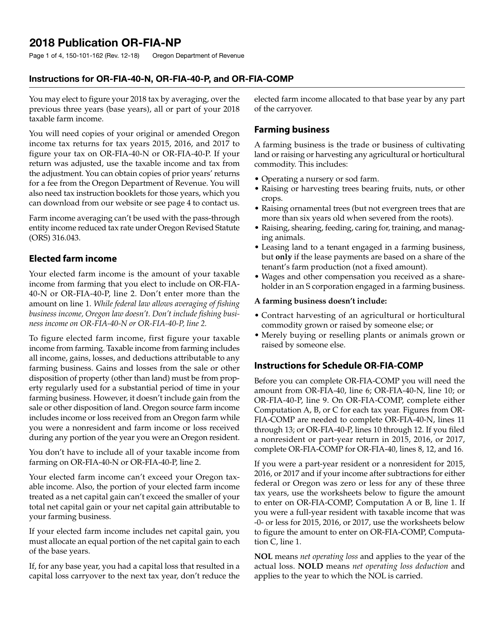

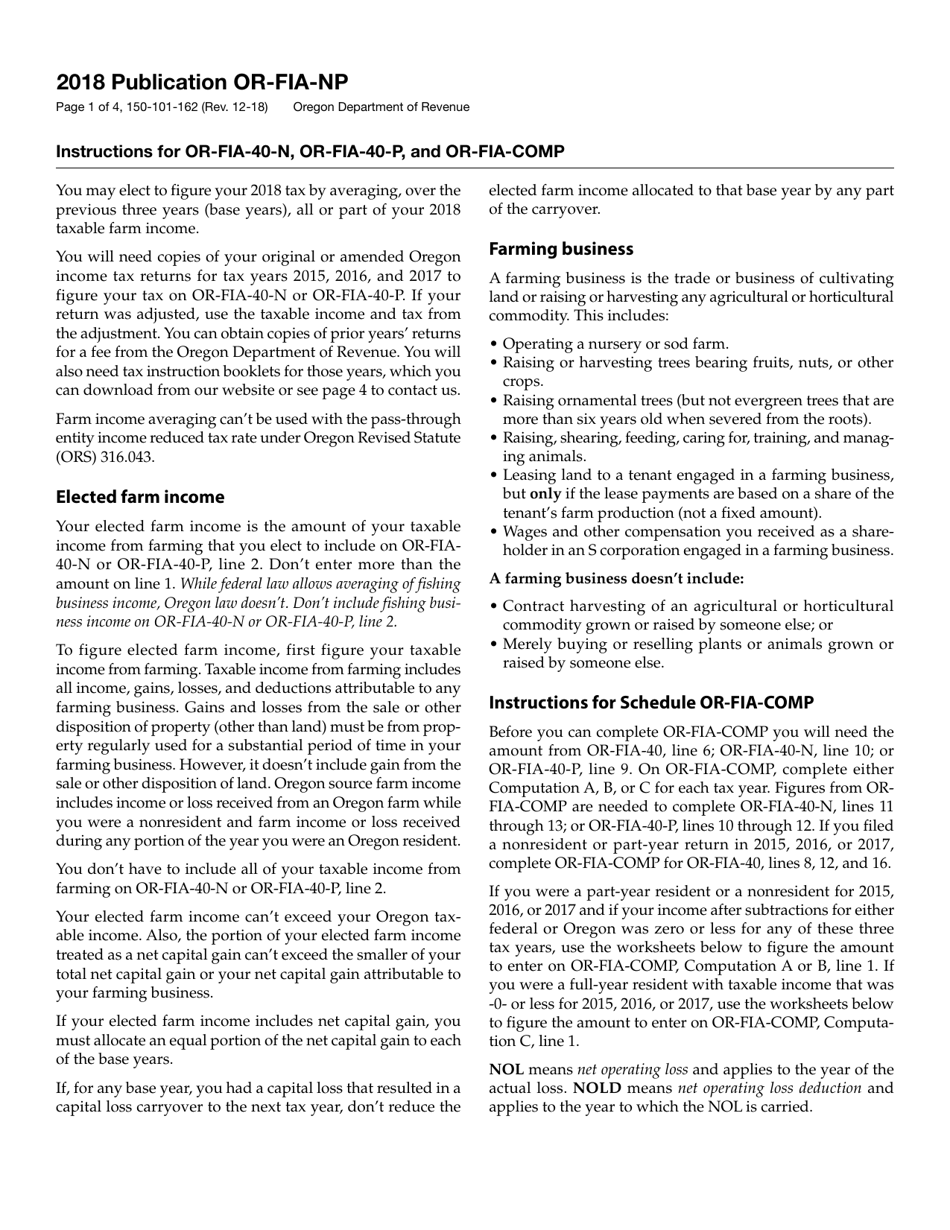

Form 150-101-162 Publication or-Fia-Np - Oregon

What Is Form 150-101-162?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-162?

A: Form 150-101-162 is a publication from the Oregon Department of Revenue.

Q: What is the purpose of Form 150-101-162?

