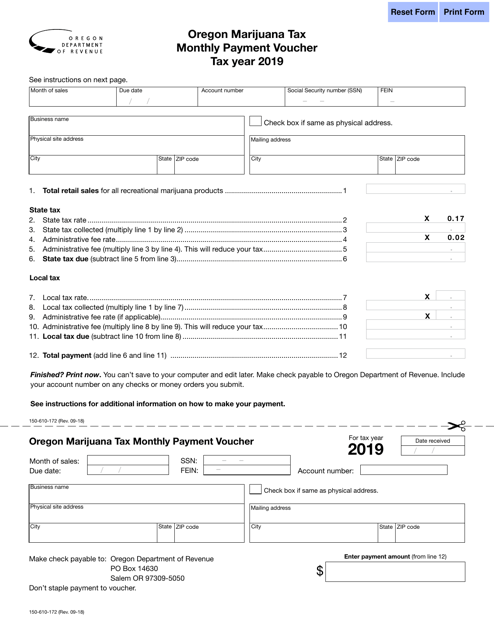

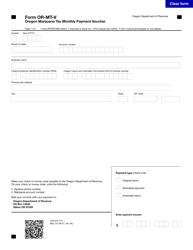

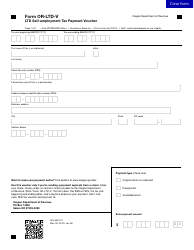

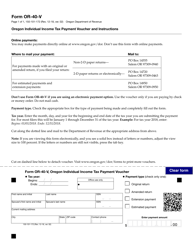

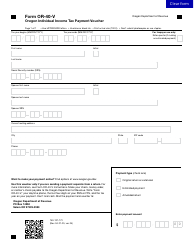

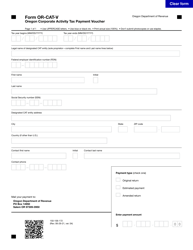

Form 150-610-172 Oregon Marijuana Tax Monthly Payment Voucher - Oregon

What Is Form 150-610-172?

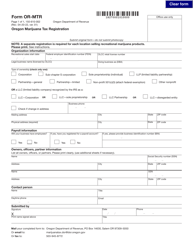

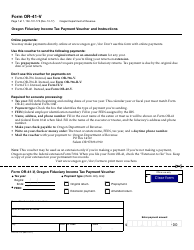

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-610-172?

A: Form 150-610-172 is the Oregon Marijuana Tax Monthly Payment Voucher.

Q: What is the purpose of Form 150-610-172?

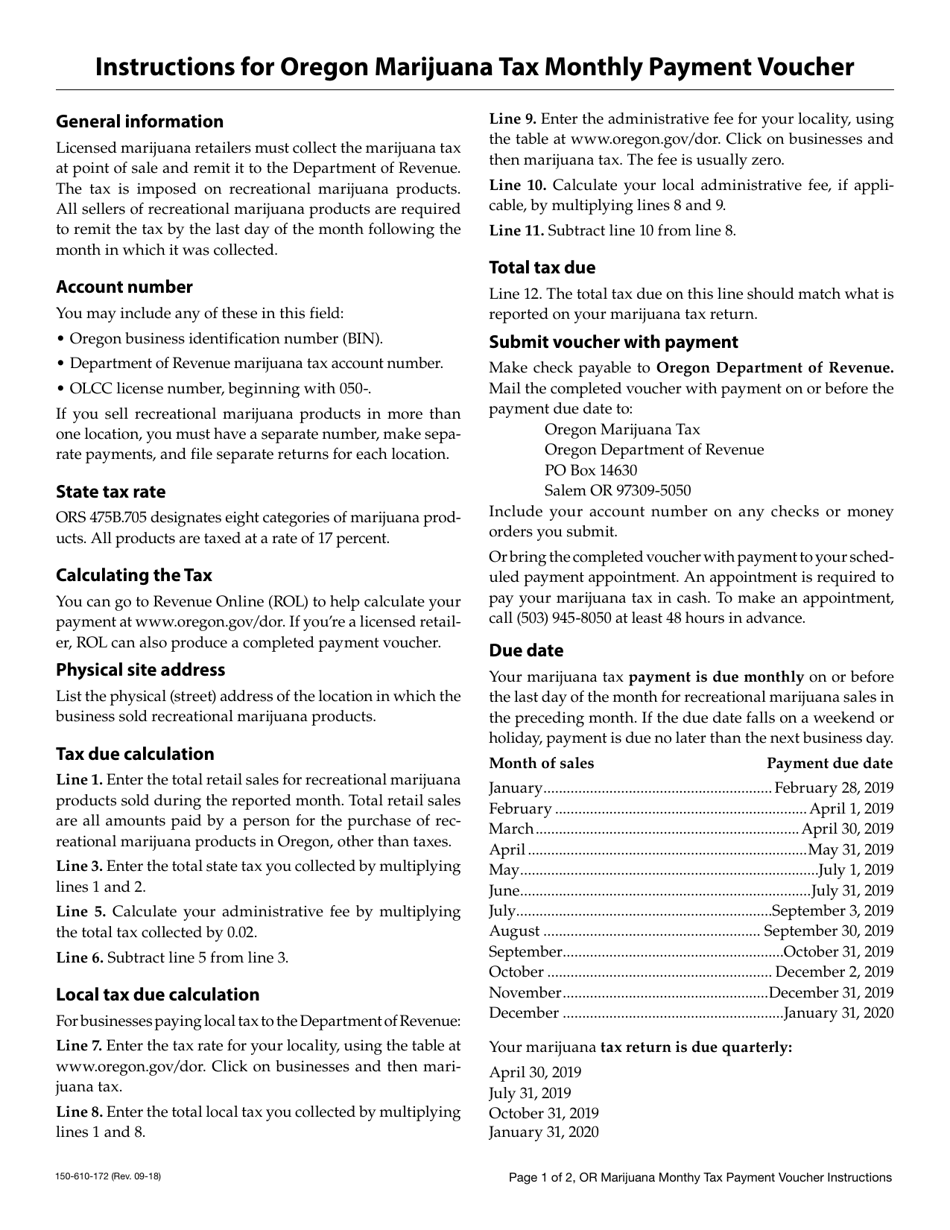

A: The purpose of Form 150-610-172 is to make monthly payments for Oregon marijuana tax.

