This version of the form is not currently in use and is provided for reference only. Download this version of

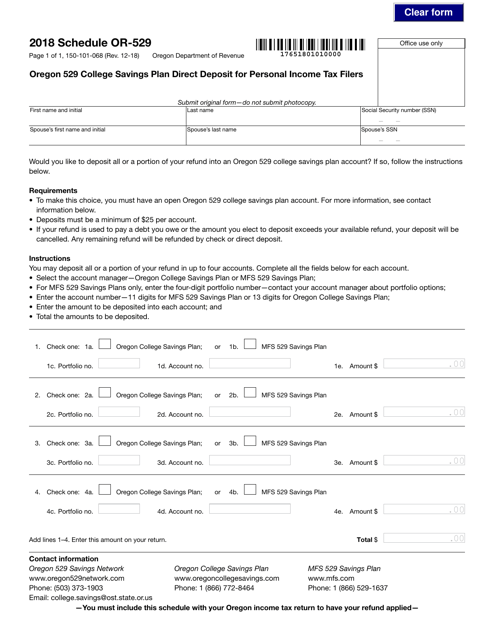

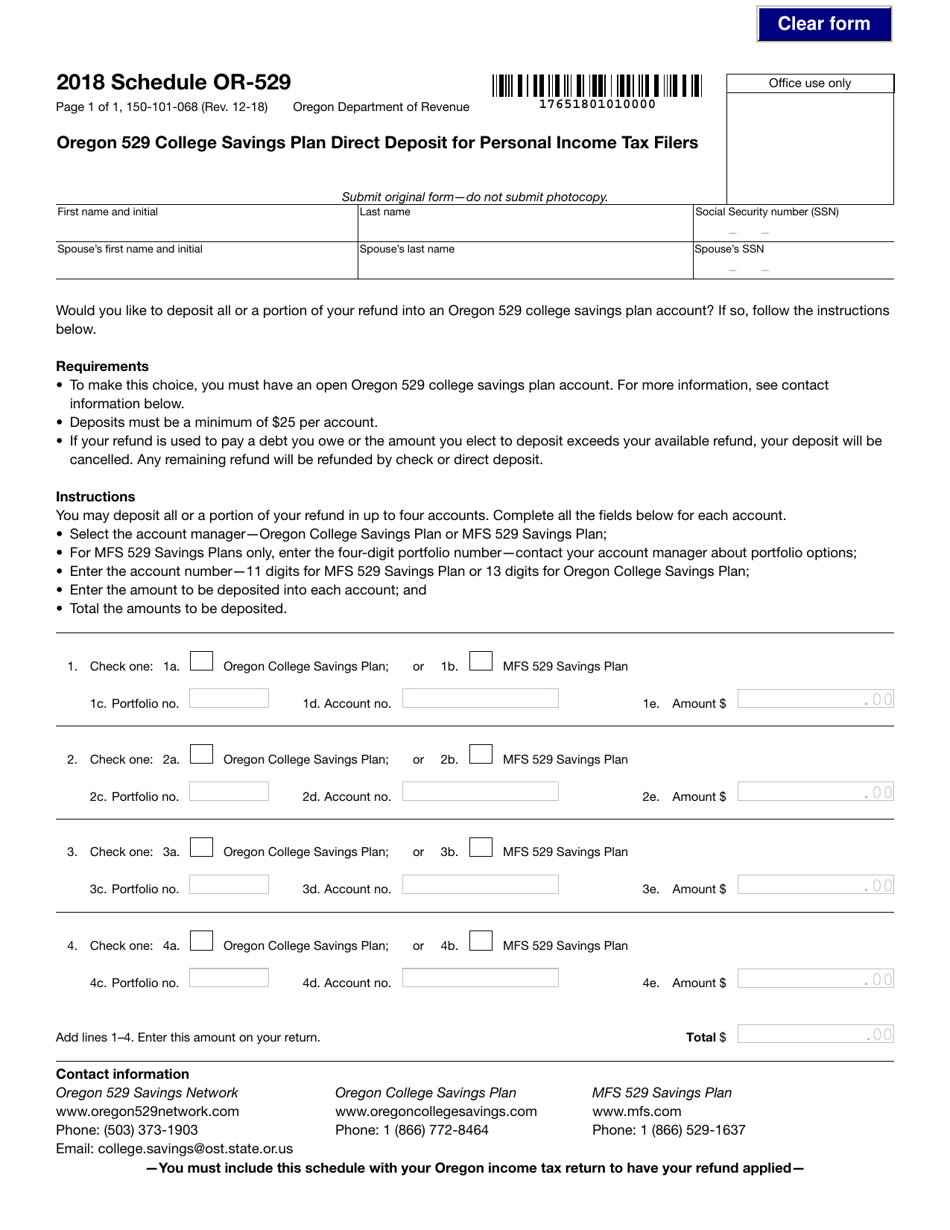

Form 150-101-068 Schedule OR-529

for the current year.

Form 150-101-068 Schedule OR-529 Oregon 529 College Savings Plan Direct Deposit for Personal Income Tax Filers - Oregon

What Is Form 150-101-068 Schedule OR-529?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-068?

A: Form 150-101-068 is the official form for Schedule OR-529 for the Oregon 529 College Savings Plan Direct Deposit for Personal Income Tax Filers.

Q: What is the purpose of Schedule OR-529?

A: The purpose of Schedule OR-529 is to authorize the direct deposit of Oregon 529 College Savings Plan funds to a personal income tax filer.

Q: Who should use Form 150-101-068?

A: Form 150-101-068 should be used by Oregon taxpayers who want to have their Oregon 529 College Savings Plan funds directly deposited.

Q: What is the Oregon 529 College Savings Plan?

A: The Oregon 529 College Savings Plan is a state-sponsored savings program designed to help individuals save for future college expenses.

Q: Can I use Schedule OR-529 if I don't have an Oregon 529 College Savings Plan?

A: No, Schedule OR-529 is specifically for taxpayers who have an Oregon 529 College Savings Plan and want to authorize direct deposit of funds.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-068 Schedule OR-529 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.