This version of the form is not currently in use and is provided for reference only. Download this version of

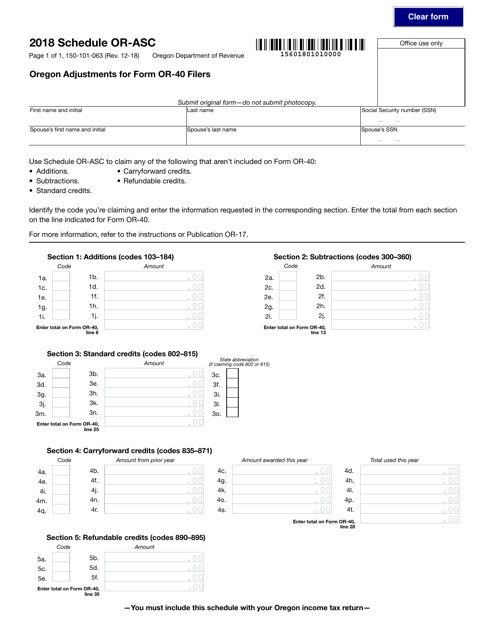

Form 150-101-063 Schedule OR-ASC

for the current year.

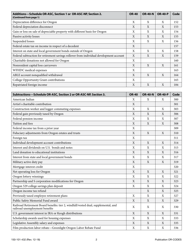

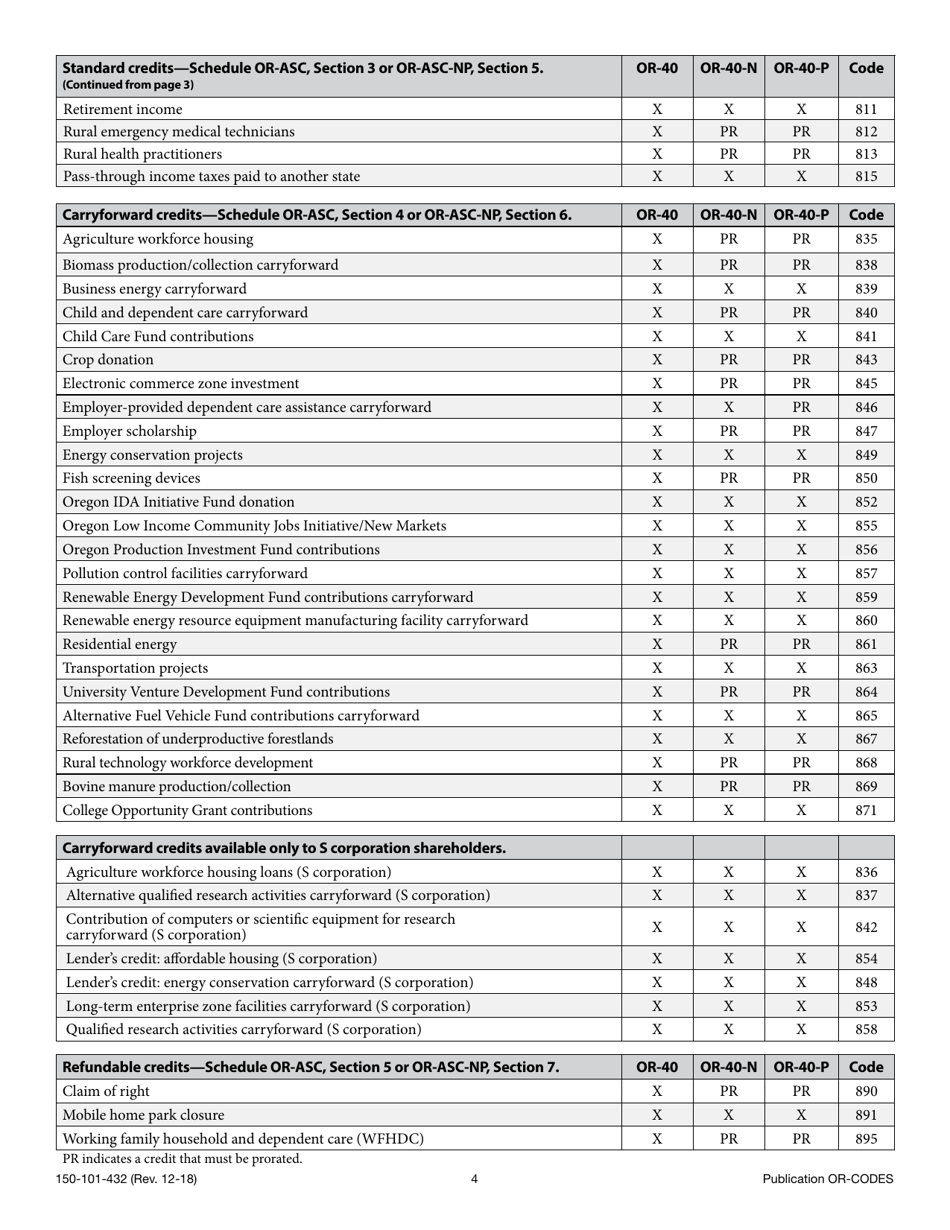

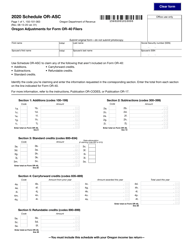

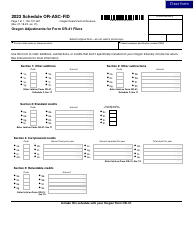

Form 150-101-063 Schedule OR-ASC Oregon Adjustments for Form or-40 Filers - Oregon

What Is Form 150-101-063 Schedule OR-ASC?

