This version of the form is not currently in use and is provided for reference only. Download this version of

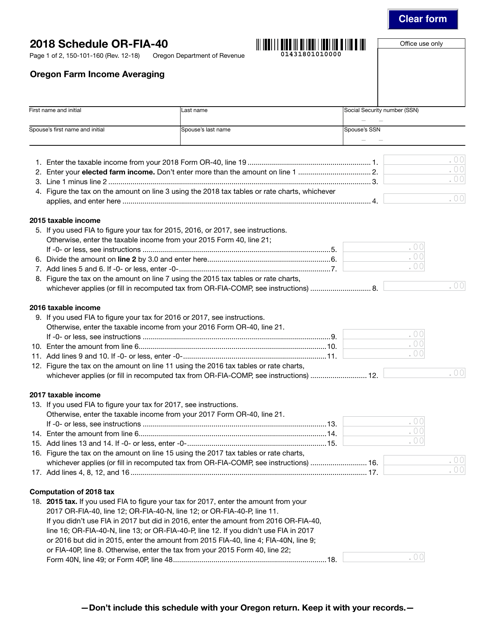

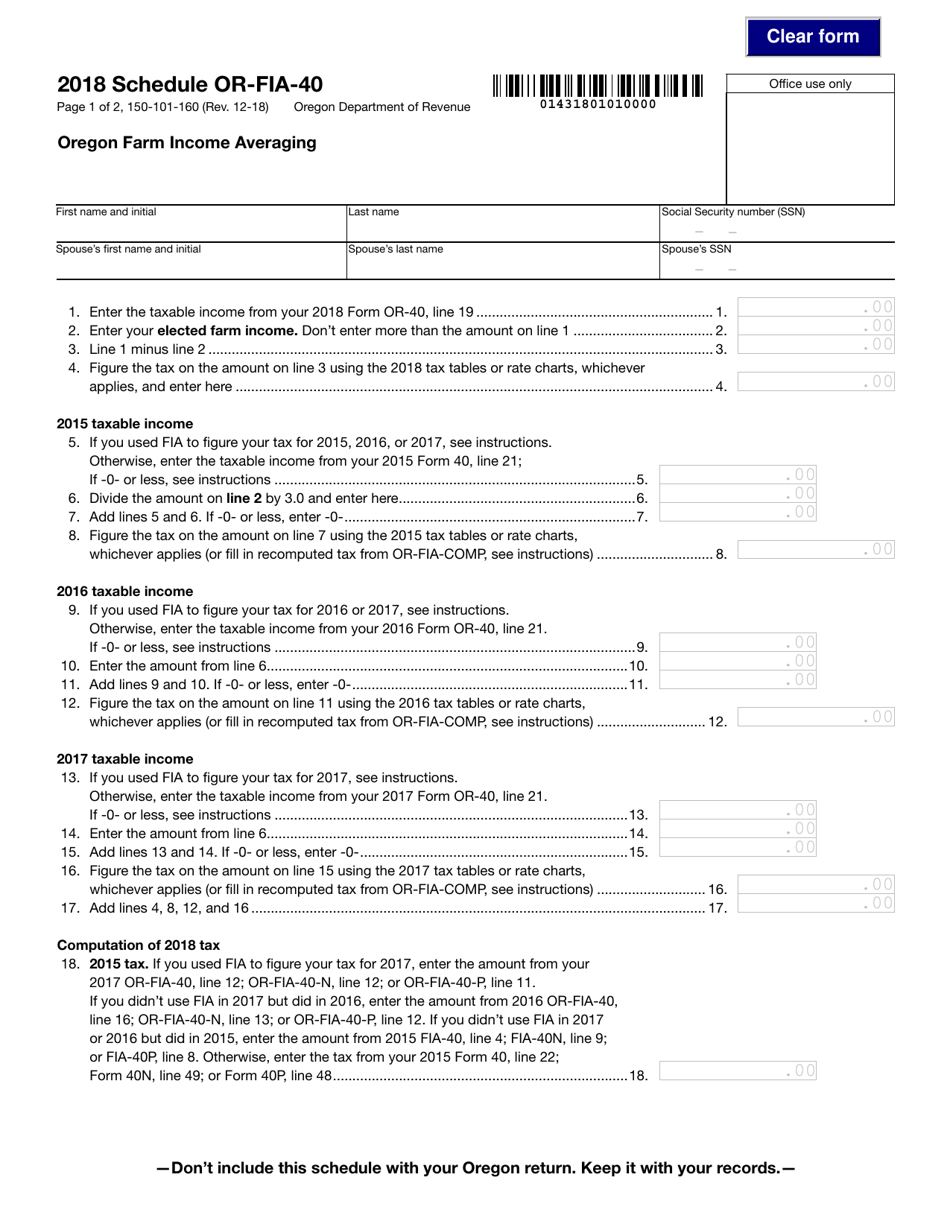

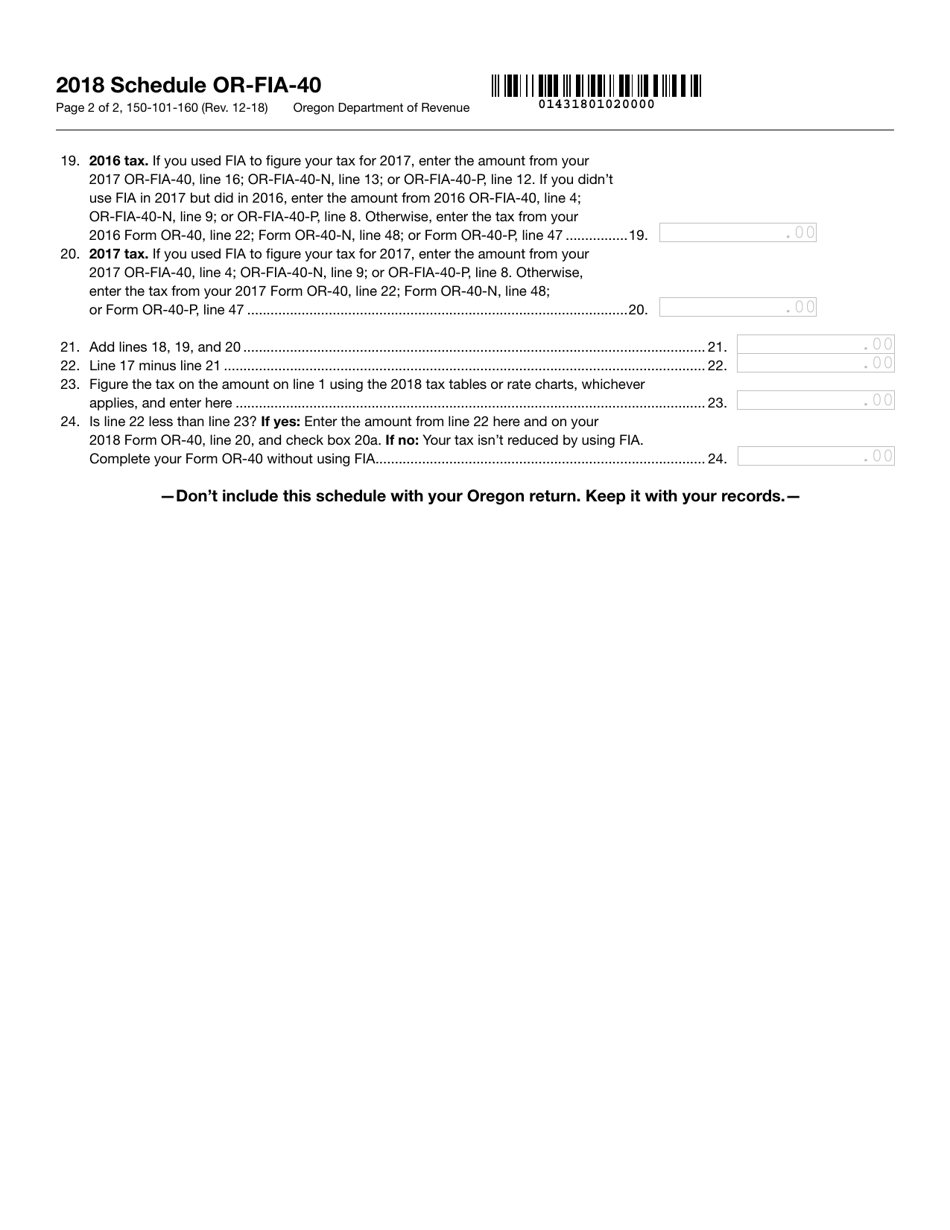

Form 150-101-160 Schedule OR-FIA-40

for the current year.

