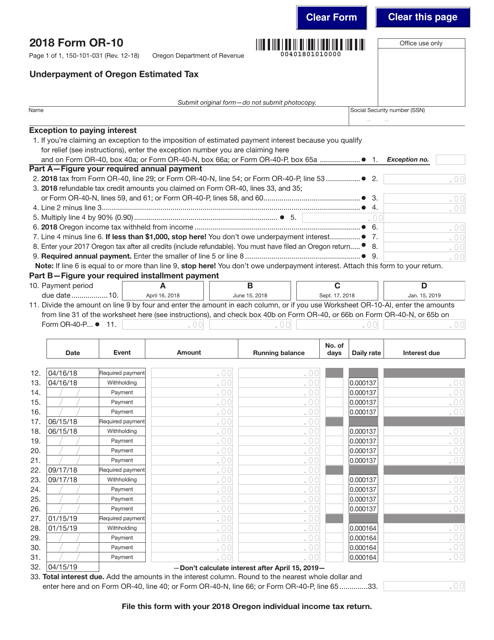

Form 150-101-03 (OR-10) Underpayment of Oregon Estimated Tax - Oregon

What Is Form 150-101-03 (OR-10)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

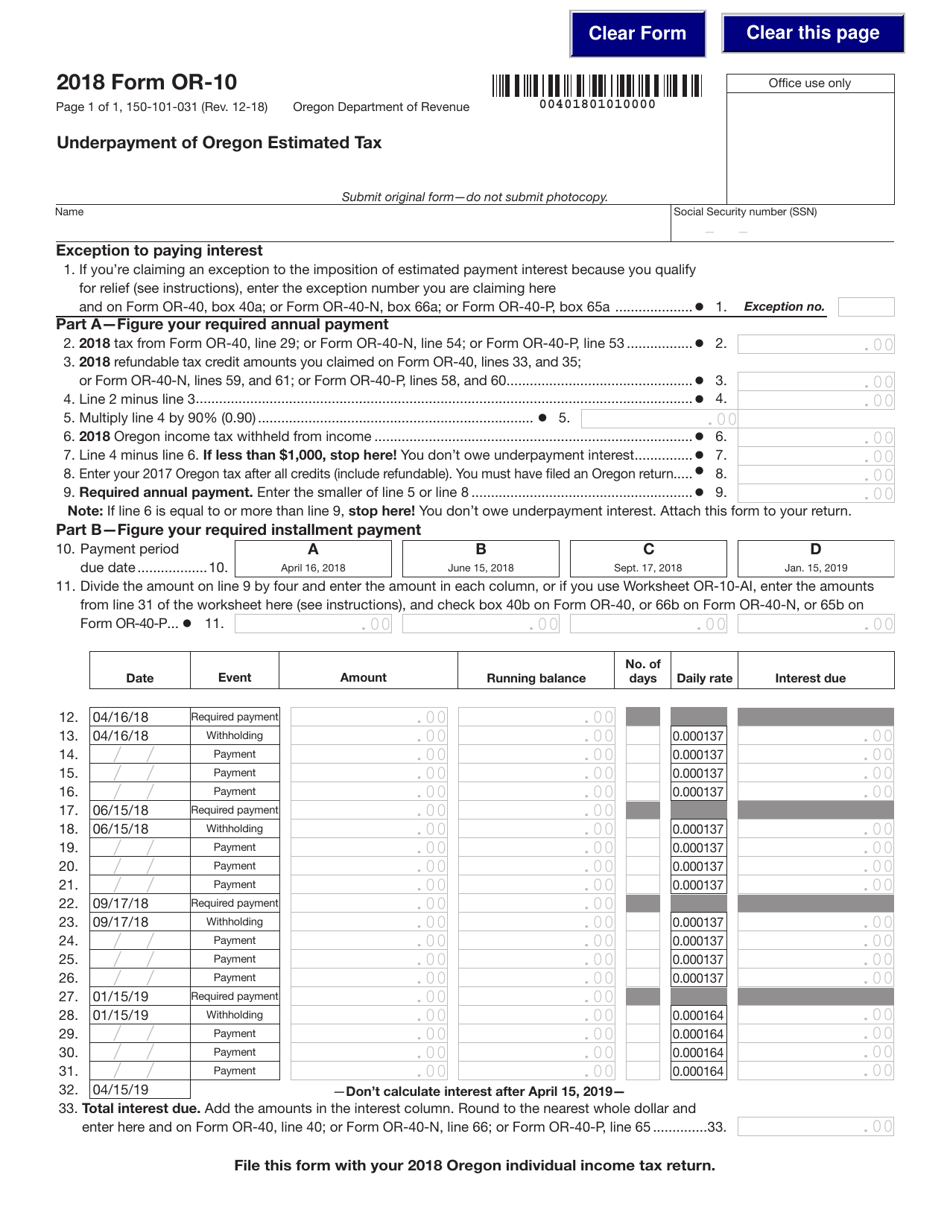

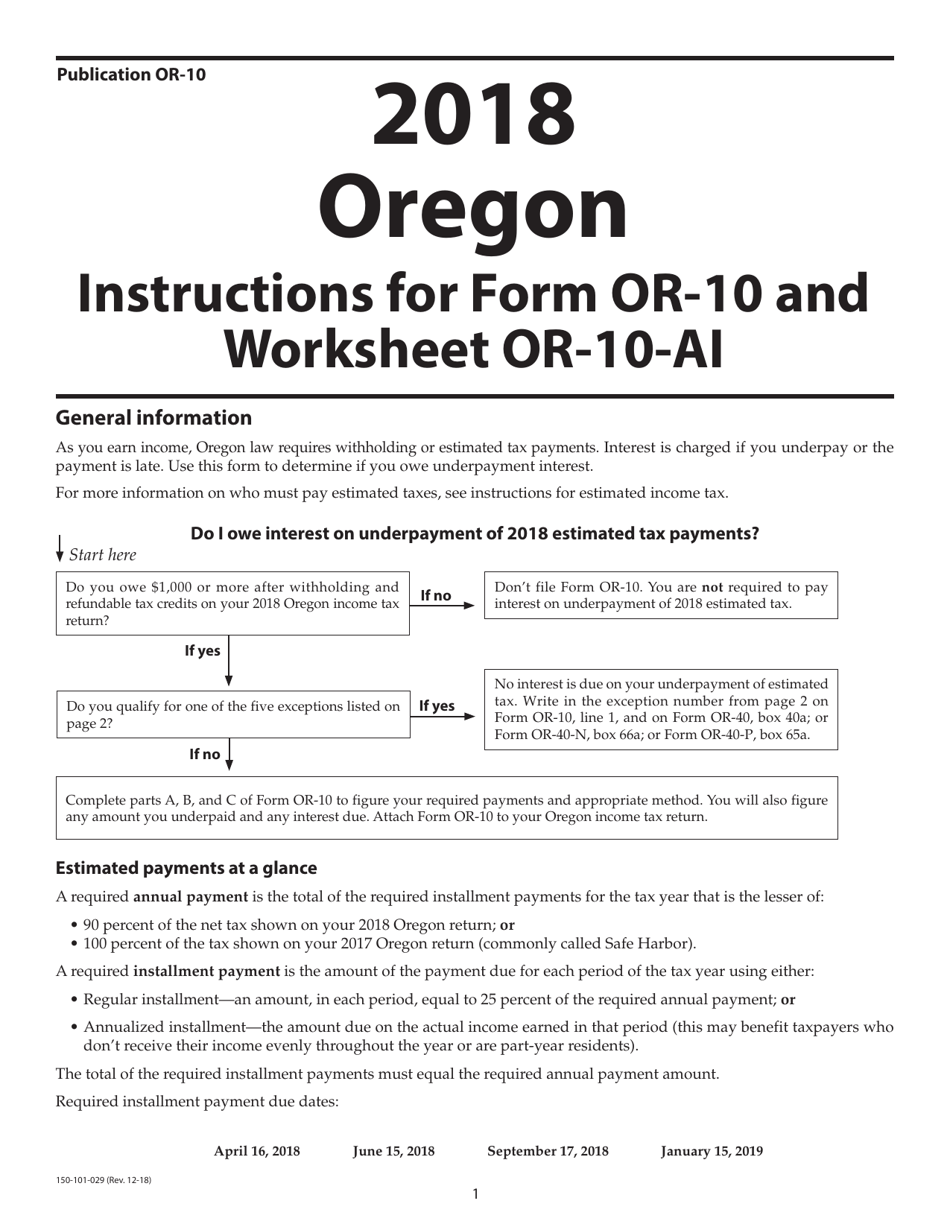

Q: What is Form 150-101-03 (OR-10)?

