This version of the form is not currently in use and is provided for reference only. Download this version of

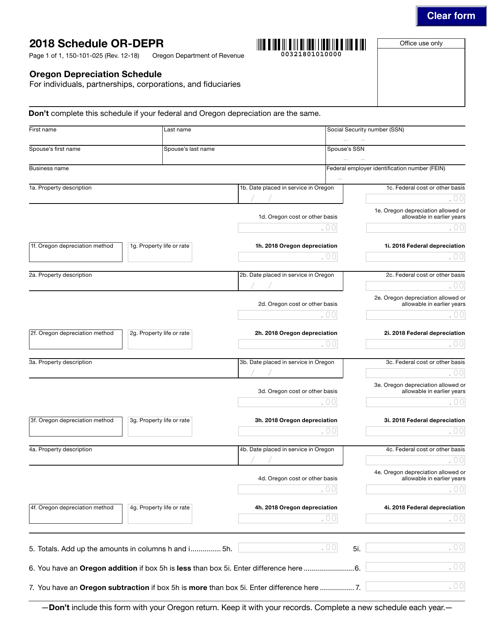

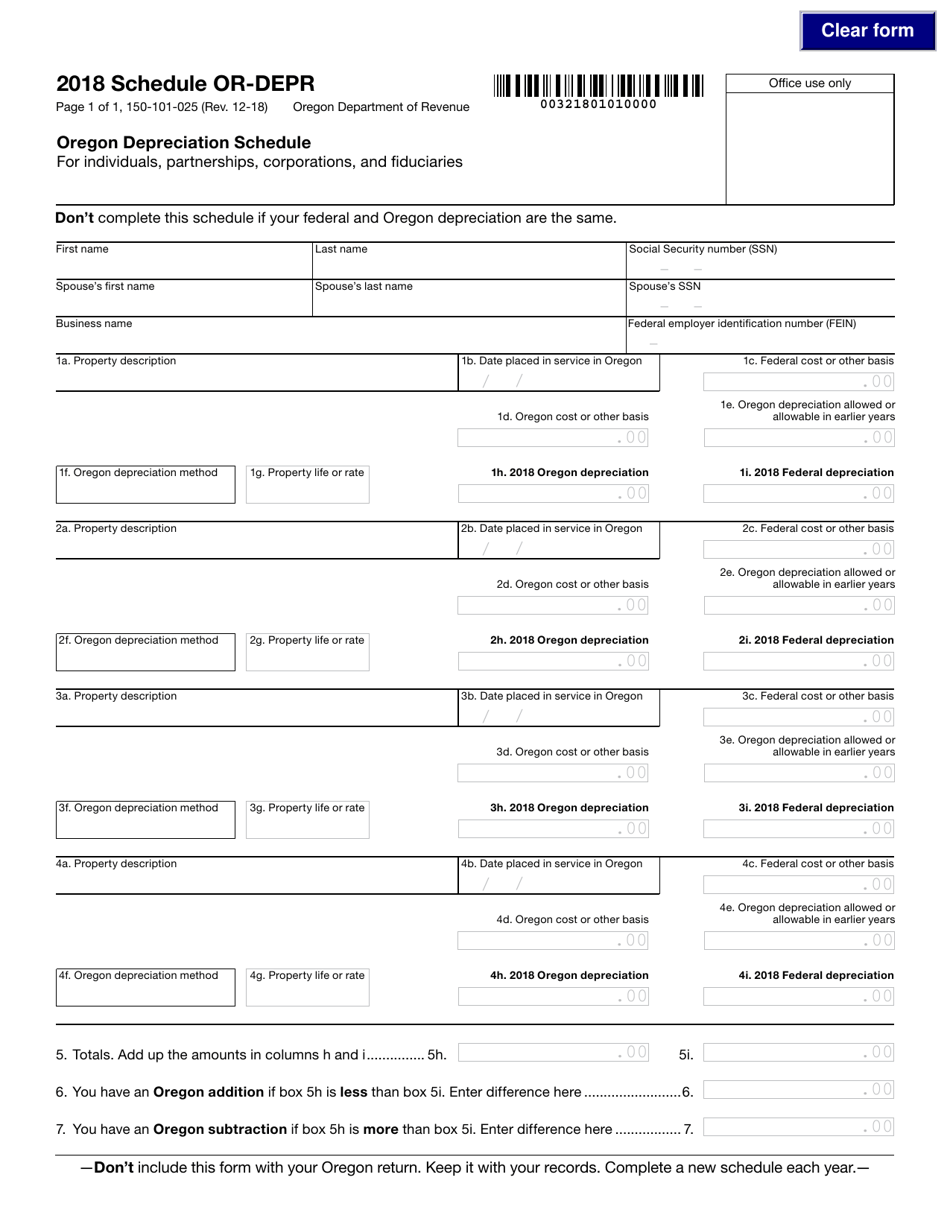

Form 150-101-025 Schedule OR-DEPR

for the current year.

