This version of the form is not currently in use and is provided for reference only. Download this version of

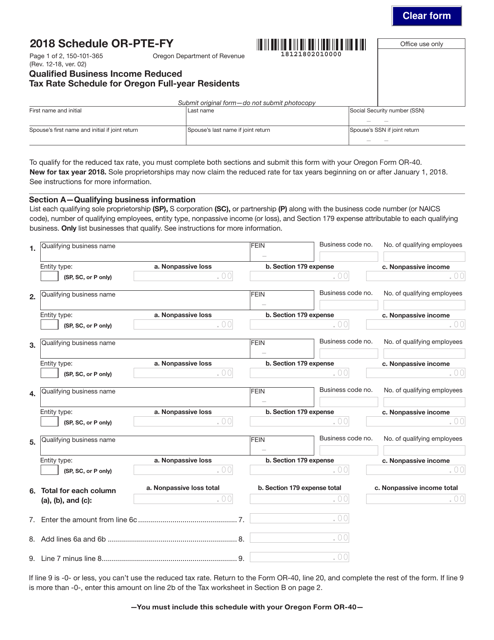

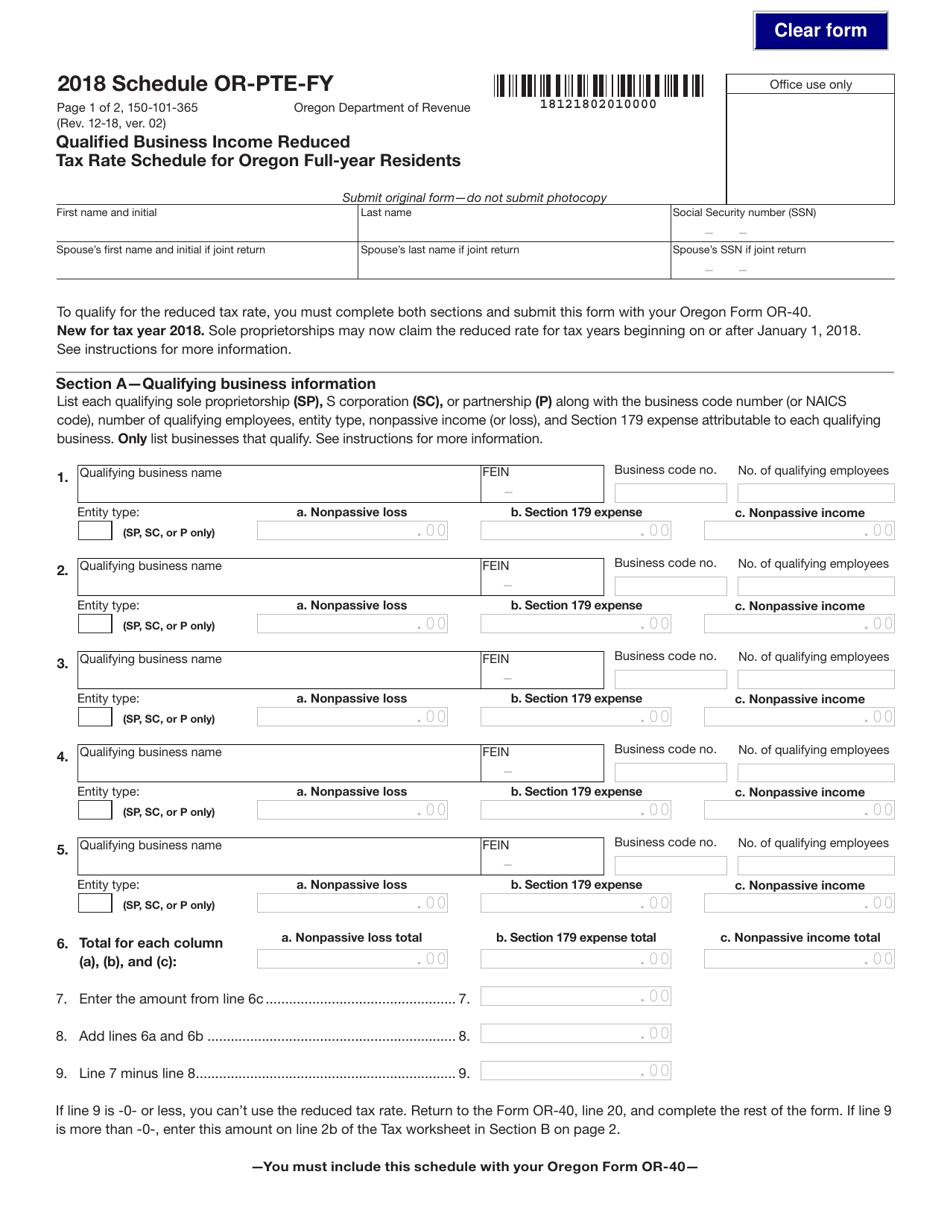

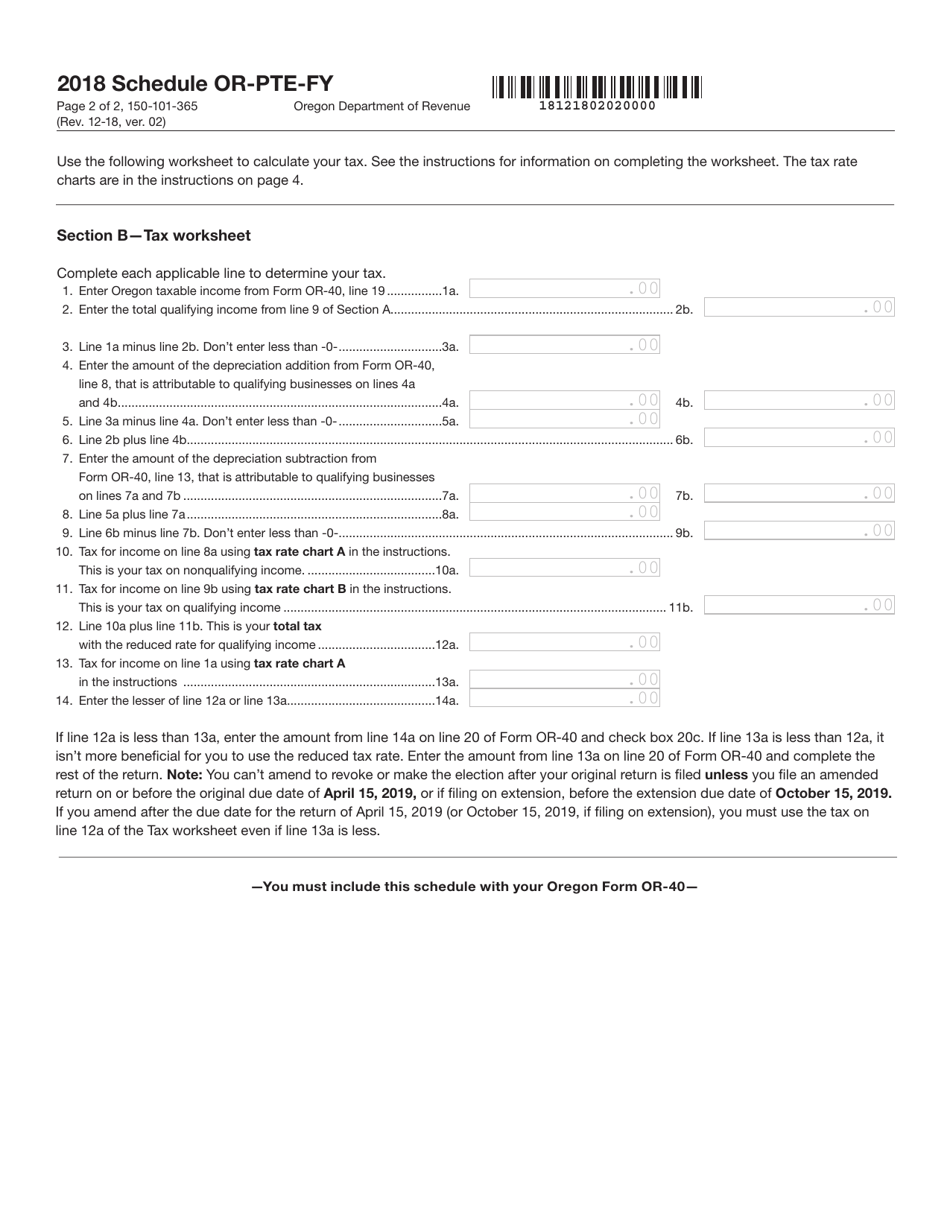

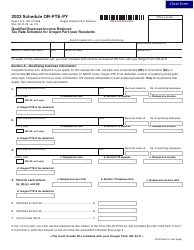

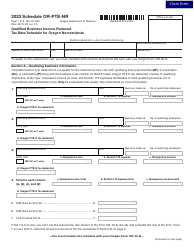

Form 150-101-365 Schedule OR-PTE-FY

for the current year.

Form 150-101-365 Schedule OR-PTE-FY Qualified Business Income Reduced Tax Rate Schedule for Oregon Full-Year Residents - Oregon

What Is Form 150-101-365 Schedule OR-PTE-FY?

