This version of the form is not currently in use and is provided for reference only. Download this version of

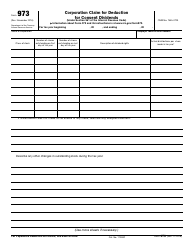

Form 150-102-038 (OR-DRD)

for the current year.

Form 150-102-038 (OR-DRD) Oregon Dividends-Received Deduction - Oregon

What Is Form 150-102-038 (OR-DRD)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

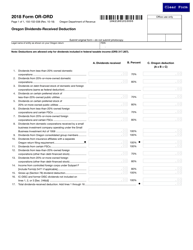

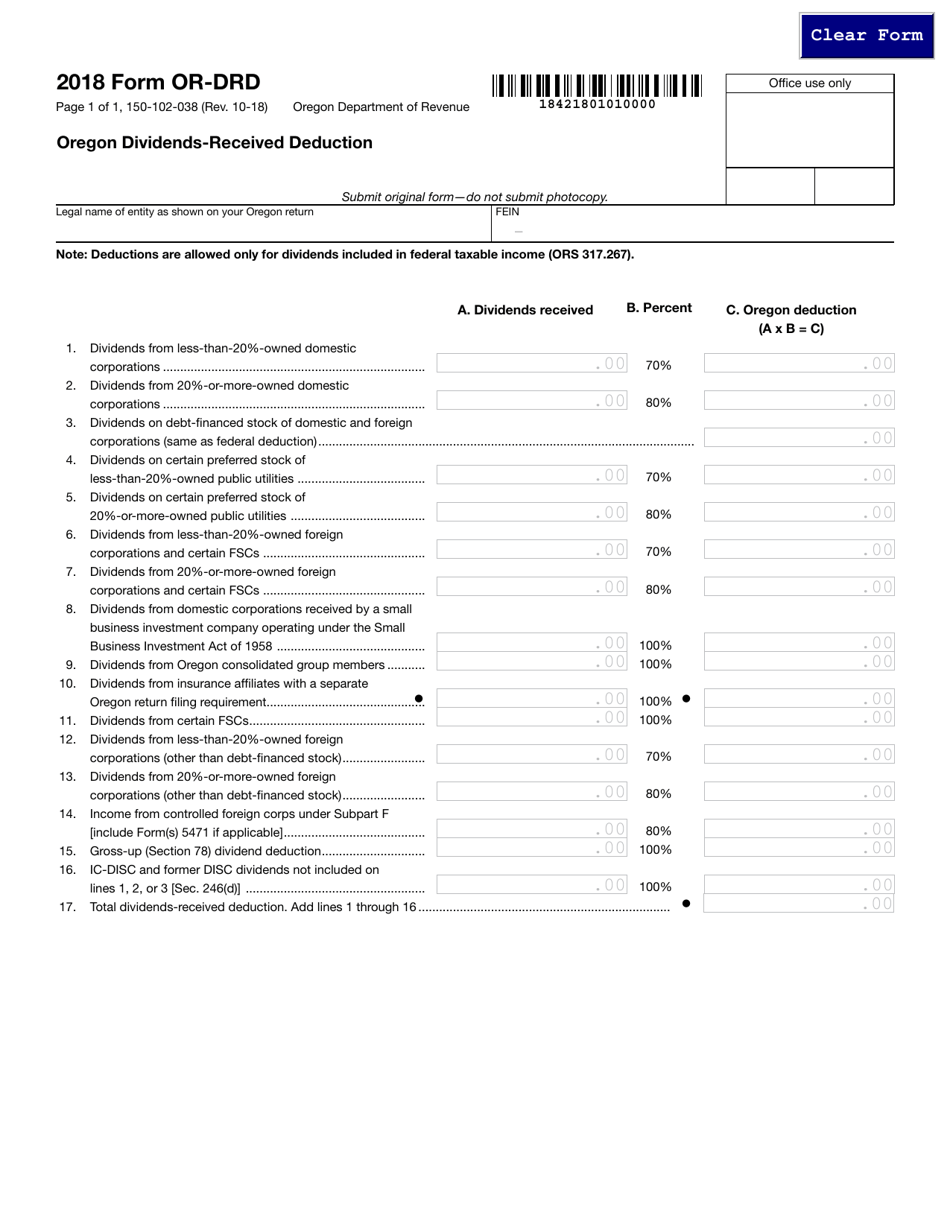

Q: What is Form 150-102-038 (OR-DRD)?

A: Form 150-102-038 (OR-DRD) is a tax form used in Oregon to claim the Dividends-Received Deduction.

