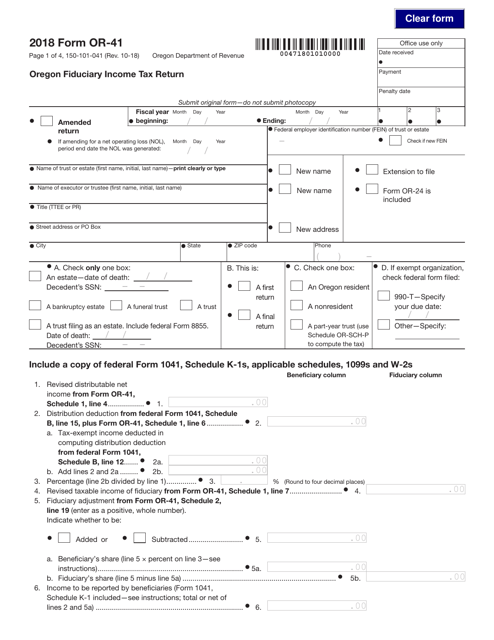

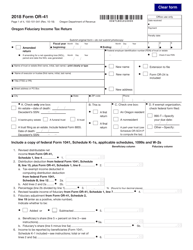

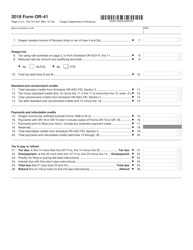

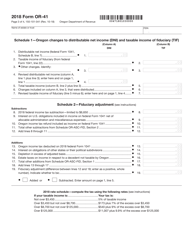

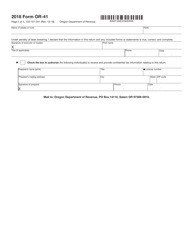

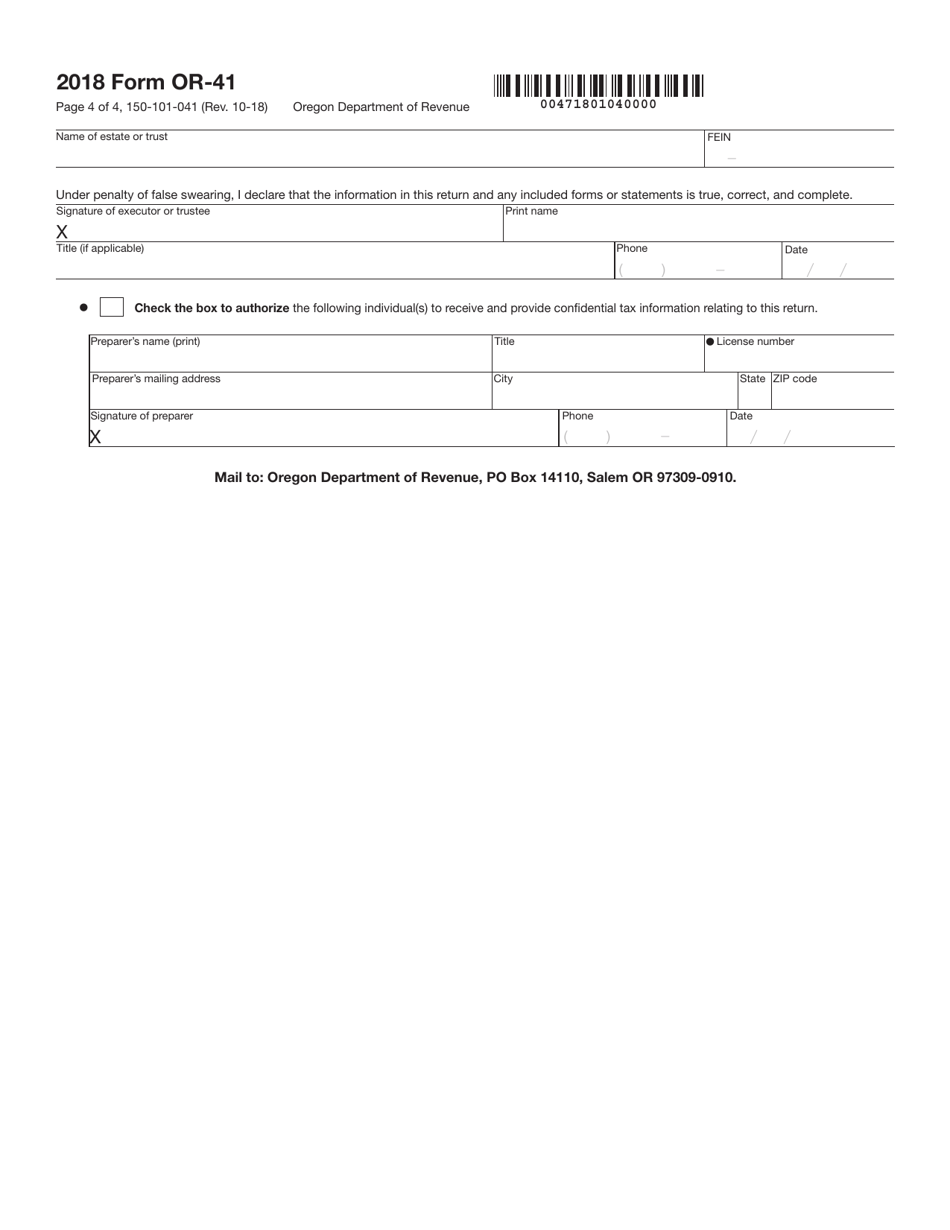

