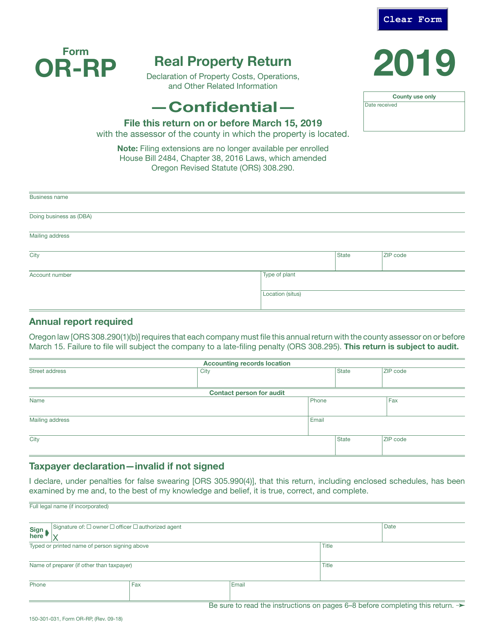

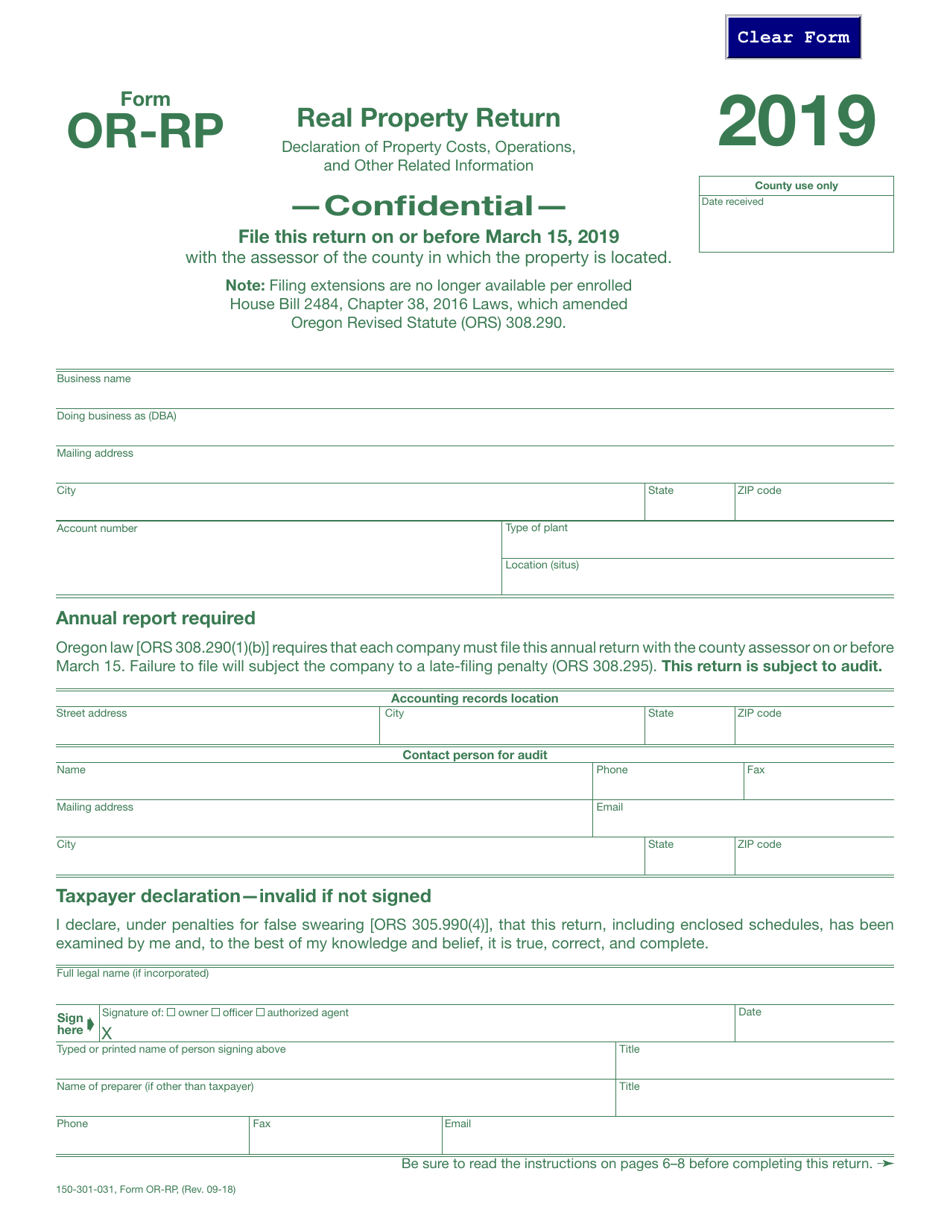

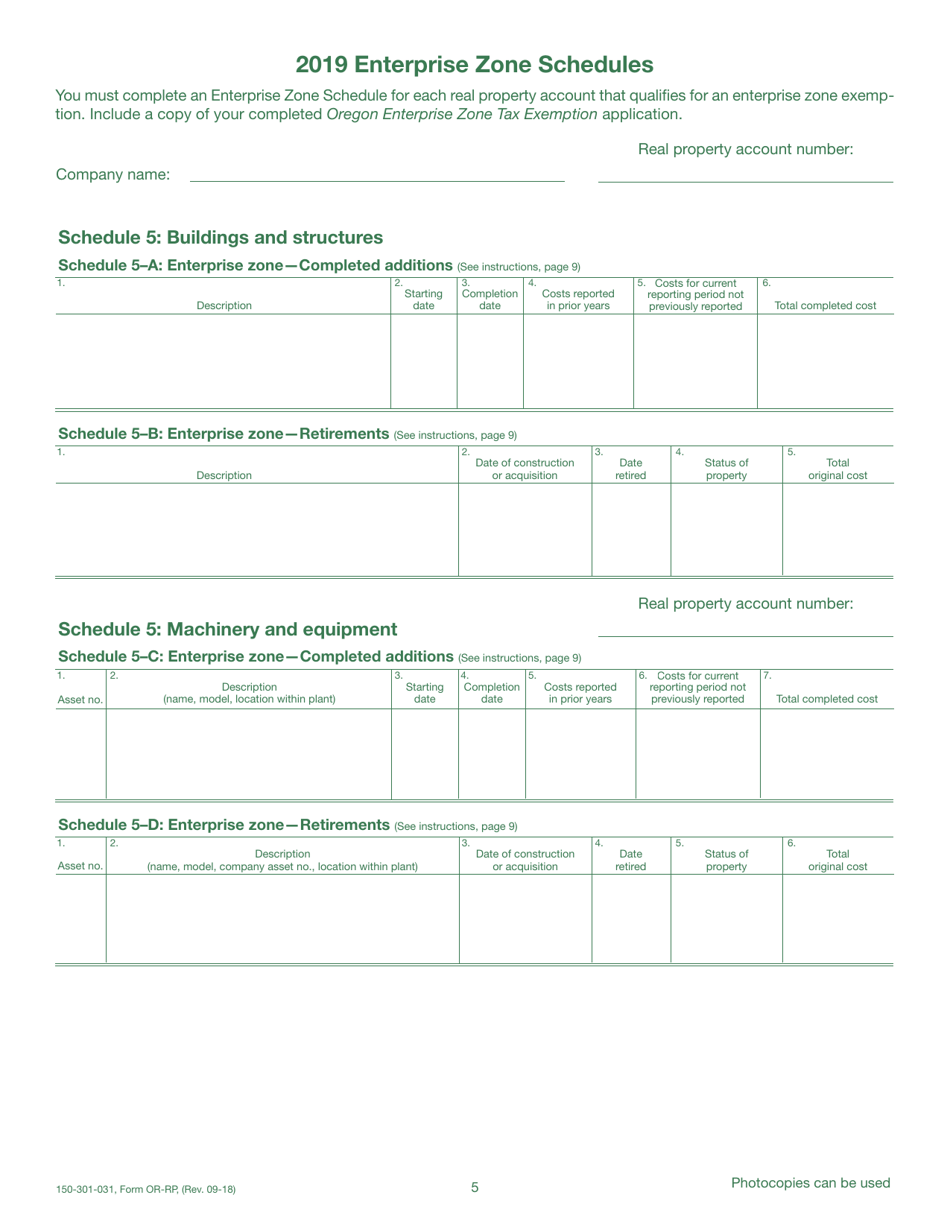

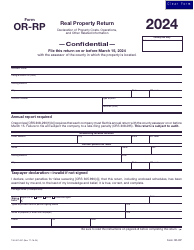

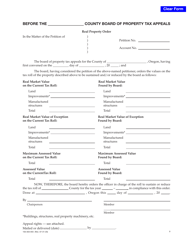

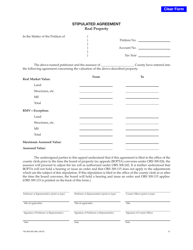

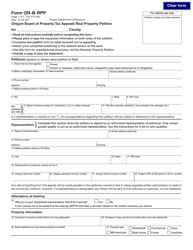

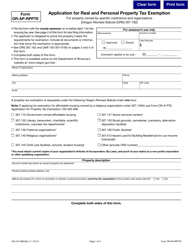

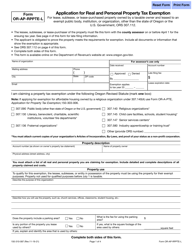

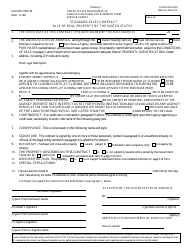

Form 150-301-031 (OR-RP) Real Property Return - Oregon

What Is Form 150-301-031 (OR-RP)?

