This version of the form is not currently in use and is provided for reference only. Download this version of

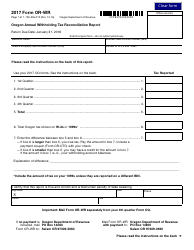

Form 150-206-015 (PA)

for the current year.

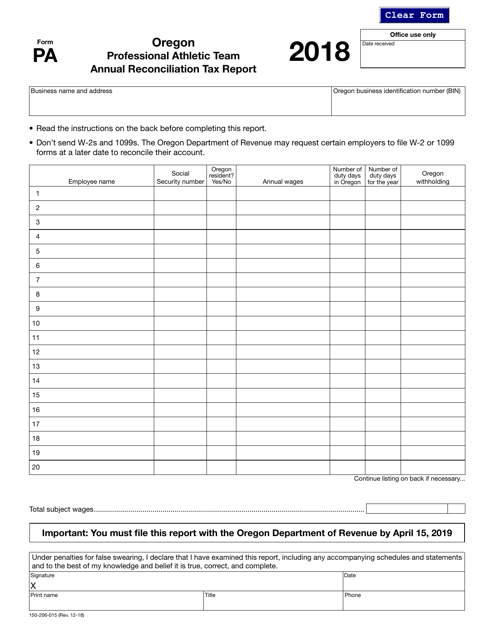

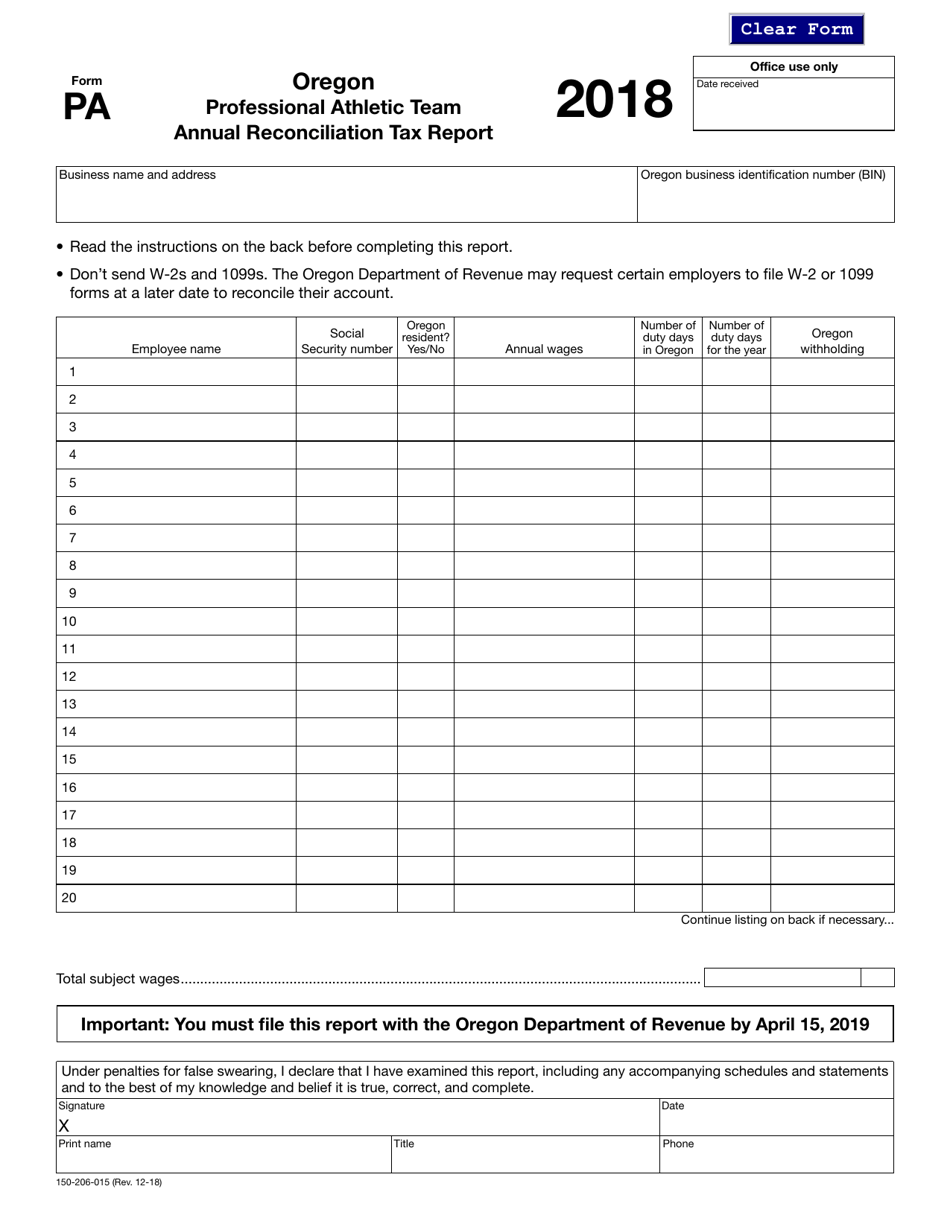

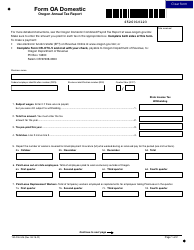

Form 150-206-015 (PA) Professional Athletic Team Annual Reconciliation Tax Report - Oregon

What Is Form 150-206-015 (PA)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-206-015 (PA)?

A: Form 150-206-015 (PA) is the Professional Athletic Team Annual Reconciliation Tax Report in Oregon.

Q: Who needs to file Form 150-206-015 (PA)?

A: Professional athletic teams in Oregon are required to file Form 150-206-015 (PA).

Q: What is the purpose of Form 150-206-015 (PA)?

A: The purpose of Form 150-206-015 (PA) is to report and reconcile the professional athletic team tax liability in Oregon.

Q: What information is required on Form 150-206-015 (PA)?

A: Form 150-206-015 (PA) requires information such as team details, payments made, credits, and deductions.

Q: When is the deadline to file Form 150-206-015 (PA)?

A: The deadline to file Form 150-206-015 (PA) is generally on or before the 15th day of the fourth month after the close of the team's tax year.

Q: Are there any penalties for not filing Form 150-206-015 (PA) on time?

A: Yes, there may be penalties for not filing Form 150-206-015 (PA) on time. It is important to adhere to the deadline to avoid penalty charges.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-206-015 (PA) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.