This version of the form is not currently in use and is provided for reference only. Download this version of

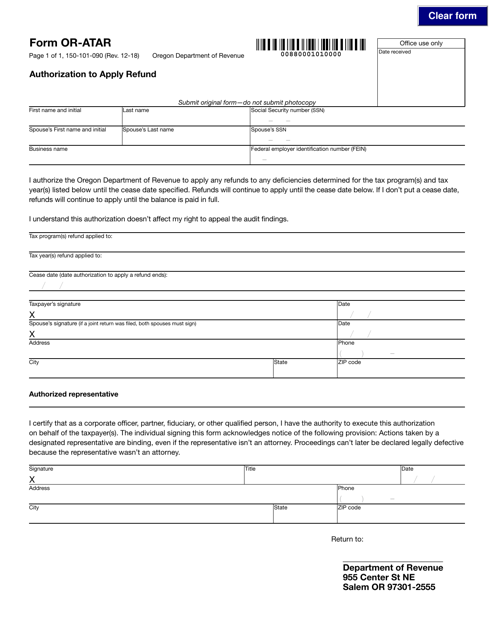

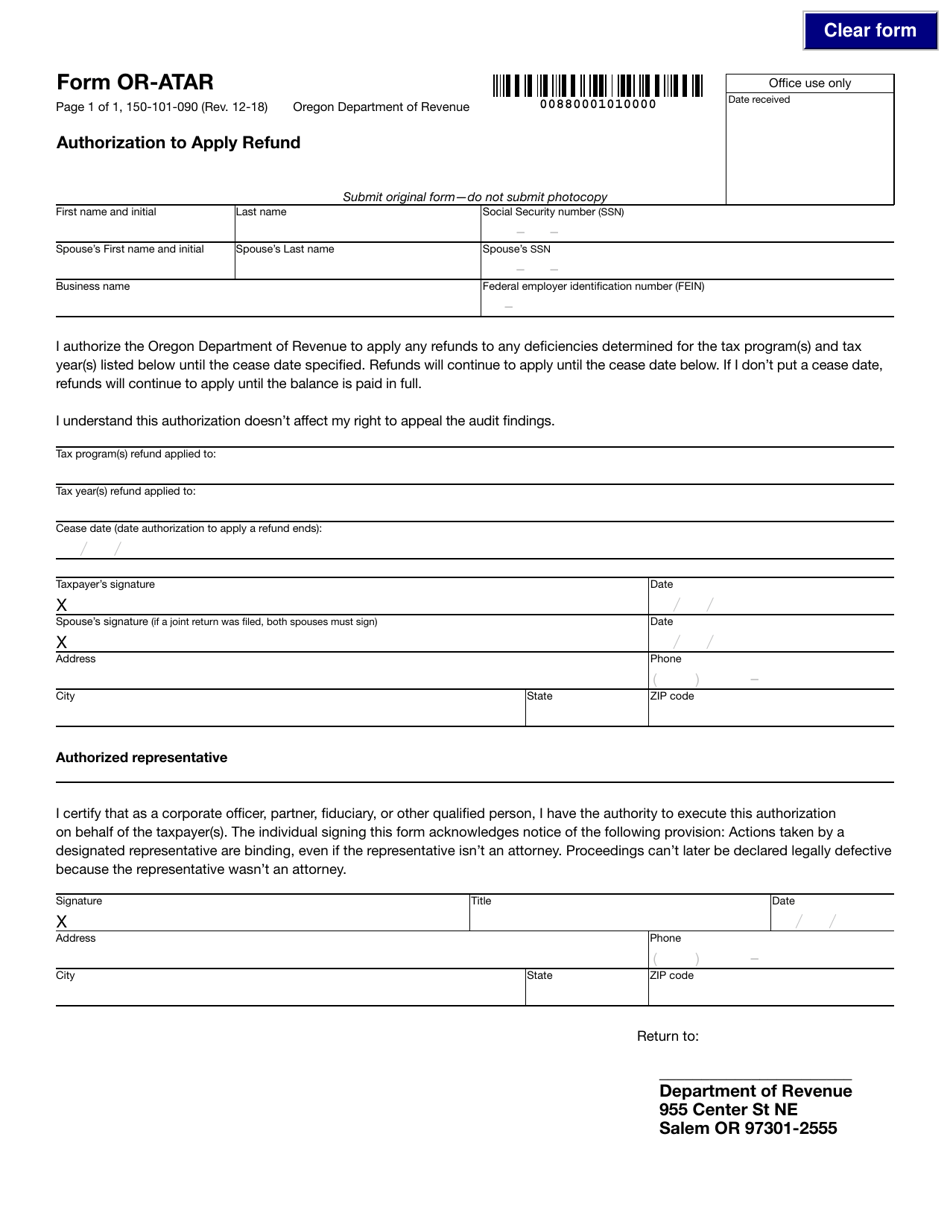

Form 150-101-090 (OR-ATAR)

for the current year.

Form 150-101-090 (OR-ATAR) Authorization to Apply Refund - Oregon

What Is Form 150-101-090 (OR-ATAR)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-090?

A: Form 150-101-090 is also known as the OR-ATAR (Authorization to Apply Refund) and is used in Oregon.

Q: What is the purpose of Form 150-101-090?

A: The purpose of Form 150-101-090 is to authorize the Oregon Department of Revenue to apply a refund amount to future taxes owed by the taxpayer.

Q: Who can use Form 150-101-090?

A: Any taxpayer in Oregon who is expecting a refund and wants to apply it to future taxes can use Form 150-101-090.

Q: Are there any eligibility requirements to use Form 150-101-090?

A: No, there are no specific eligibility requirements to use Form 150-101-090. Any taxpayer in Oregon can use it.

Q: Can I apply a refund to taxes owed in a different year?

A: No, Form 150-101-090 can only be used to apply a refund to future taxes owed in the same tax year.

Q: How long does it take for the refund to be applied?

A: The refund will typically be applied within a few business days after the Oregon Department of Revenue receives and processes Form 150-101-090.

Q: Can I change my mind after submitting Form 150-101-090?

A: No, once you submit Form 150-101-090, the authorization is final and cannot be changed or revoked.

Q: Do I need to include any additional documentation with Form 150-101-090?

A: No, you do not need to include any additional documentation with Form 150-101-090. Just complete and submit the form.

Q: What should I do if I have more questions about Form 150-101-090?

A: If you have more questions about Form 150-101-090, you can contact the Oregon Department of Revenue for assistance.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-090 (OR-ATAR) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.