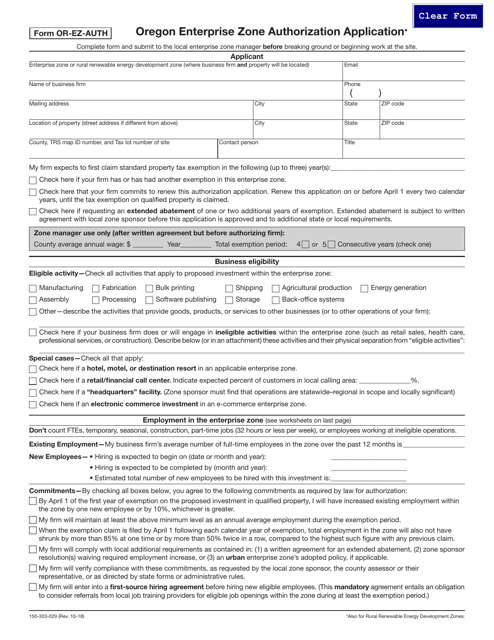

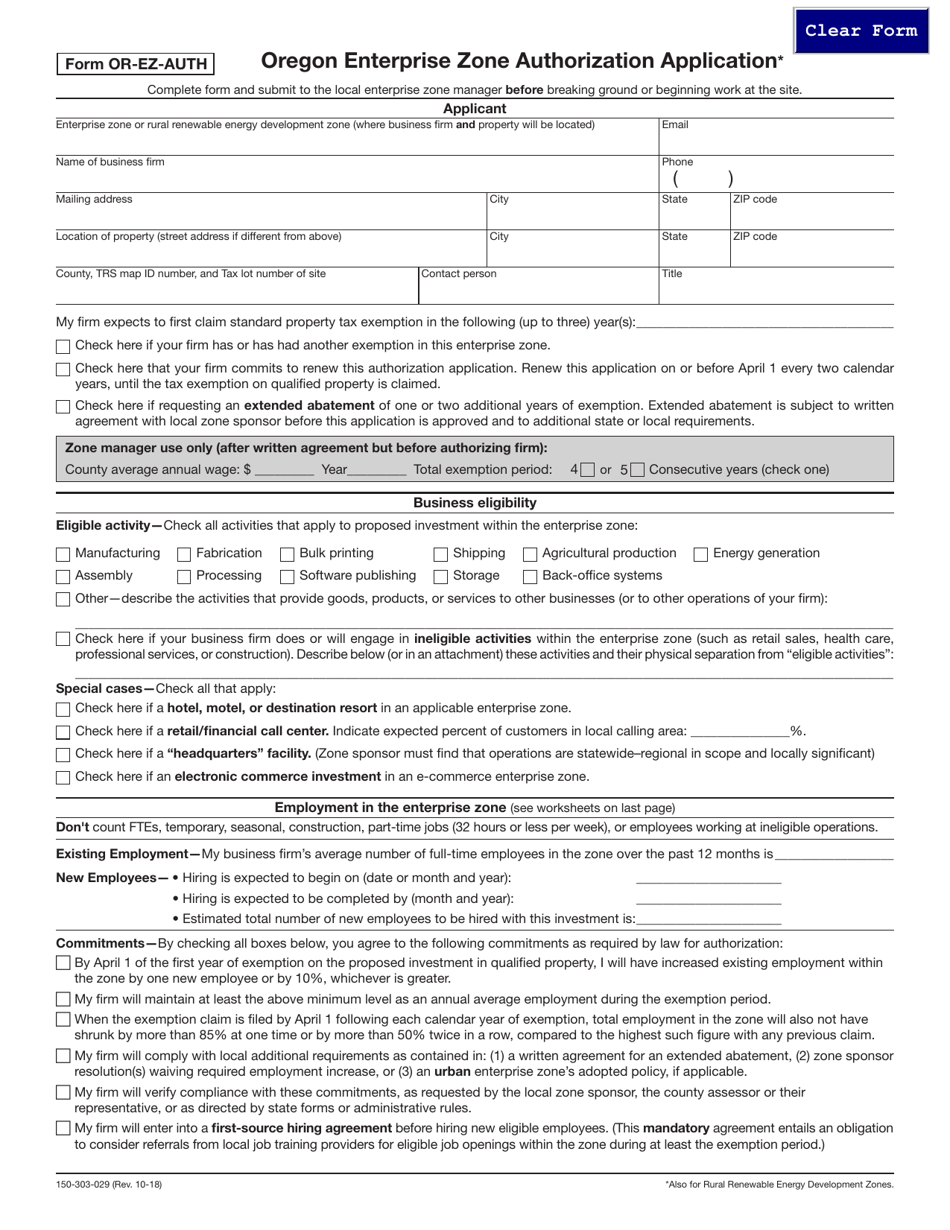

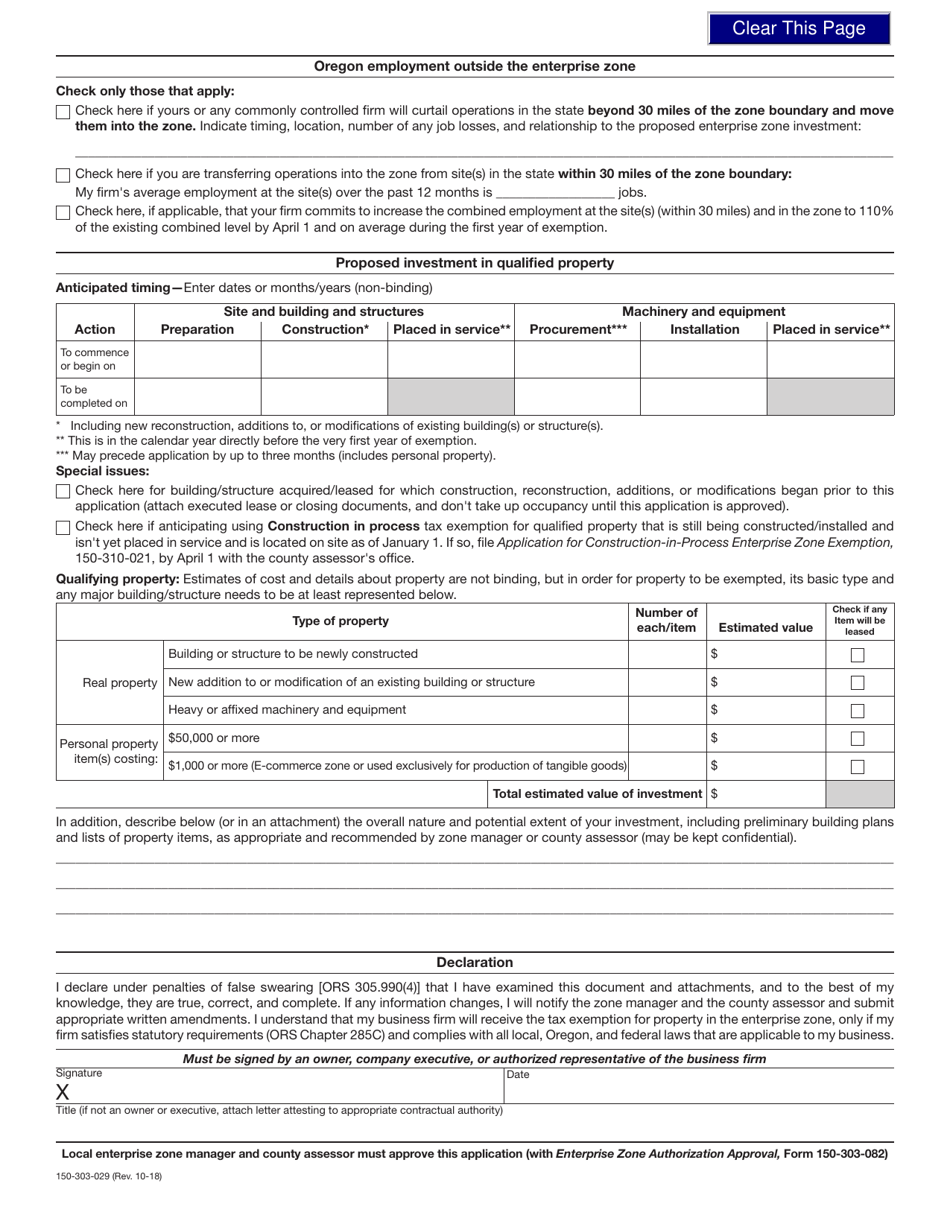

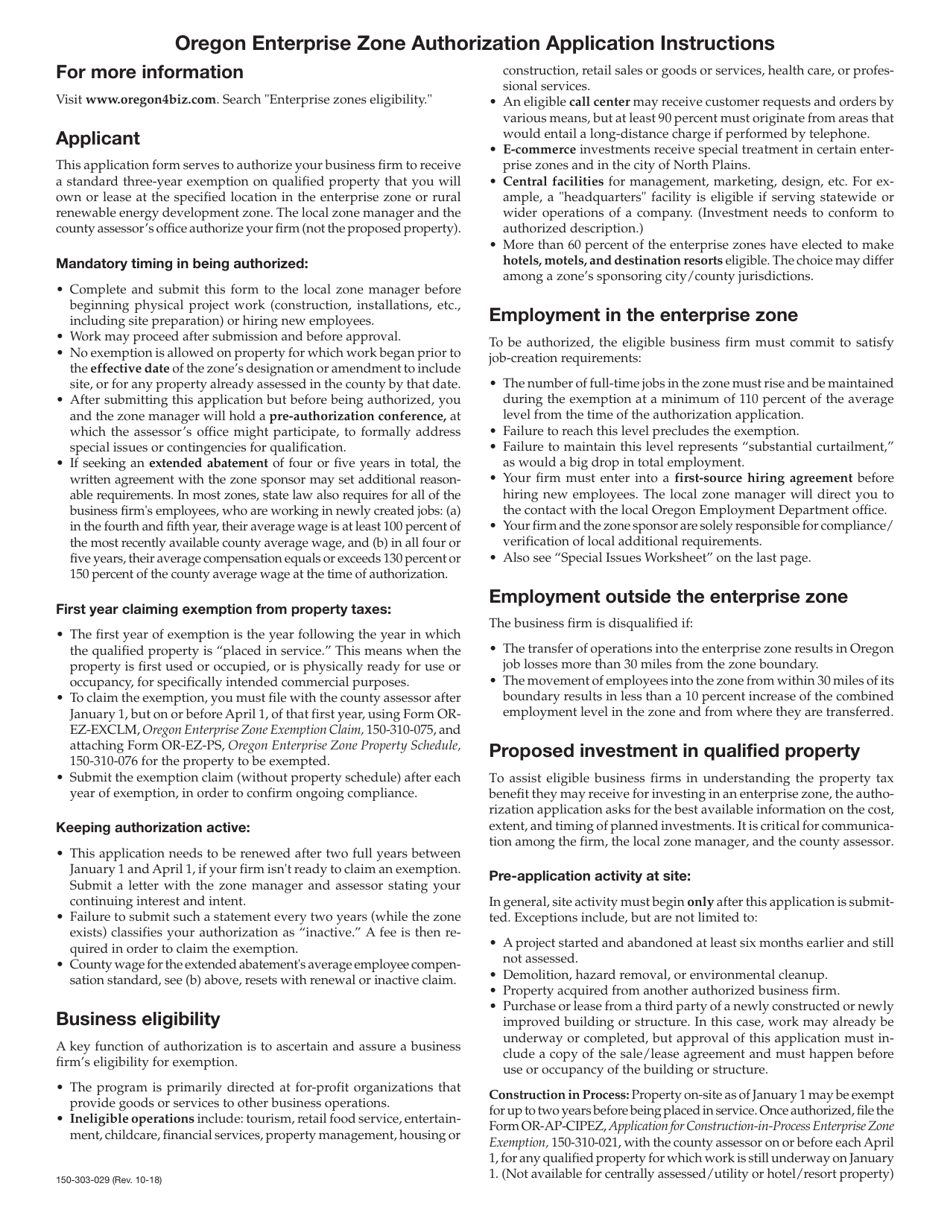

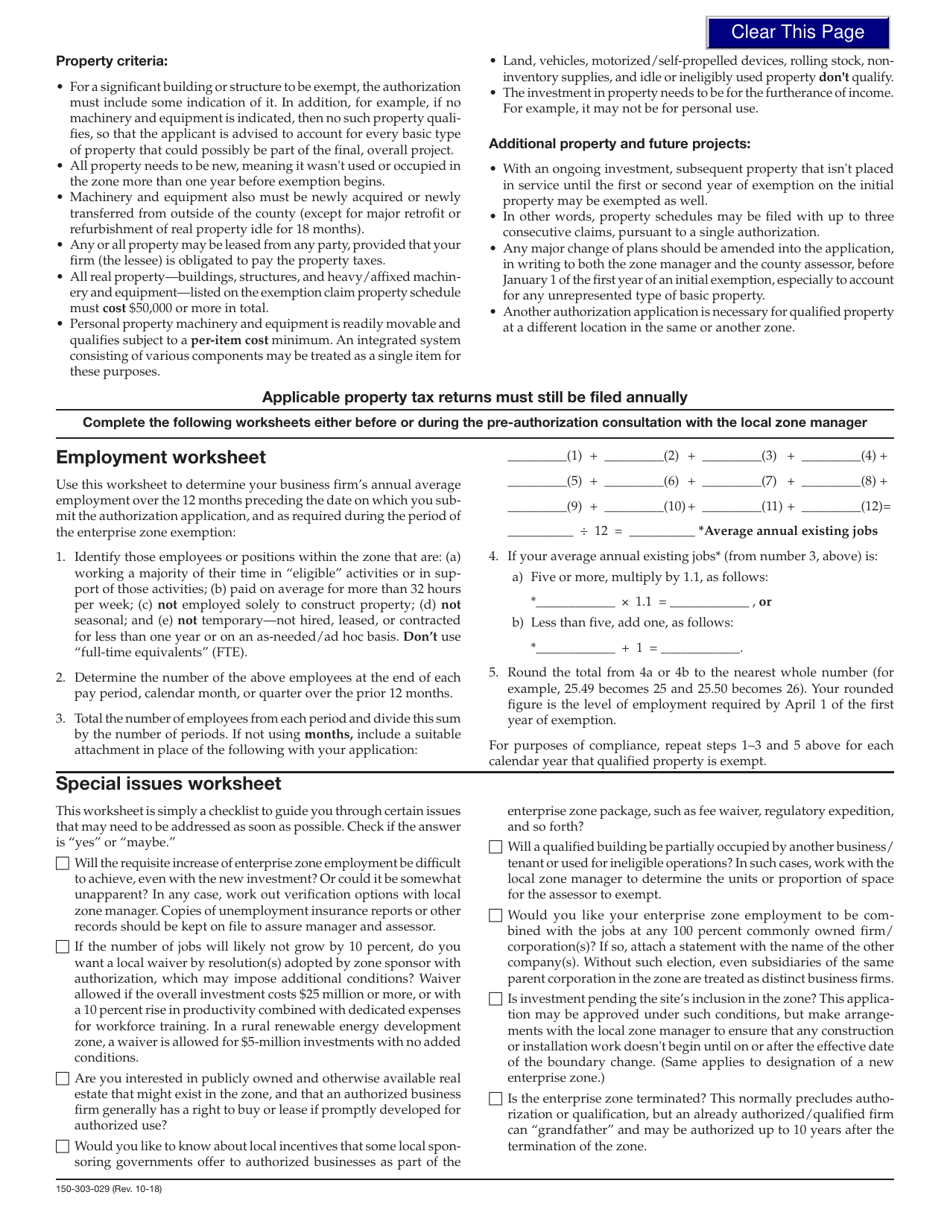

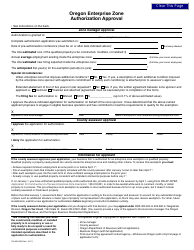

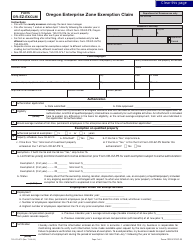

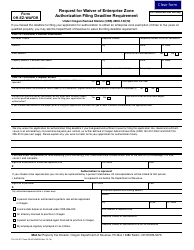

Form 150-303-029 (OR-EZ-AUTH) Oregon Enterprise Zone Authorization Application - Oregon

What Is Form 150-303-029 (OR-EZ-AUTH)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-303-029?

