This version of the form is not currently in use and is provided for reference only. Download this version of

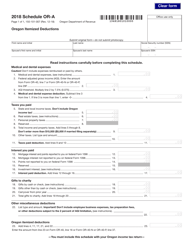

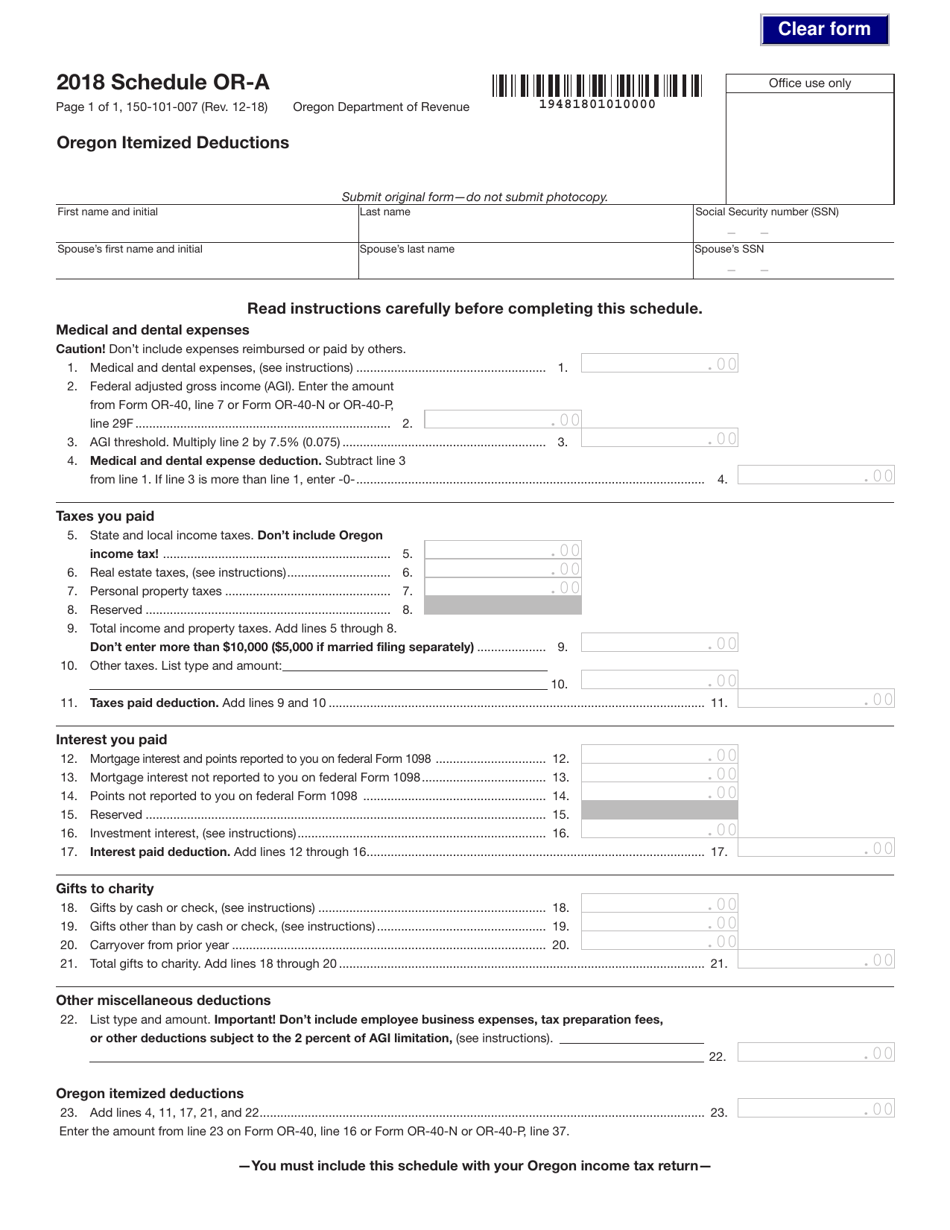

Form 150-101-007 Schedule OR-A

for the current year.

Form 150-101-007 Schedule OR-A Oregon Itemized Deductions - Oregon

What Is Form 150-101-007 Schedule OR-A?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule OR-A?