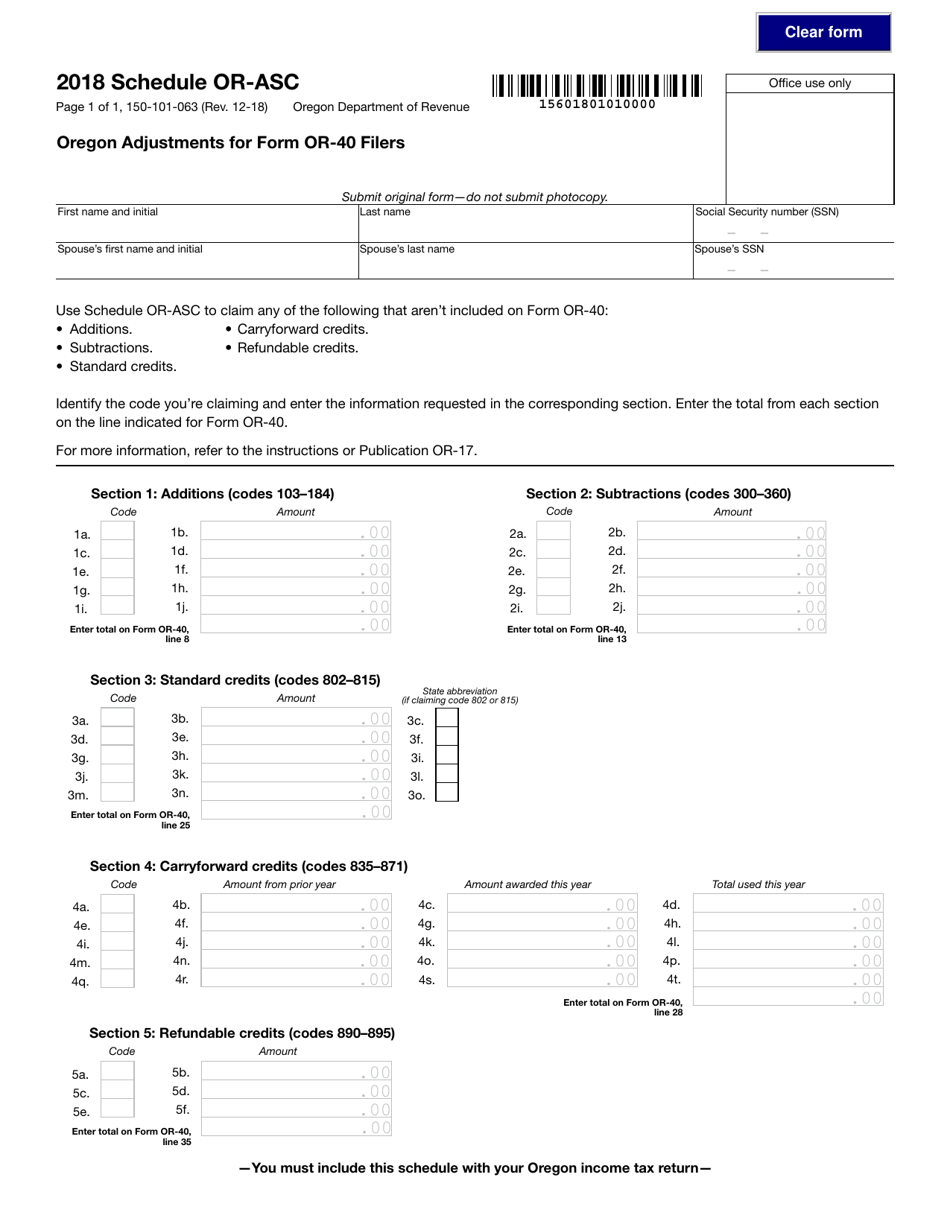

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-063?