A: Form 150-303-029 is the Oregon Enterprise Zone Authorization Application.

Q: What is the purpose of Form 150-303-029?

A: The purpose of Form 150-303-029 is to apply for authorization in the Oregon Enterprise Zone.

Q: Who needs to fill out this form?

A: Anyone seeking authorization in the Oregon Enterprise Zone needs to fill out this form.

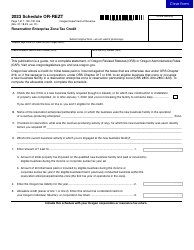

Q: What is the Oregon Enterprise Zone?

A: The Oregon Enterprise Zone is a program that offers tax benefits to eligible businesses that choose to locate, invest, or expand within designated zones in Oregon.

Q: Are there any fees associated with this form?

A: No, there are no fees associated with filing Form 150-303-029.

Q: What other documentation may be required?

A: Along with Form 150-303-029, you may be required to provide additional documentation such as business plans, financial statements, and proof of eligibility.

Q: How long does it take to process this application?

A: The processing time for the Oregon Enterprise Zone Authorization Application may vary, but it generally takes a few weeks to a few months.

Q: Can I apply for multiple enterprise zones with this form?

A: Yes, you can apply for authorization in multiple enterprise zones using Form 150-303-029.

Q: Who can I contact for further assistance?

A: For further assistance with Form 150-303-029 or the Oregon Enterprise Zone program, you can contact the Oregon Department of Revenue or the local enterprise zone administrator.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-303-029 (OR-EZ-AUTH) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.