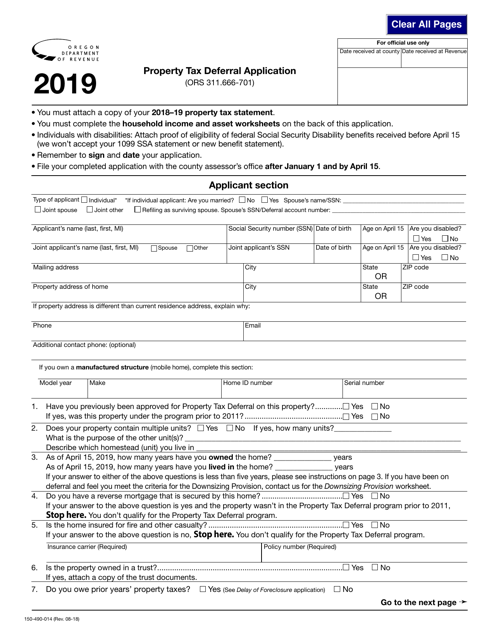

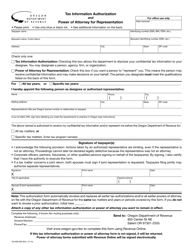

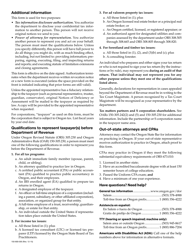

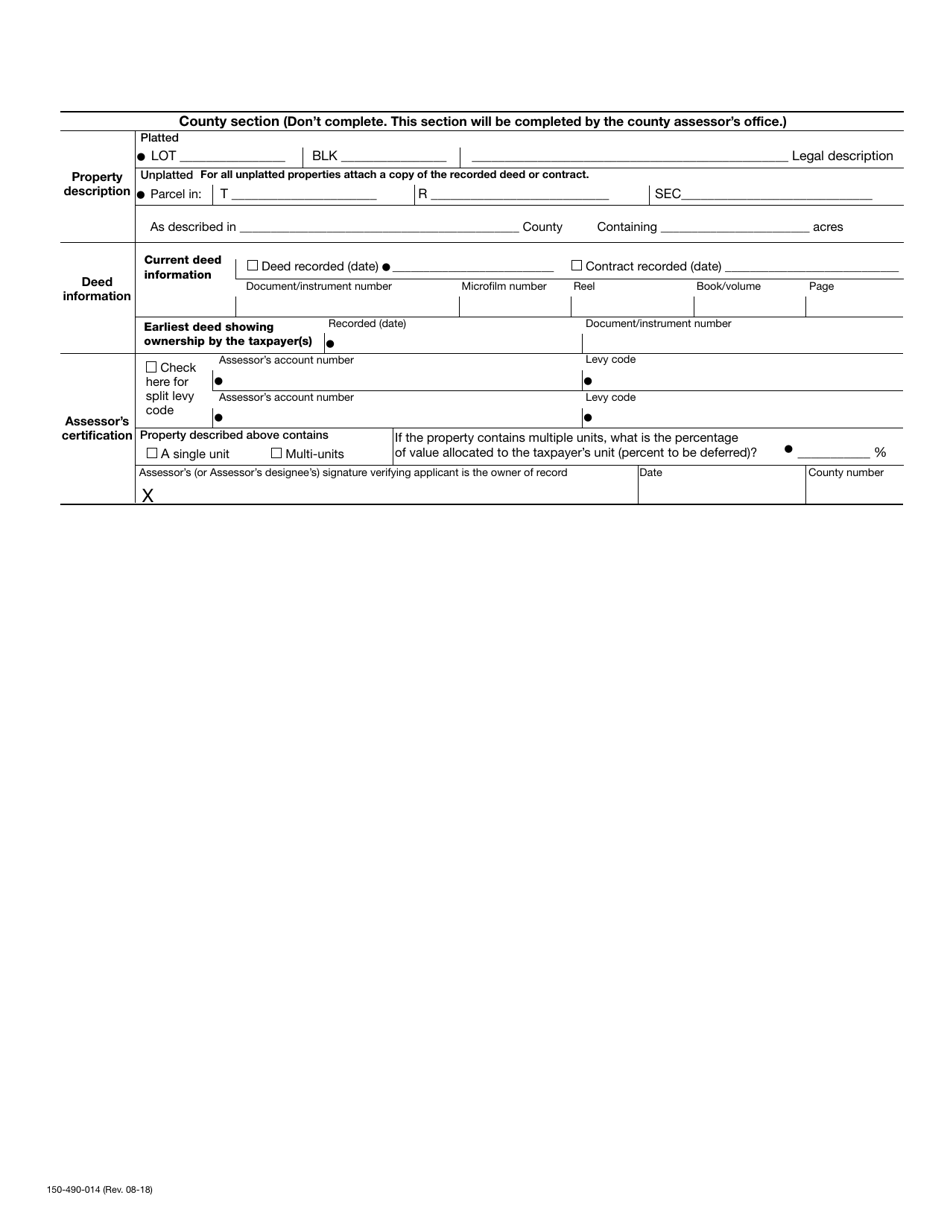

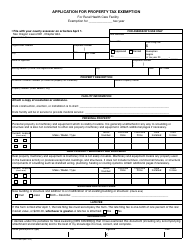

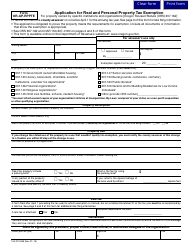

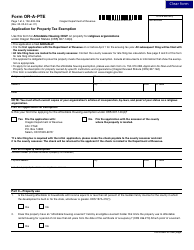

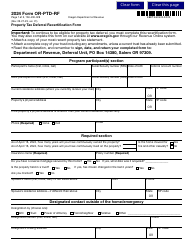

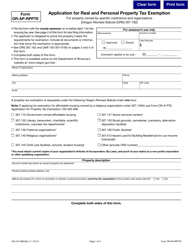

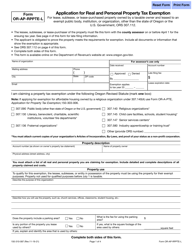

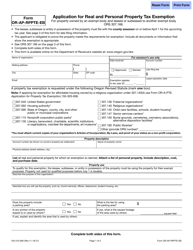

Form 150-490-014 Property for Ors Tax Deferral Application - Oregon

What Is Form 150-490-014?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-490-014?

A: Form 150-490-014 is the Property for Ors Tax Deferral Application form in Oregon.

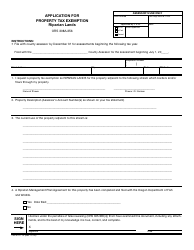

Q: What is the purpose of Form 150-490-014?

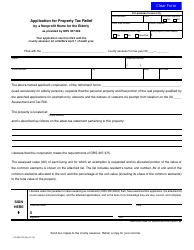

A: The purpose of Form 150-490-014 is to apply for a property tax deferral in Oregon.

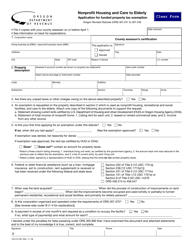

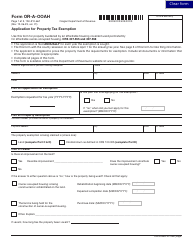

Q: Who is eligible to use Form 150-490-014?

A: Property owners in Oregon who meet the eligibility requirements can use Form 150-490-014.

Q: What is a property tax deferral?

A: A property tax deferral is a program that allows qualified individuals to postpone payment of their property taxes.

