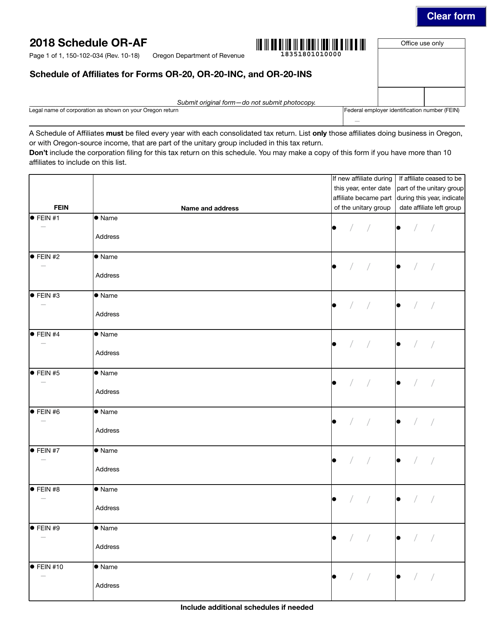

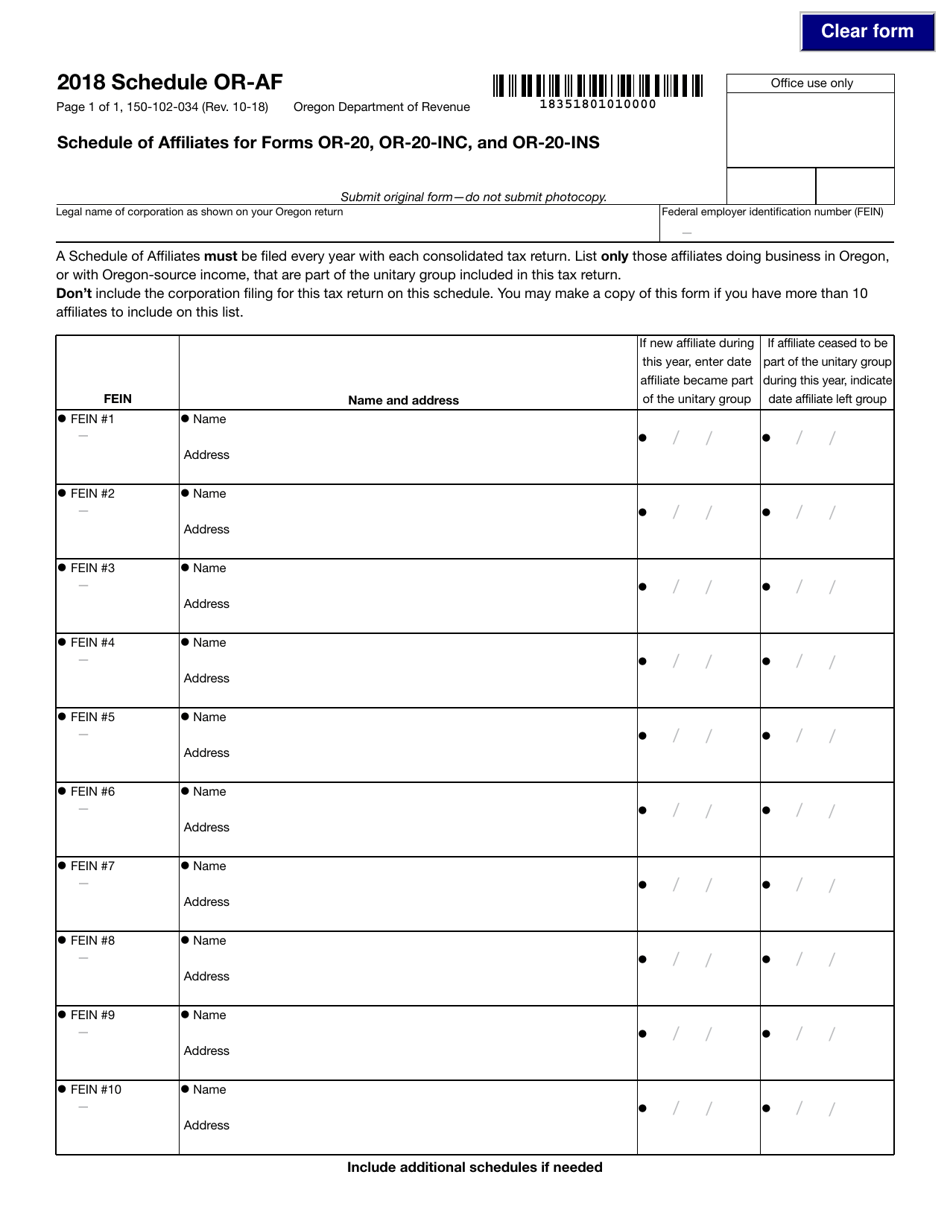

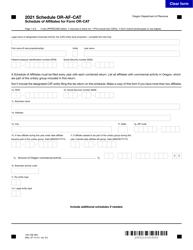

Form OR-20 (OR-20-INC; OR-20-INS) Schedule OR'AF Schedule of Affiliates - Oregon

What Is Form OR-20 (OR-20-INC; OR-20-INS) Schedule OR‑AF?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon.The document is a supplement to Form OR-20, Form OR-20-INC, and Form OR-20-INS. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-20?

A: Form OR-20 is a tax form used in Oregon.

Q: What are the different versions of Form OR-20?

A: There are three versions of Form OR-20: OR-20-INC, OR-20-INS, and OR-20-AF.

Q: What is OR-20-INC?

A: OR-20-INC is a version of Form OR-20 used for corporations.

Q: What is OR-20-INS?

A: OR-20-INS is a version of Form OR-20 used for insurance companies.

Q: What is OR-20-AF?

A: OR-20-AF is a schedule of affiliates that is filed along with Form OR-20.

Q: What is Schedule of Affiliates?

A: Schedule of Affiliates is a form or schedule that provides information about affiliated companies.

Q: When should Form OR-20 be filed?

A: Form OR-20 should be filed annually by the due date of the corporation's federal tax return.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-20 (OR-20-INC; OR-20-INS) Schedule OR‑AF by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.