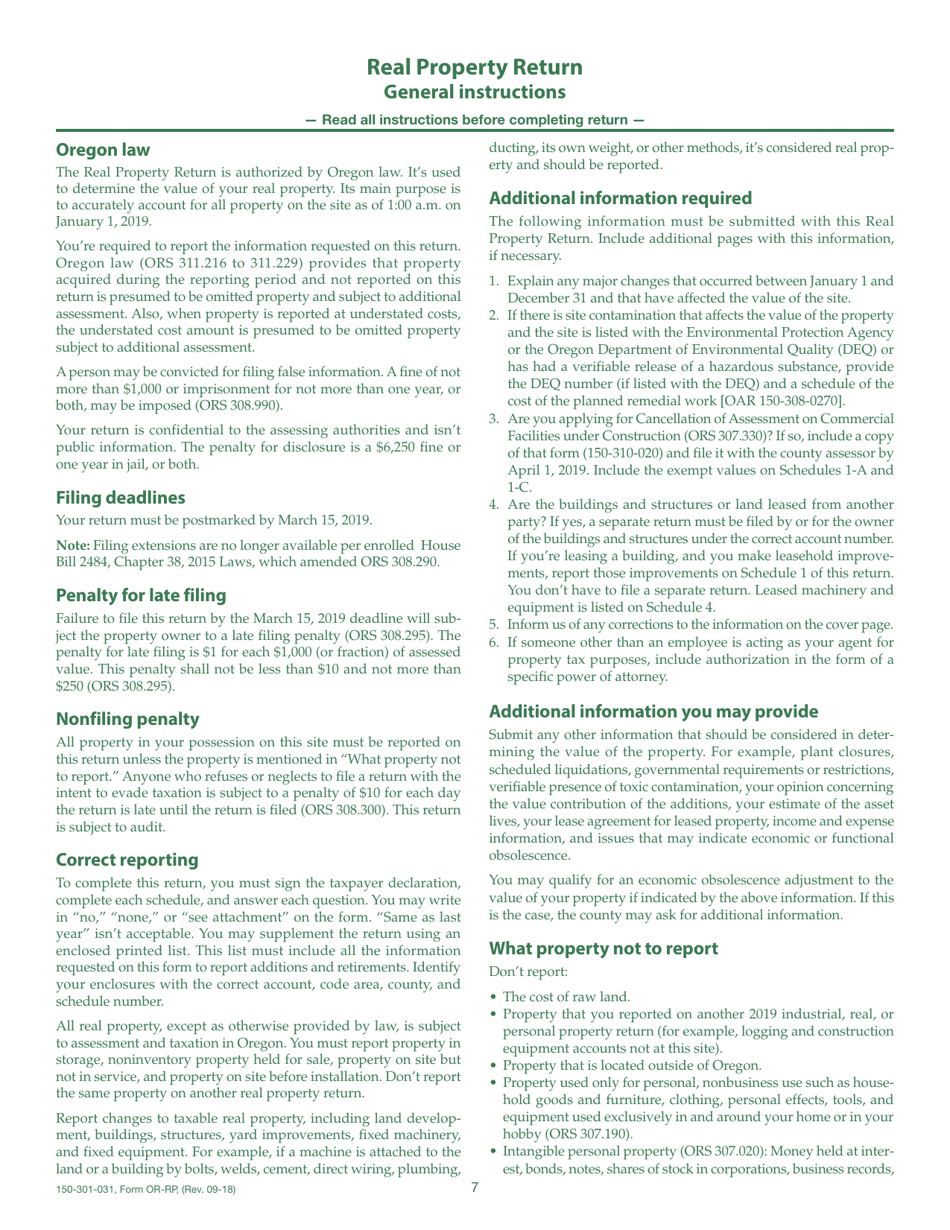

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-301-031?

A: Form 150-301-031 is the Real Property Return form for Oregon.

Q: What is the purpose of Form 150-301-031?

A: The purpose of Form 150-301-031 is to report real property owned in Oregon.

Q: Who needs to file Form 150-301-031?

A: Any individual or business that owns real property in Oregon needs to file Form 150-301-031.

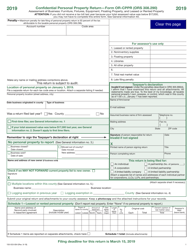

Q: When is Form 150-301-031 due?

A: Form 150-301-031 is due on or before March 15th of each year.

