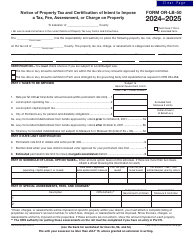

This version of the form is not currently in use and is provided for reference only. Download this version of

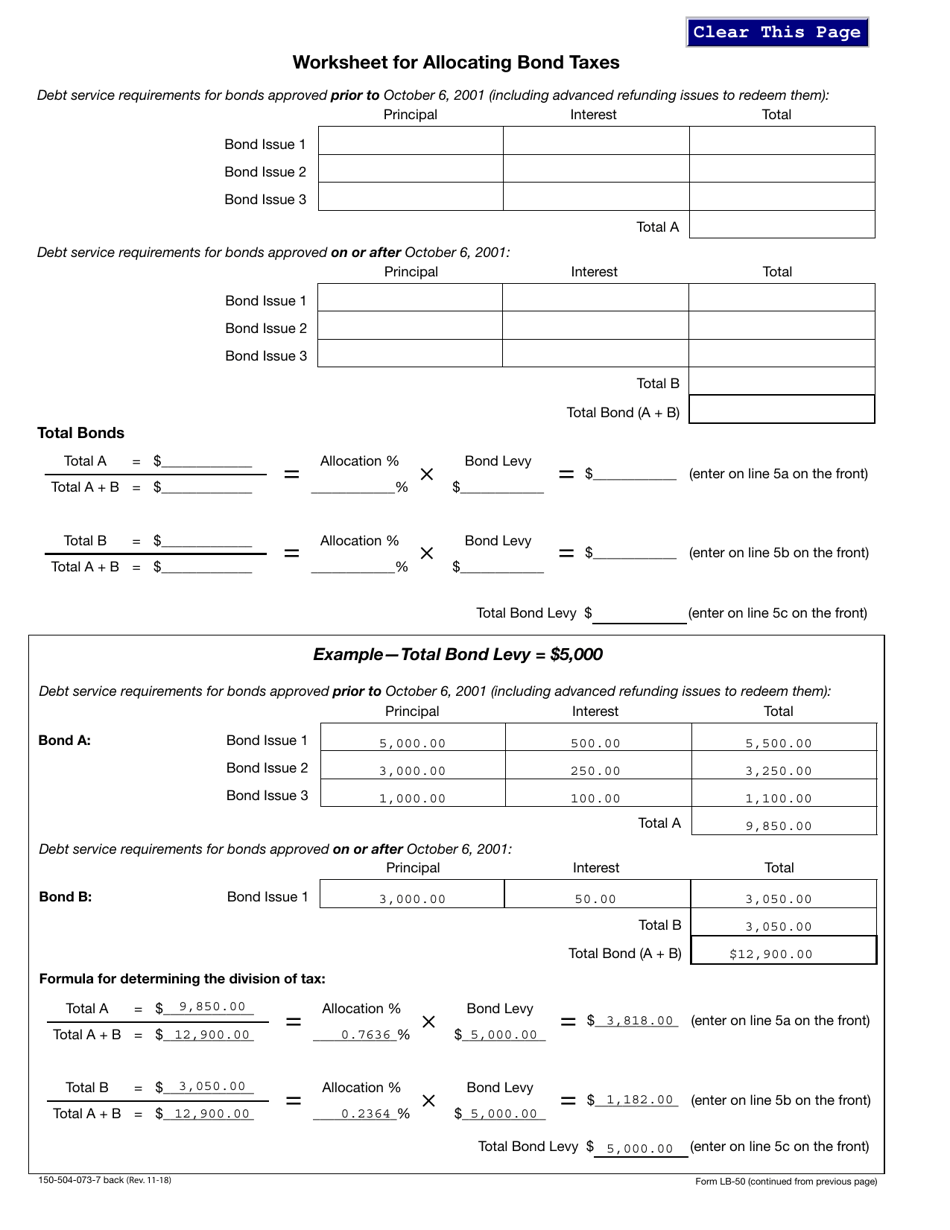

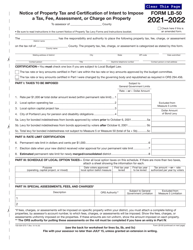

Form 150-504-073-7 (LB-50)

for the current year.