A: Schedule OR-A is a form used in Oregon to itemize deductions on your state tax return.

Q: Who should use Schedule OR-A?

A: You should use Schedule OR-A if you want to itemize your deductions on your Oregon state tax return.

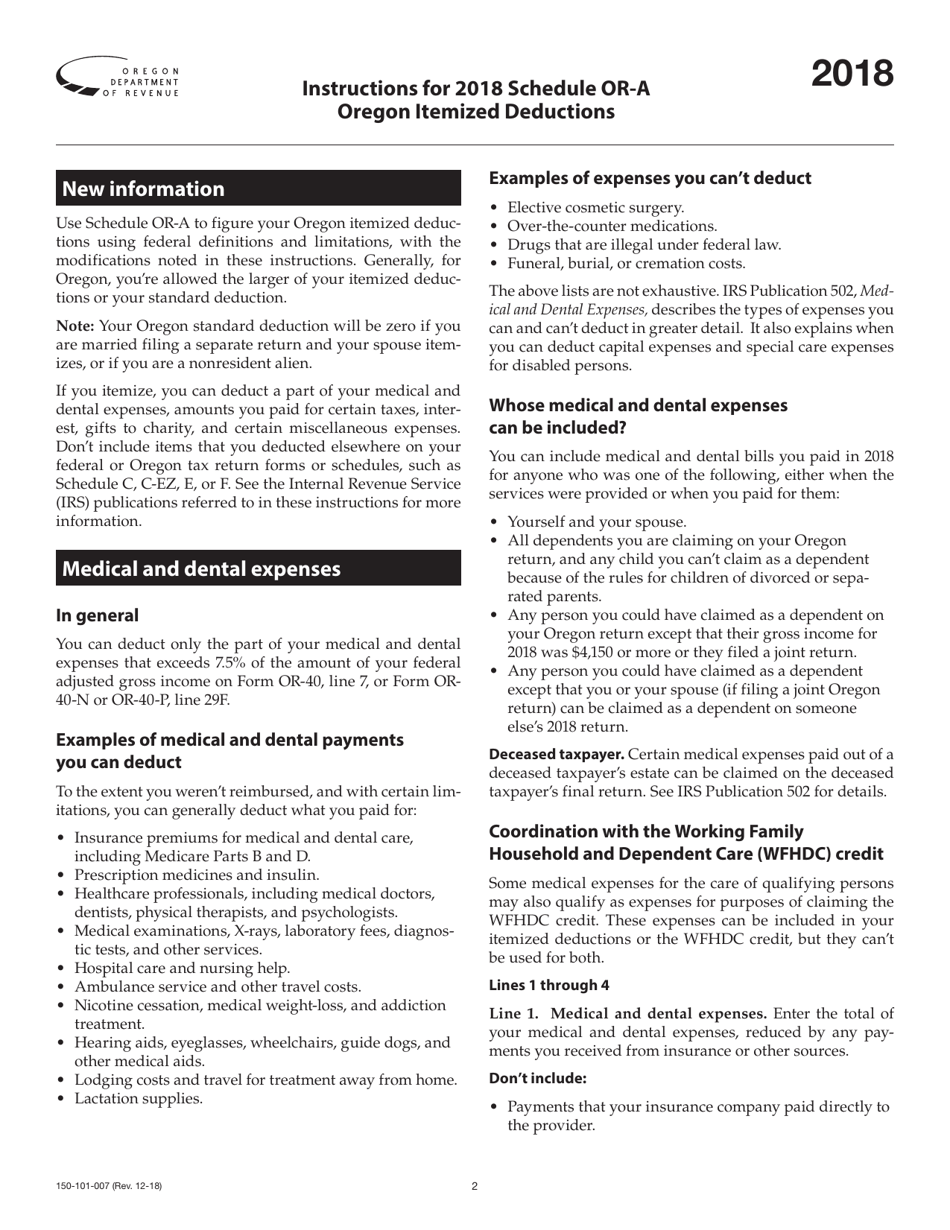

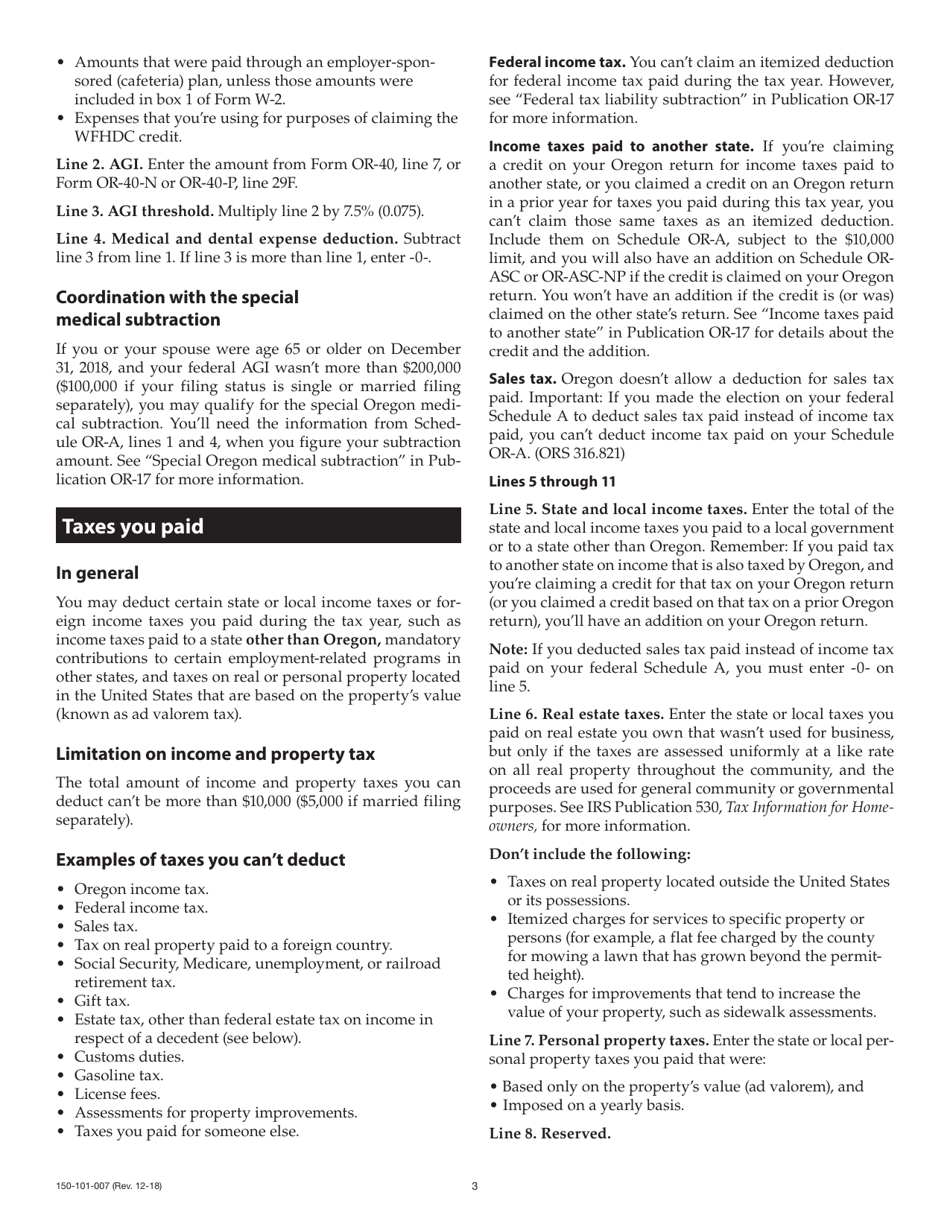

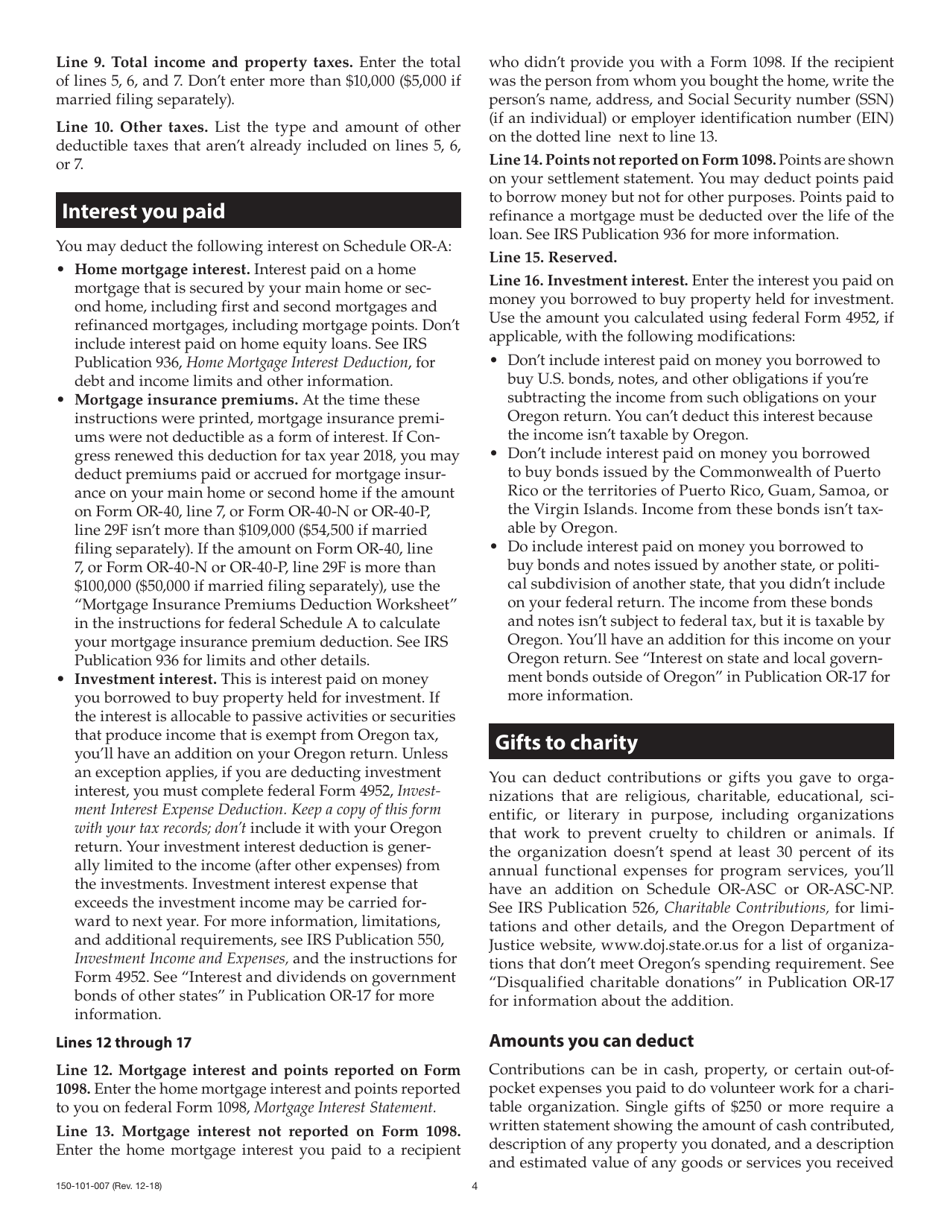

Q: What deductions can be itemized on Schedule OR-A?

A: Some common deductions that can be itemized on Schedule OR-A include medical expenses, mortgage interest, property taxes, and charitable contributions.

Q: Is it beneficial to itemize deductions on Schedule OR-A?

A: Itemizing deductions on Schedule OR-A may be beneficial if your total itemized deductions exceed the standard deduction amount offered by the state.

Q: When is the deadline to file Schedule OR-A?

A: The deadline to file Schedule OR-A is the same as the deadline to file your Oregon state tax return, which is typically April 15th.

Q: Can Schedule OR-A be electronically filed?

A: Yes, Schedule OR-A can be electronically filed along with your Oregon state tax return.

Q: What if I don't have enough deductions to itemize on Schedule OR-A?

A: If you don't have enough deductions to itemize on Schedule OR-A, you can choose to take the standard deduction instead.

Q: Can I use Schedule OR-A if I am filing my taxes as a non-resident of Oregon?

A: No, Schedule OR-A is only for residents of Oregon. Non-residents should consult the instructions for their respective state tax forms.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-007 Schedule OR-A by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.