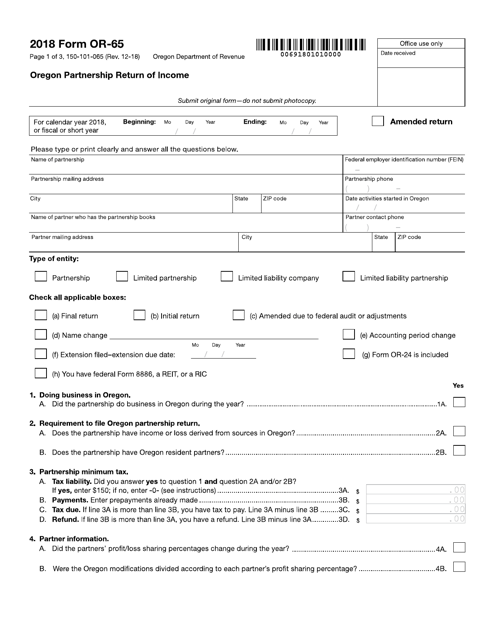

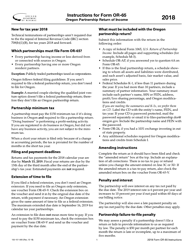

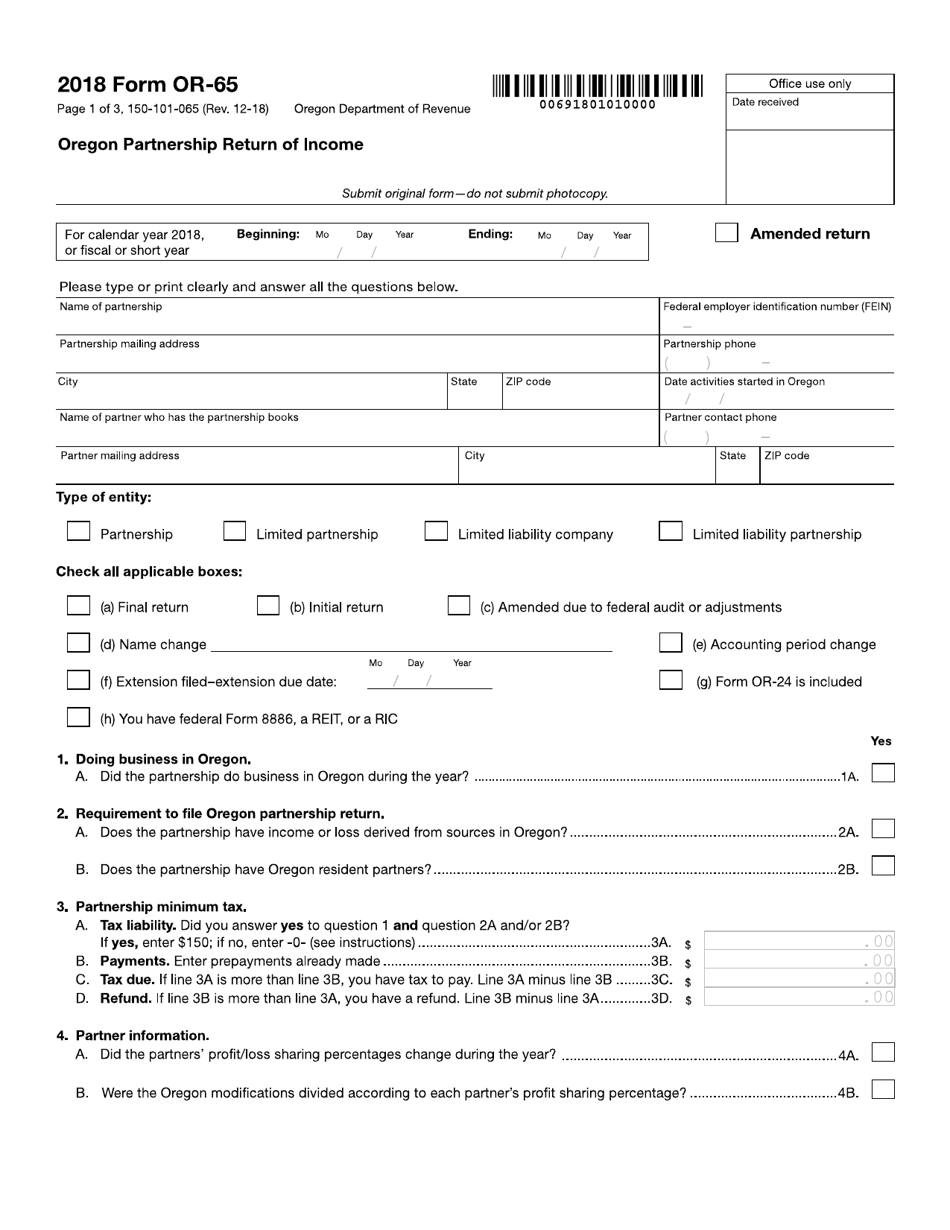

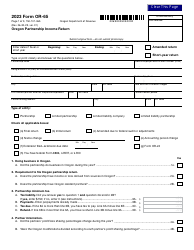

Form 150-101-065 (OR-65) Oregon Partnership Return of Income - Oregon

What Is Form 150-101-065 (OR-65)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-065 (OR-65)?

A: Form 150-101-065 (OR-65) is the Oregon Partnership Return of Income form.

Q: Who needs to file Form 150-101-065 (OR-65)?

A: Partnerships in Oregon need to file Form 150-101-065 (OR-65) to report their income.

Q: What is the purpose of Form 150-101-065 (OR-65)?

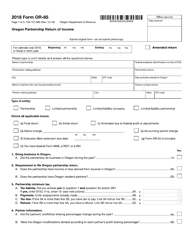

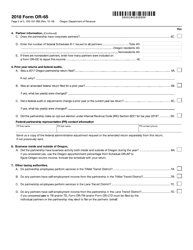

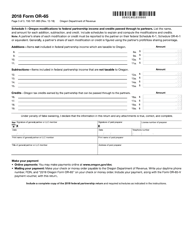

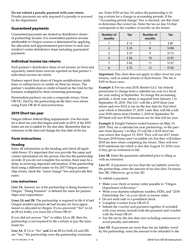

A: The purpose of Form 150-101-065 (OR-65) is to calculate and report the partnership's income, deductions, and credits.

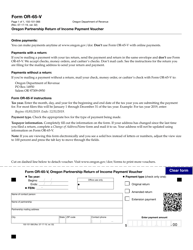

Q: When is Form 150-101-065 (OR-65) due?

A: Form 150-101-065 (OR-65) is due on the 15th day of the 4th month after the end of the partnership's tax year.

