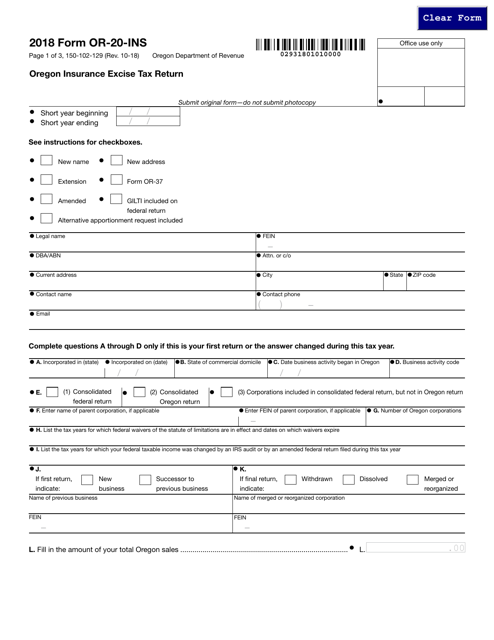

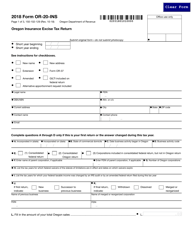

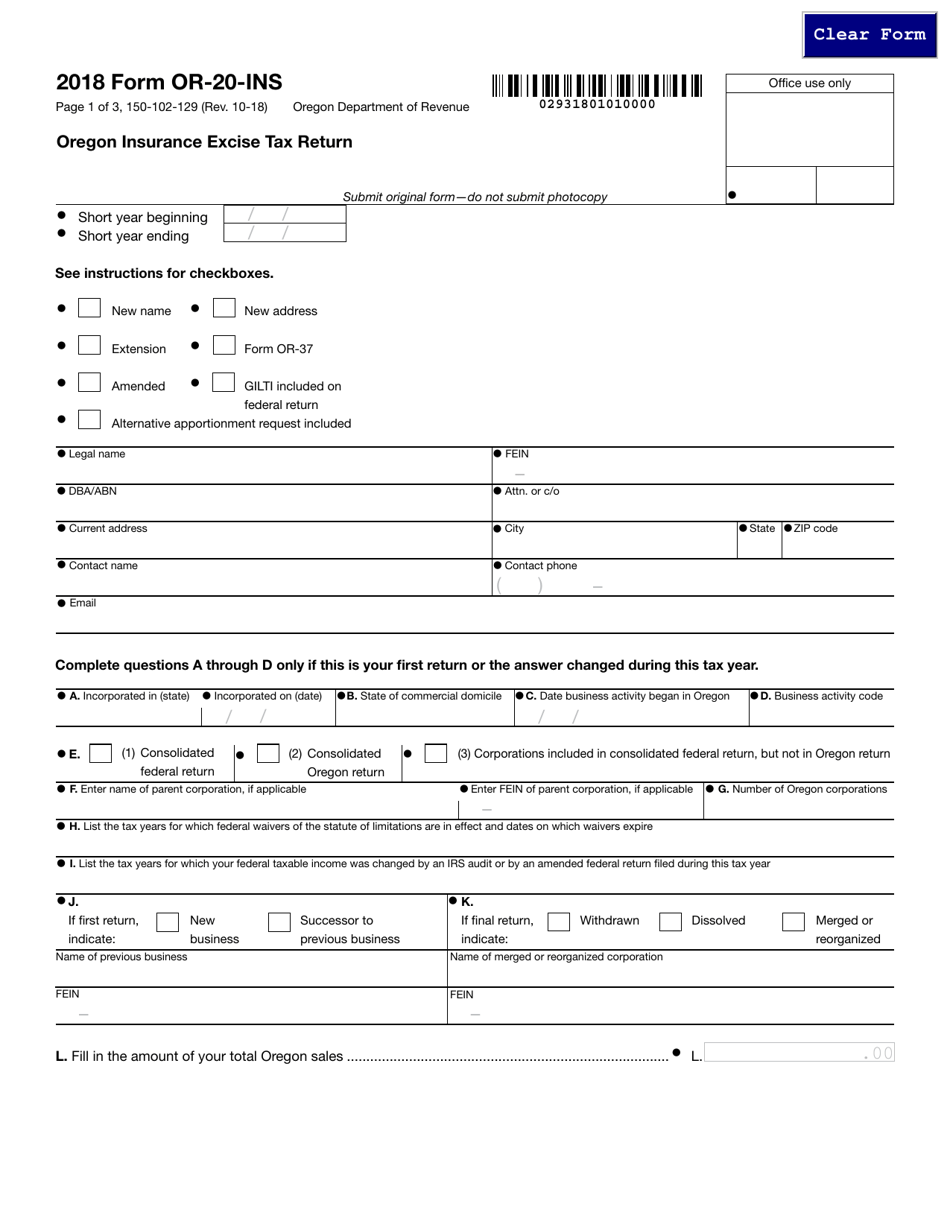

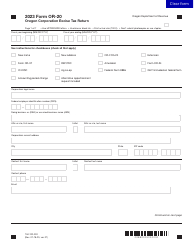

Form 150-102-129 (OR-20-INS) Oregon Insurance Excise Tax Return - Oregon

What Is Form 150-102-129 (OR-20-INS)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-102-129?