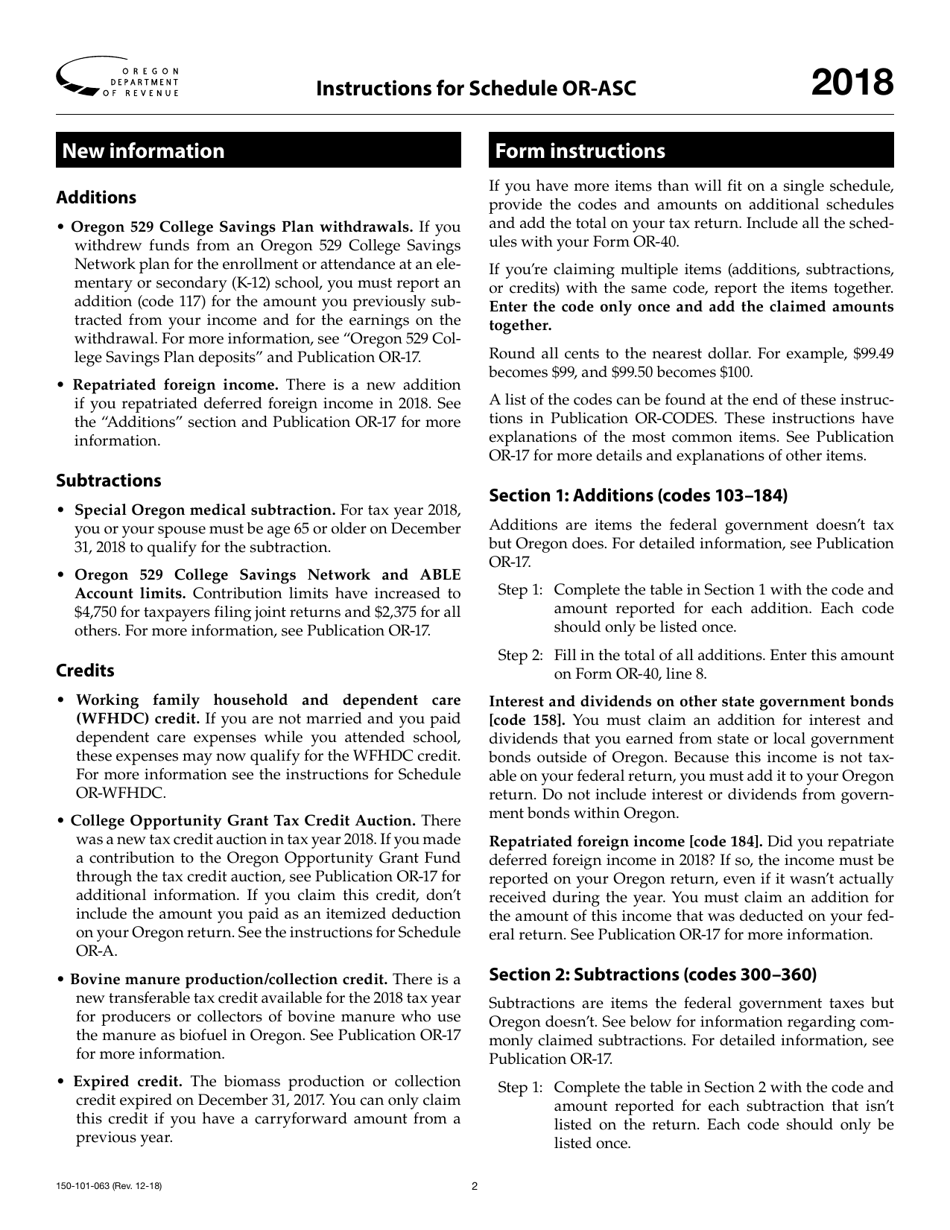

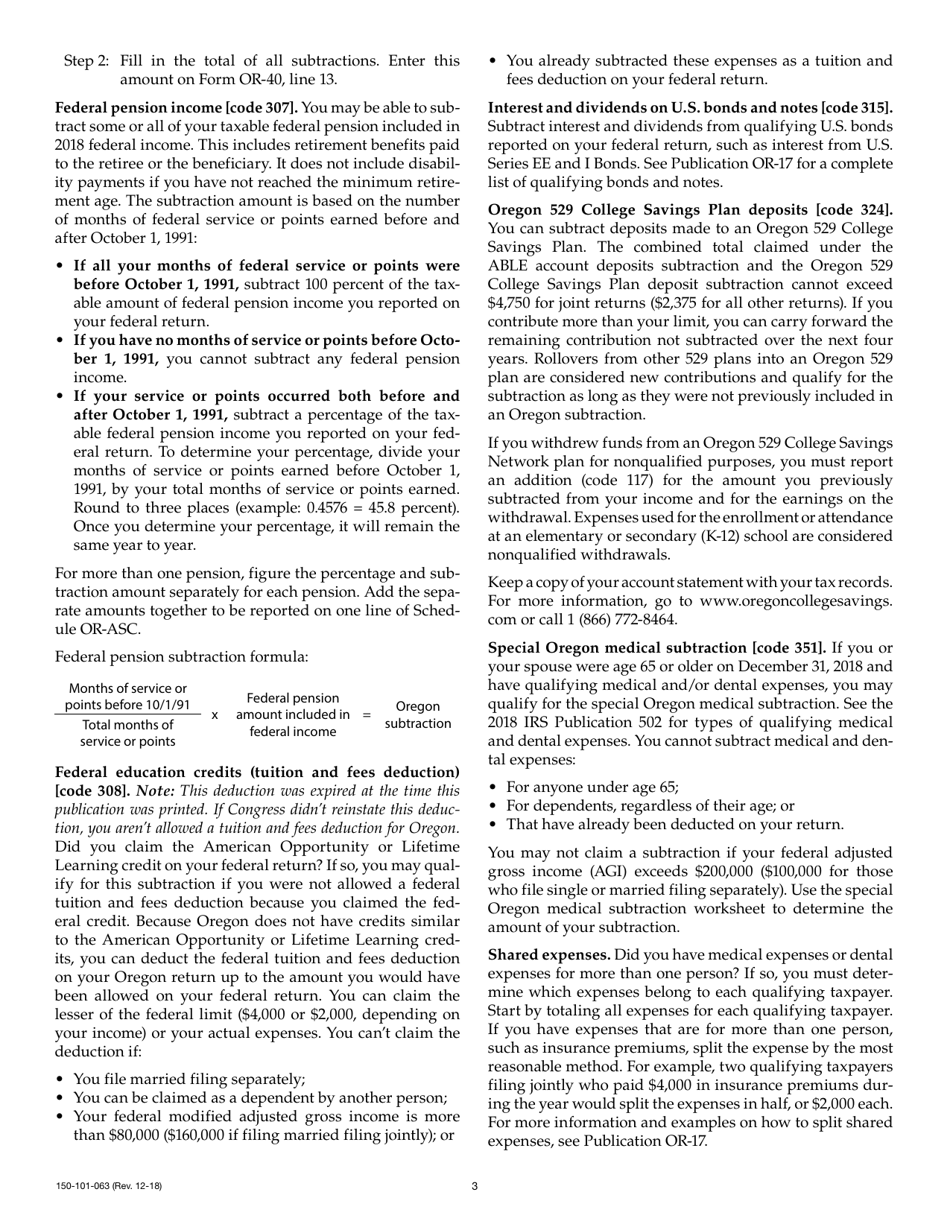

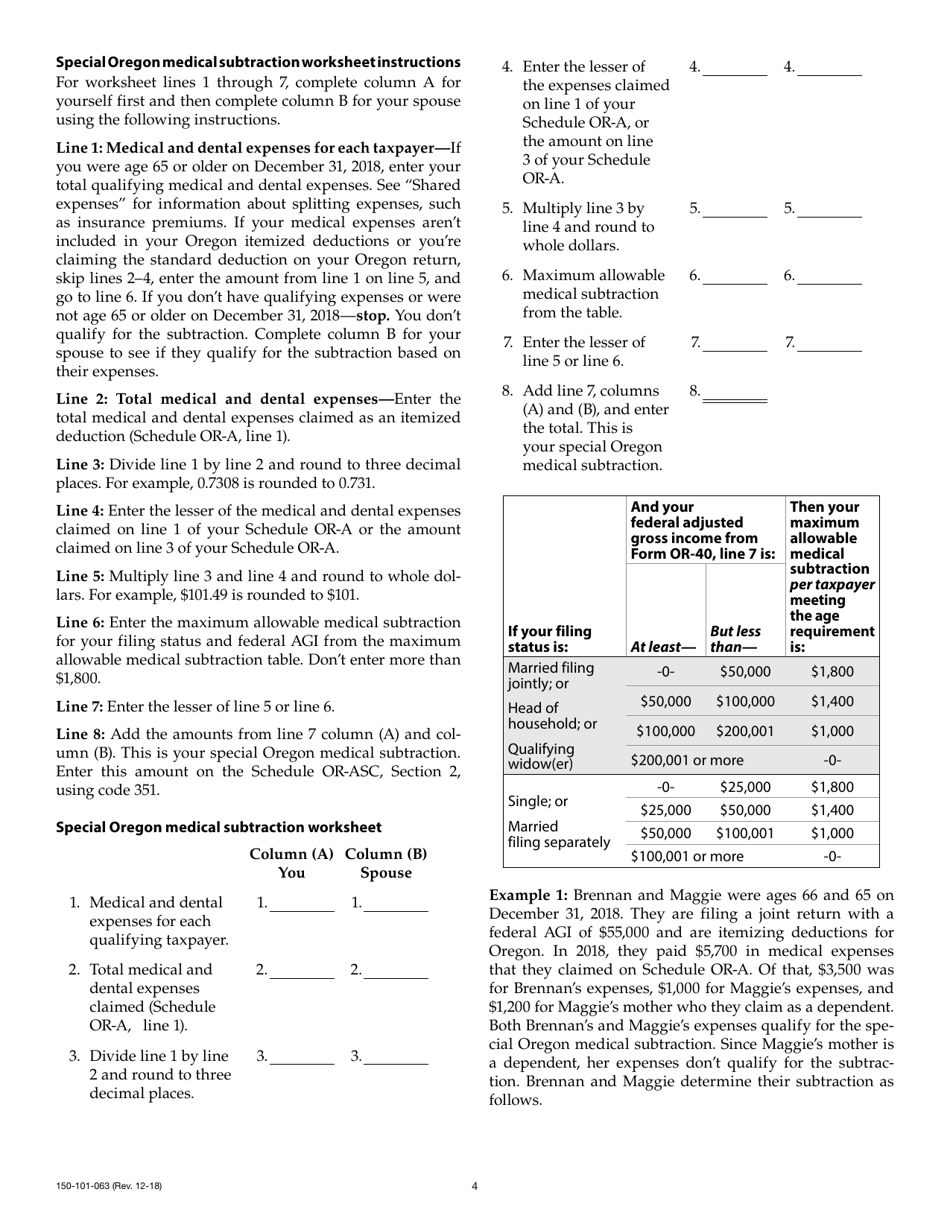

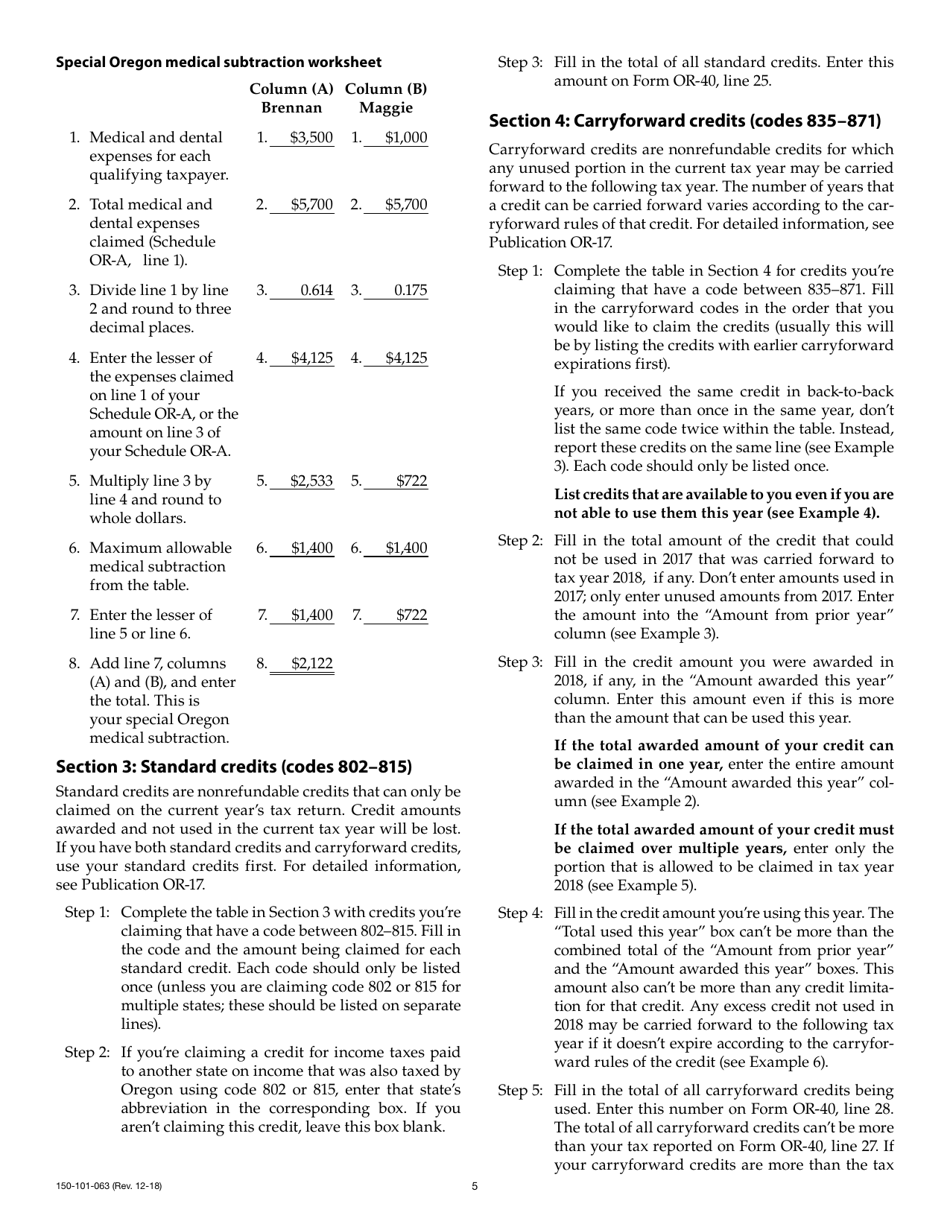

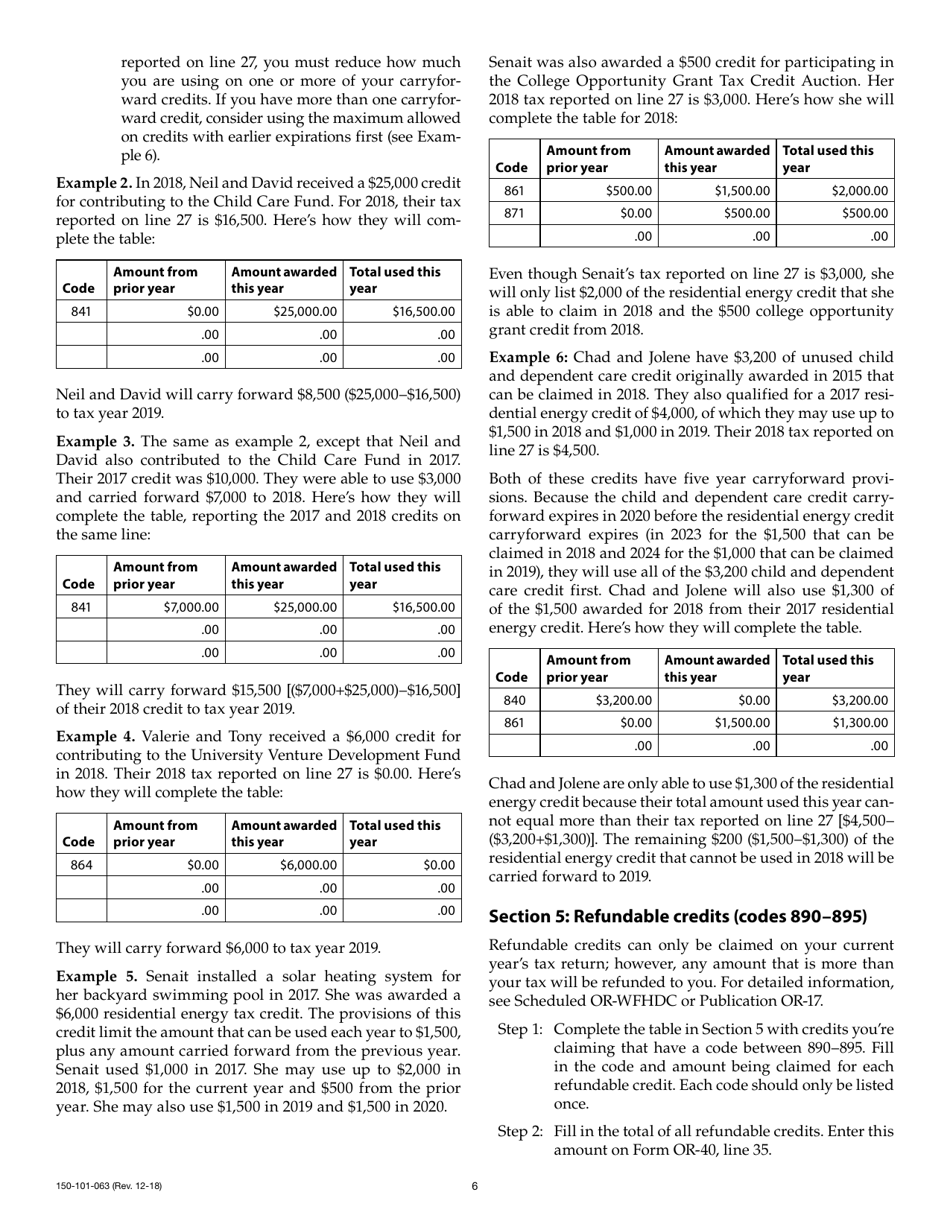

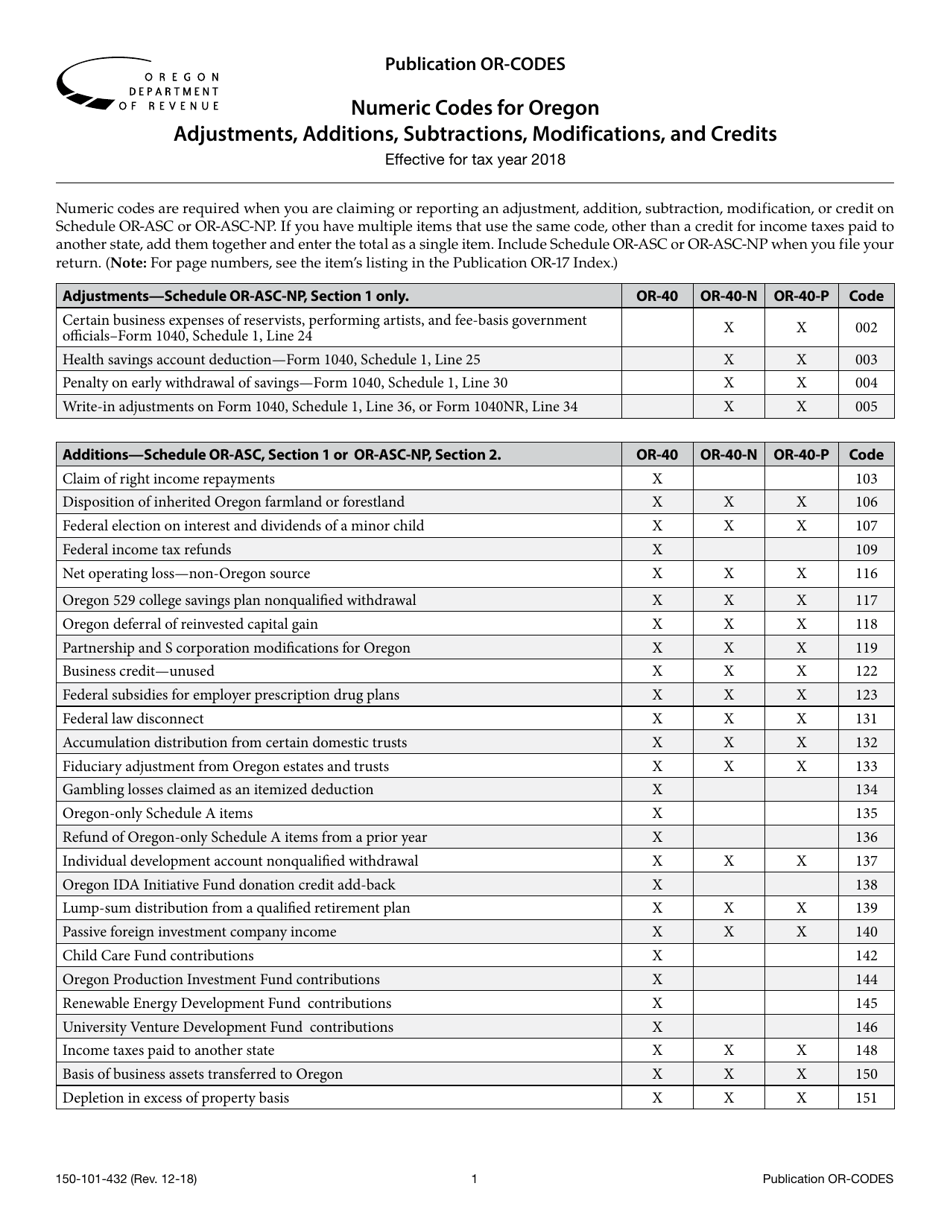