Q: Are there any penalties for not filing Form 150-101-065 (OR-65) on time?

A: Yes, there are penalties for not filing Form 150-101-065 (OR-65) on time. The penalty is based on the partnership's net income and can range from $20 to $1,000 per month.

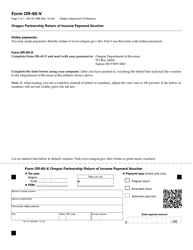

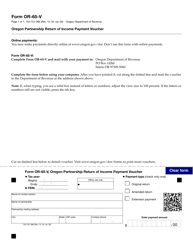

Q: Can Form 150-101-065 (OR-65) be filed electronically?

A: Yes, Form 150-101-065 (OR-65) can be filed electronically using the Oregon e-file system.

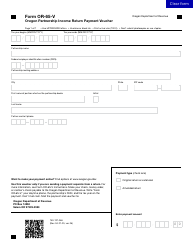

Q: Do I need to include any attachments with Form 150-101-065 (OR-65)?

A: Yes, you may need to include certain attachments, such as Schedule OR-AP, Schedule OR-APT, and Schedule OR-WNW, depending on your partnership's situation.

Q: Can I amend Form 150-101-065 (OR-65) if I made a mistake?

A: Yes, you can amend Form 150-101-065 (OR-65) by filing Form 150-101-065 (OR-65-X) and following the instructions for amending a partnership return.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-065 (OR-65) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.