This version of the form is not currently in use and is provided for reference only. Download this version of

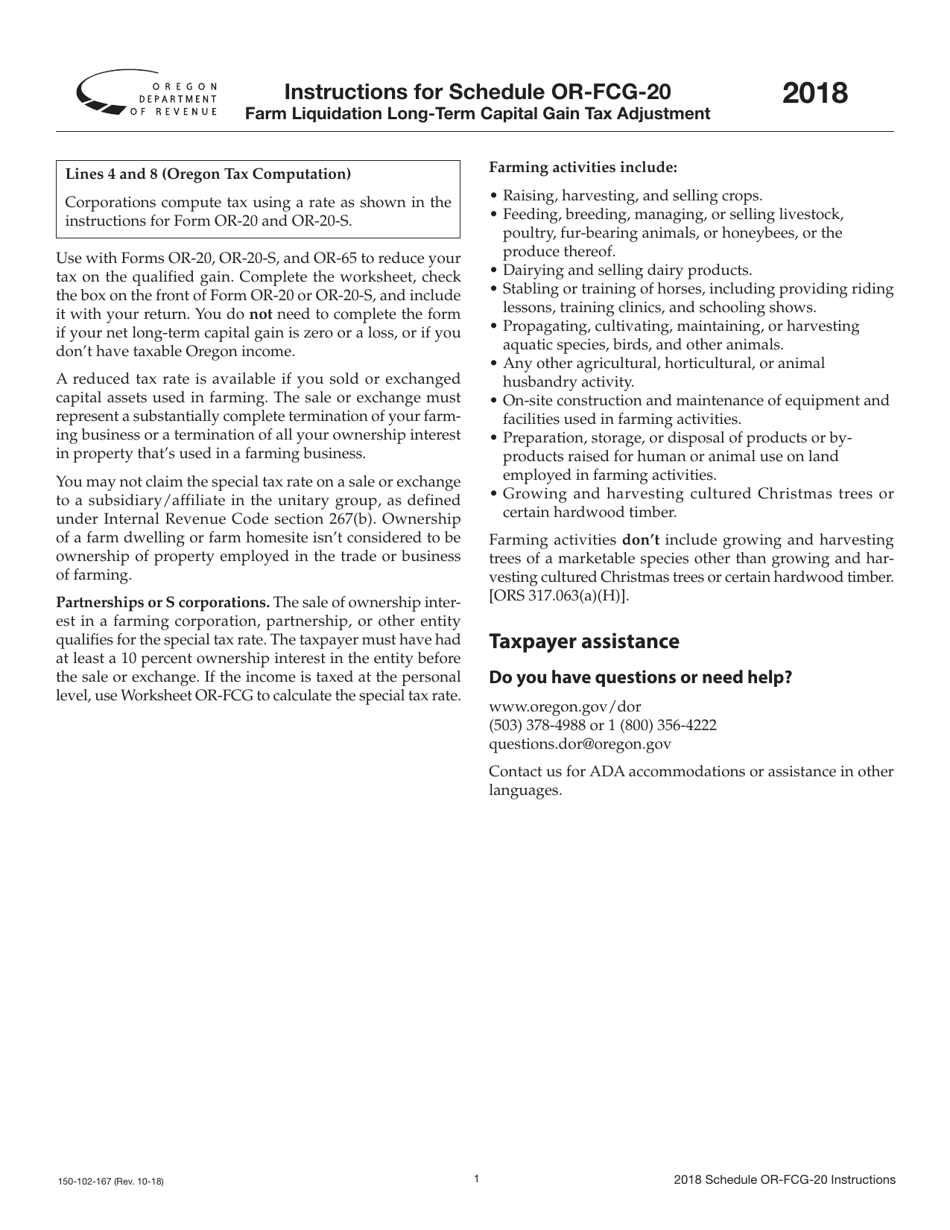

Form 150-102-167 Schedule OR-FCG-20

for the current year.