A: Form 150-101-03 (OR-10) is the form used to report and pay any underpayment of estimated tax in the state of Oregon.

Q: Who needs to file Form 150-101-03 (OR-10)?

A: Any individual or business who underestimated their Oregon tax liability and failed to pay enough estimated tax throughout the year needs to file Form 150-101-03 (OR-10).

Q: When is Form 150-101-03 (OR-10) due?

A: Form 150-101-03 (OR-10) is due on or before the 15th day of the fourth month following the end of the tax year.

Q: What happens if I don't file Form 150-101-03 (OR-10) on time?

A: If you don't file Form 150-101-03 (OR-10) on time, you may be subject to penalties and interest on the underpayment amount.

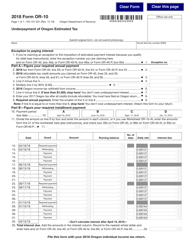

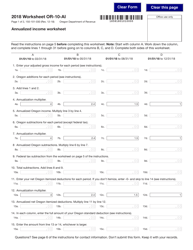

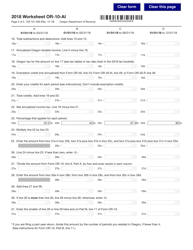

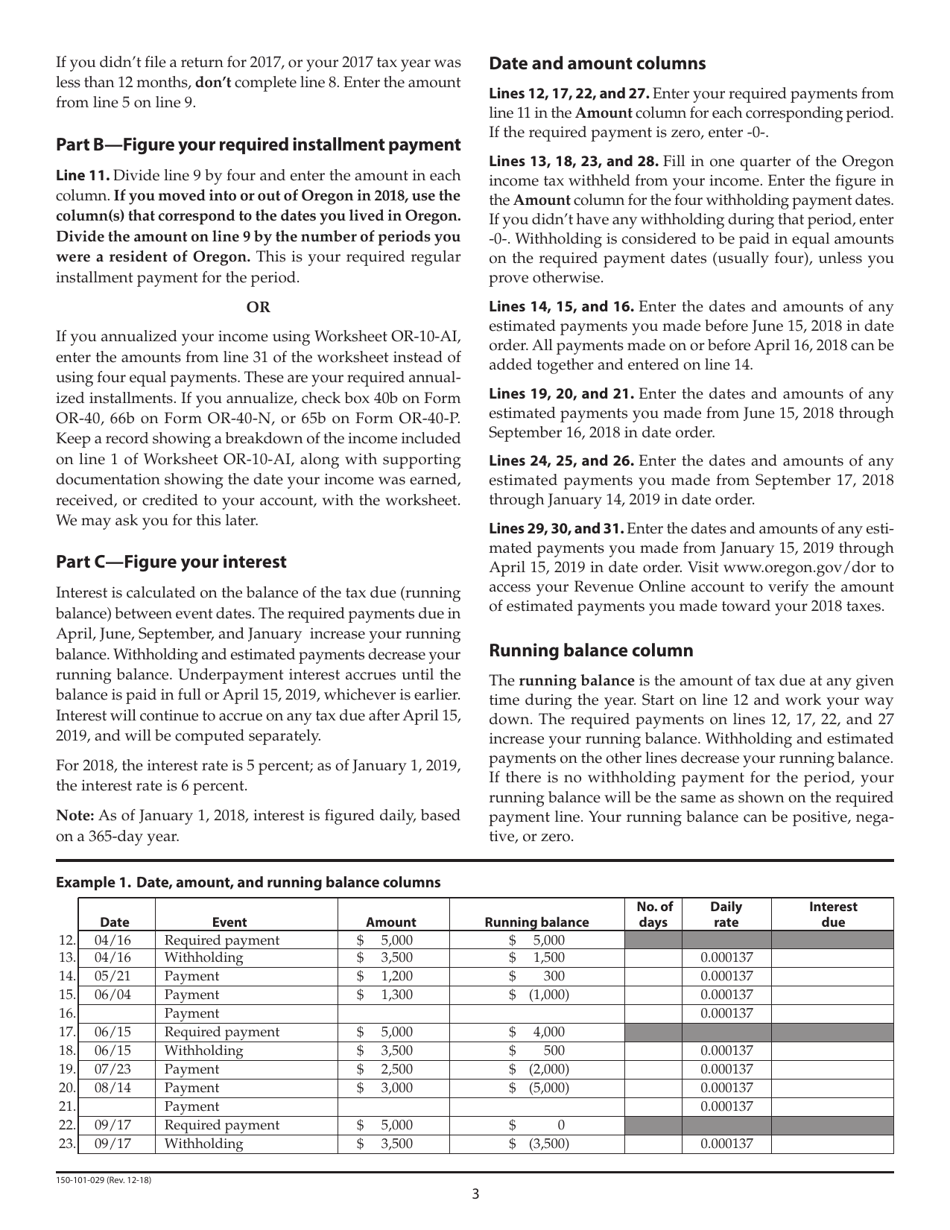

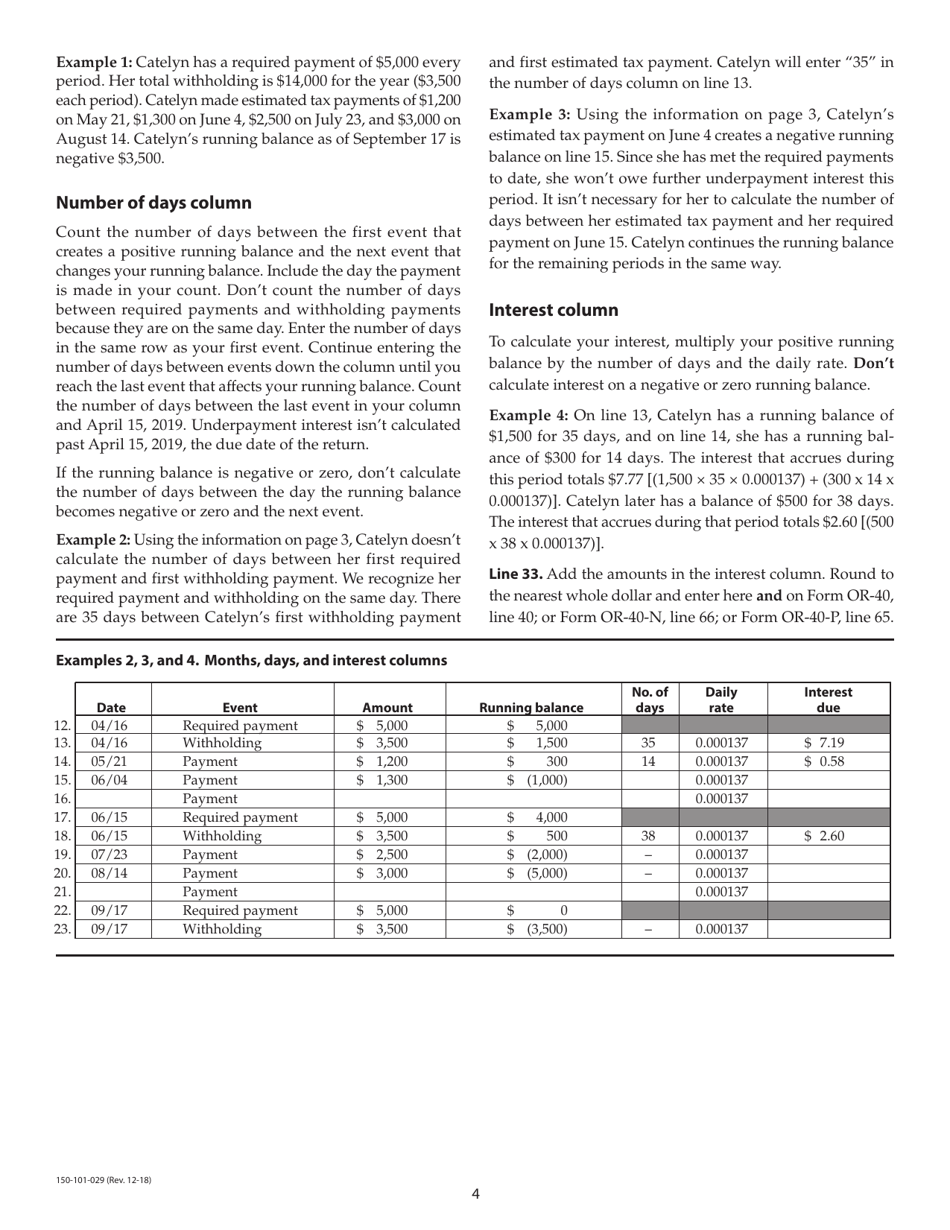

Q: How do I calculate the underpayment on Form 150-101-03 (OR-10)?

A: The underpayment amount is calculated by comparing your estimated tax payments to your actual tax liability.

