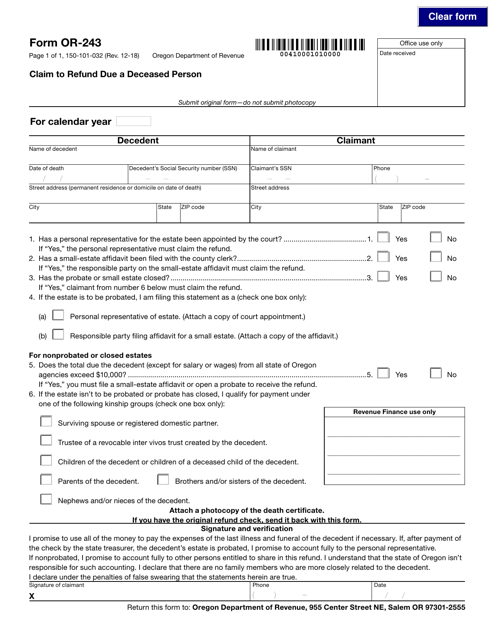

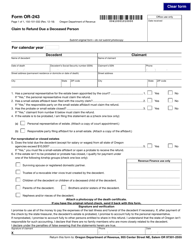

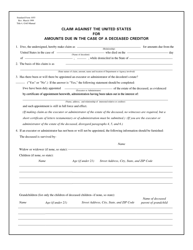

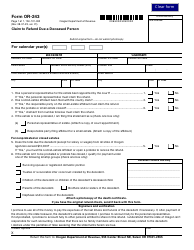

Form OR-150-101-032 (OR-243) Claim to Refund Due a Deceased Person - Oregon

What Is Form OR-150-101-032 (OR-243)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-150-101-032 (OR-243)?

A: Form OR-150-101-032 (OR-243) is a form used in the state of Oregon to claim a refund due to a deceased person.

Q: When should I use Form OR-150-101-032 (OR-243)?

A: You should use Form OR-150-101-032 (OR-243) when you need to claim a refund on behalf of a deceased person in the state of Oregon.

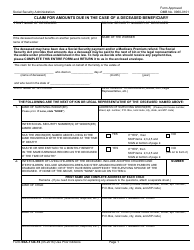

Q: What information do I need to fill out Form OR-150-101-032 (OR-243)?

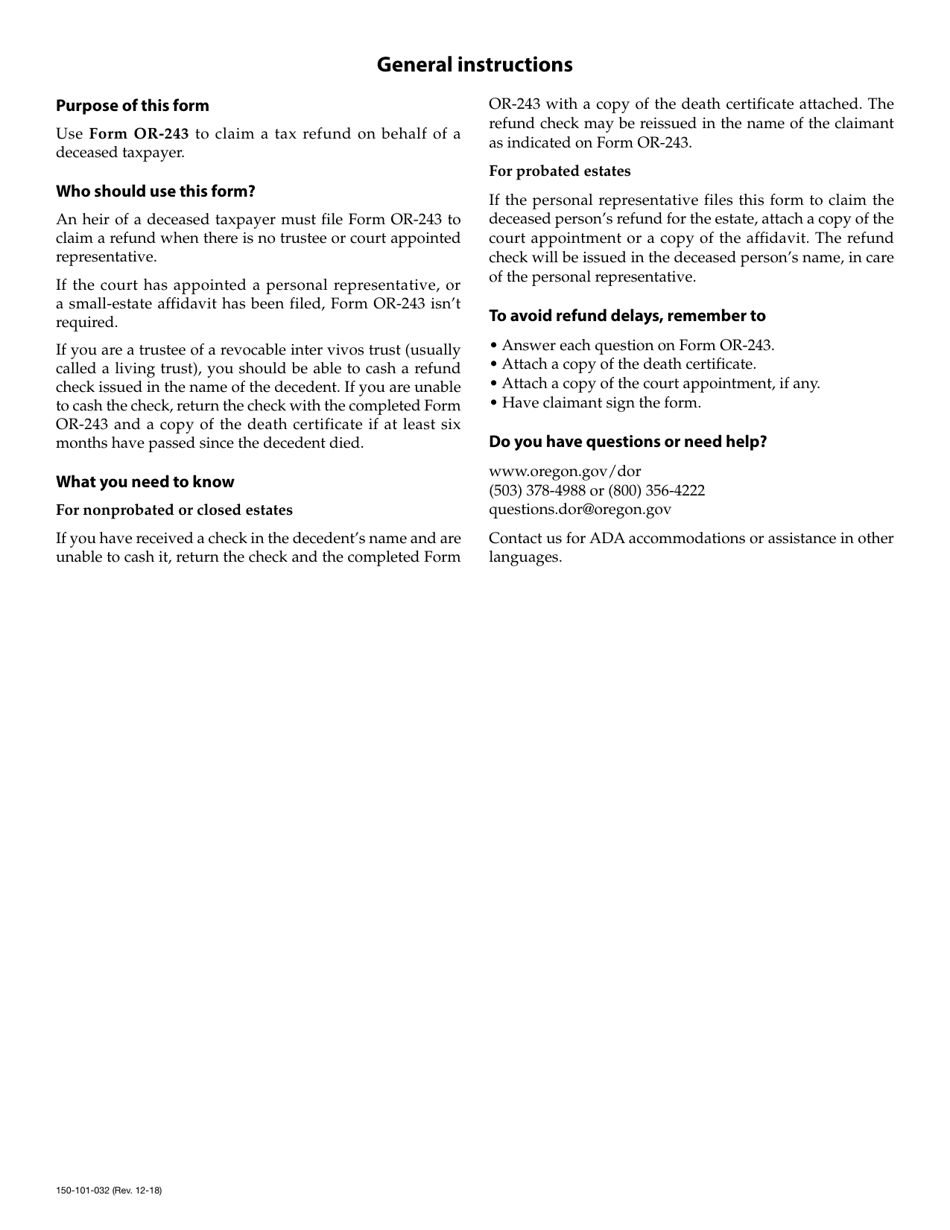

A: You will need the deceased person's personal information, information about their estate or trust, and documentation to support the claim.

Q: Are there any specific instructions for filling out Form OR-150-101-032 (OR-243)?

A: Yes, there are specific instructions provided with the form that you should carefully follow when filling it out.

Q: Is there a deadline for filing Form OR-150-101-032 (OR-243)?

A: Yes, there is a deadline for filing Form OR-150-101-032 (OR-243). The exact deadline and any applicable extensions are mentioned in the instructions provided with the form.

Q: Can I file Form OR-150-101-032 (OR-243) electronically?

A: No, at the moment electronic filing is not available for Form OR-150-101-032 (OR-243). You need to mail the completed form and supporting documents.

Q: Is there a fee for filing Form OR-150-101-032 (OR-243)?

A: No, there is no fee for filing Form OR-150-101-032 (OR-243).

Q: How long does it take to process Form OR-150-101-032 (OR-243)?

A: The processing time for Form OR-150-101-032 (OR-243) varies. You can contact the Oregon Department of Revenue for more information on the current processing times.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-150-101-032 (OR-243) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.