Q: Who needs to use Form 150-610-172?

A: Anyone who owes Oregon marijuana tax needs to use Form 150-610-172.

Q: How often do I need to submit Form 150-610-172?

A: Form 150-610-172 needs to be submitted monthly.

Q: Can I submit Form 150-610-172 electronically?

A: Yes, you can submit Form 150-610-172 electronically.

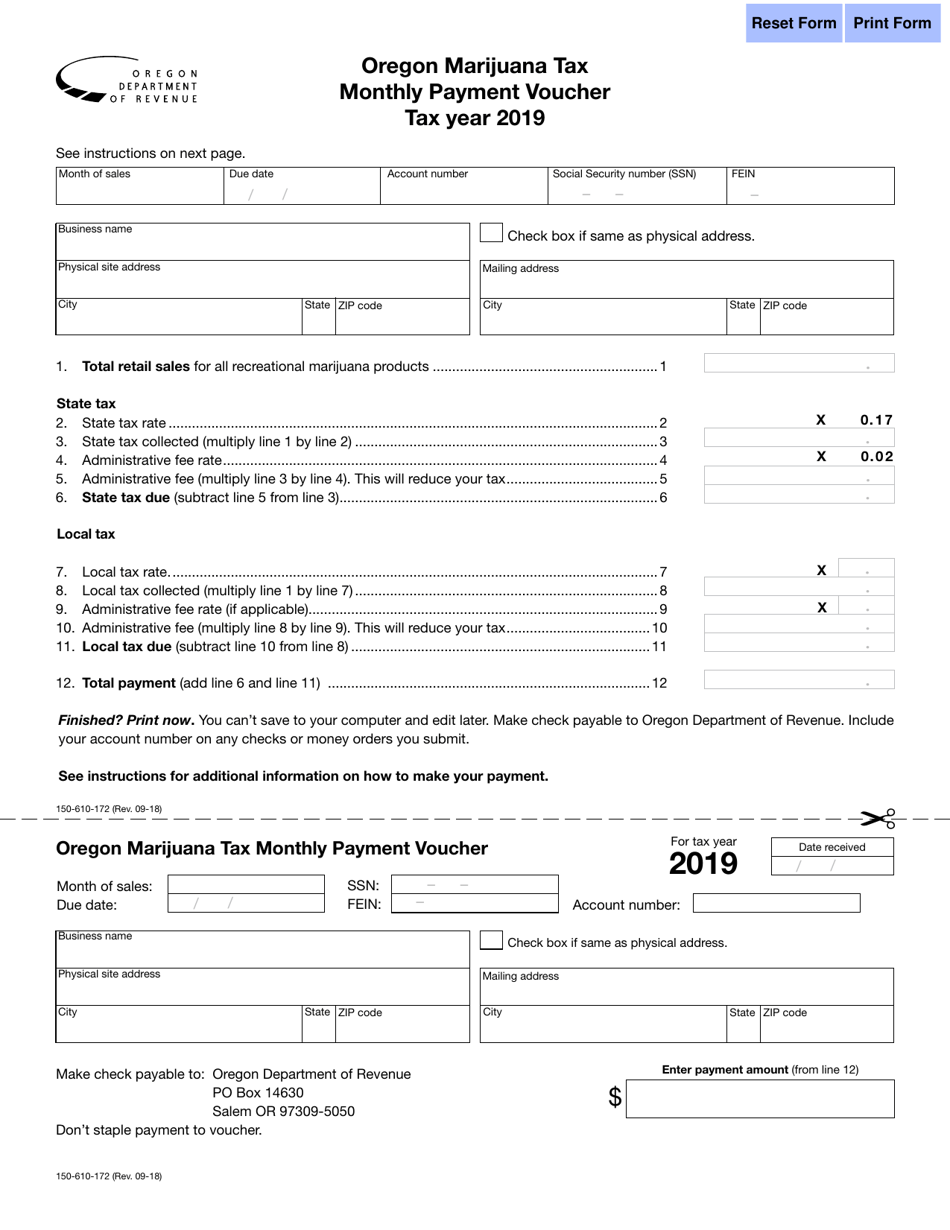

Q: What information do I need to fill out Form 150-610-172?

A: You will need to provide your name, account number, payment amount, and other relevant details.

Q: Is there a deadline for submitting Form 150-610-172?

A: Yes, Form 150-610-172 must be submitted by the 20th day of the month following the reporting period.

Q: What happens if I don't submit Form 150-610-172 or pay the tax on time?

A: Failure to submit Form 150-610-172 or pay the tax on time may result in penalties and interest.

Q: Who should I contact if I have questions about Form 150-610-172?

A: For any questions or assistance, you can contact the Oregon Department of Revenue.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-610-172 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.