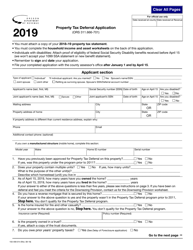

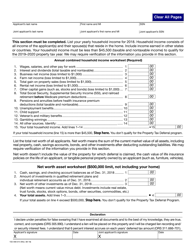

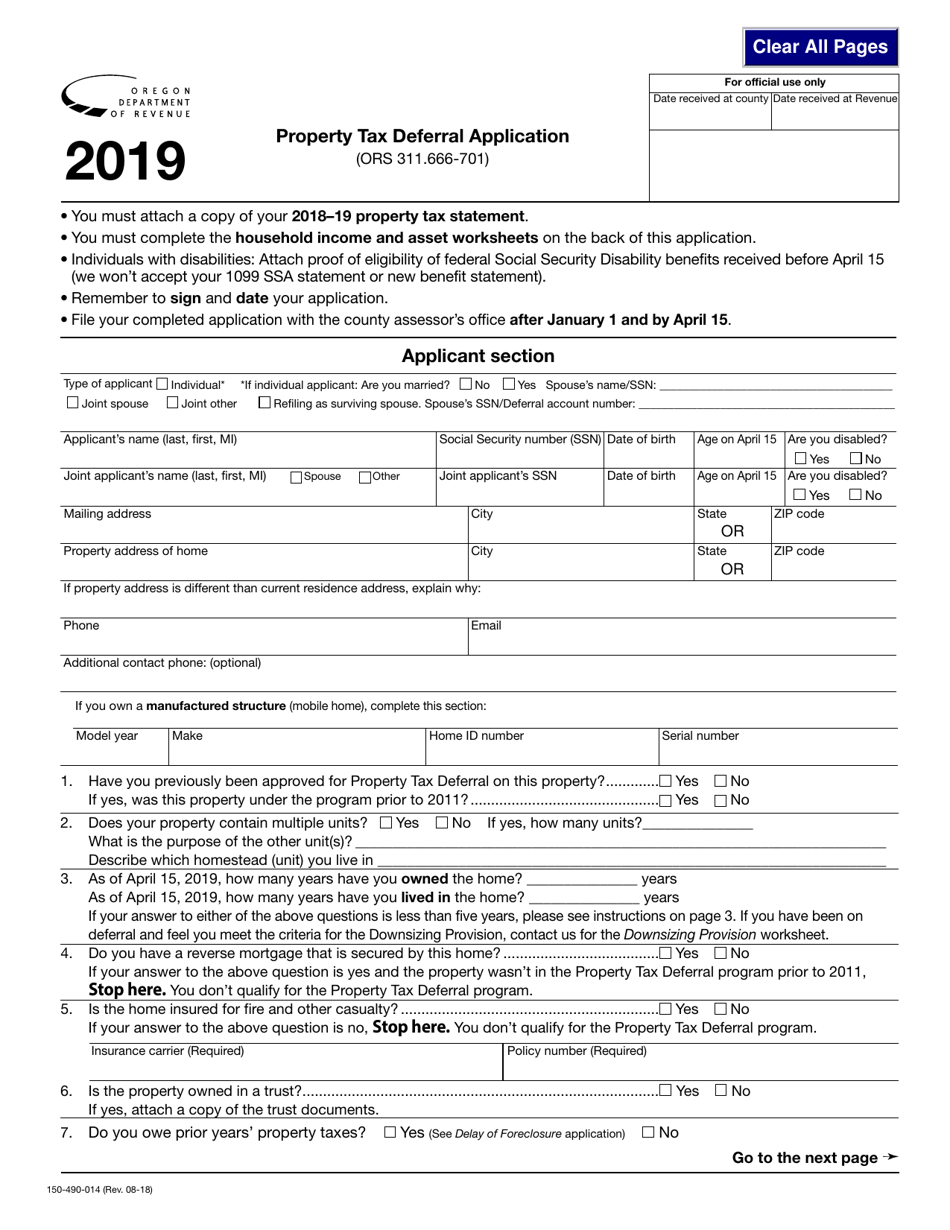

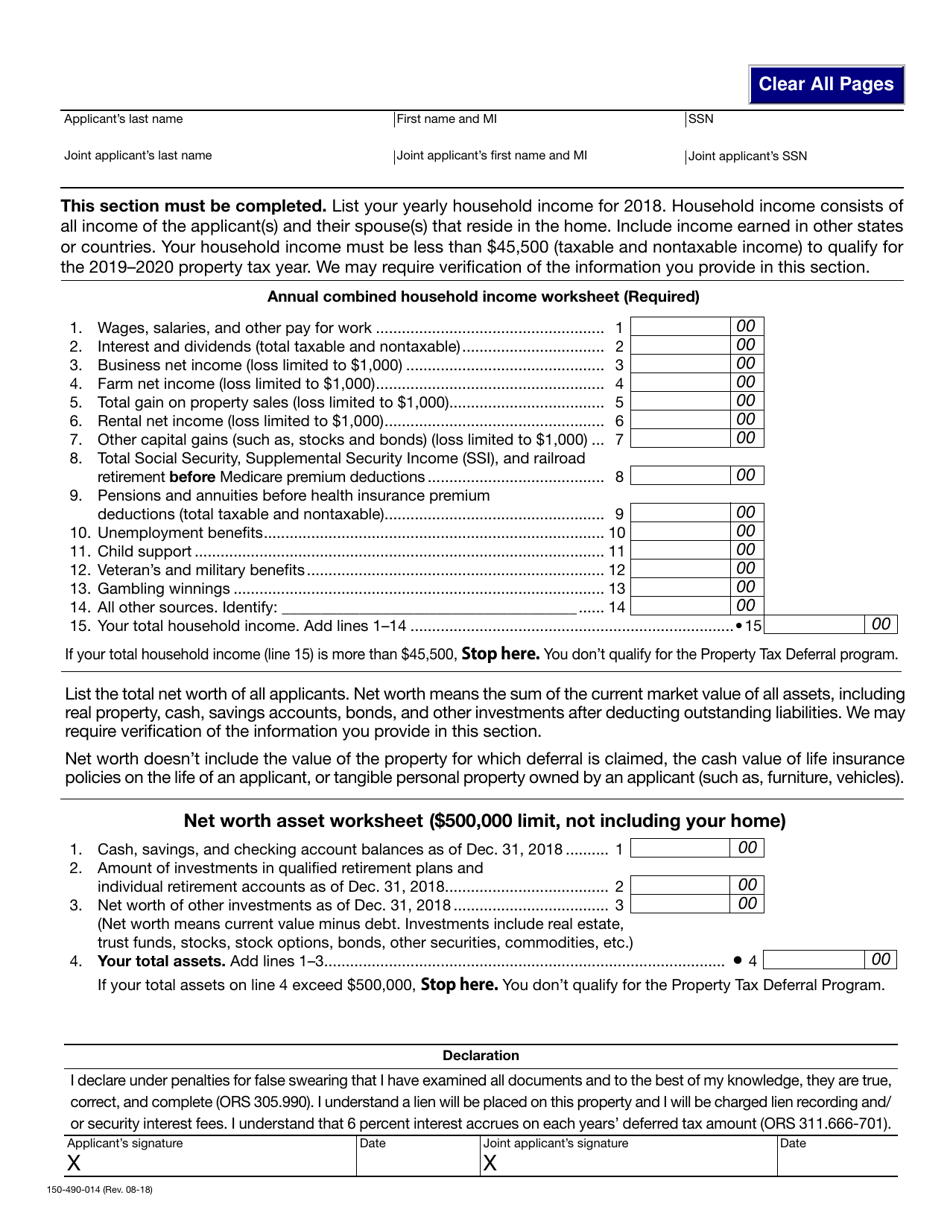

Q: What information do I need to complete Form 150-490-014?

A: You will need information about your property and your financial situation to complete Form 150-490-014.

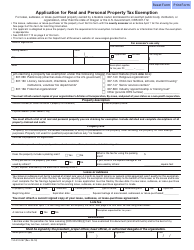

Q: Are there any fees associated with Form 150-490-014?

A: Yes, there is a nonrefundable application fee for Form 150-490-014.

Q: What is the deadline for submitting Form 150-490-014?

A: The deadline for submitting Form 150-490-014 is April 15th of the assessment year.

Q: What happens after I submit Form 150-490-014?

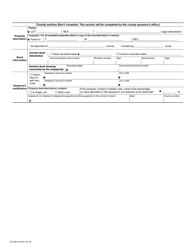

A: After you submit Form 150-490-014, the Oregon Department of Revenue will review your application and notify you of their decision.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-490-014 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.