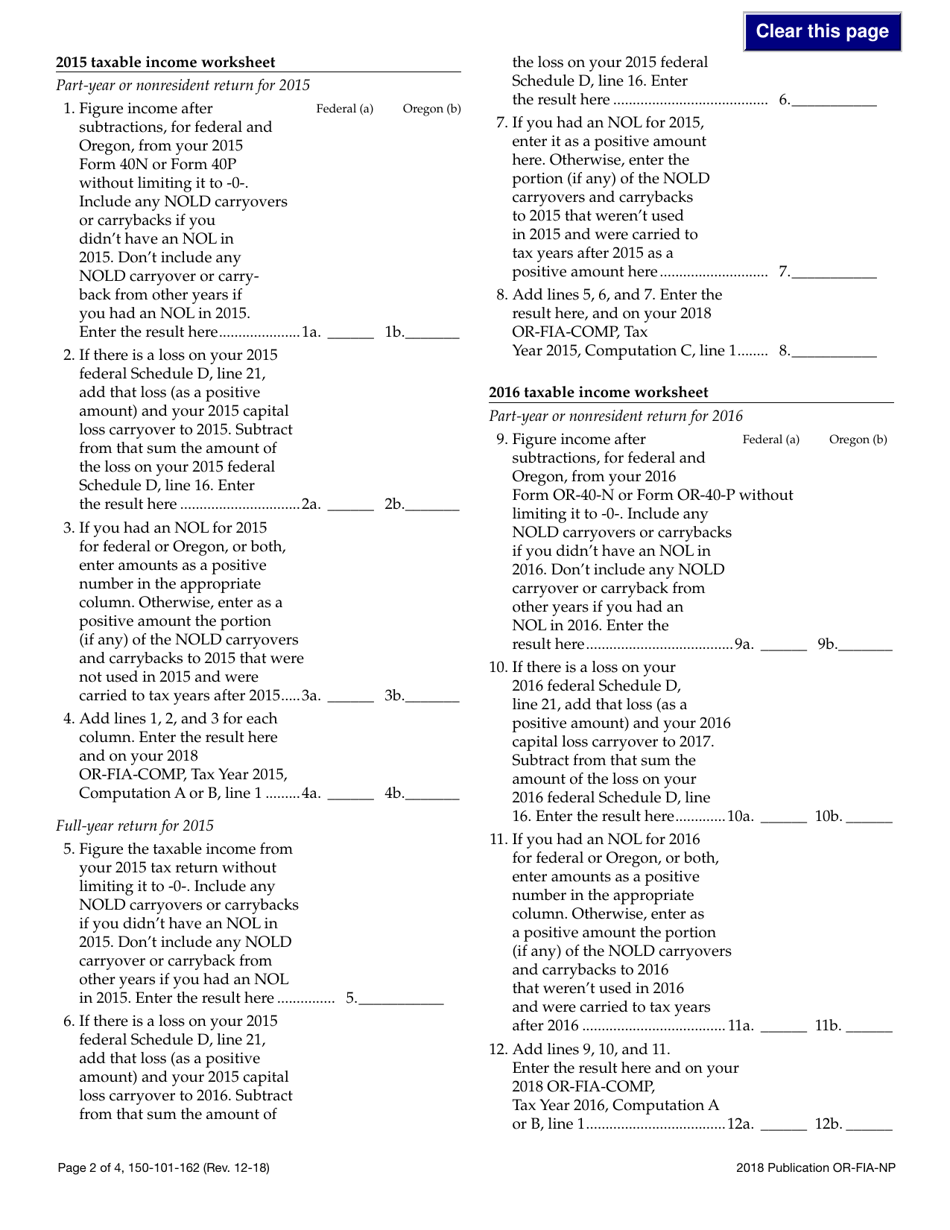

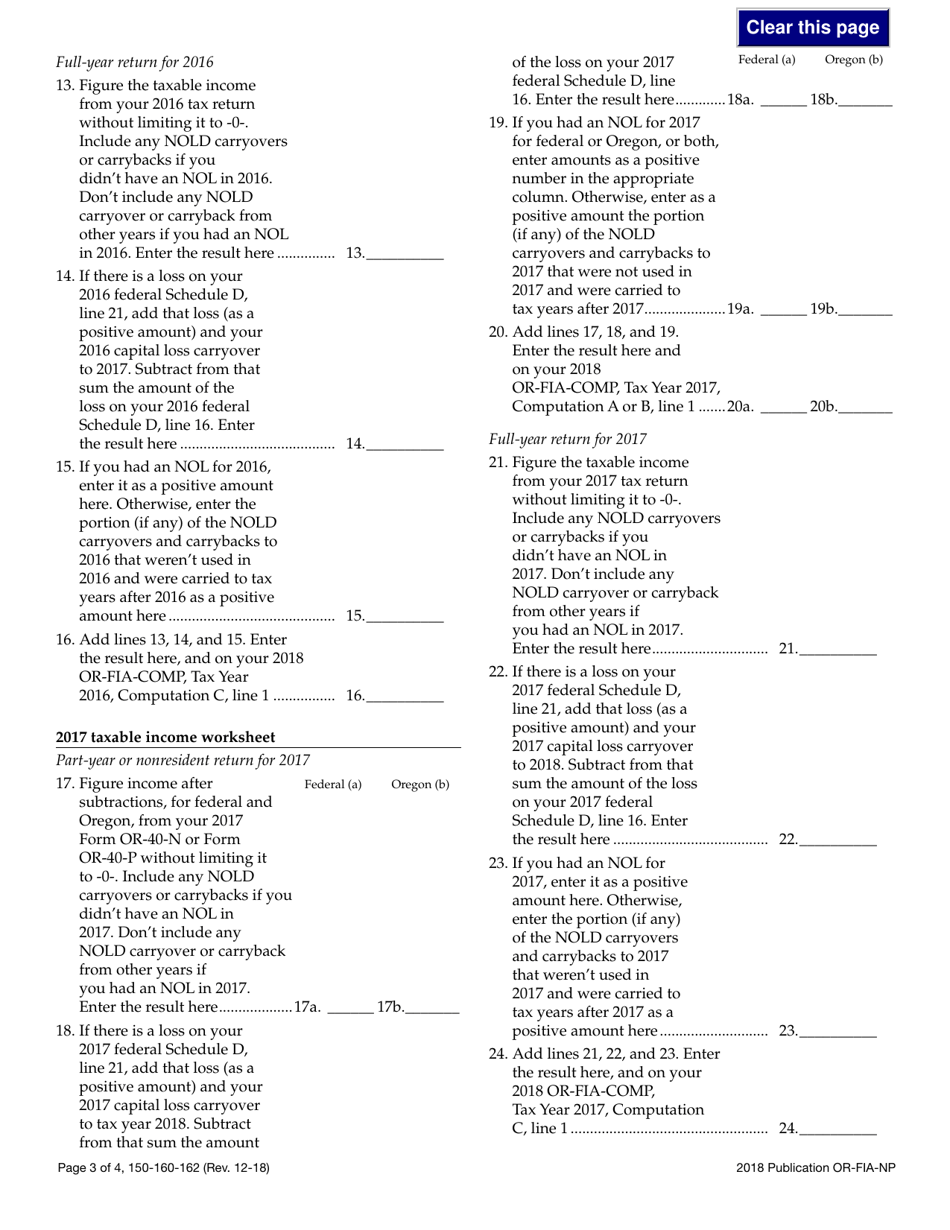

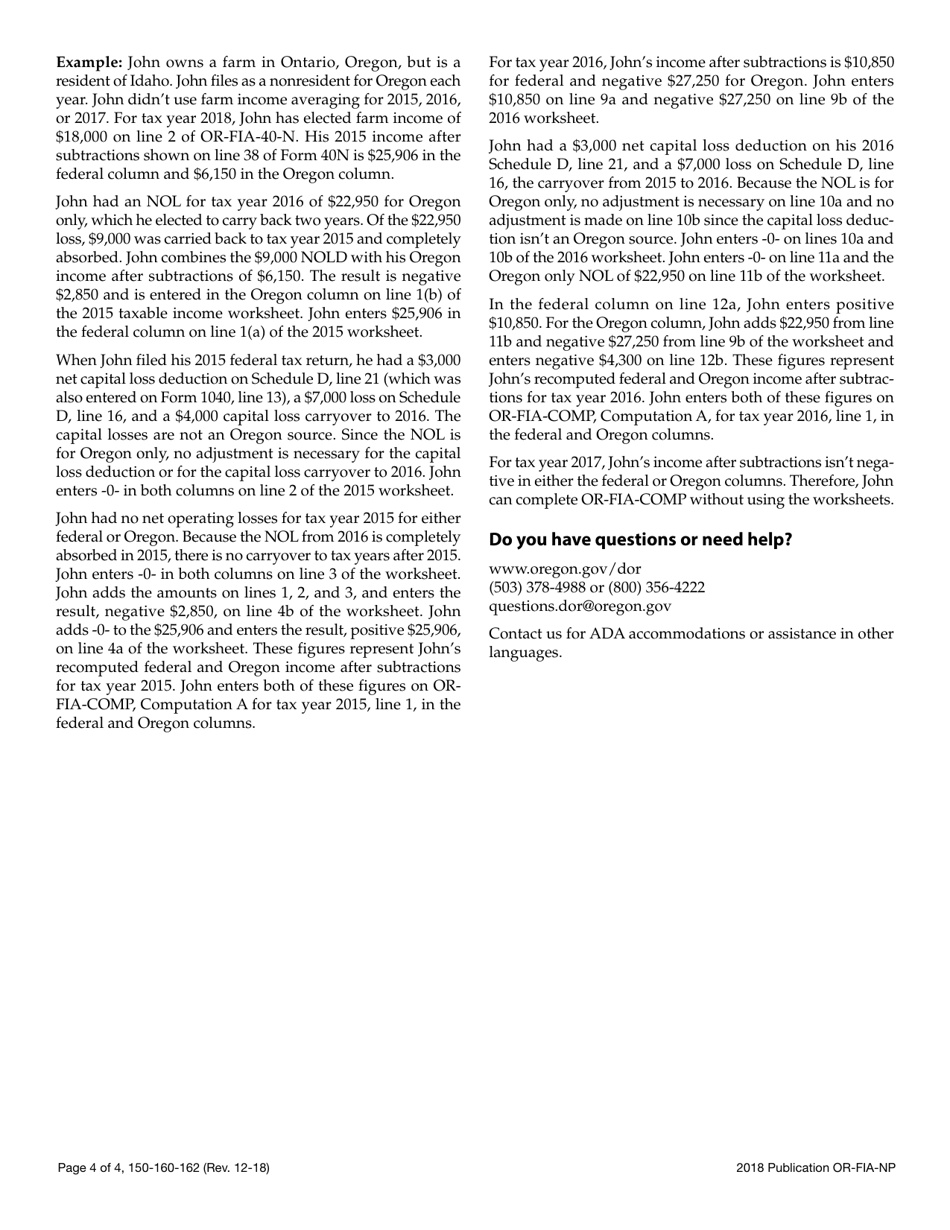

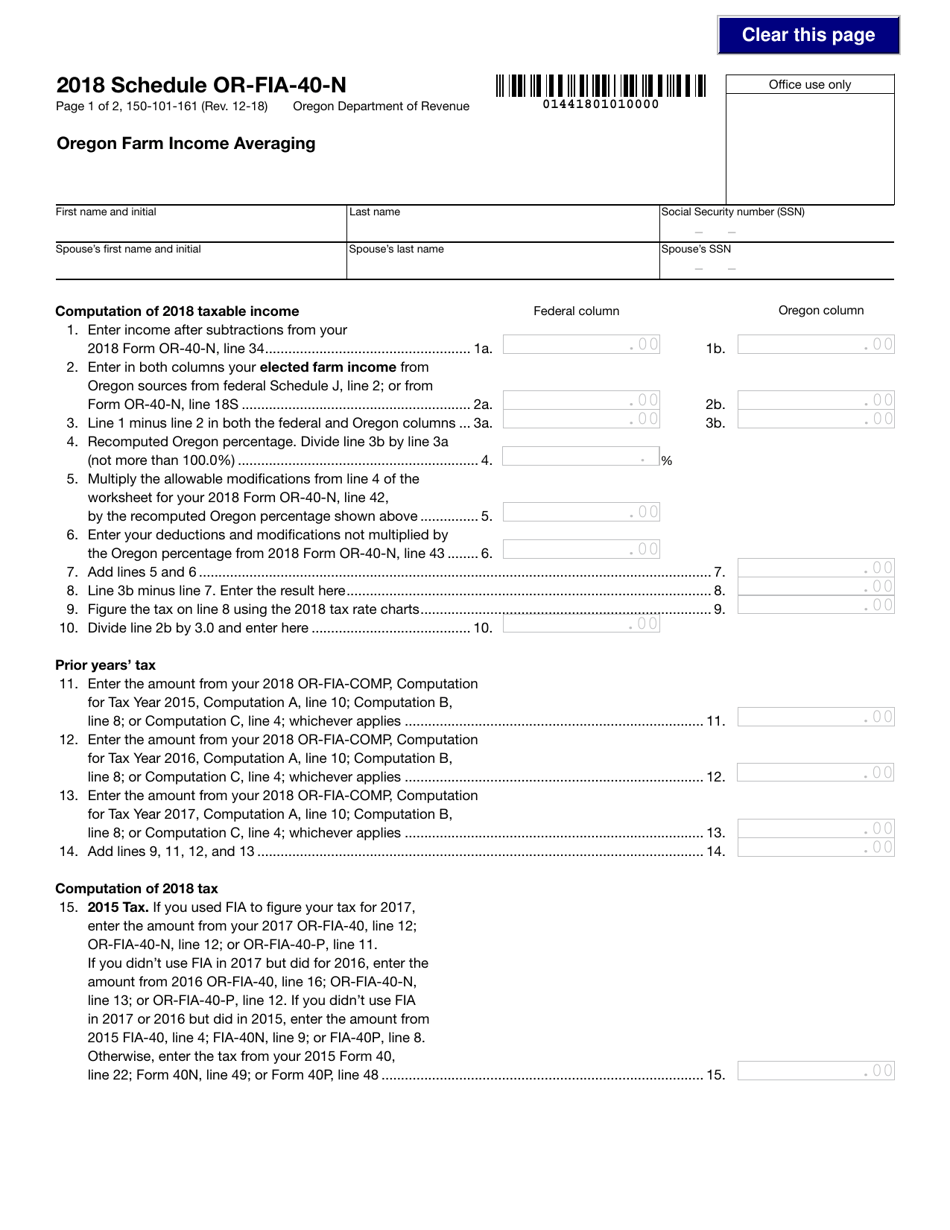

A: The purpose of Form 150-101-162 is to provide information about the Oregon Fiduciary Income Tax.

Q: What is Oregon Fiduciary Income Tax?

A: Oregon Fiduciary Income Tax is a tax on income earned by estates and trusts in Oregon.

Q: Who needs to file Form 150-101-162?

A: Individuals who are serving as fiduciaries of estates or trusts in Oregon may need to file Form 150-101-162.

Q: Are there any filing deadlines for Form 150-101-162?

A: Yes, there are specific deadlines for filing Form 150-101-162. You should refer to the instructions provided with the form for more information.

Q: What should I do if I have more questions about Form 150-101-162?

A: If you have more questions about Form 150-101-162, you should contact the Oregon Department of Revenue for assistance.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-162 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.