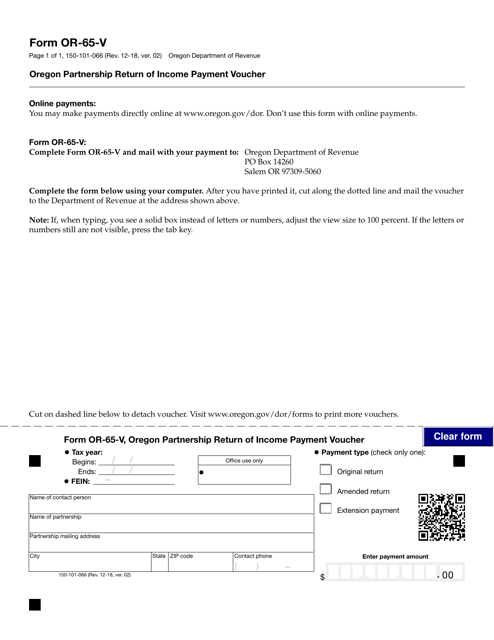

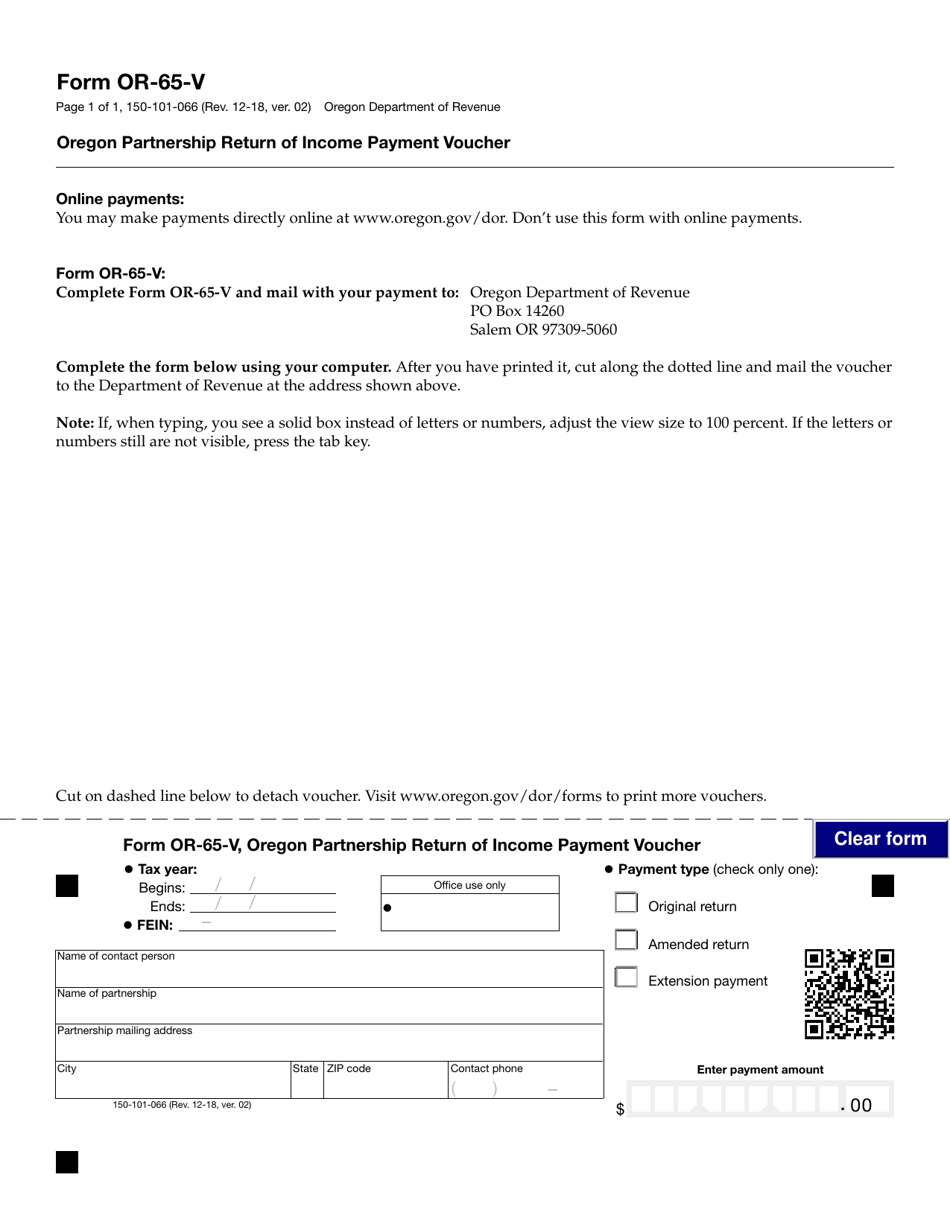

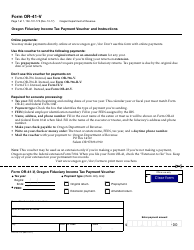

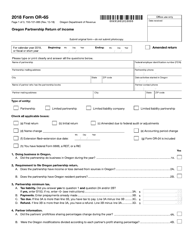

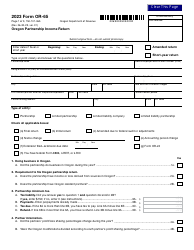

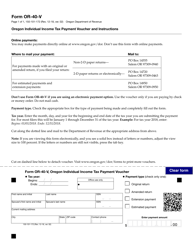

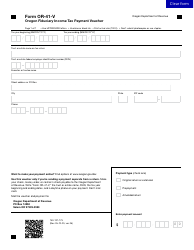

Form 150-101-066 (OR-65-V) Oregon Partnership Return of Income Payment Voucher - Oregon

What Is Form 150-101-066 (OR-65-V)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-066?

A: Form 150-101-066 is the Oregon Partnership Return of Income Payment Voucher.

Q: What is the purpose of Form 150-101-066?

A: The purpose of Form 150-101-066 is to remit payment for the Oregon Partnership Return of Income.

Q: Who needs to file Form 150-101-066?

A: Partnerships in Oregon are required to file Form 150-101-066 if they have income to report and/or owe taxes.

Q: When is Form 150-101-066 due?

A: Form 150-101-066 is due on the 15th day of the 4th month following the close of the partnership's tax year.

Q: Are there any penalties for not filing Form 150-101-066?

A: Yes, failure to file Form 150-101-066 or pay the taxes owed on time may result in penalties and interest being assessed by the Oregon Department of Revenue.

Q: What should I do if I made an error on Form 150-101-066?

A: If you made an error on Form 150-101-066, you should file an amended return to correct the mistake.

Q: Is Form 150-101-066 the same as the federal partnership return?

A: No, Form 150-101-066 is specific to Oregon and is used to report income and pay taxes to the state.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-066 (OR-65-V) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.