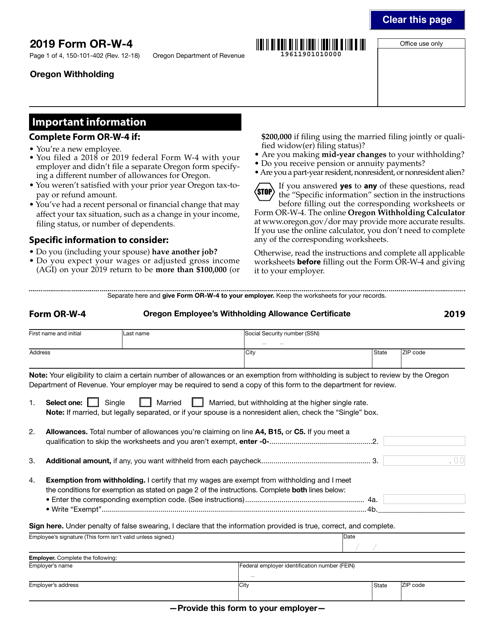

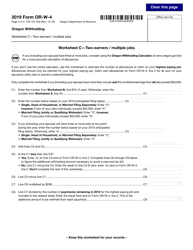

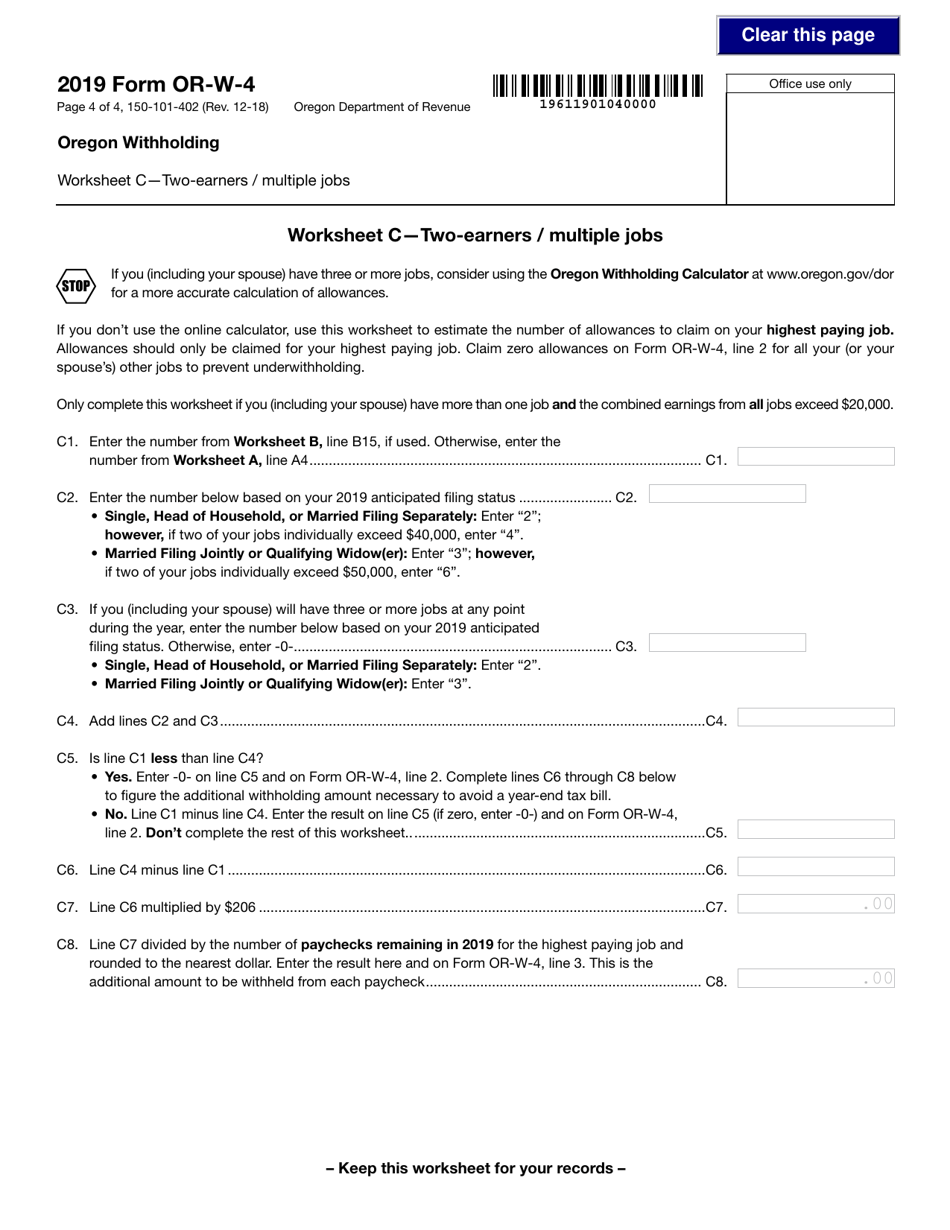

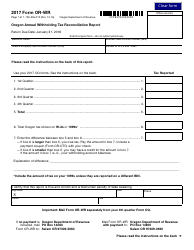

Form 150-101-402 (OR-W-4) Oregon Withholding - Oregon

What Is Form 150-101-402 (OR-W-4)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-402 (OR-W-4)?

