This version of the form is not currently in use and is provided for reference only. Download this version of

Form 150-102-037 (OR-37)

for the current year.

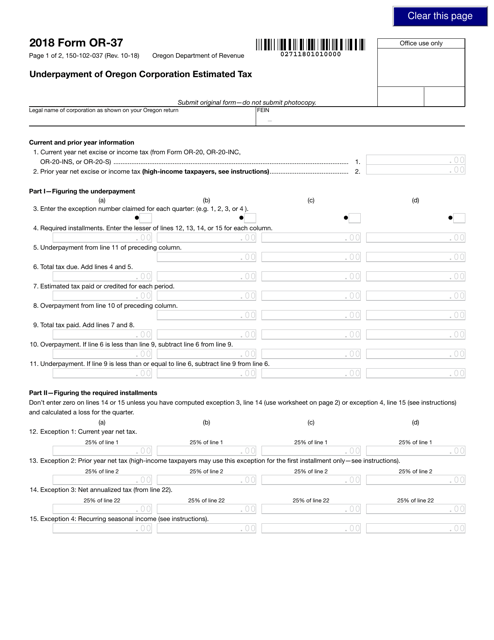

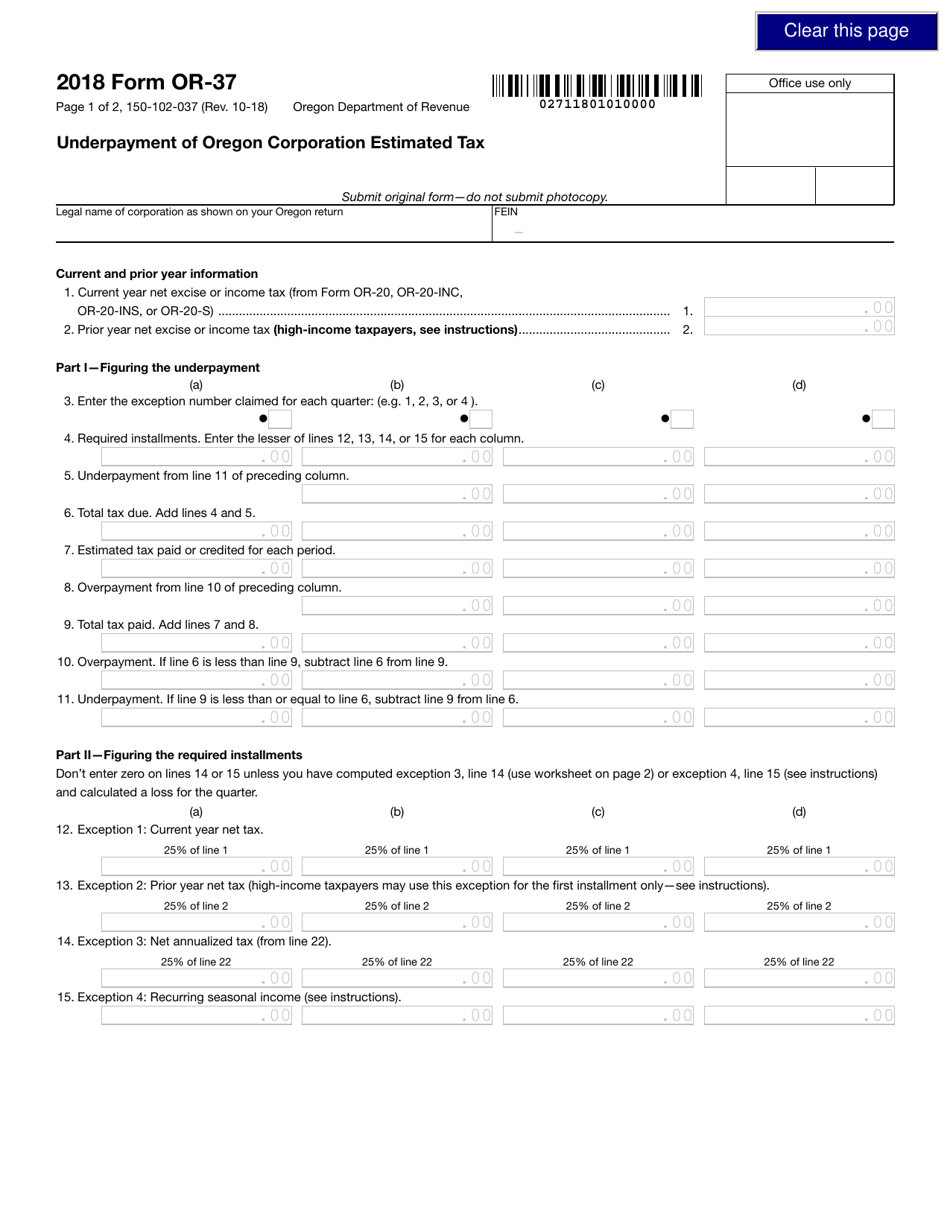

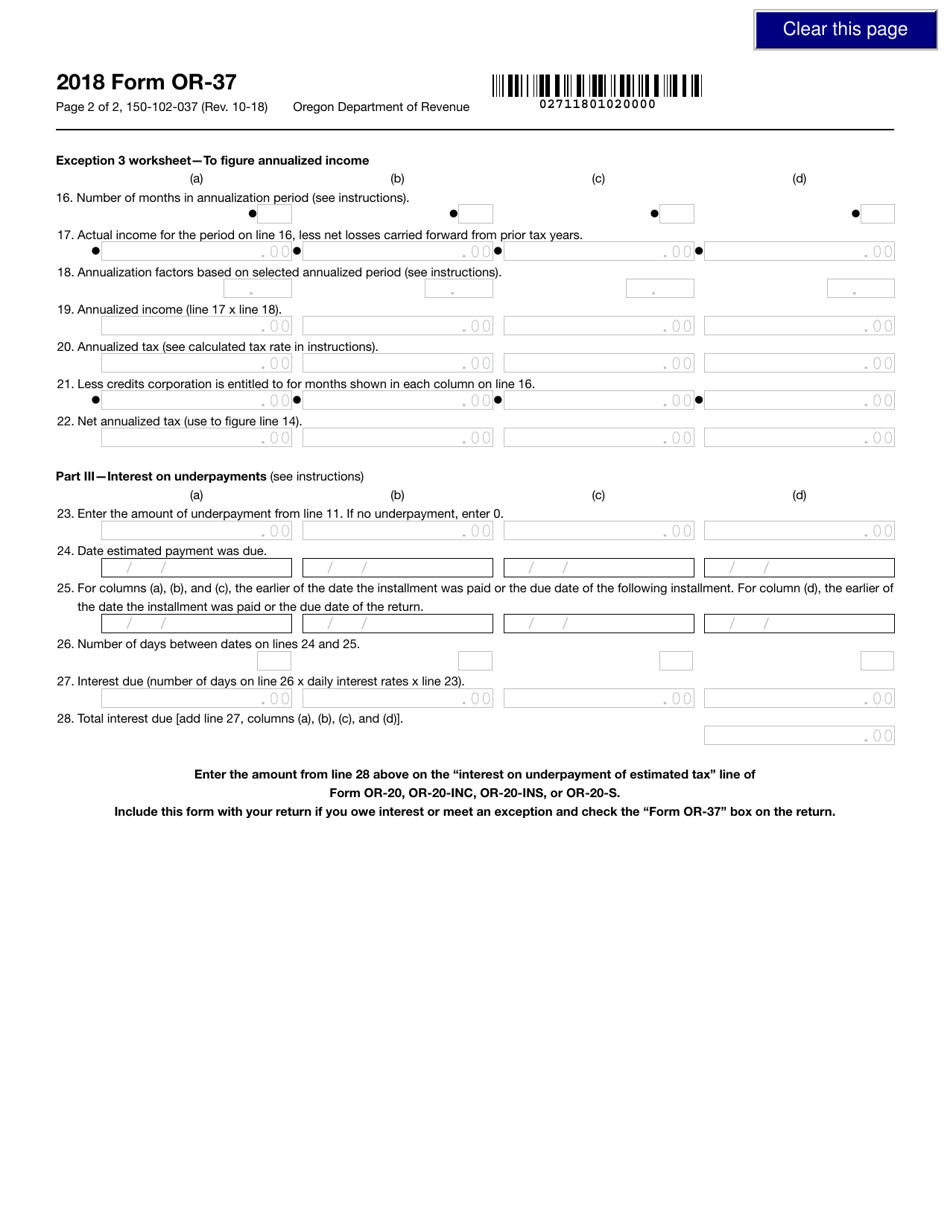

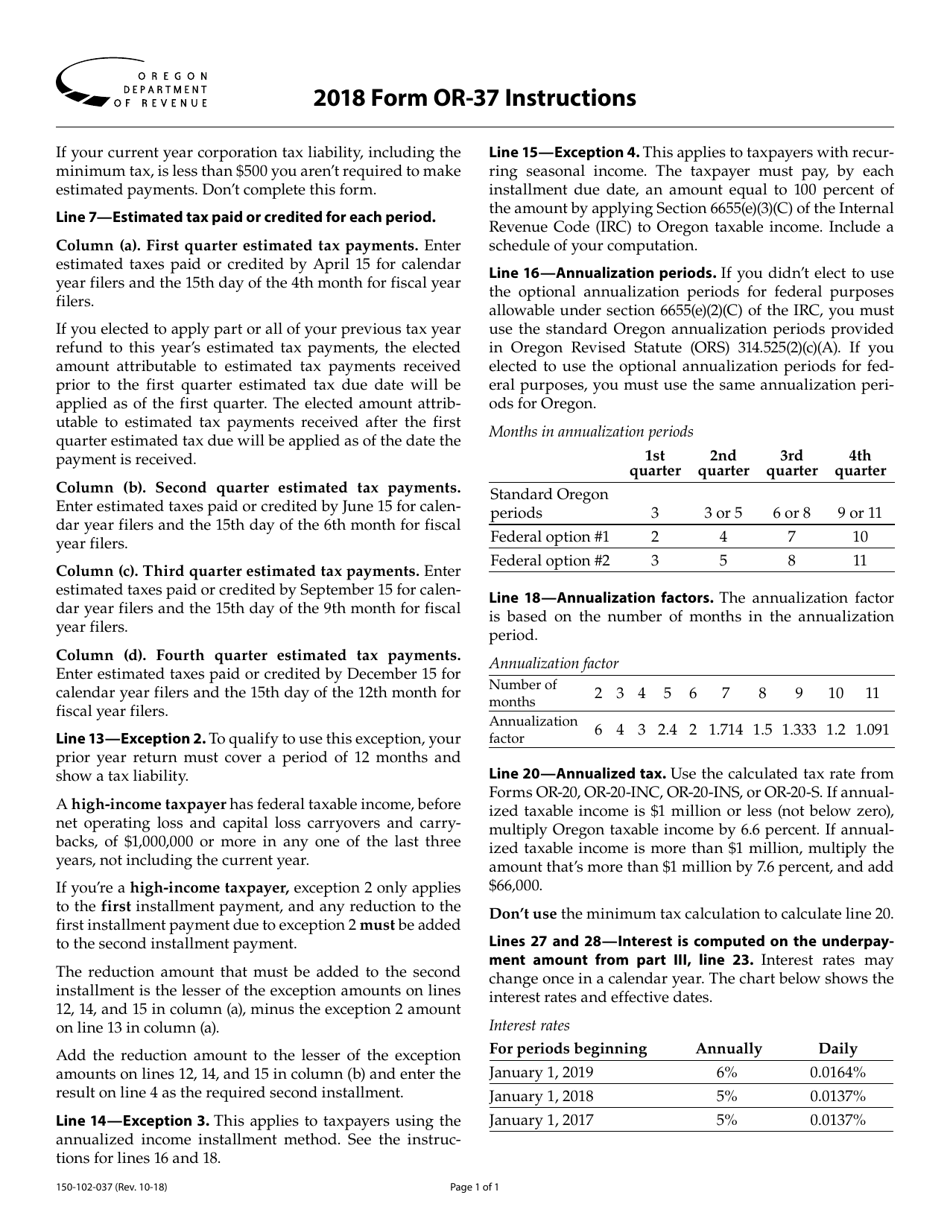

Form 150-102-037 (OR-37) Underpayment of Oregon Corporation Estimated Tax - Oregon

What Is Form 150-102-037 (OR-37)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-102-037 (OR-37)?

A: Form 150-102-037 (OR-37) is used to report underpayment of Oregon corporation estimated tax.

Q: Who needs to file Form 150-102-037 (OR-37)?

A: Oregon corporations that have underpaid their estimated tax need to file Form 150-102-037 (OR-37).

Q: What is the purpose of Form 150-102-037 (OR-37)?

A: The purpose of Form 150-102-037 (OR-37) is to calculate and report the underpayment of estimated tax by an Oregon corporation.

Q: How do I file Form 150-102-037 (OR-37)?

A: Form 150-102-037 (OR-37) can be filed electronically or by mail to the Oregon Department of Revenue.

Q: What happens if I don't file Form 150-102-037 (OR-37)?

A: Failure to file Form 150-102-037 (OR-37) may result in penalties and interest.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-037 (OR-37) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.