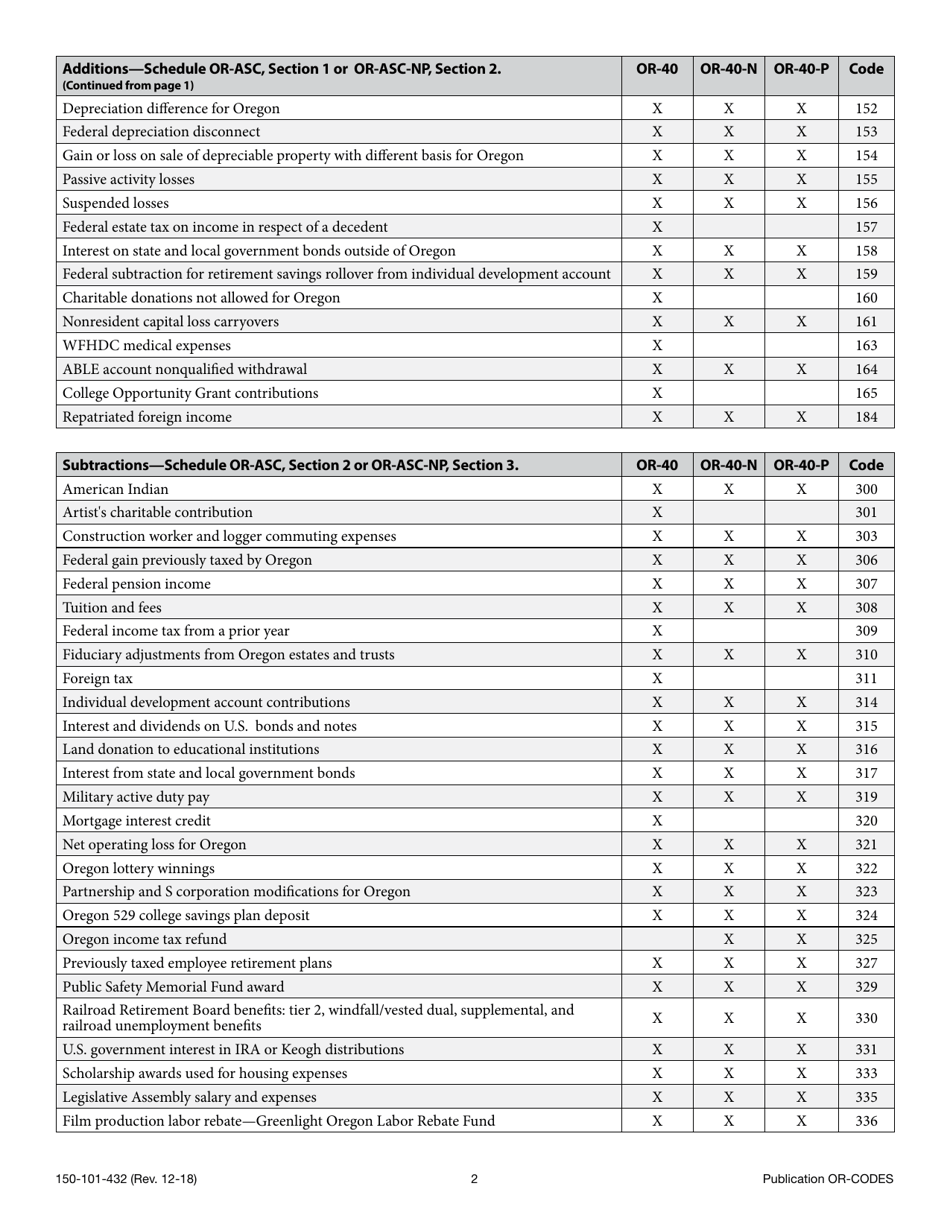

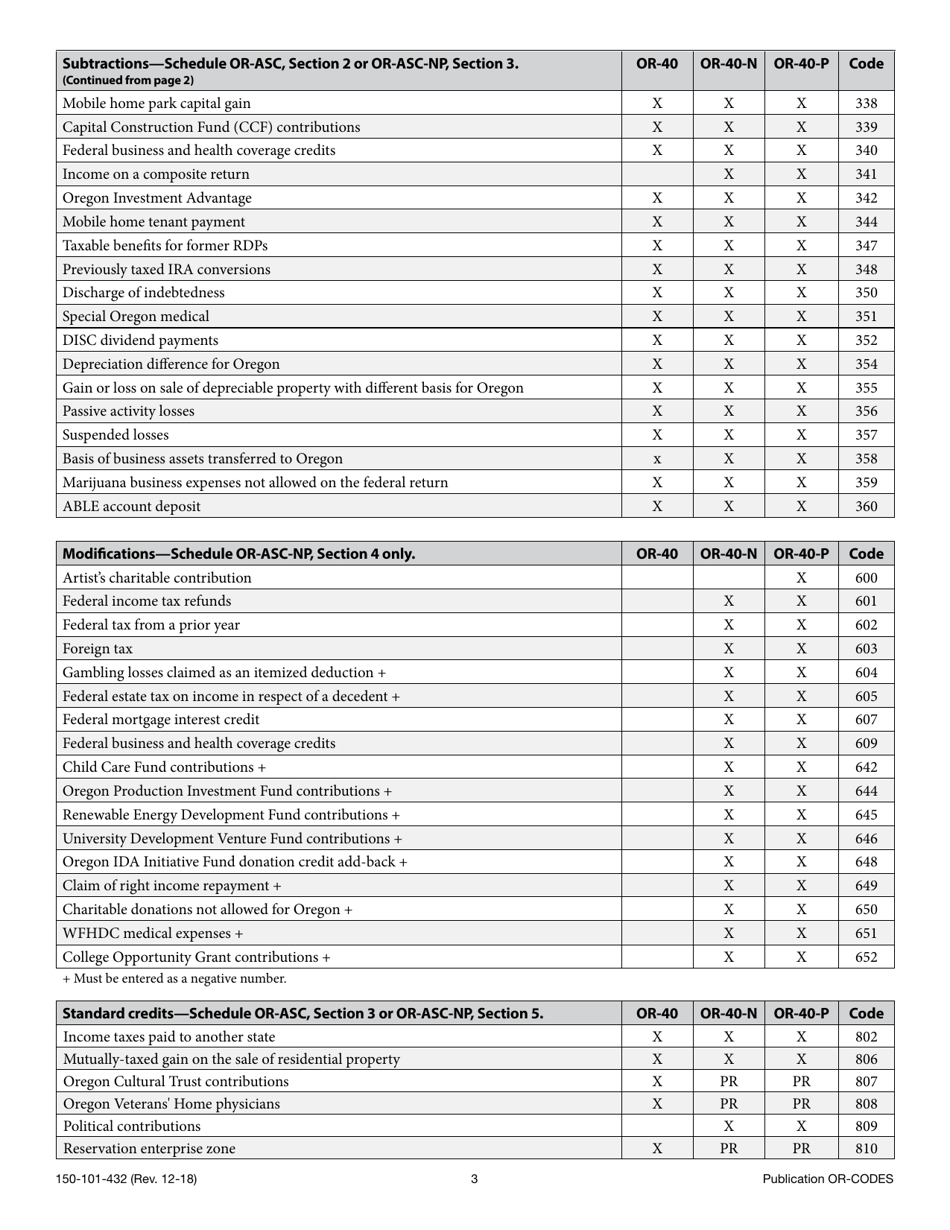

A: Form 150-101-063 is the Schedule OR-ASC, which is used by Oregon residents who file Form OR-40 to report any adjustments to their income.

Q: Who needs to file Schedule OR-ASC?

A: Oregon residents who file Form OR-40 and have adjustments to their income need to file Schedule OR-ASC.

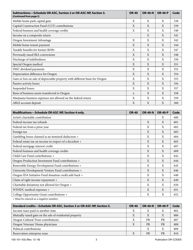

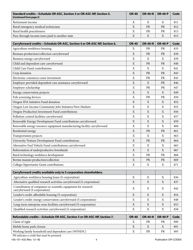

Q: What are Oregon adjustments for Form OR-40 filers?

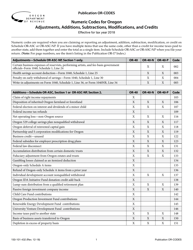

A: Oregon adjustments are changes made to the income reported on Form OR-40, such as deductions or additions to income based on Oregon-specific laws.

Q: When is Schedule OR-ASC due?

A: Schedule OR-ASC is due on the same date as your Form OR-40, which is generally April 15th of each year.

Q: What should I do if I have questions or need help with Schedule OR-ASC?

A: If you have questions or need help with Schedule OR-ASC, you can contact the Oregon Department of Revenue for assistance.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-063 Schedule OR-ASC by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.