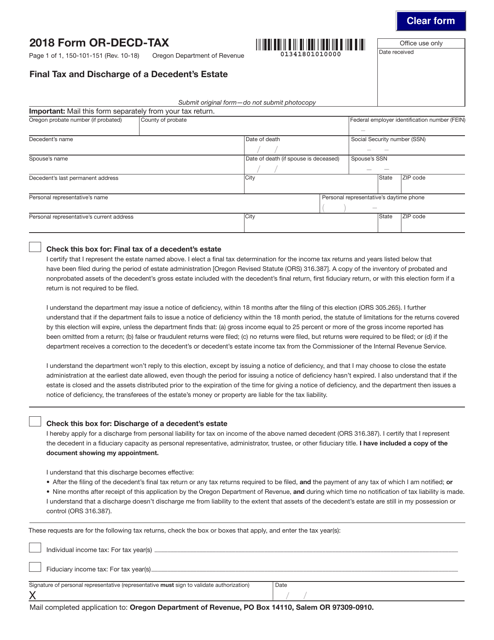

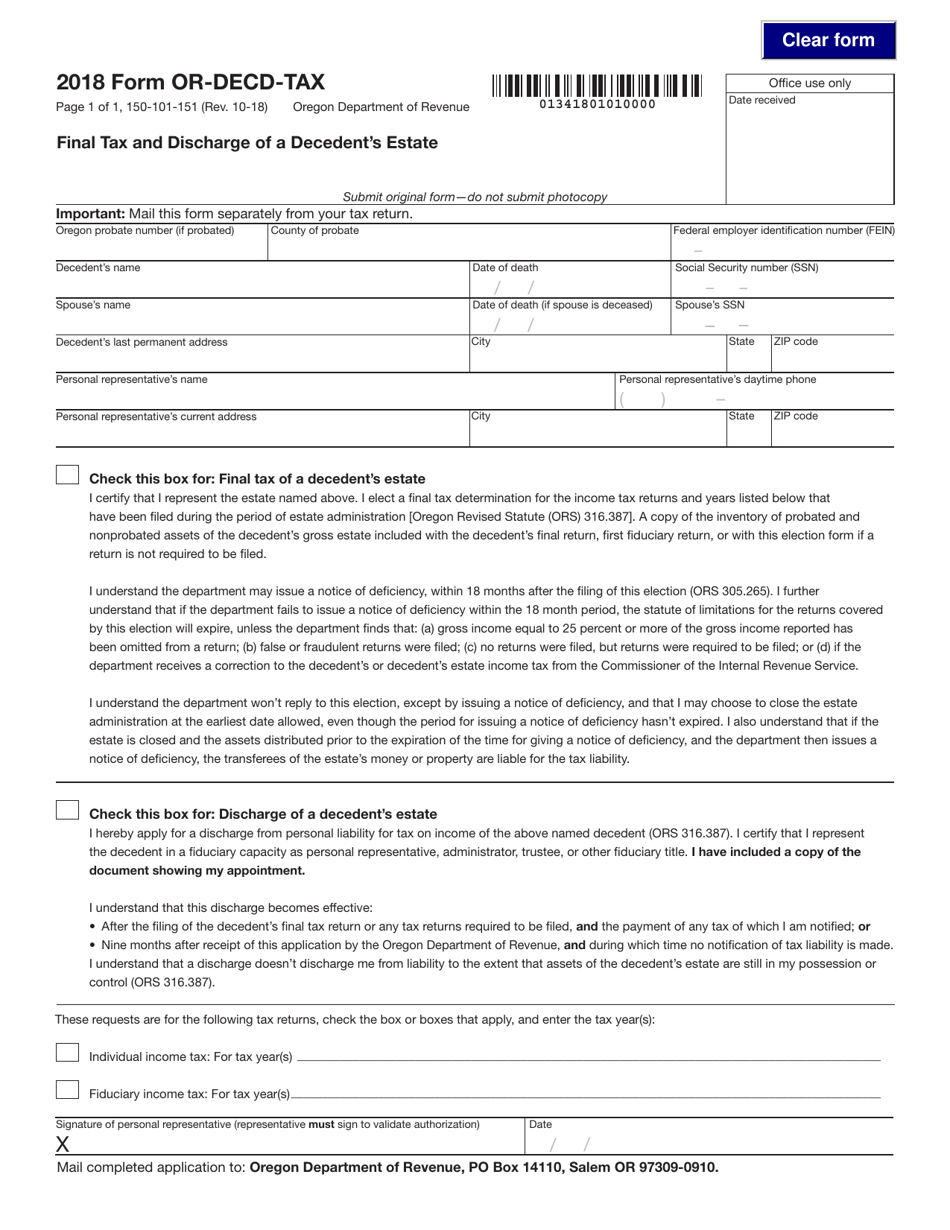

Form 150-101-151 (OR-DECD-TAX) Final Tax and Discharge of a Decedent's Estate - Oregon

What Is Form 150-101-151 (OR-DECD-TAX)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-151?

A: Form 150-101-151 is a tax form used in Oregon for the final tax and discharge of a decedent's estate.

Q: Who uses Form 150-101-151?

A: Form 150-101-151 is used by individuals in Oregon who are handling the final tax and discharge of a decedent's estate.

Q: What is the purpose of Form 150-101-151?

A: The purpose of Form 150-101-151 is to calculate and report the final tax liability of a decedent's estate in Oregon.

Q: Are there any specific requirements for using Form 150-101-151?

A: Yes, there are specific requirements for using Form 150-101-151. It is important to carefully review the instructions provided with the form to ensure compliance.

Q: Is there a deadline for filing Form 150-101-151?

A: Yes, there is a deadline for filing Form 150-101-151. It is recommended to check with the Oregon Department of Revenue for the specific deadline.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-151 (OR-DECD-TAX) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.