This version of the form is not currently in use and is provided for reference only. Download this version of

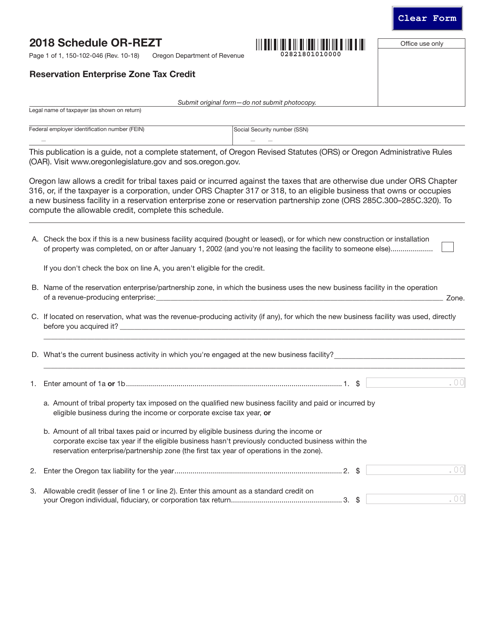

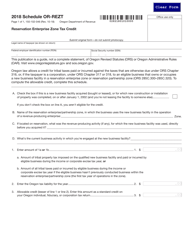

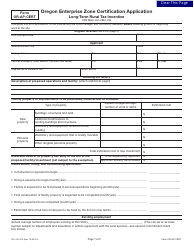

Form 150-102-046 Schedule OR-REZT

for the current year.

Form 150-102-046 Schedule OR-REZT Reservation Enterprise Zone Tax Credit - Oregon

What Is Form 150-102-046 Schedule OR-REZT?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-102-046?

A: Form 150-102-046 is the Schedule OR-REZT, which is used to claim the Reservation Enterprise Zone Tax Credit in Oregon.

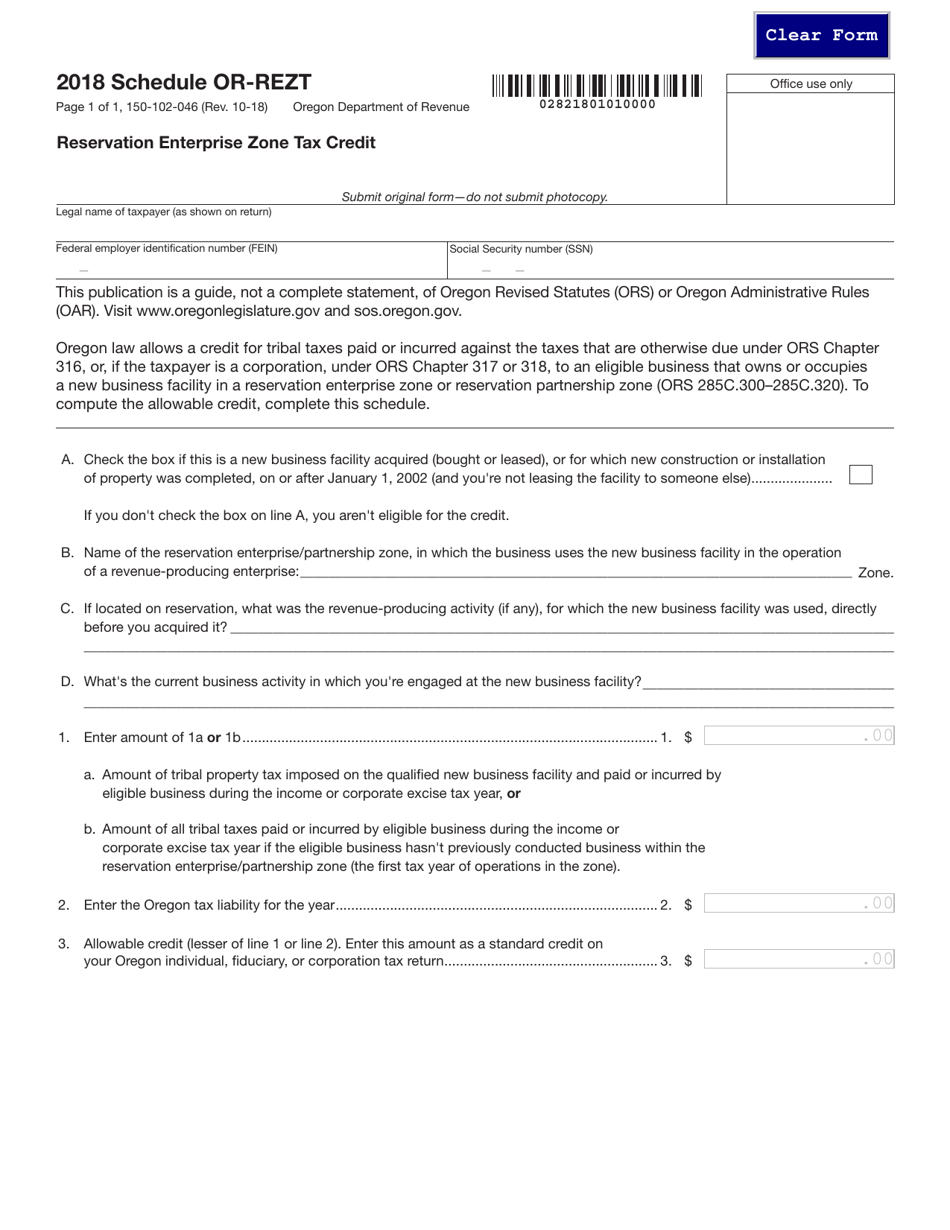

Q: What is the Reservation Enterprise Zone Tax Credit?

A: The Reservation Enterprise Zone Tax Credit is a tax credit available to businesses that operate in designated reservation enterprise zones in Oregon.

Q: How do I claim the Reservation Enterprise Zone Tax Credit?

A: To claim the Reservation Enterprise Zone Tax Credit, you need to complete and file Schedule OR-REZT (Form 150-102-046) along with your Oregon tax return.

Q: Are there any qualifications or requirements to claim the Reservation Enterprise Zone Tax Credit?

A: Yes, there are specific qualifications and requirements to claim the Reservation Enterprise Zone Tax Credit, such as meeting the eligibility criteria for operating in a reservation enterprise zone and maintaining compliance with the program's rules.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-046 Schedule OR-REZT by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.