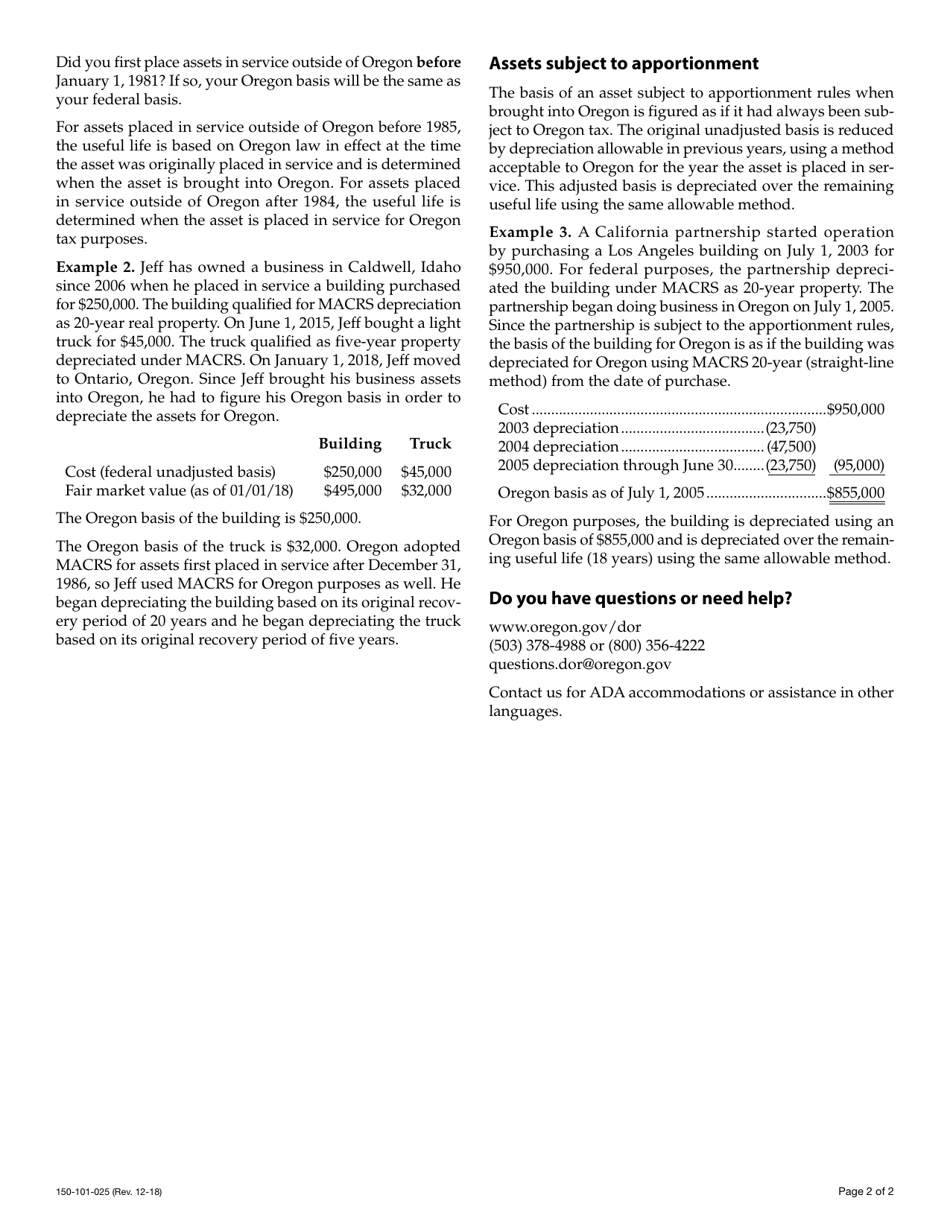

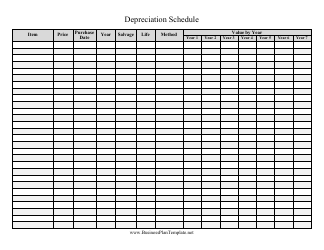

Form 150-101-025 Schedule OR-DEPR Oregon Depreciation Schedule - Oregon

What Is Form 150-101-025 Schedule OR-DEPR?