A: Form 150-102-129 is the Oregon Insurance Excise Tax Return.

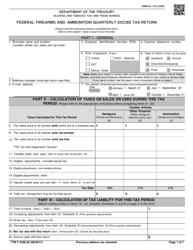

Q: Who needs to file Form 150-102-129?

A: Anyone engaged in the business of insurance in Oregon and liable for insurance excise tax needs to file this form.

Q: What is the purpose of Form 150-102-129?

A: The purpose of this form is to report and pay insurance excise tax on premiums received in Oregon.

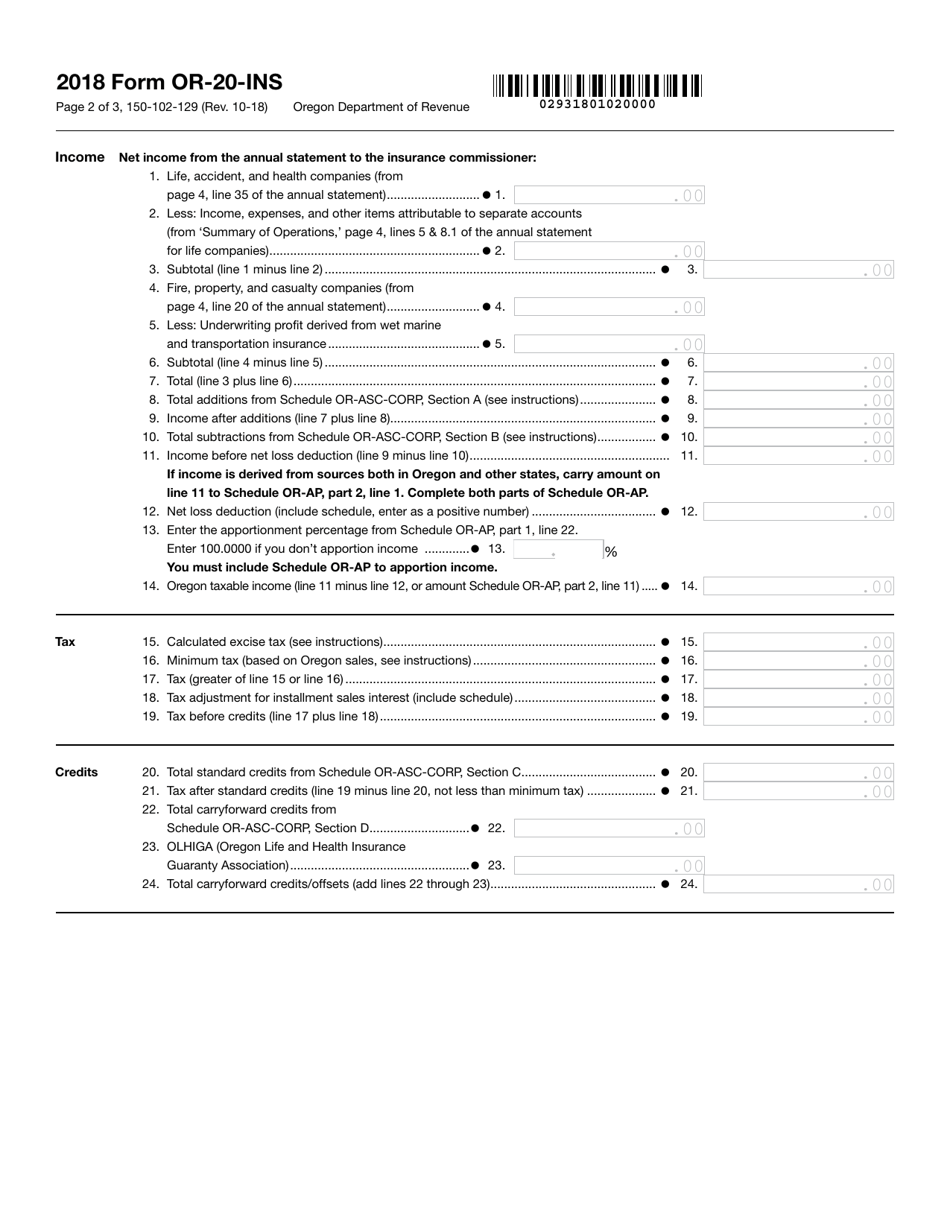

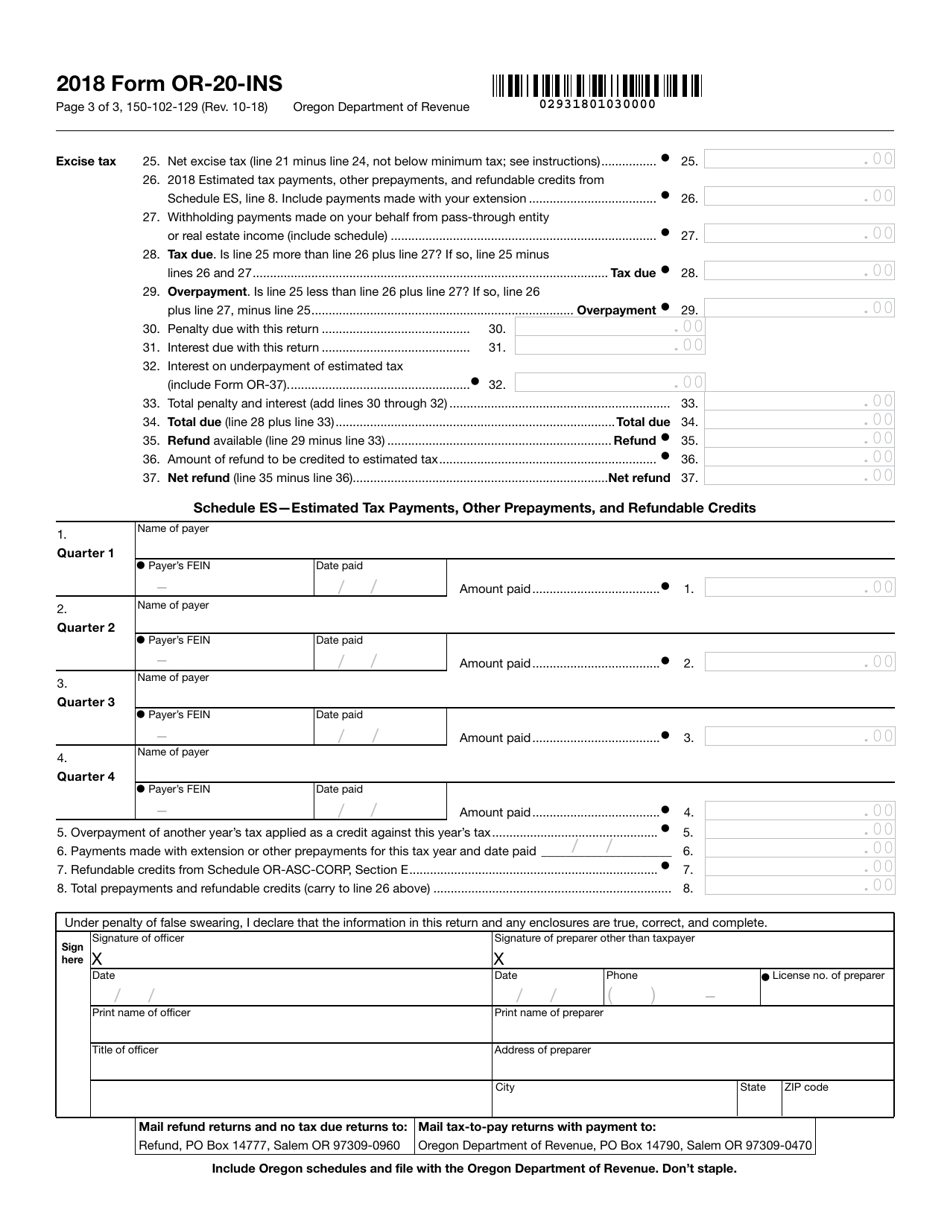

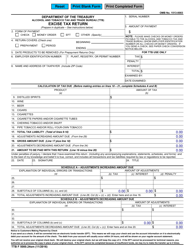

Q: What information is required on Form 150-102-129?

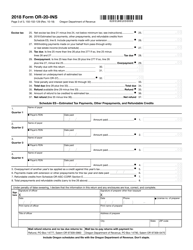

A: The form requires information about the insurance company, premiums received in Oregon, deductions, credits, and the amount of tax due.

Q: When is Form 150-102-129 due?

A: Form 150-102-129 is due on the last day of the month following the end of the calendar quarter.

Q: Is Form 150-102-129 available electronically?

A: Yes, you can file Form 150-102-129 electronically through the Oregon Department of Revenue's electronic filing system.

Q: Are there any penalties for late filing of Form 150-102-129?

A: Yes, penalties and interest may apply if you fail to file or pay the tax on time.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-102-129 (OR-20-INS) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.