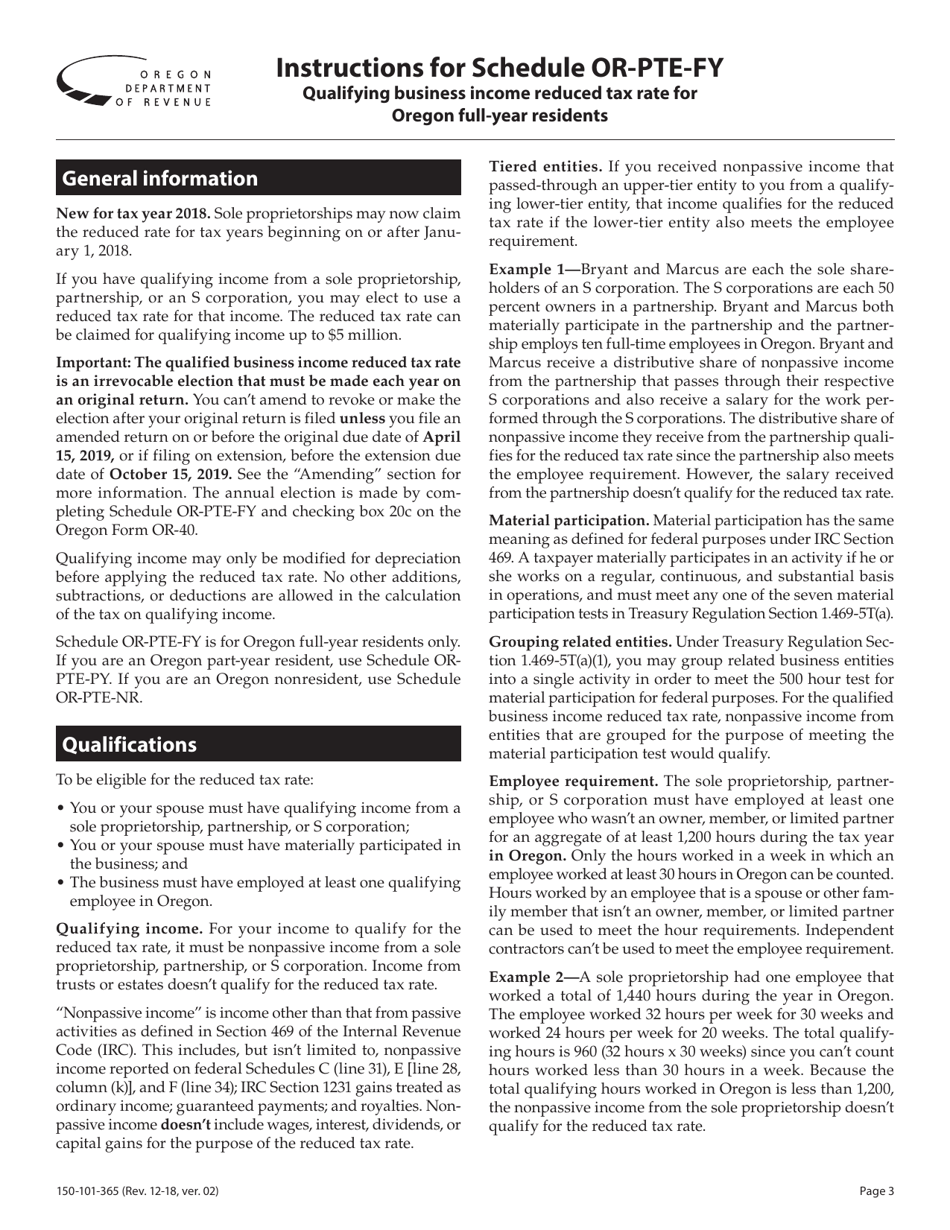

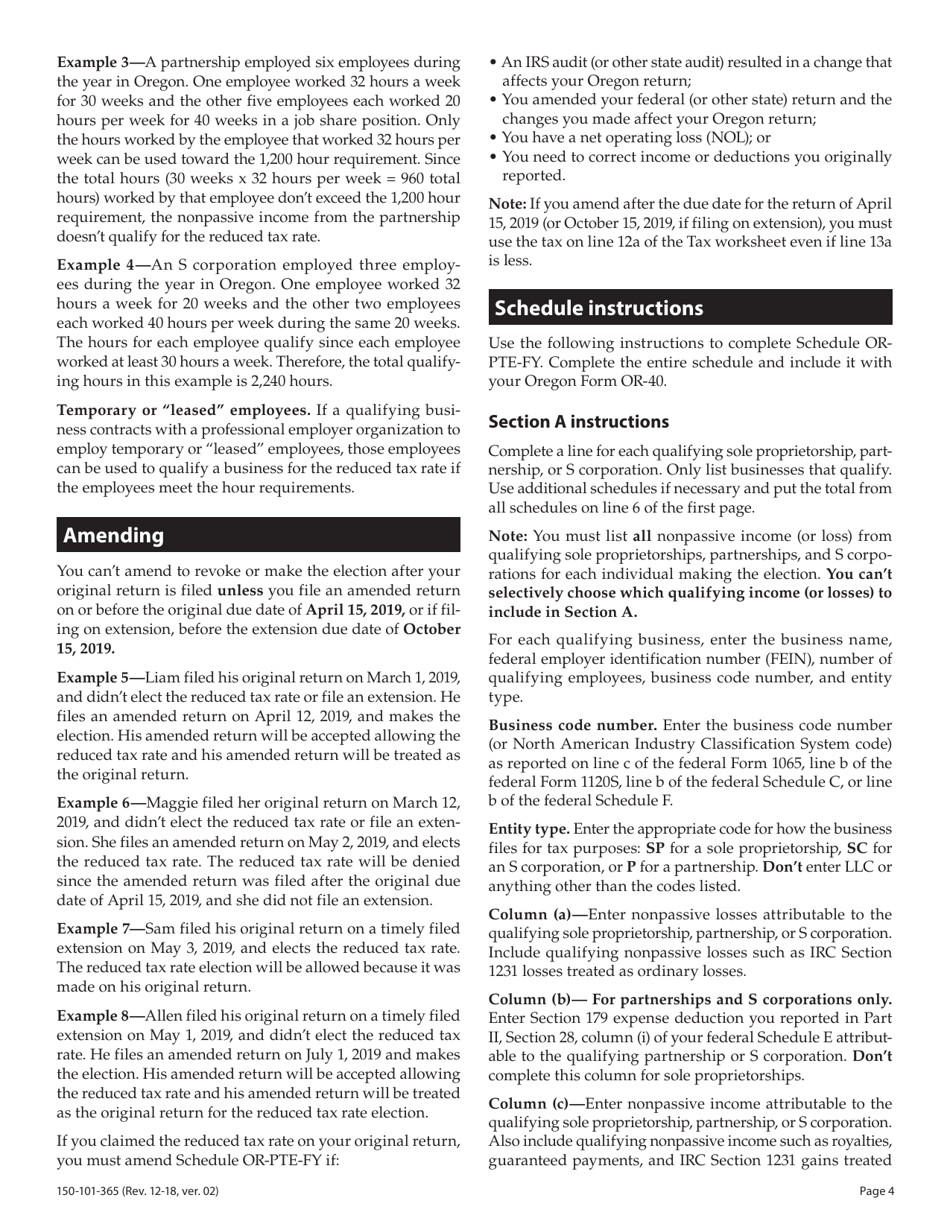

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-365?

A: Form 150-101-365 is the Qualified Business Income Reduced Tax Rate Schedule for Oregon Full-Year Residents.

Q: Who needs to use Form 150-101-365?

A: Oregon full-year residents who have qualified business income and are eligible for reduced tax rates need to use Form 150-101-365.

Q: What is qualified business income?

A: Qualified business income refers to the income earned from a qualified trade or business.

Q: What are the reduced tax rates?

A: The reduced tax rates are specific tax rates that apply to qualified business income.

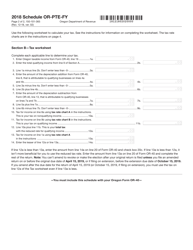

Q: How do I fill out Form 150-101-365?

A: To fill out Form 150-101-365, you need to provide information about your qualified business income and calculate the reduced tax using the provided schedule.

Q: Is Form 150-101-365 only for Oregon residents?

A: Yes, Form 150-101-365 is specifically for Oregon full-year residents.

Q: What if I am not an Oregon resident?

A: If you are not an Oregon resident, you do not need to use Form 150-101-365.

Q: Do I need any additional forms with Form 150-101-365?

A: You may need to include other relevant forms or schedules depending on your individual tax situation.

Q: Can I e-file Form 150-101-365?

A: Yes, you can e-file Form 150-101-365 if you meet the requirements for electronic filing in Oregon.

Q: Are there any deadlines for filing Form 150-101-365?

A: The deadline for filing Form 150-101-365 is typically the same as the deadline for filing your Oregon state tax return.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-365 Schedule OR-PTE-FY by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.