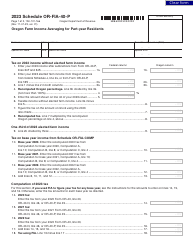

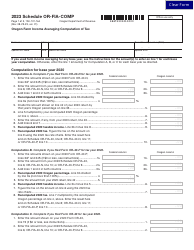

Form 150-101-160 Schedule OR-FIA-40 Oregon Farm Income Averaging - Oregon

What Is Form 150-101-160 Schedule OR-FIA-40?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-160?

A: Form 150-101-160 is a tax form used in Oregon.

Q: What is Schedule OR-FIA-40?

A: Schedule OR-FIA-40 is a specific section of Form 150-101-160.

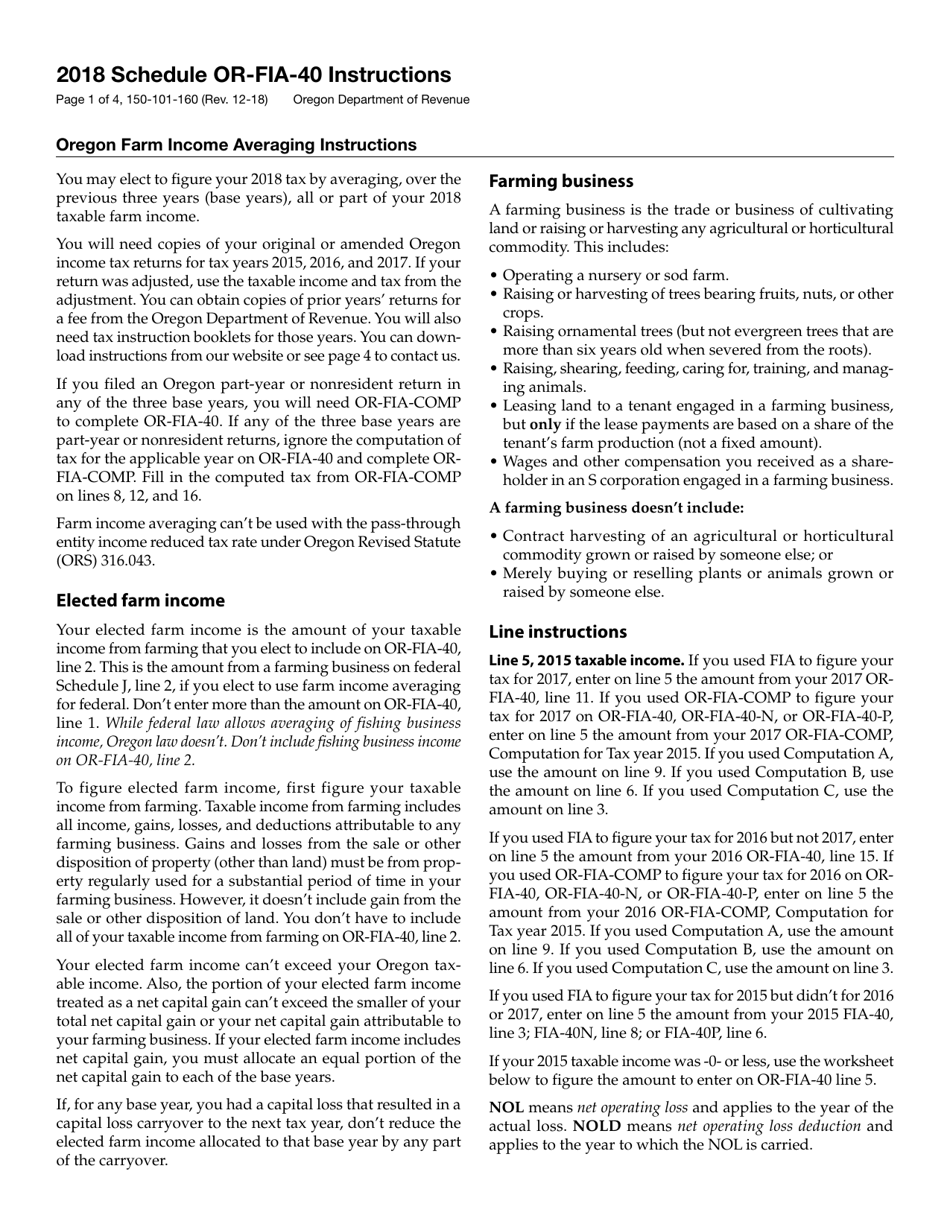

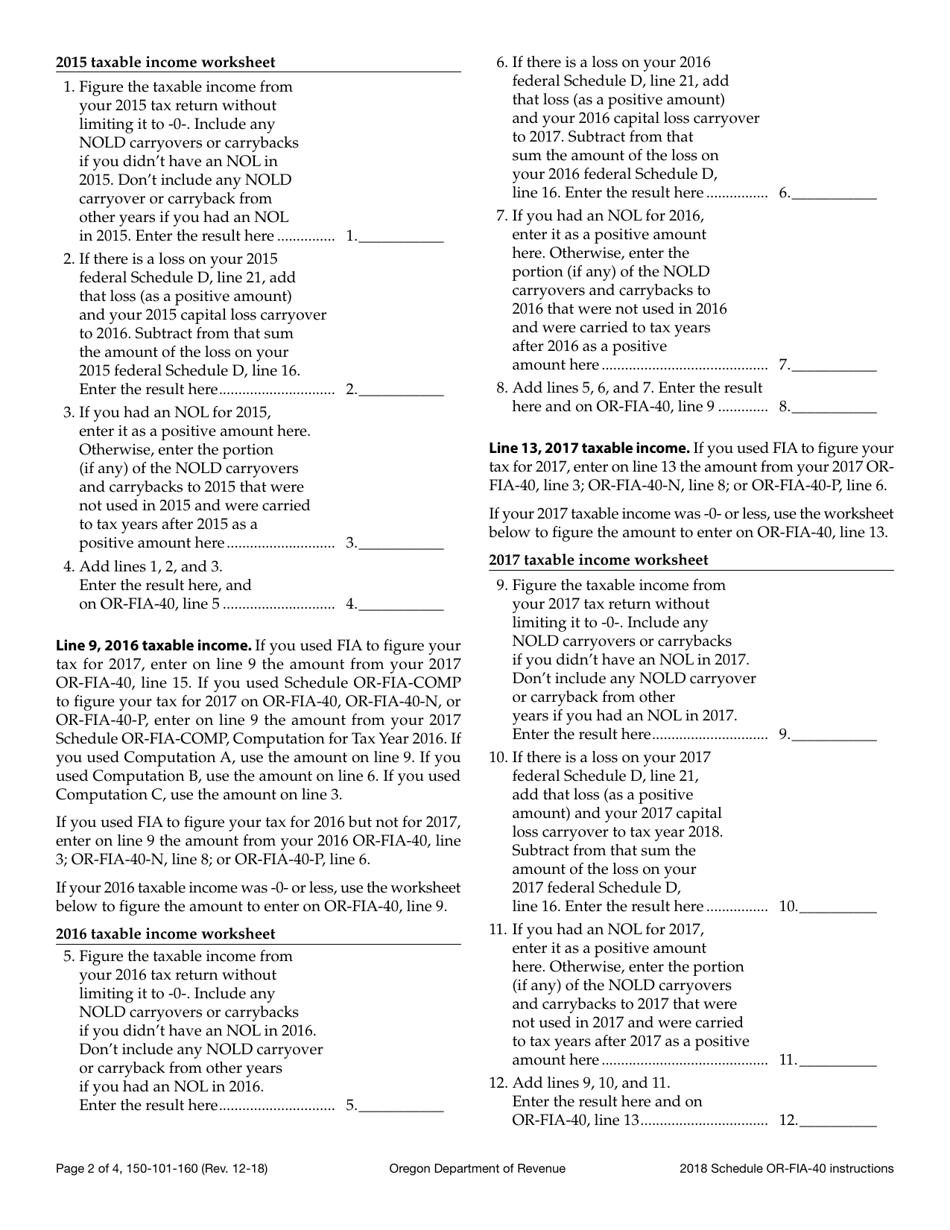

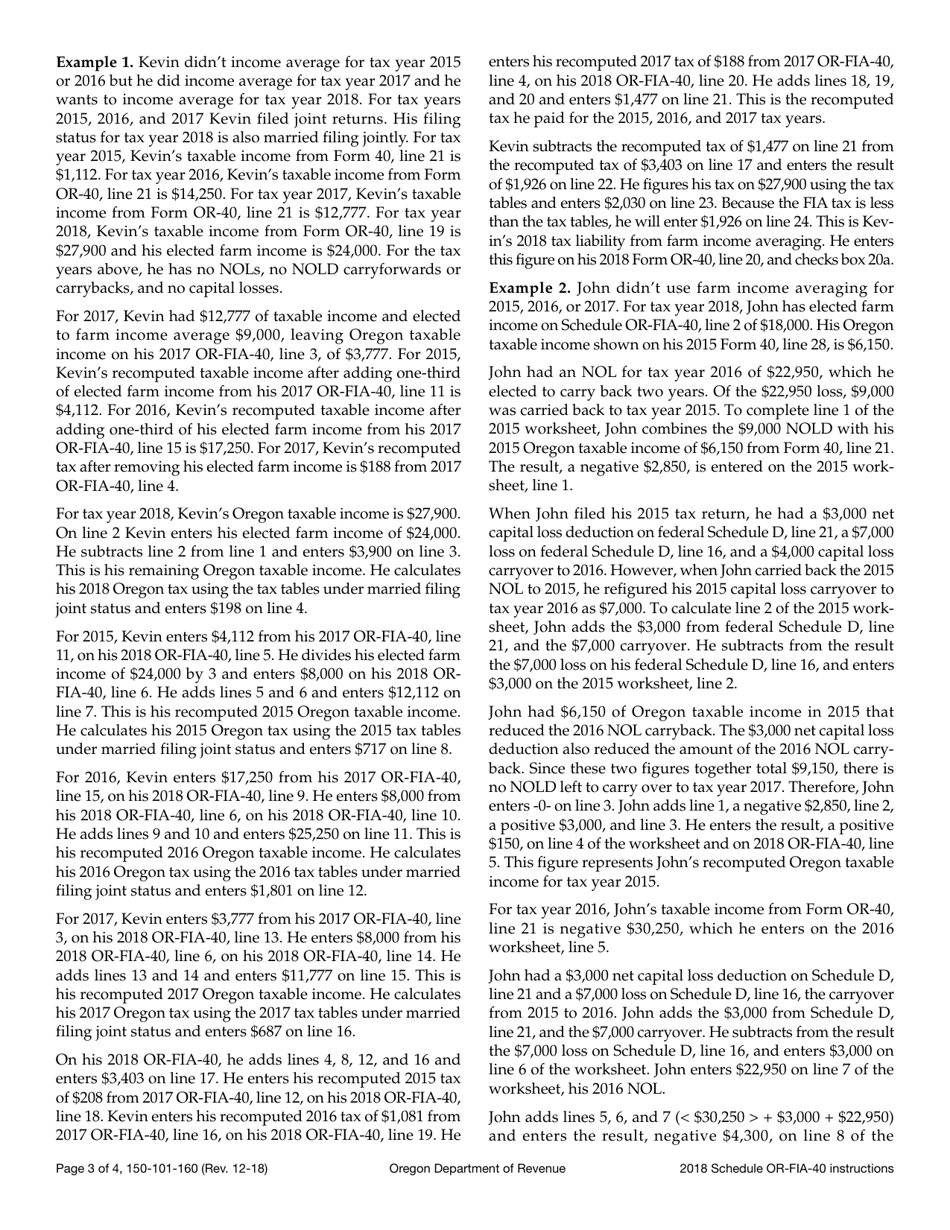

Q: What is Oregon Farm Income Averaging?

A: Oregon Farm Income Averaging is a tax method that allows farmers in Oregon to average their income over a period of years.

Q: Who can use Schedule OR-FIA-40?

A: Schedule OR-FIA-40 is used by farmers in Oregon who want to take advantage of the farm income averaging method.

Q: What is the purpose of Schedule OR-FIA-40?

A: The purpose of Schedule OR-FIA-40 is to calculate the farm income averaging adjustment for Oregon farmers.

Q: Are there any eligibility requirements to use Schedule OR-FIA-40?

A: Yes, farmers must meet certain criteria to be eligible to use Schedule OR-FIA-40. It is recommended to consult the instructions of the form for specific details.

Q: How do I fill out Schedule OR-FIA-40?

A: To fill out Schedule OR-FIA-40, follow the instructions provided with the form. It is advised to consult a tax professional if you are unsure.

Q: When is Schedule OR-FIA-40 due?

A: Schedule OR-FIA-40 is due on the same date as your Oregon tax return, which is typically April 15th, unless it falls on a weekend or holiday.

Q: What if I make a mistake on Schedule OR-FIA-40?

A: If you make a mistake on Schedule OR-FIA-40, you can file an amended return to correct the error. It is recommended to consult a tax professional for guidance.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-160 Schedule OR-FIA-40 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.