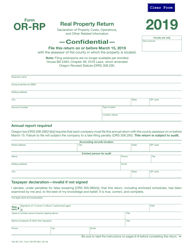

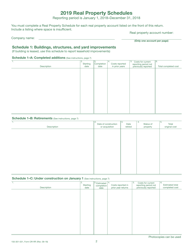

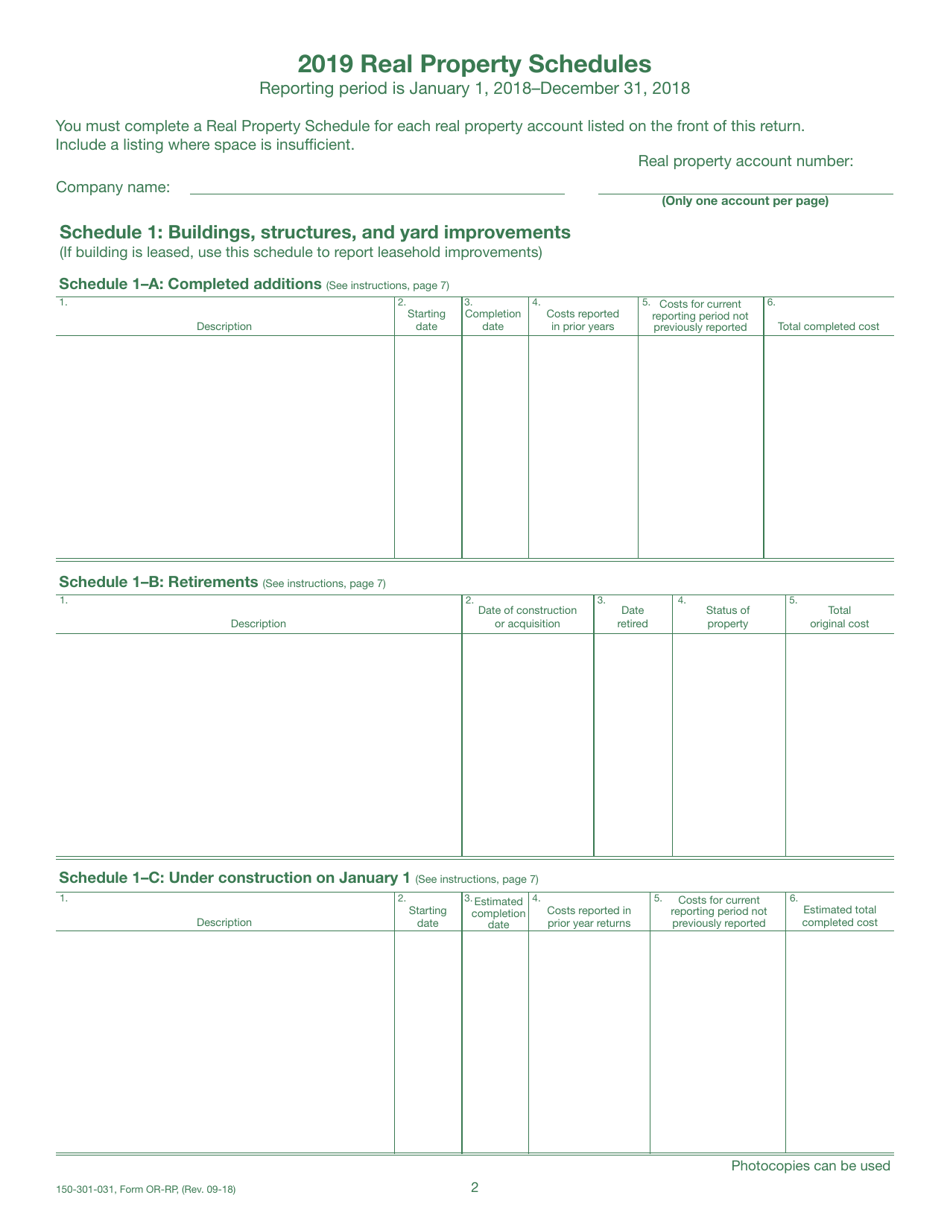

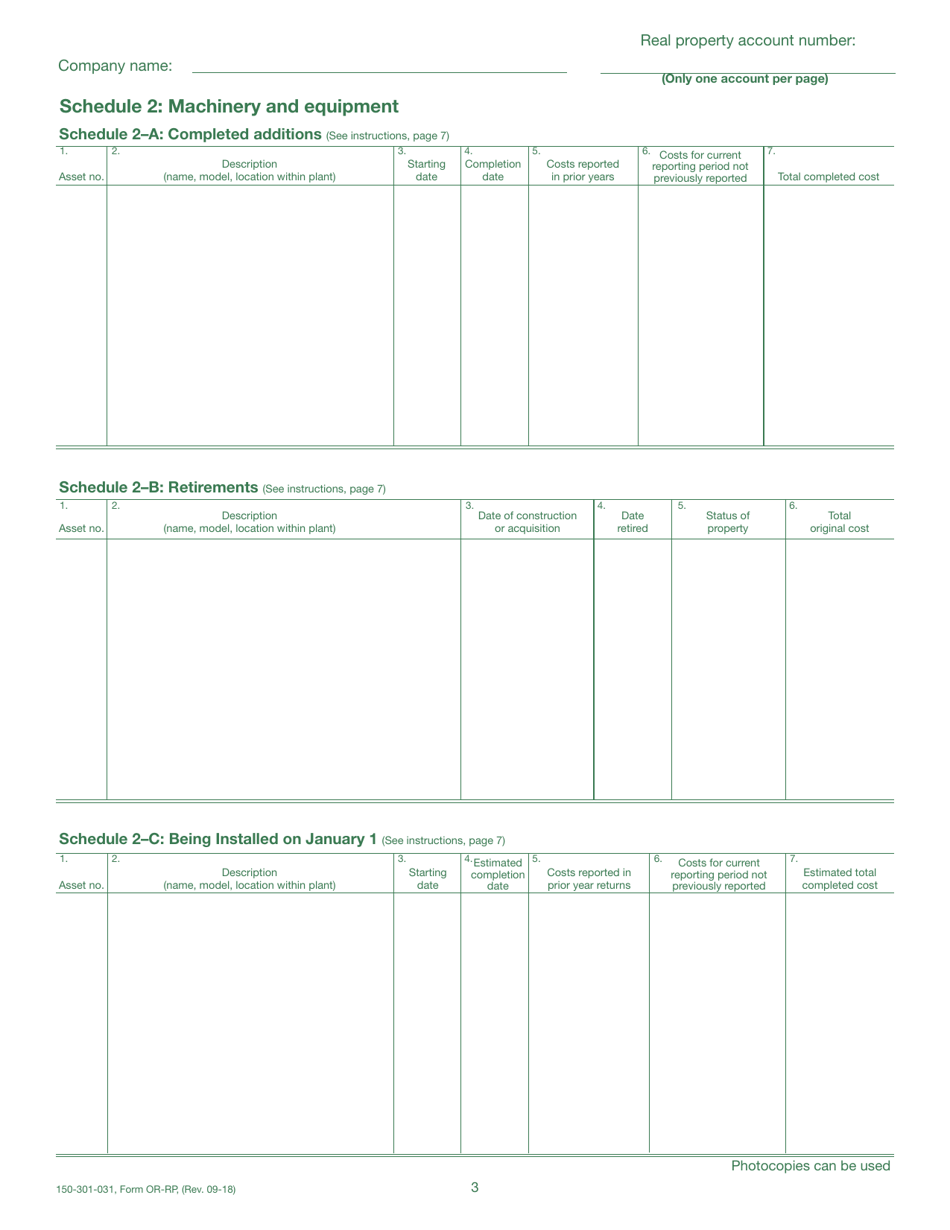

