This version of the form is not currently in use and is provided for reference only. Download this version of

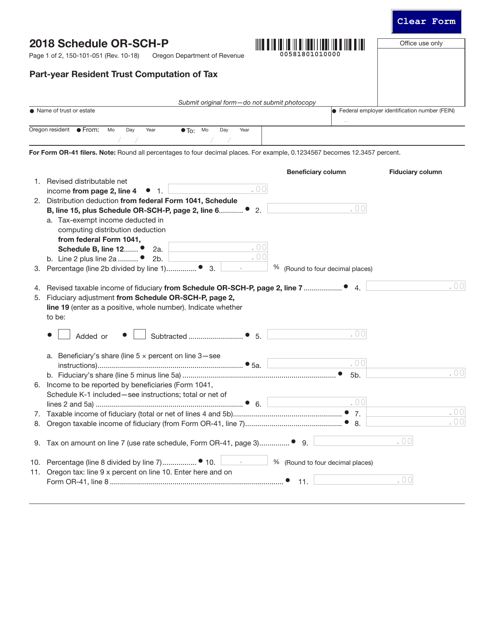

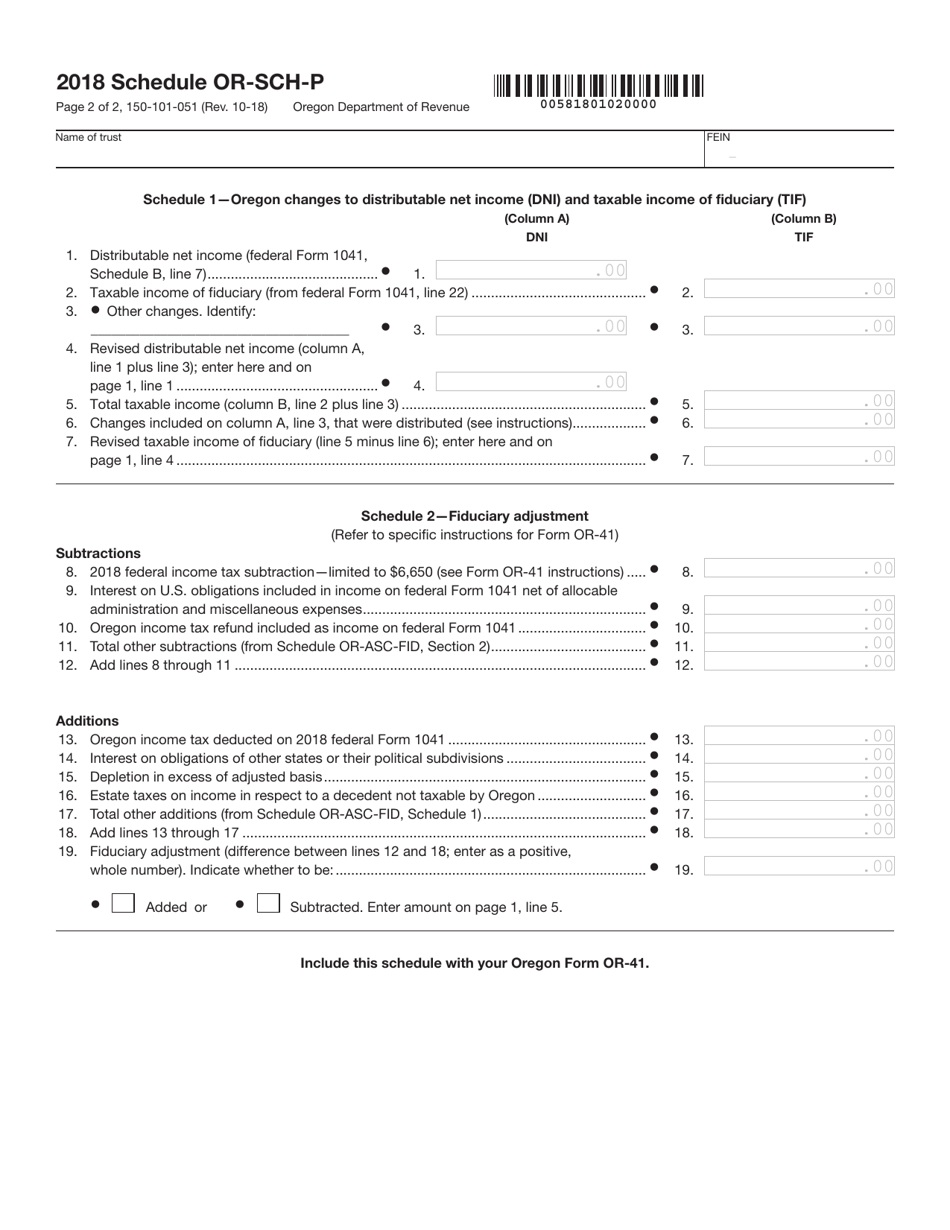

Form 150-101-051 Schedule OR-SCH-P

for the current year.

Form 150-101-051 Schedule OR-SCH-P Part-Year Resident Trust Computation of Tax - Oregon

What Is Form 150-101-051 Schedule OR-SCH-P?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-051?