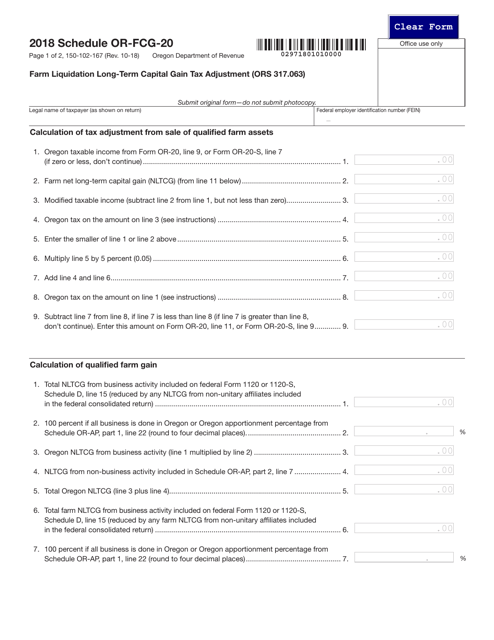

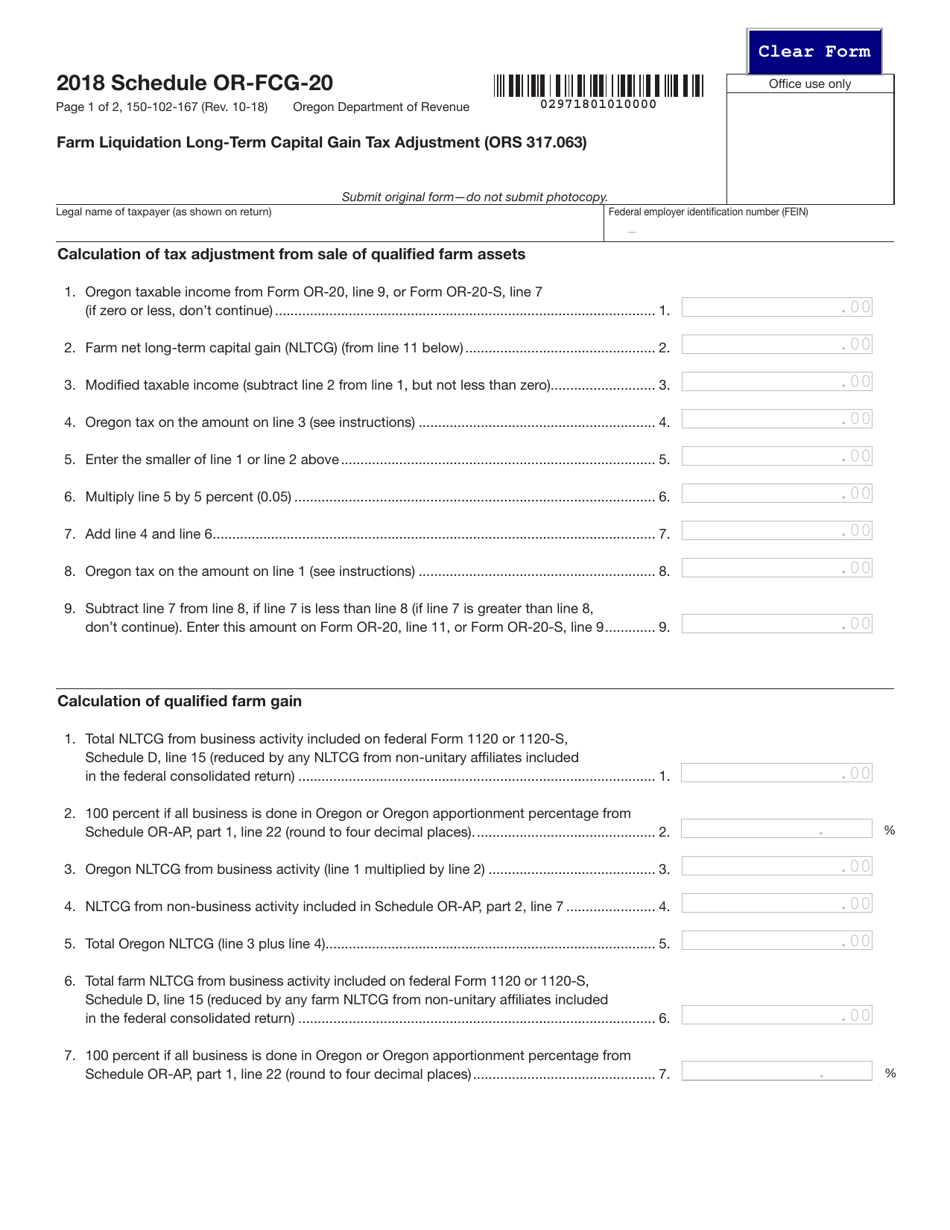

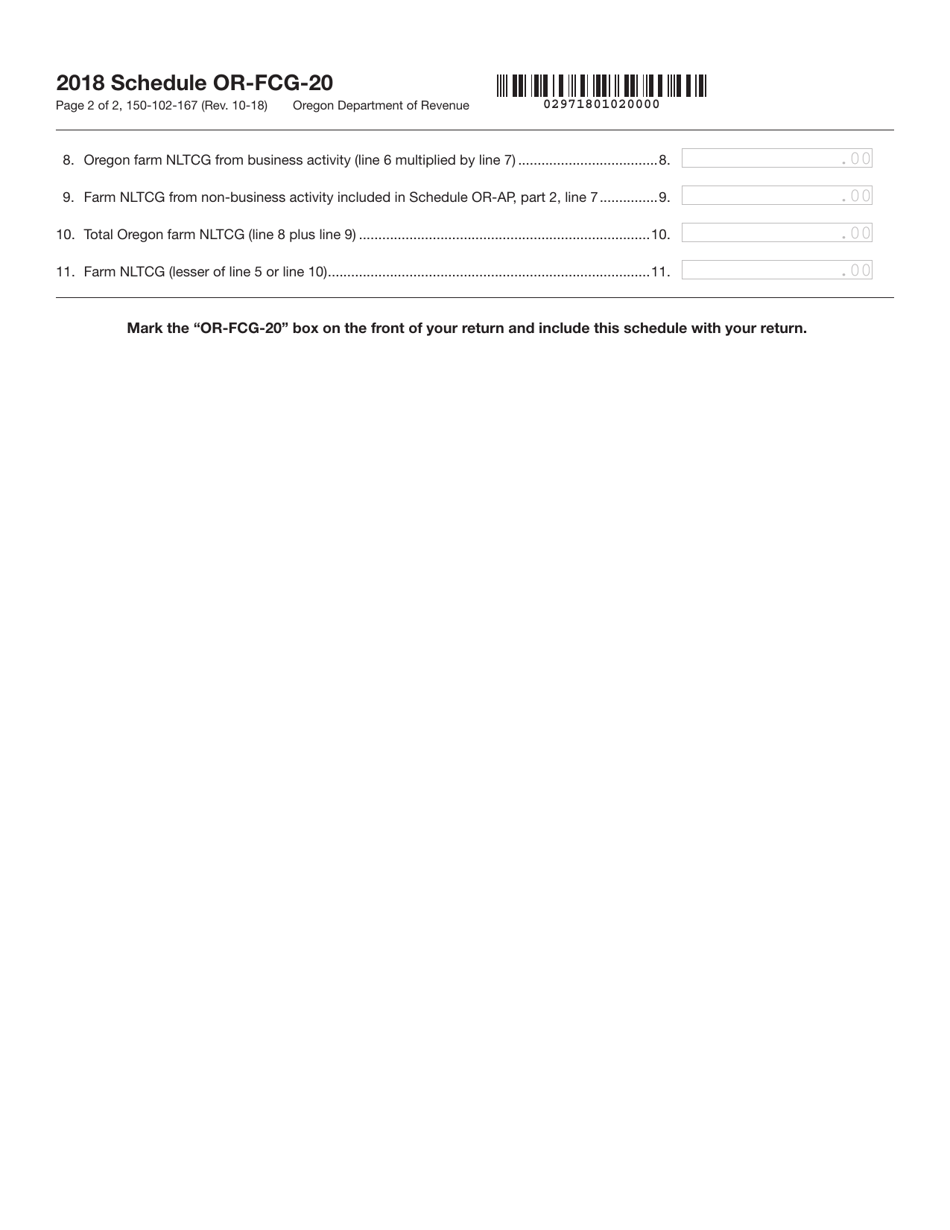

Form 150-102-167 Schedule OR-FCG-20 Farm Liquidation Long-Term Capital Gain Tax Adjustment (Ors 317.063) - Oregon

What Is Form 150-102-167 Schedule OR-FCG-20?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-102-167?

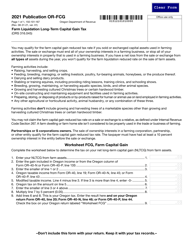

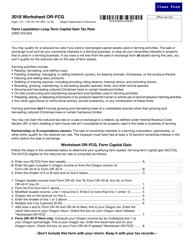

A: Form 150-102-167 is a tax form used for reporting the Farm Liquidation Long-Term Capital Gain Tax Adjustment in Oregon.

Q: What is Schedule OR-FCG-20?

A: Schedule OR-FCG-20 is a specific schedule within Form 150-102-167 that is used to report the Farm Liquidation Long-Term Capital Gain Tax Adjustment in Oregon.

Q: What is Farm Liquidation Long-Term Capital Gain Tax Adjustment?

A: Farm Liquidation Long-Term Capital Gain Tax Adjustment is a tax adjustment specific to farms in Oregon that allows for a reduction in long-term capital gains tax.

Q: When do I use Form 150-102-167?

A: You use Form 150-102-167 when you need to report the Farm Liquidation Long-Term Capital Gain Tax Adjustment in Oregon.

Q: What is the purpose of Form 150-102-167?

A: The purpose of Form 150-102-167 is to calculate and report the Farm Liquidation Long-Term Capital Gain Tax Adjustment in Oregon.

Q: Do I need to file Form 150-102-167 if I am not a farmer?

A: No, Form 150-102-167 is specifically for reporting the Farm Liquidation Long-Term Capital Gain Tax Adjustment and is only required for farmers in Oregon.

Q: What is Ors 317.063?

A: Ors 317.063 is the specific Oregon Revised Statute that outlines the Farm Liquidation Long-Term Capital Gain Tax Adjustment.

Q: Are there any other forms or schedules related to Form 150-102-167?

A: No, Schedule OR-FCG-20 is the only specific schedule related to Form 150-102-167 for reporting the Farm Liquidation Long-Term Capital Gain Tax Adjustment in Oregon.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-167 Schedule OR-FCG-20 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.