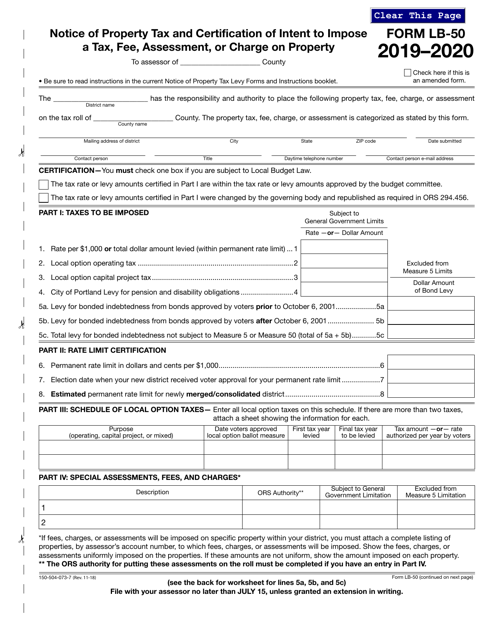

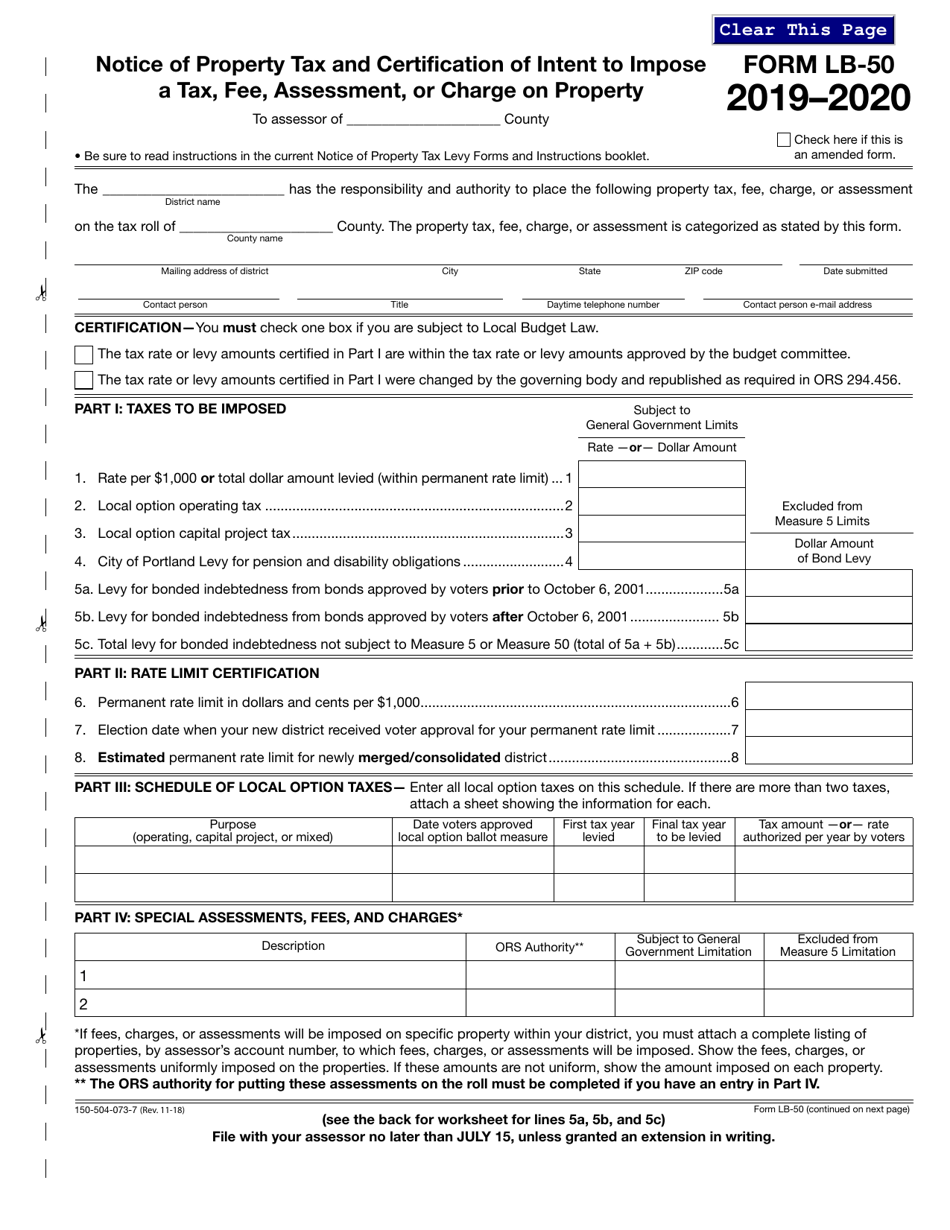

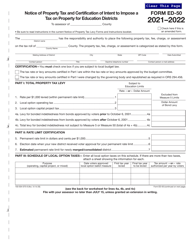

Form 150-504-073-7 (LB-50) Notice of Property Tax and Certification of Intent to Impose a Tax, Fee, Assessment, or Charge on Property - Oregon

What Is Form 150-504-073-7 (LB-50)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-504-073-7?

A: Form 150-504-073-7 (LB-50) is the Notice of Property Tax and Certification of Intent to Impose a Tax, Fee, Assessment, or Charge on Property in Oregon.

Q: What is the purpose of Form 150-504-073-7?

A: The purpose of Form 150-504-073-7 is to notify property owners in Oregon about any intended tax, fee, assessment, or charge on their property.

Q: Who needs to fill out Form 150-504-073-7?

A: The form needs to be filled out by the relevant governmental authority or agency that intends to impose a tax, fee, assessment, or charge on property in Oregon.

Q: Is Form 150-504-073-7 specific to Oregon?

A: Yes, Form 150-504-073-7 is specific to property tax matters in Oregon.

Q: What information is required on Form 150-504-073-7?

A: The form requires information about the property, the intended tax, fee, assessment, or charge, and the contact information of the governmental authority or agency imposing it.

Q: Are there any deadlines for submitting Form 150-504-073-7?

A: Yes, the form must be submitted to the Oregon Department of Revenue within 20 days after the tax, fee, assessment, or charge is imposed.

Q: Is there a fee for filing Form 150-504-073-7?

A: No, there is no fee for filing Form 150-504-073-7.

Q: What happens after Form 150-504-073-7 is filed?

A: After the form is filed, property owners in Oregon will be notified about the intended tax, fee, assessment, or charge on their property.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-504-073-7 (LB-50) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.