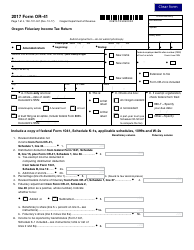

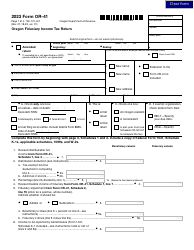

Form 150-101-041 (OR-41) Oregon Fiduciary Income Tax Return - Oregon

What Is Form 150-101-041 (OR-41)?

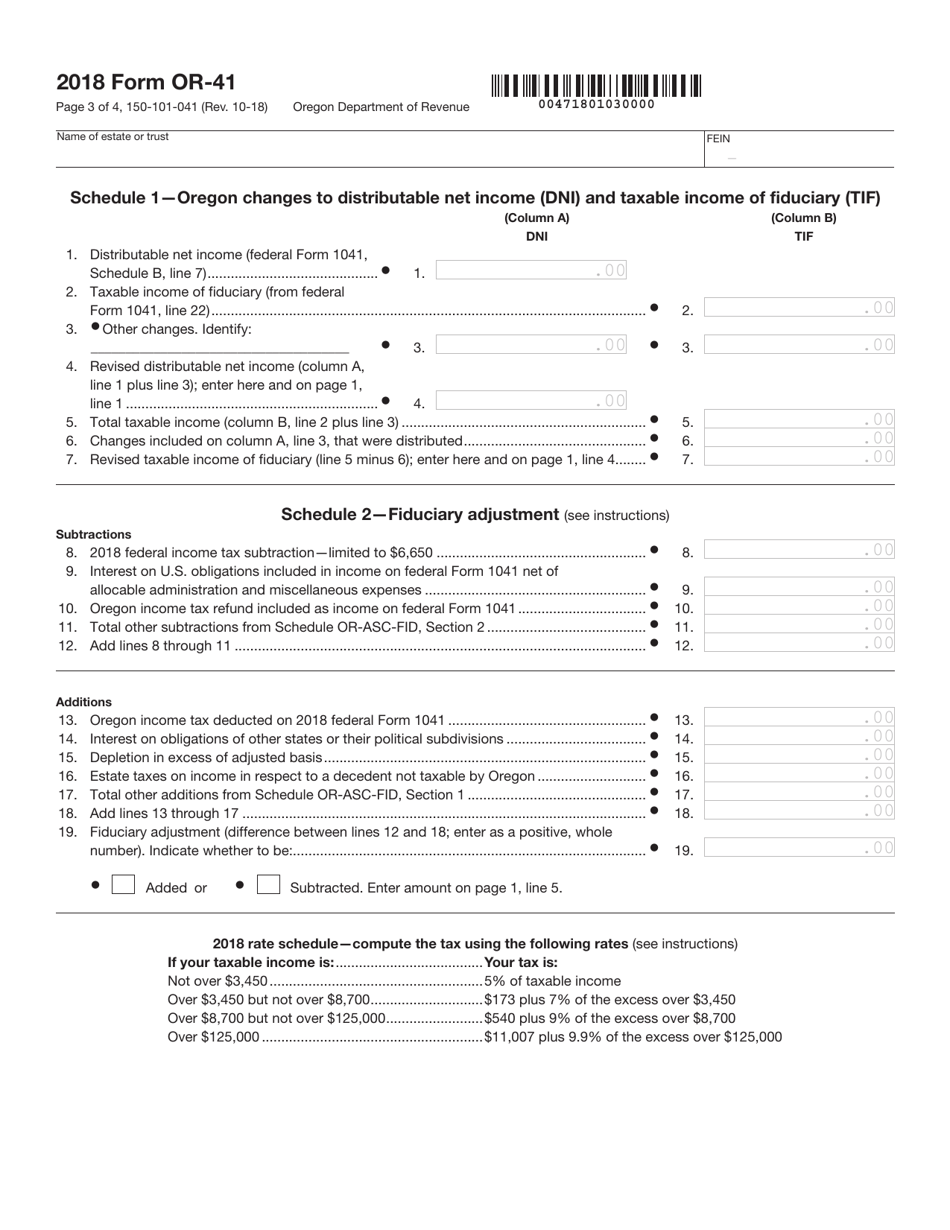

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-041?