Q: Can I request a waiver of the underpayment penalty?

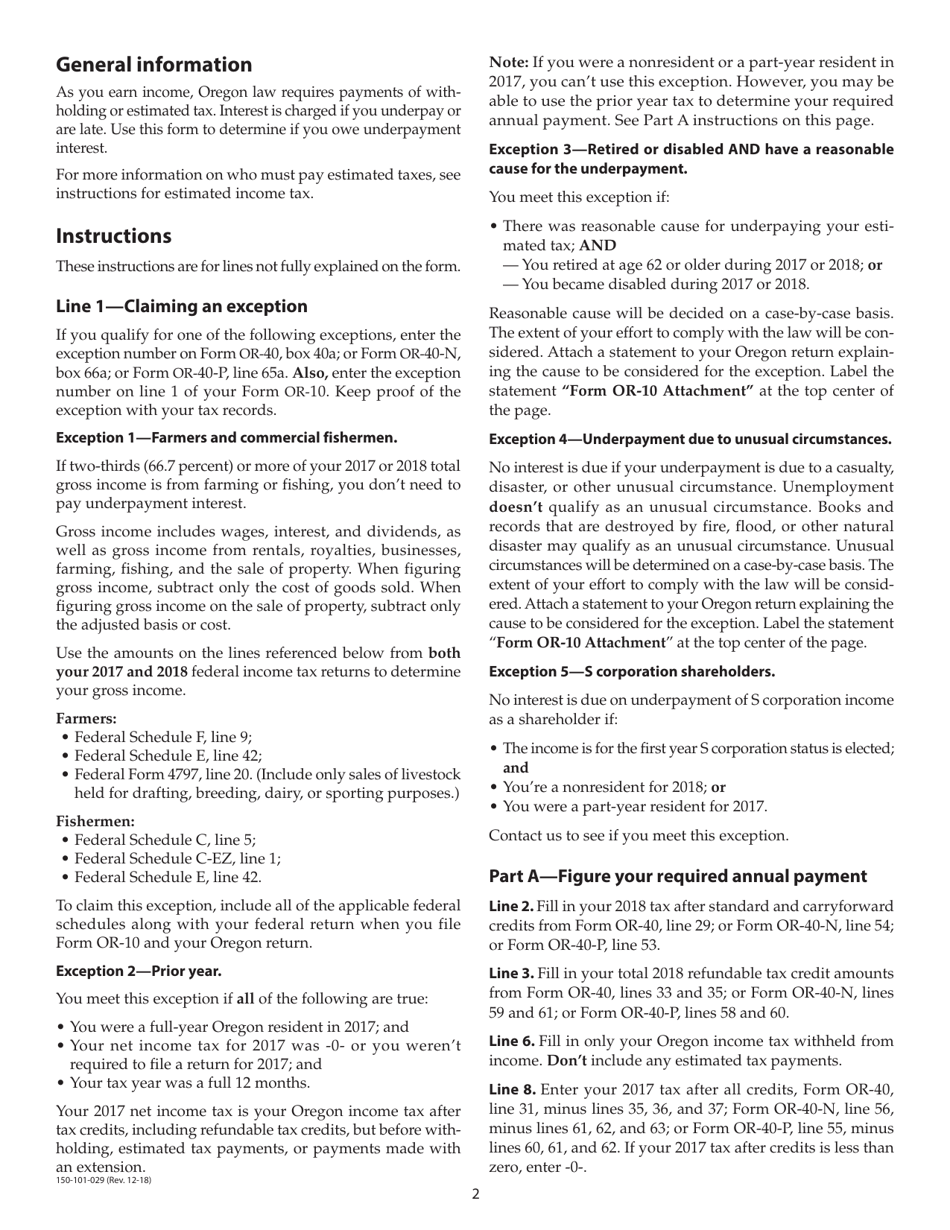

A: Yes, you can request a waiver of the underpayment penalty if you meet certain criteria, such as having a reasonable cause for the underpayment.

Q: Are there any exceptions to filing Form 150-101-03 (OR-10)?

A: Yes, there are exceptions for certain individuals and businesses, such as farmers and fishermen who meet specific requirements.

Q: Can I amend my Form 150-101-03 (OR-10) if I made a mistake?

A: Yes, you can amend your Form 150-101-03 (OR-10) by filing an amended return using Form 150-101-01 (AM).

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-03 (OR-10) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.