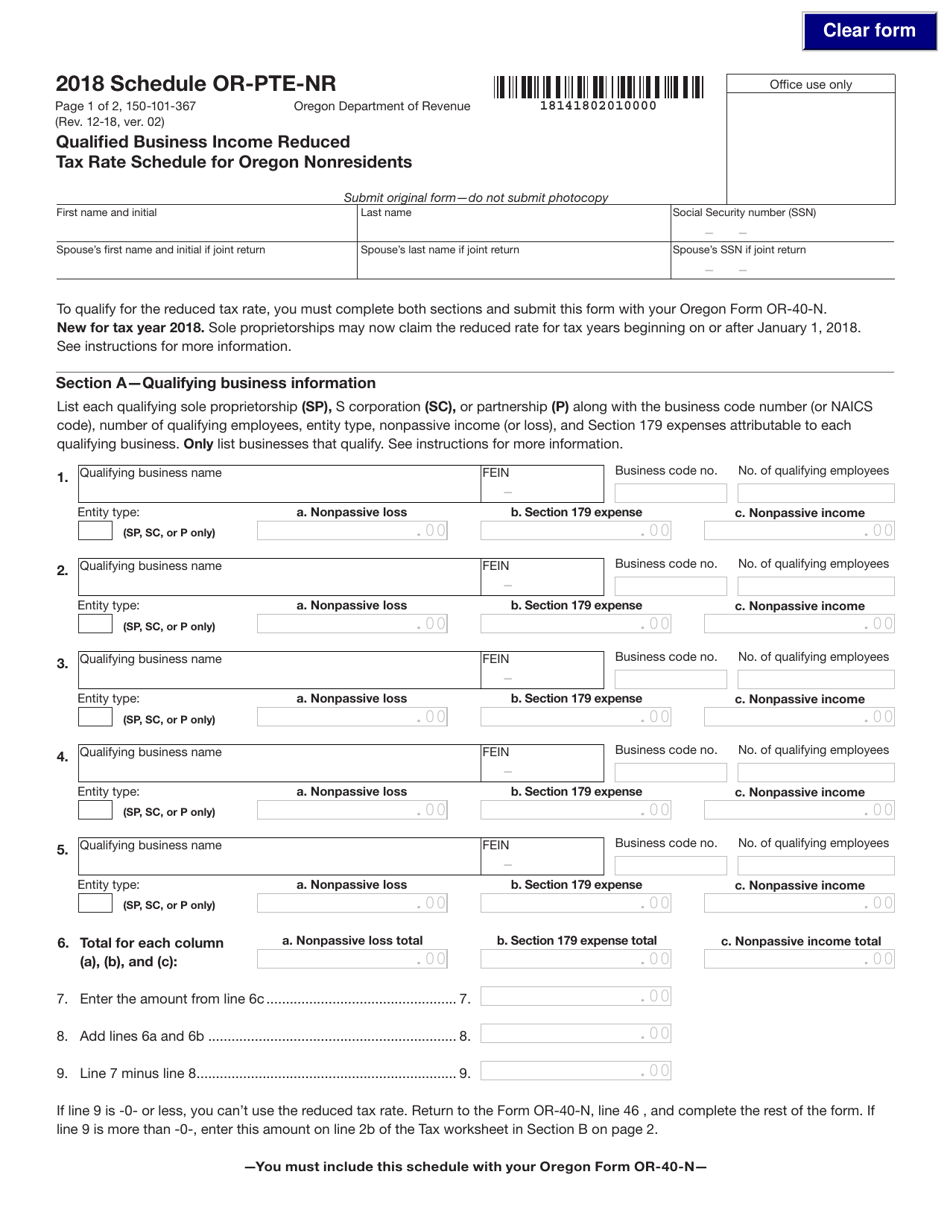

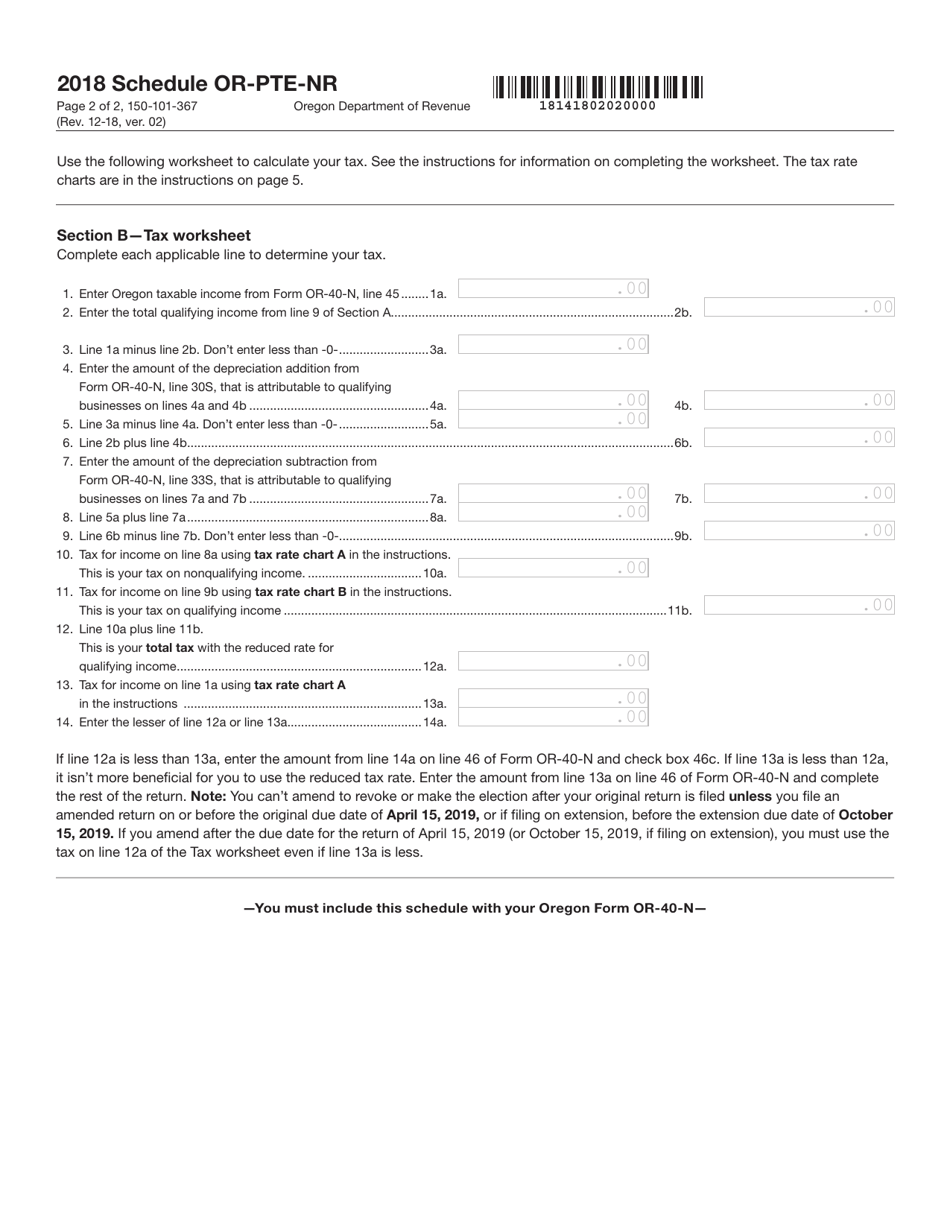

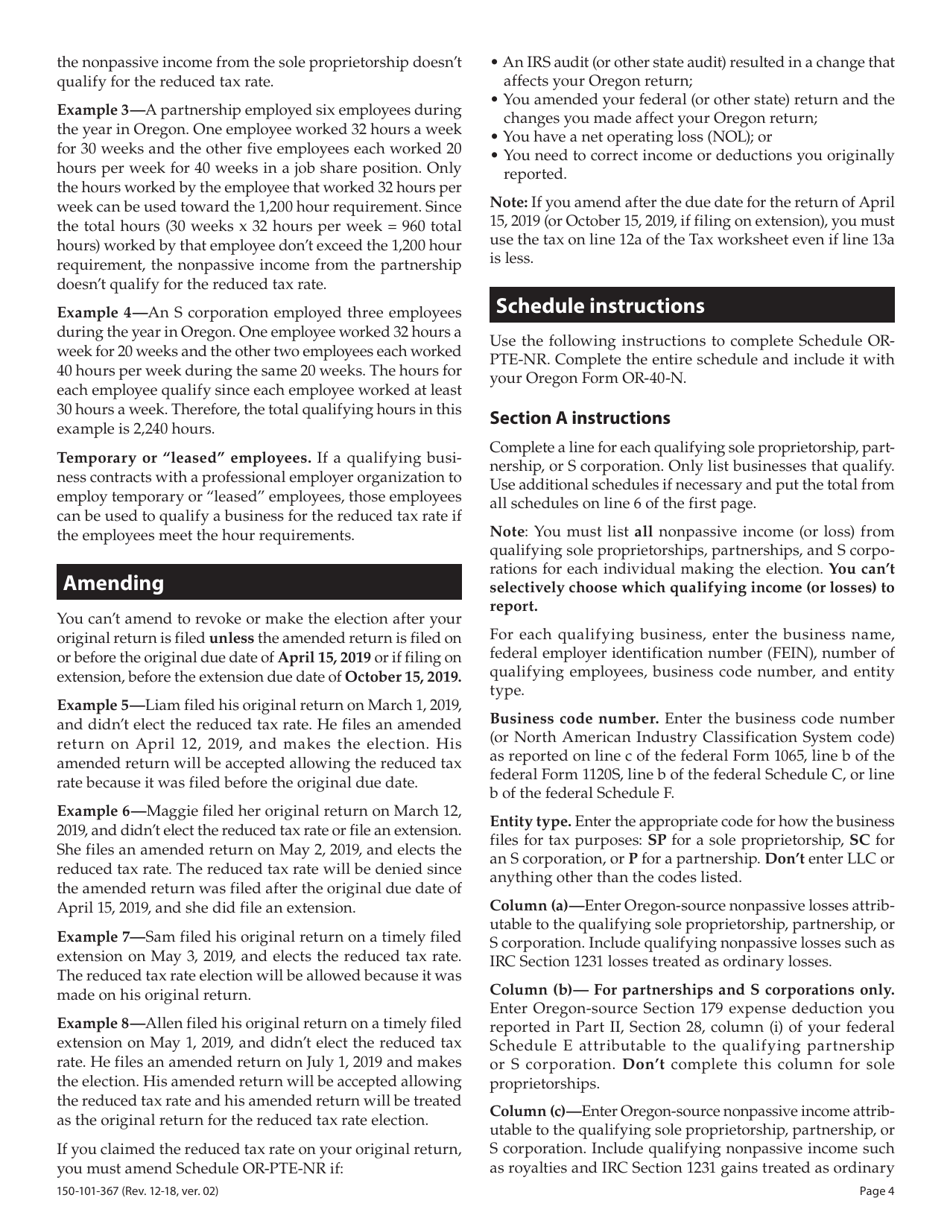

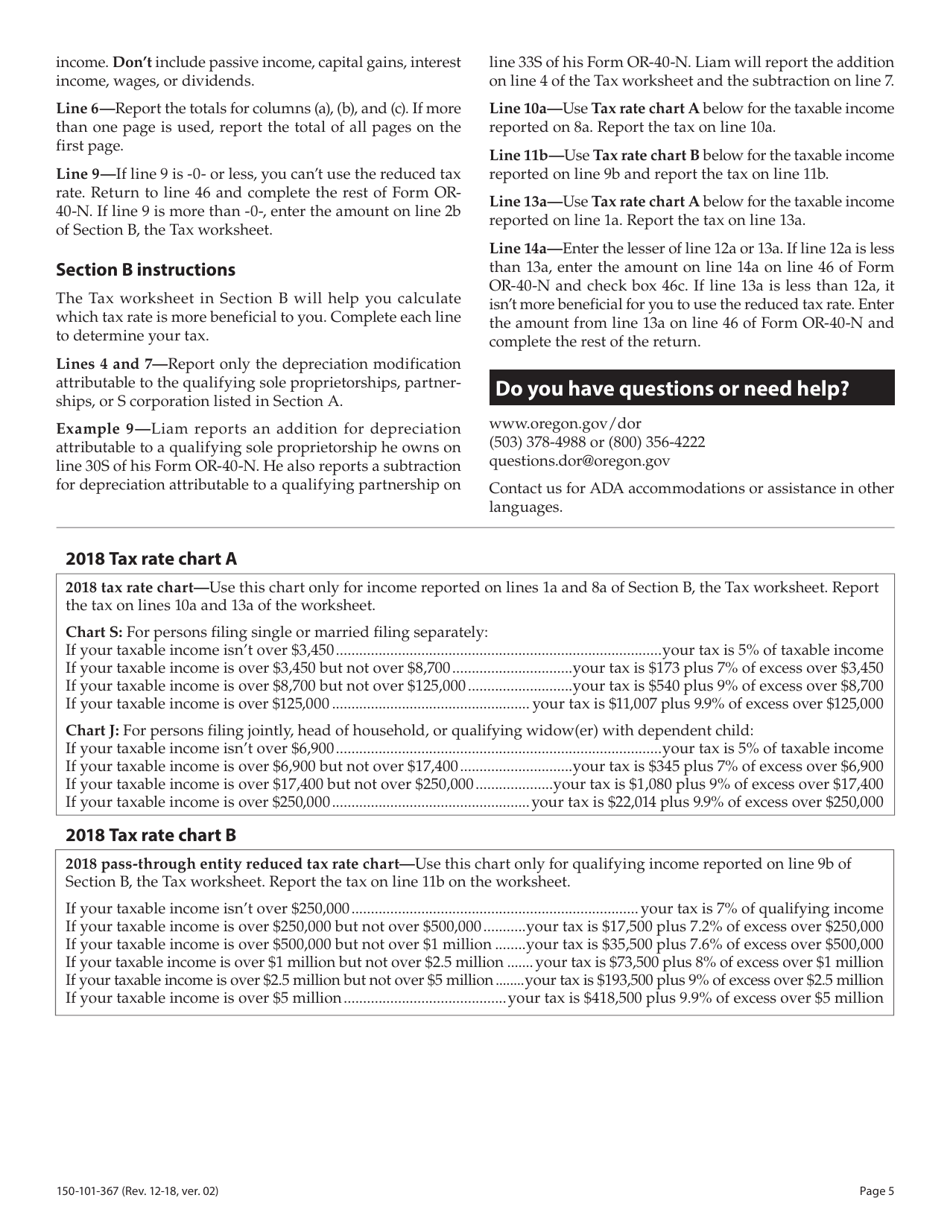

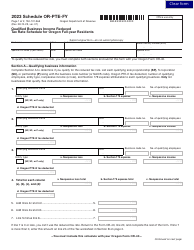

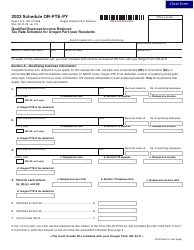

Form 150-101-367 Schedule OR-PTE-NR

for the current year.

Form 150-101-367 Schedule OR-PTE-NR Qualified Business Income Reduced Tax Rate Schedule for Oregon Nonresidents - Oregon

What Is Form 150-101-367 Schedule OR-PTE-NR?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-367?

