This version of the form is not currently in use and is provided for reference only. Download this version of

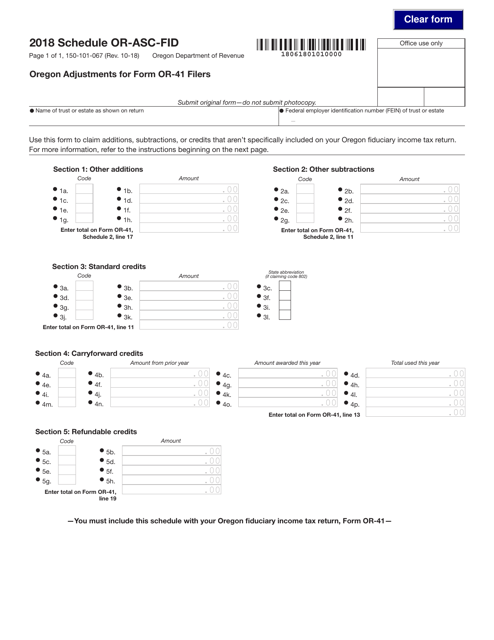

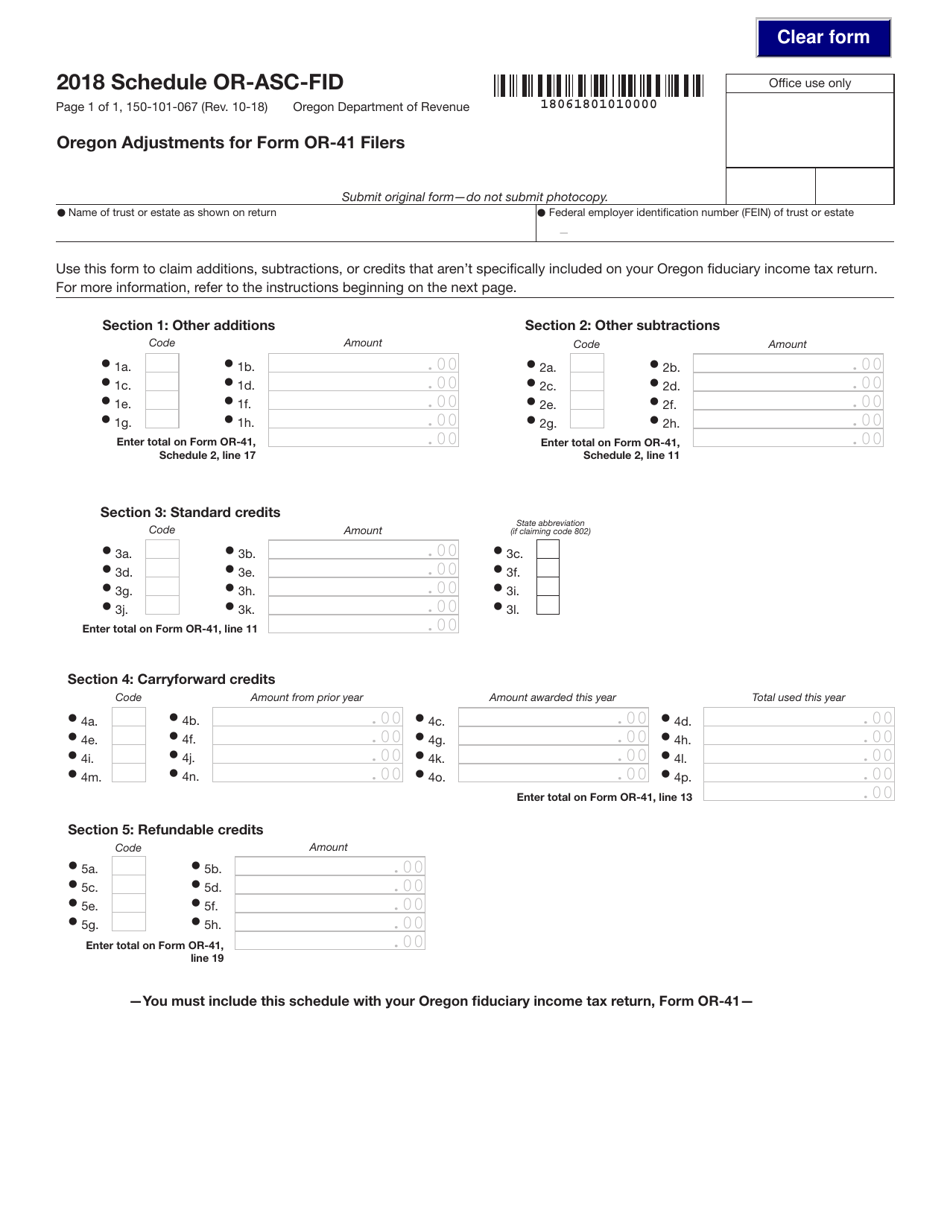

Form 150-101-067 Schedule OR-ASC-FID

for the current year.

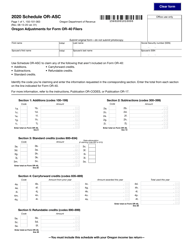

Form 150-101-067 Schedule OR-ASC-FID Oregon Adjustments for Form or-41 Filers - Oregon

What Is Form 150-101-067 Schedule OR-ASC-FID?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-067 Schedule OR-ASC-FID?

A: Form 150-101-067 Schedule OR-ASC-FID is a document used in Oregon to report adjustments for Form OR-41 filers.

Q: Who needs to use Schedule OR-ASC-FID?

A: Schedule OR-ASC-FID needs to be used by individuals who are filing Form OR-41 in Oregon and have adjustments to report.

Q: What is the purpose of Schedule OR-ASC-FID?

A: The purpose of Schedule OR-ASC-FID is to report Oregon adjustments for Form OR-41 filers.

Q: What information do I need to complete Schedule OR-ASC-FID?

A: To complete Schedule OR-ASC-FID, you will need information about your Oregon income and deductions that require adjustment.

Q: Are there any deadlines for filing Schedule OR-ASC-FID?

A: Yes, Schedule OR-ASC-FID should be filed along with Form OR-41 by the due date for filing your Oregon tax return.

Q: Can I e-file Schedule OR-ASC-FID?

A: Yes, you can e-file Schedule OR-ASC-FID along with your Form OR-41.

Q: What should I do if I made a mistake on my Schedule OR-ASC-FID?

A: If you made a mistake on your Schedule OR-ASC-FID, you should correct the error and submit an amended Schedule OR-ASC-FID to the Oregon Department of Revenue.

Q: Do I need to keep a copy of Schedule OR-ASC-FID for my records?

A: Yes, it is recommended to keep a copy of Schedule OR-ASC-FID for your records in case of future audits or inquiries from the Oregon Department of Revenue.

Q: Is there any fee associated with filing Schedule OR-ASC-FID?

A: No, there is no fee associated with filing Schedule OR-ASC-FID.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-067 Schedule OR-ASC-FID by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.