This version of the form is not currently in use and is provided for reference only. Download this version of

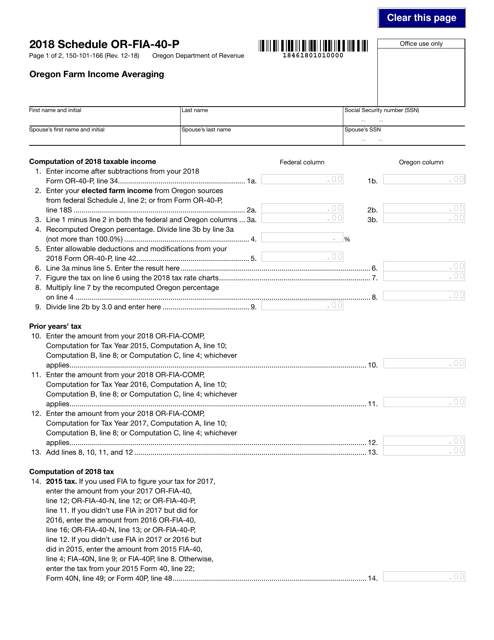

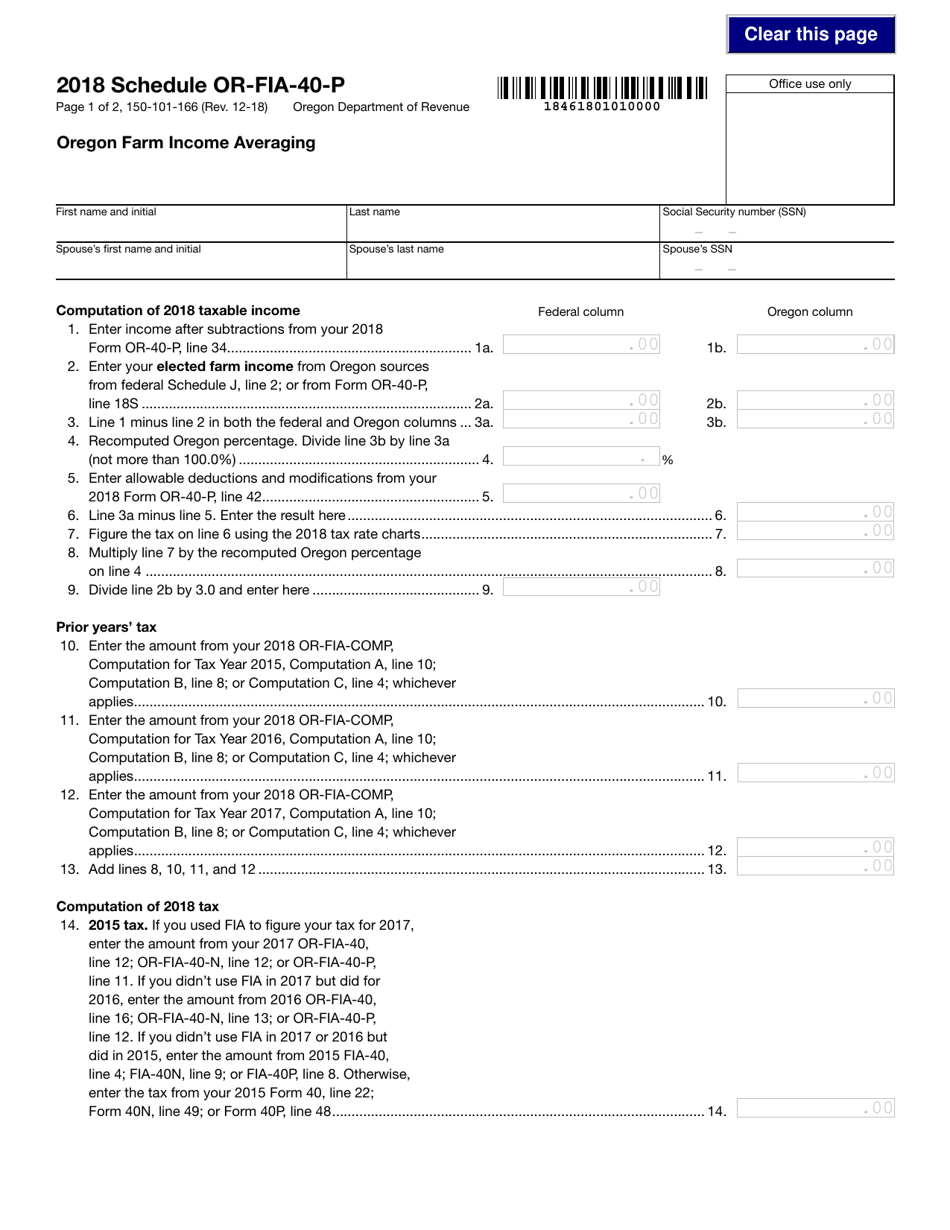

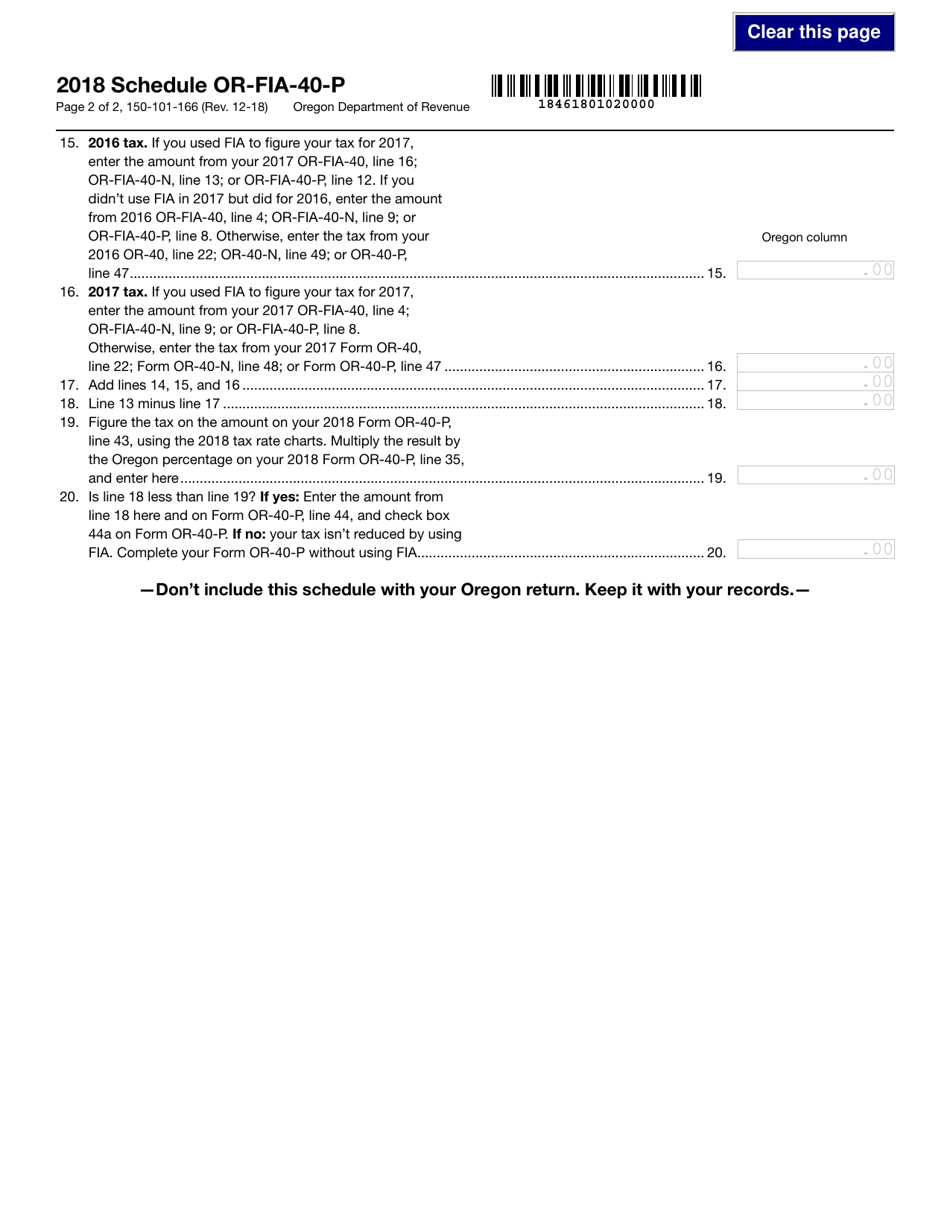

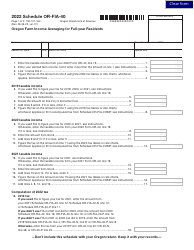

Form 150-101-166 Schedule OR-FIA-40-P

for the current year.

Form 150-101-166 Schedule OR-FIA-40-P Oregon Farm Income Averaging - Oregon

What Is Form 150-101-166 Schedule OR-FIA-40-P?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-166 Schedule OR-FIA-40-P?

A: Form 150-101-166 Schedule OR-FIA-40-P is a tax form used in Oregon for farm income averaging.

Q: What is farm income averaging?

A: Farm income averaging is a tax calculation that allows farmers in Oregon to reduce their tax liability by averaging their income over a period of years.

Q: Who can use Form 150-101-166 Schedule OR-FIA-40-P?

A: Farmers in Oregon who meet certain criteria can use Form 150-101-166 Schedule OR-FIA-40-P to calculate their farm income averaging.

Q: How does farm income averaging work?

A: Farm income averaging allows farmers to calculate their taxable income based on an average of their income over a specified number of years, which can help reduce their tax liability.

Q: Are there any eligibility criteria for using Form 150-101-166 Schedule OR-FIA-40-P?

A: Yes, farmers in Oregon must meet certain criteria, such as having at least three years of farm income and meeting specific income thresholds, in order to use Form 150-101-166 Schedule OR-FIA-40-P.

Q: Can farm income averaging reduce my tax liability?

A: Yes, farm income averaging can help reduce the tax liability for farmers in Oregon by allowing them to calculate their taxable income based on an average of their income over a specified period of years.

Q: Are there any limitations to farm income averaging?

A: Yes, there are certain limitations to farm income averaging, such as a maximum number of years that can be averaged and specific rules regarding the calculation of income and deductions.

Q: What other forms or documents may be required for farm income averaging?

A: In addition to Form 150-101-166 Schedule OR-FIA-40-P, farmers may need to provide supporting documents such as income statements, expense records, and tax returns for the years being averaged.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-166 Schedule OR-FIA-40-P by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.