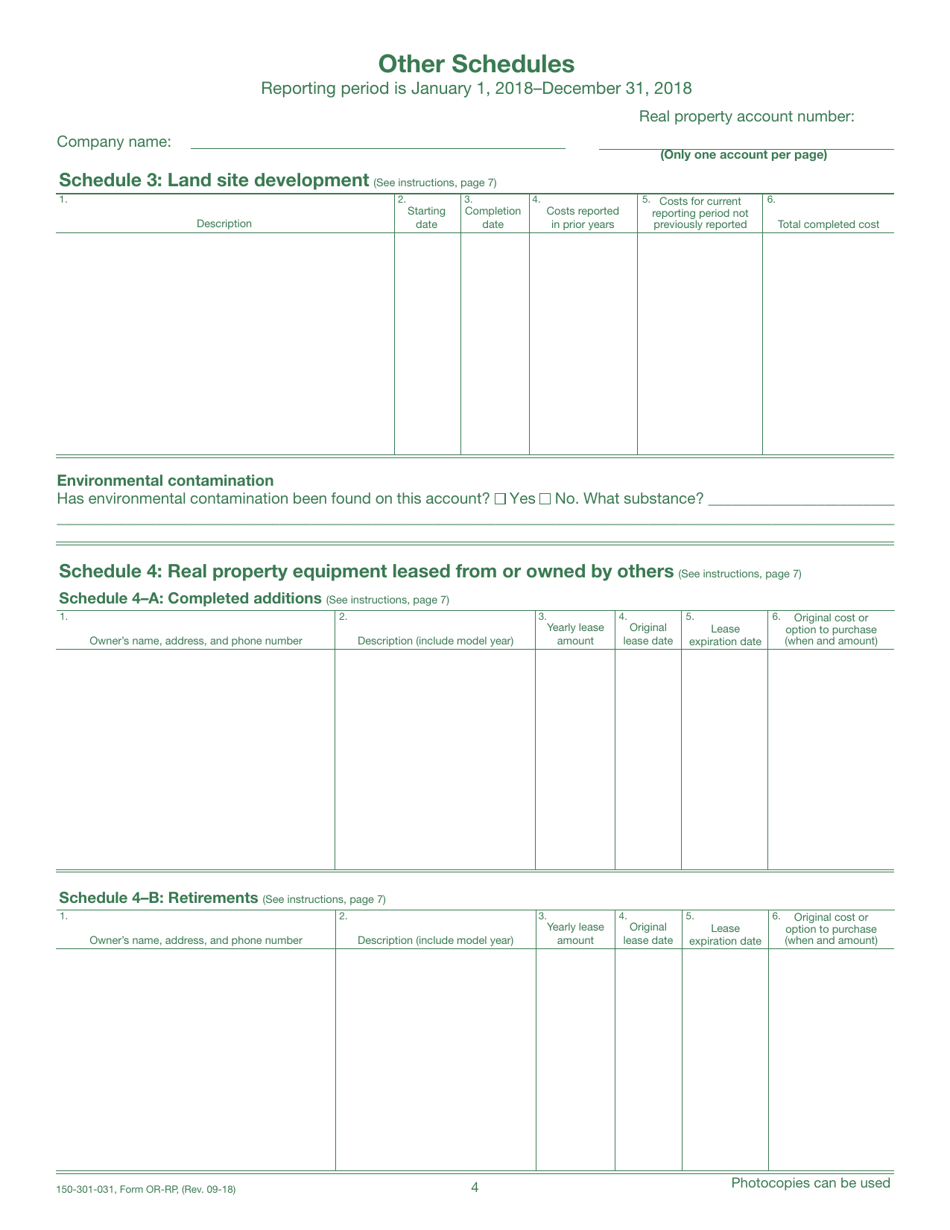

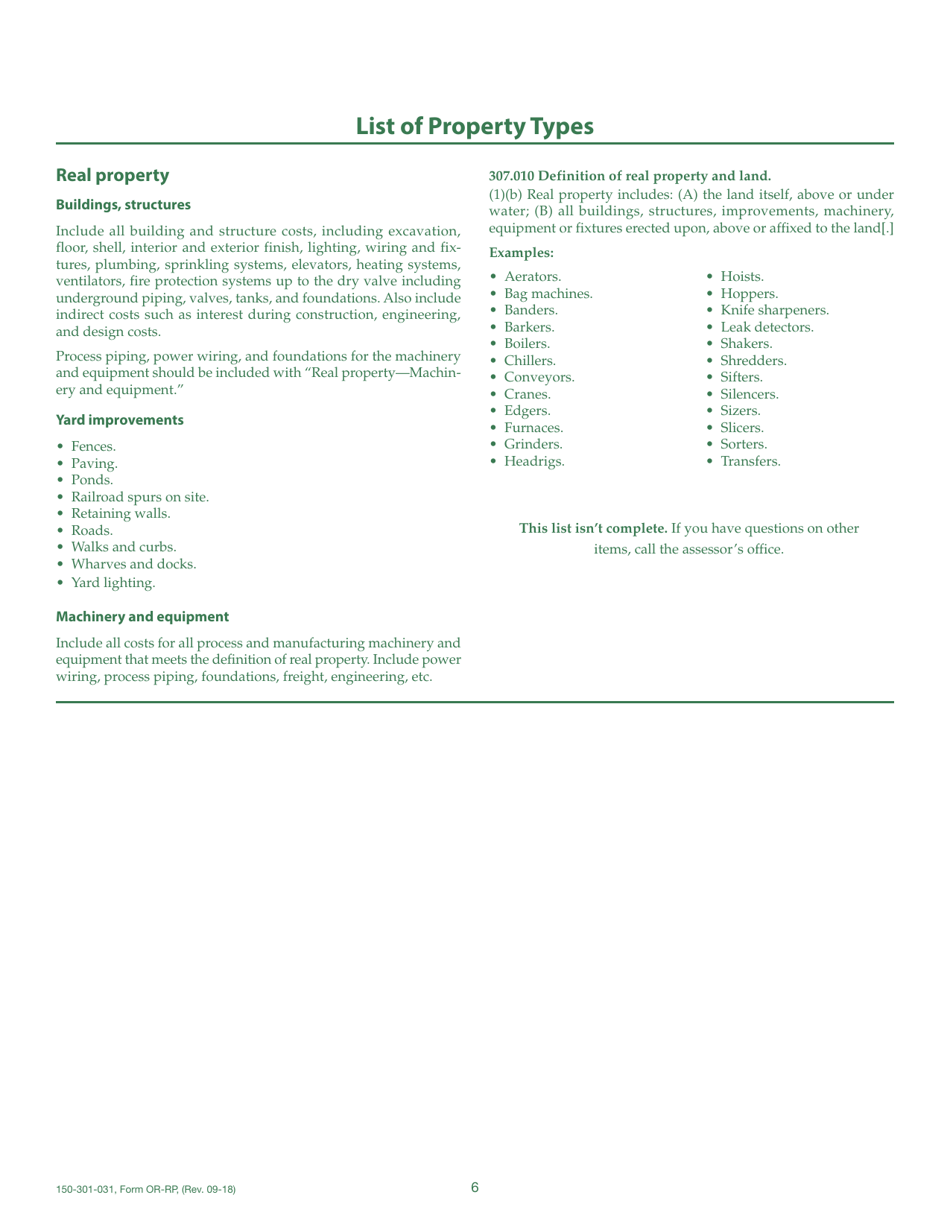

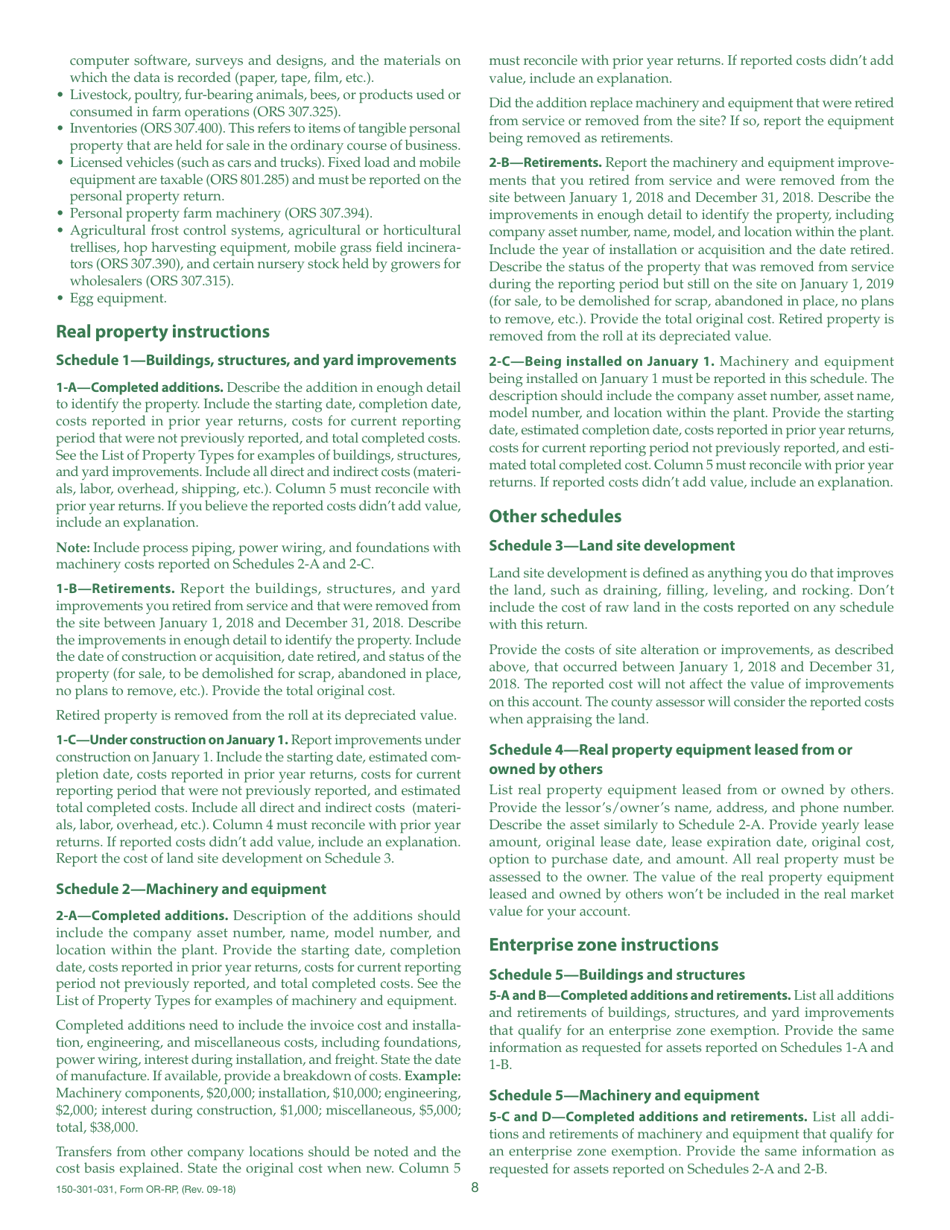

Q: What information do I need to provide on Form 150-301-031?

A: You need to provide information about the property, its location, value, and ownership details.

Q: Are there any penalties for not filing Form 150-301-031?

A: Yes, there are penalties for not filing or filing the form late. It's important to submit the form on time to avoid penalties.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-301-031 (OR-RP) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.