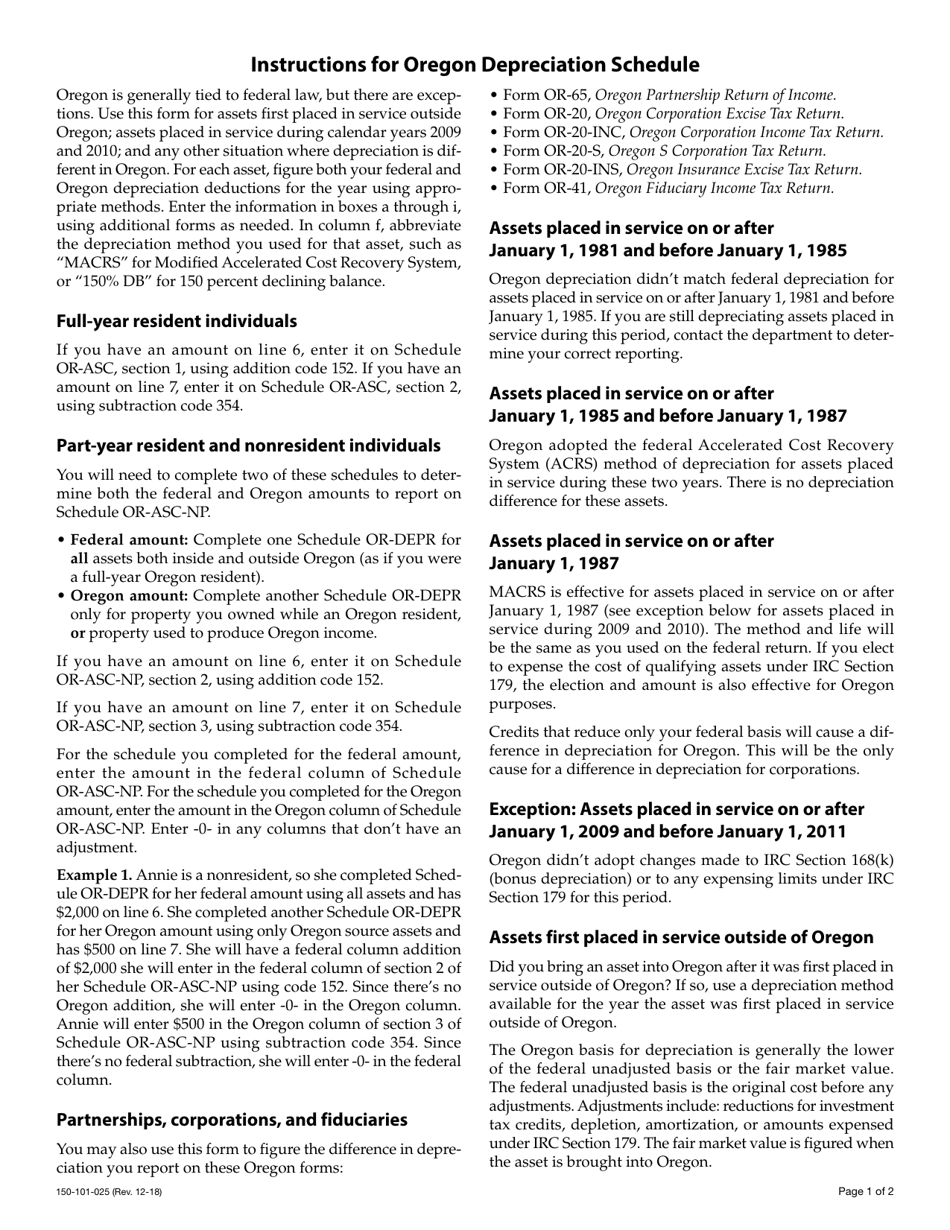

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-025?

A: Form 150-101-025 is a tax form used for reporting depreciation expenses in the state of Oregon.

Q: What is Schedule OR-DEPR?

A: Schedule OR-DEPR is a specific part of Form 150-101-025 used for reporting depreciation in Oregon.

Q: What is Oregon Depreciation Schedule?

A: The Oregon Depreciation Schedule is a schedule within Form 150-101-025 used to calculate and report depreciation expenses in Oregon.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-025 Schedule OR-DEPR by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.