A: Form 150-101-041 is the Oregon Fiduciary Income Tax Return.

Q: Who should file Form 150-101-041?

A: Fiduciaries or trustees who are responsible for filing the Oregon state income tax return for estates and trusts should file this form.

Q: What is the purpose of Form 150-101-041?

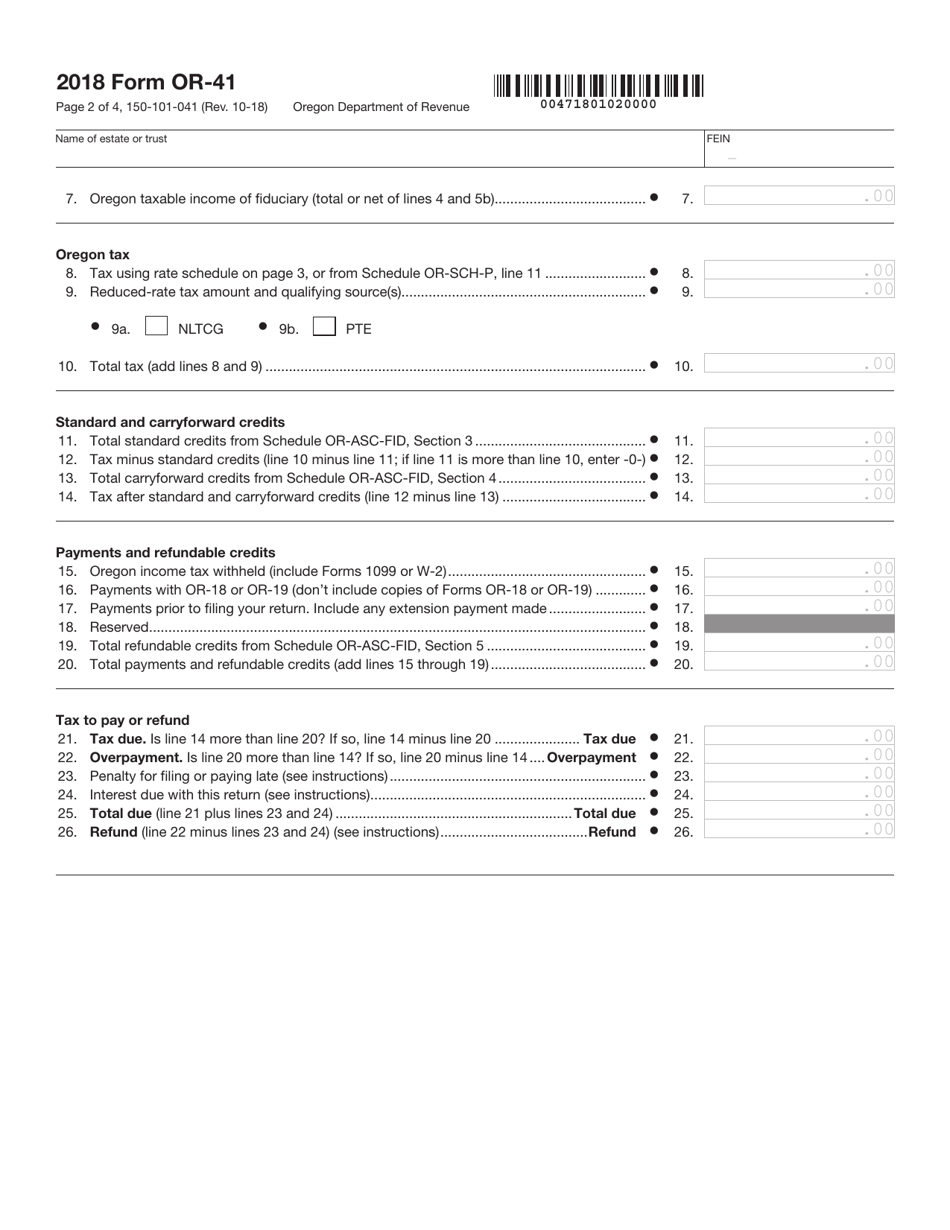

A: The purpose of Form 150-101-041 is to report the income, deductions, and credits of an estate or trust in Oregon.

Q: When is the due date for filing Form 150-101-041?