A: Form 150-101-051 is a tax form used by part-year resident trusts in Oregon to compute their tax liabilities.

Q: Who should use Form 150-101-051?

A: Part-year resident trusts in Oregon should use Form 150-101-051.

Q: What is the purpose of Form 150-101-051?

A: The purpose of Form 150-101-051 is to calculate the tax liabilities of part-year resident trusts in Oregon.

Q: What is OR-SCH-P?

A: OR-SCH-P is a part of Form 150-101-051 that specifically deals with the computation of tax for part-year resident trusts.

Q: Who is considered a part-year resident trust?

A: A part-year resident trust is a trust that was a resident of Oregon for only part of the tax year.

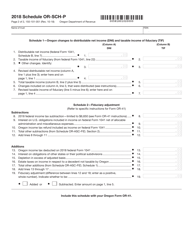

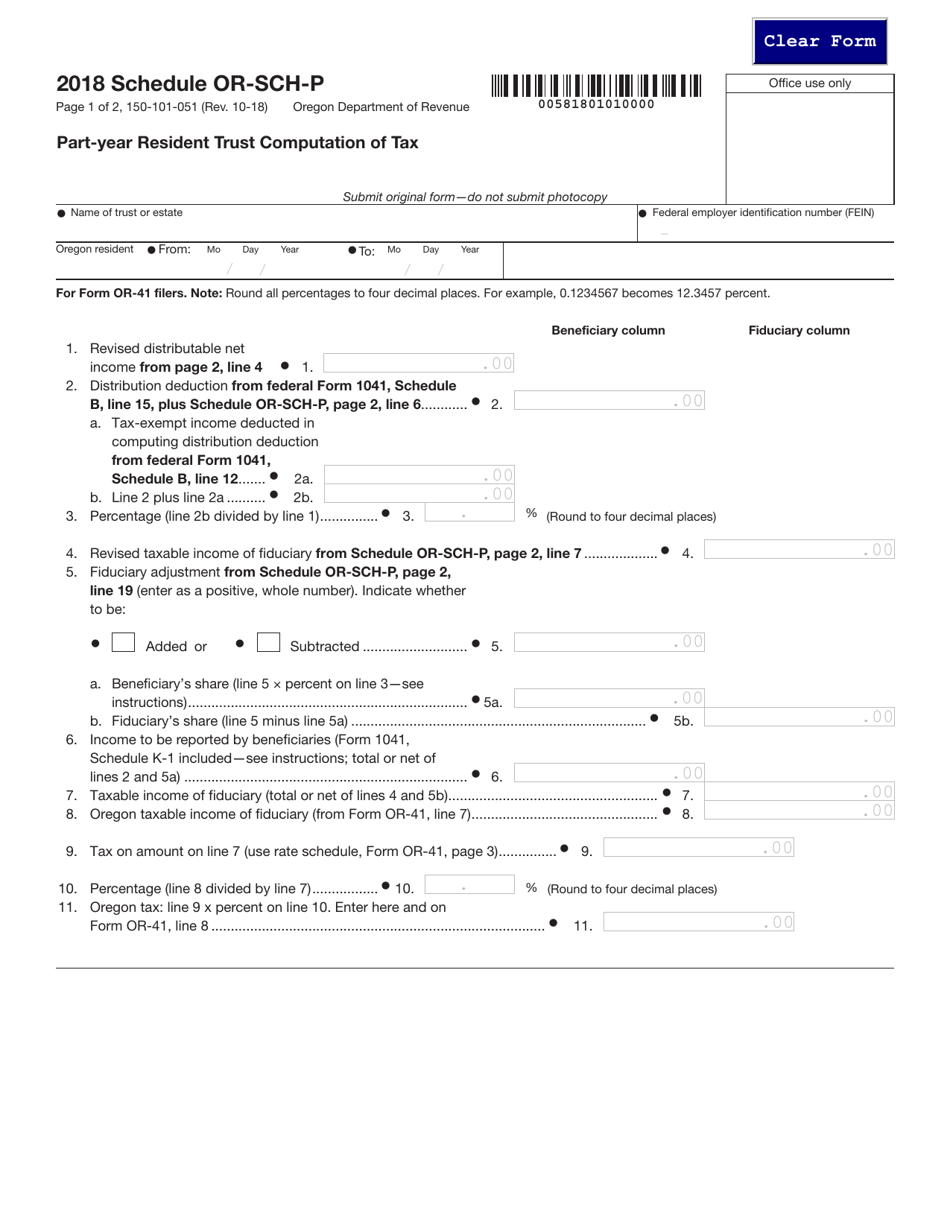

Q: What information is required on OR-SCH-P?

A: OR-SCH-P requires information such as the trust's income, deductions, and credits for the tax year.

Q: When is Form 150-101-051 due?

A: Form 150-101-051 is generally due by the same date as the trust's annual tax return, which is typically April 15th.

Q: Are there any penalties for late filing of Form 150-101-051?

A: Yes, there may be penalties for late filing of Form 150-101-051. It is important to file the form on time to avoid these penalties.

Q: Can I file Form 150-101-051 electronically?

A: Yes, Form 150-101-051 can be filed electronically if you are using an approved e-file system.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-051 Schedule OR-SCH-P by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.