Q: What is the Oregon Dividends-Received Deduction?

A: The Oregon Dividends-Received Deduction is a deduction available to Oregon residents for certain dividend income.

Q: Who can claim the Oregon Dividends-Received Deduction?

A: Only Oregon residents can claim the Oregon Dividends-Received Deduction.

Q: What income is eligible for the Oregon Dividends-Received Deduction?

A: Only dividends received from Oregon corporations or dividends received from a real estate investment trust (REIT) that qualifies for the federal dividends-received deduction are eligible for the Oregon Dividends-Received Deduction.

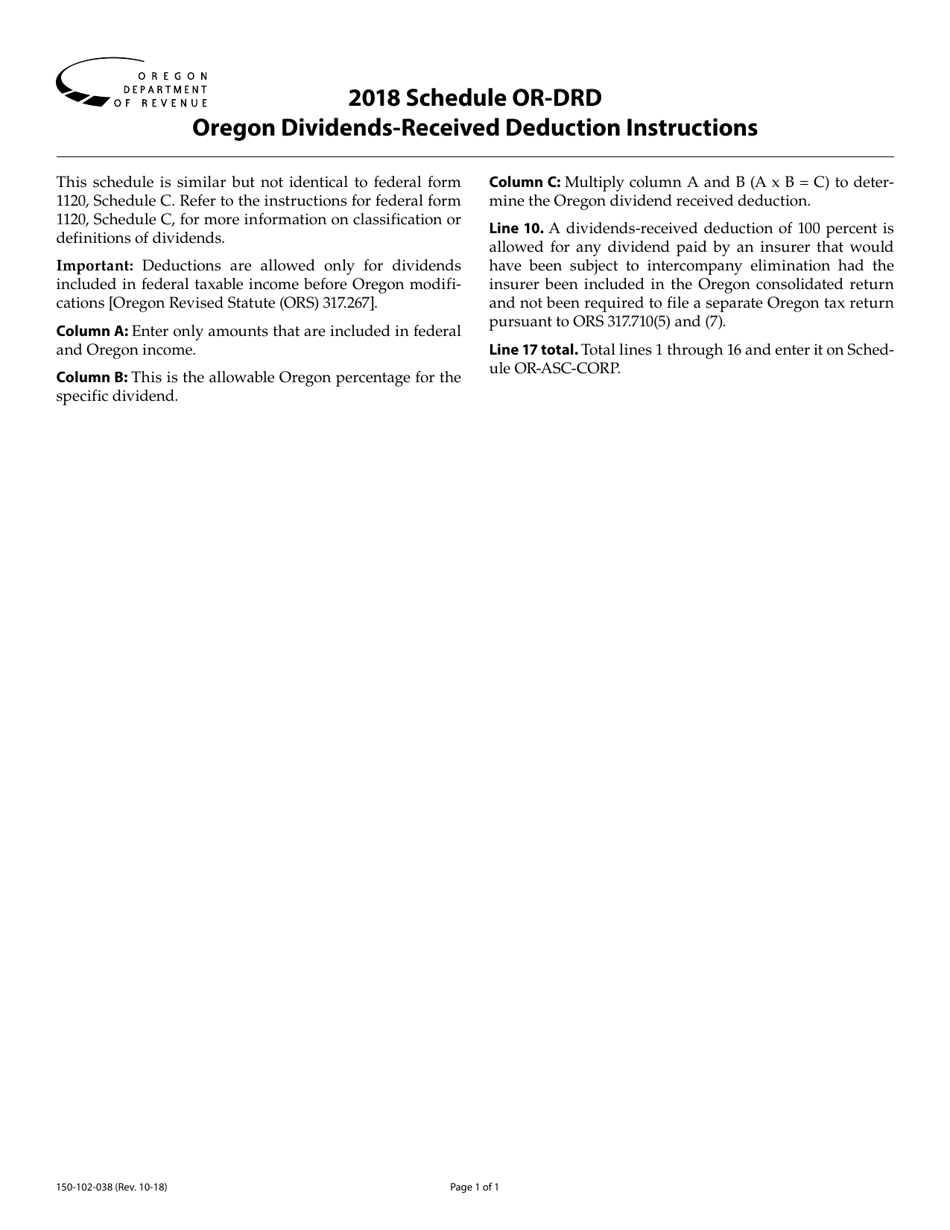

Q: How do I claim the Oregon Dividends-Received Deduction?

A: You can claim the Oregon Dividends-Received Deduction by completing Form 150-102-038 (OR-DRD) and attaching it to your Oregon tax return.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-038 (OR-DRD) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.