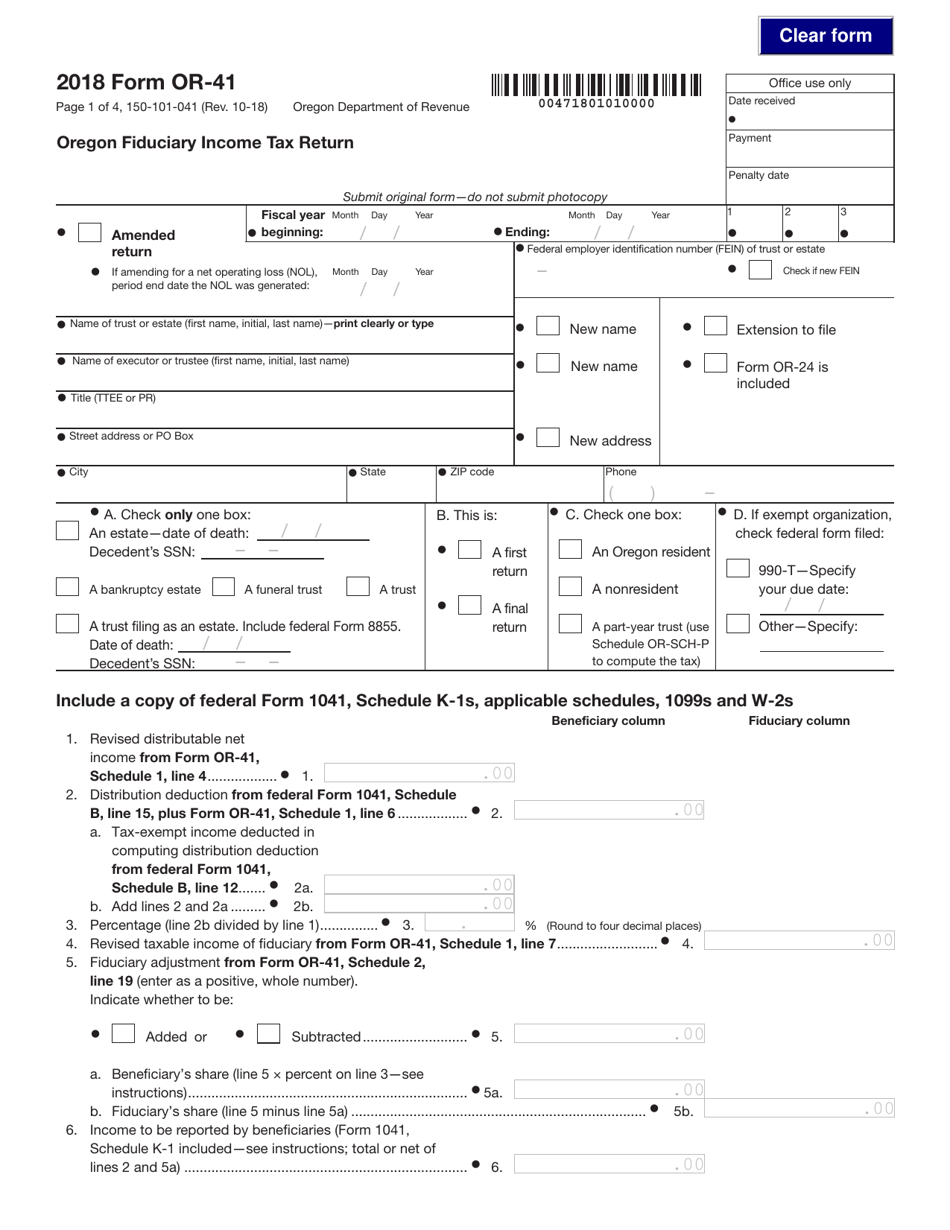

A: The due date for filing Form 150-101-041 is generally on or before April 15th, following the close of the calendar year.

Q: Are there any extensions available for filing Form 150-101-041?

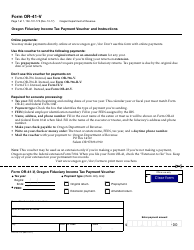

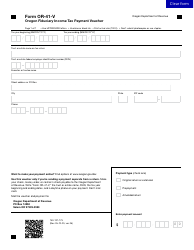

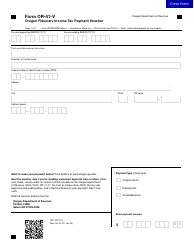

A: Yes, you can request an extension by filing Form OR-41-V (Oregon Extension Payment Voucher) and make the payment by the original due date.

Q: Are there any special requirements or considerations for filing Form 150-101-041?

A: Yes, there may be additional requirements or considerations depending on the specific circumstances of the estate or trust. It is advisable to consult the instructions provided with the form or seek professional tax advice.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-041 (OR-41) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.