A: Form 150-101-367 is the Schedule OR-PTE-NR Qualified Business Income Reduced Tax Rate Schedule for Oregon Nonresidents.

Q: Who is required to file Form 150-101-367?

A: Oregon nonresidents who have Qualified Business Income and are eligible for a reduced tax rate need to file Form 150-101-367.

Q: What is the purpose of Form 150-101-367?

A: The purpose of Form 150-101-367 is to calculate the reduced tax rate applicable to Oregon nonresidents' Qualified Business Income.

Q: What is Qualified Business Income?

A: Qualified Business Income refers to income earned from a qualified trade or business, as defined by the IRS.

Q: How do I complete Form 150-101-367?

A: To complete Form 150-101-367, you need to provide information about your Qualified Business Income, deductions, and credits.

Q: When is the deadline to file Form 150-101-367?

A: The deadline to file Form 150-101-367 is the same as the deadline for your Oregon tax return, which is usually April 15th.

Q: Are there any penalties for not filing Form 150-101-367?

A: Yes, failure to file Form 150-101-367 may result in penalties imposed by the Oregon Department of Revenue.

Q: Do I need to file Form 150-101-367 if I don't have Qualified Business Income?

A: No, if you don't have Qualified Business Income, you are not required to file Form 150-101-367.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-367 Schedule OR-PTE-NR by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.