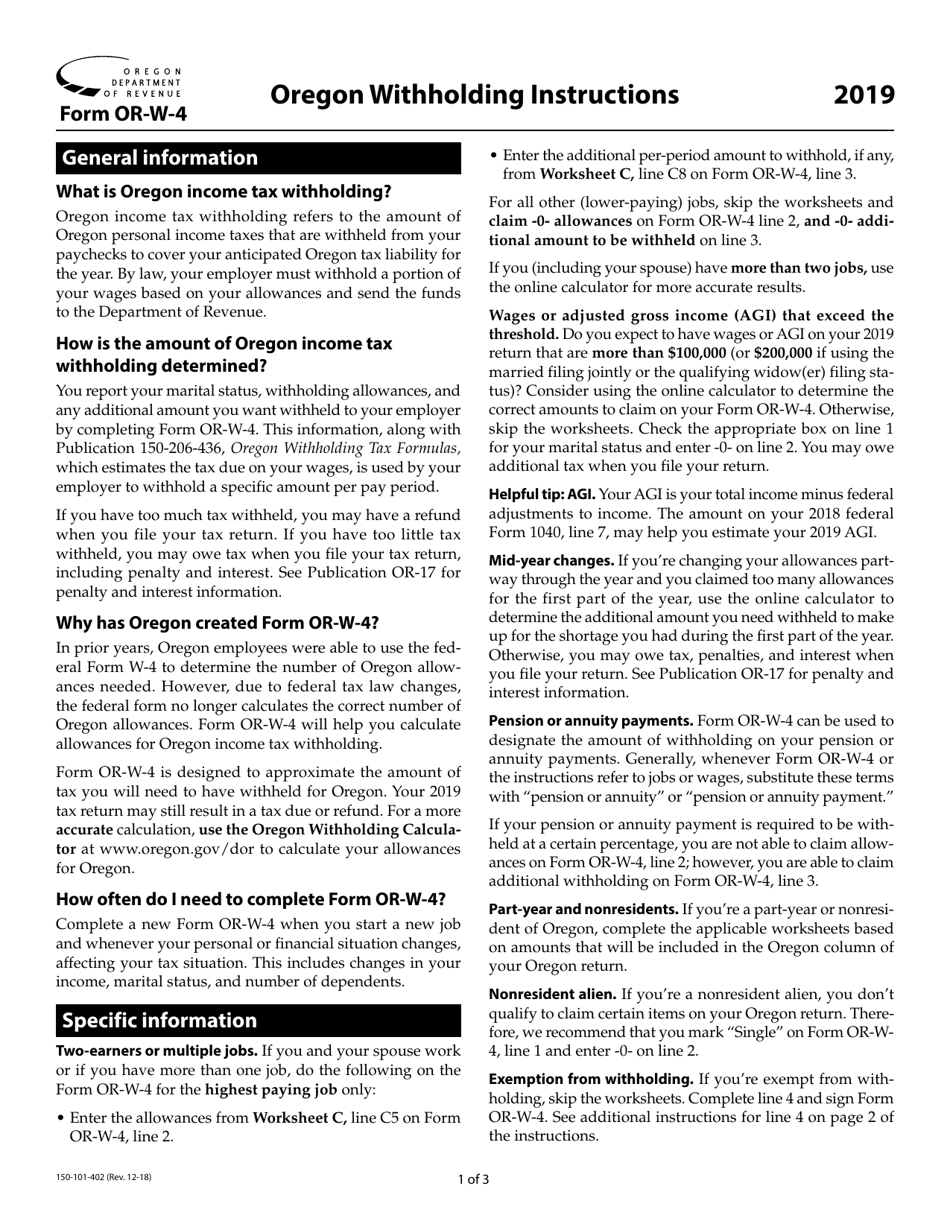

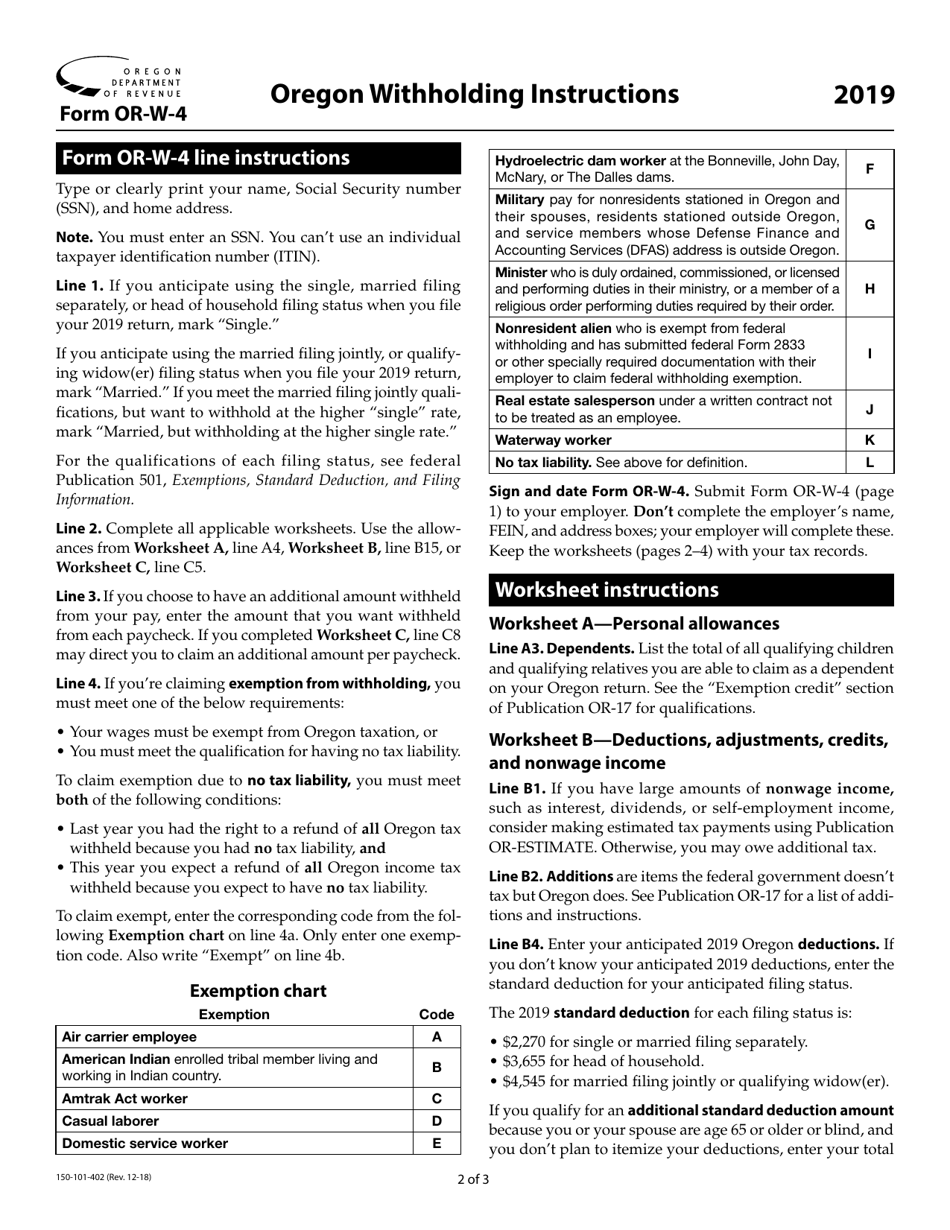

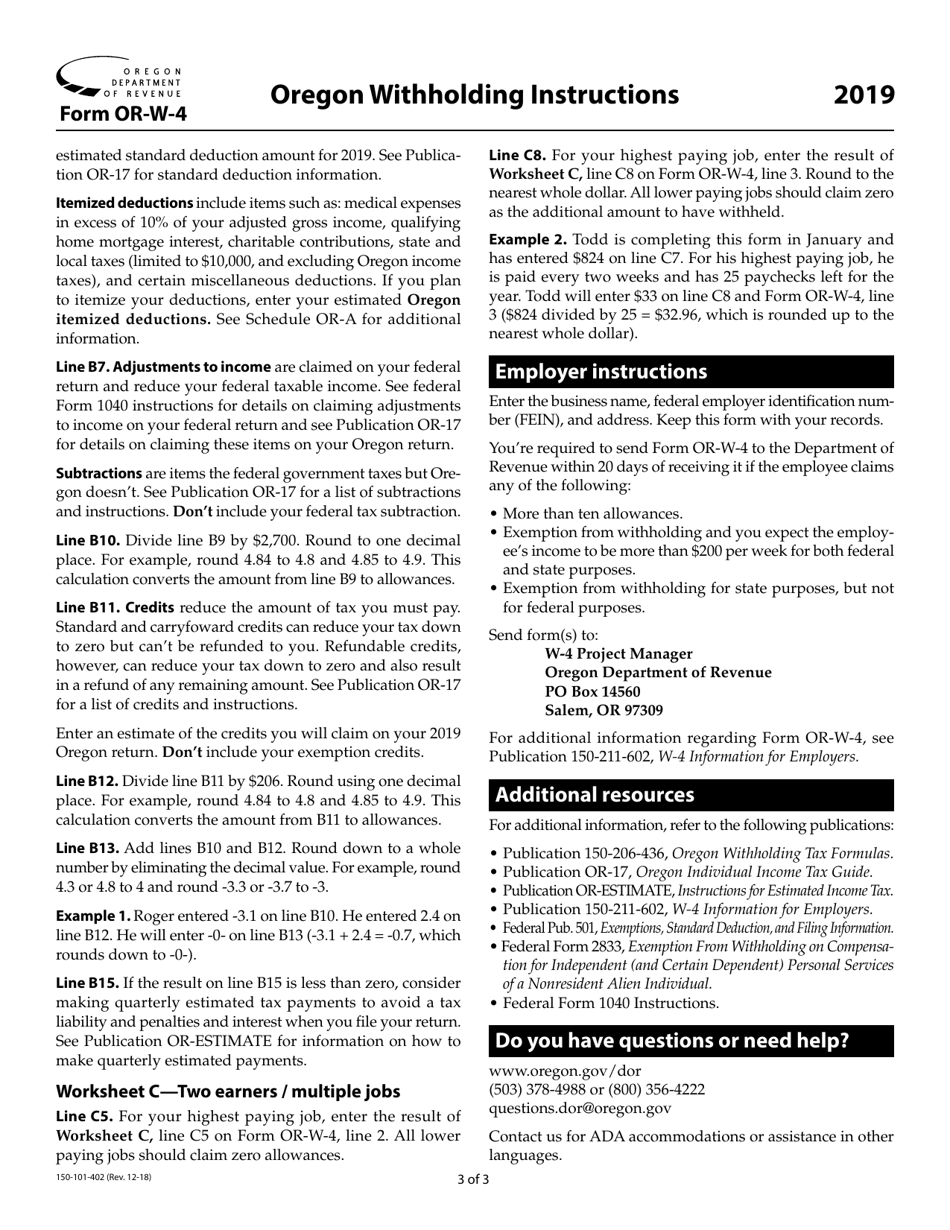

A: Form 150-101-402 (OR-W-4) is the Oregon withholding form, used for determining the amount of state income tax to be withheld from an employee's paycheck.

Q: Who needs to fill out Form 150-101-402 (OR-W-4)?

A: Employees working in Oregon who want to adjust the amount of state income tax withheld from their paychecks need to fill out Form 150-101-402 (OR-W-4).

Q: How do I fill out Form 150-101-402 (OR-W-4)?

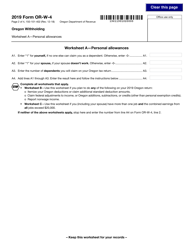

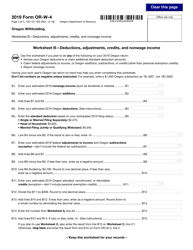

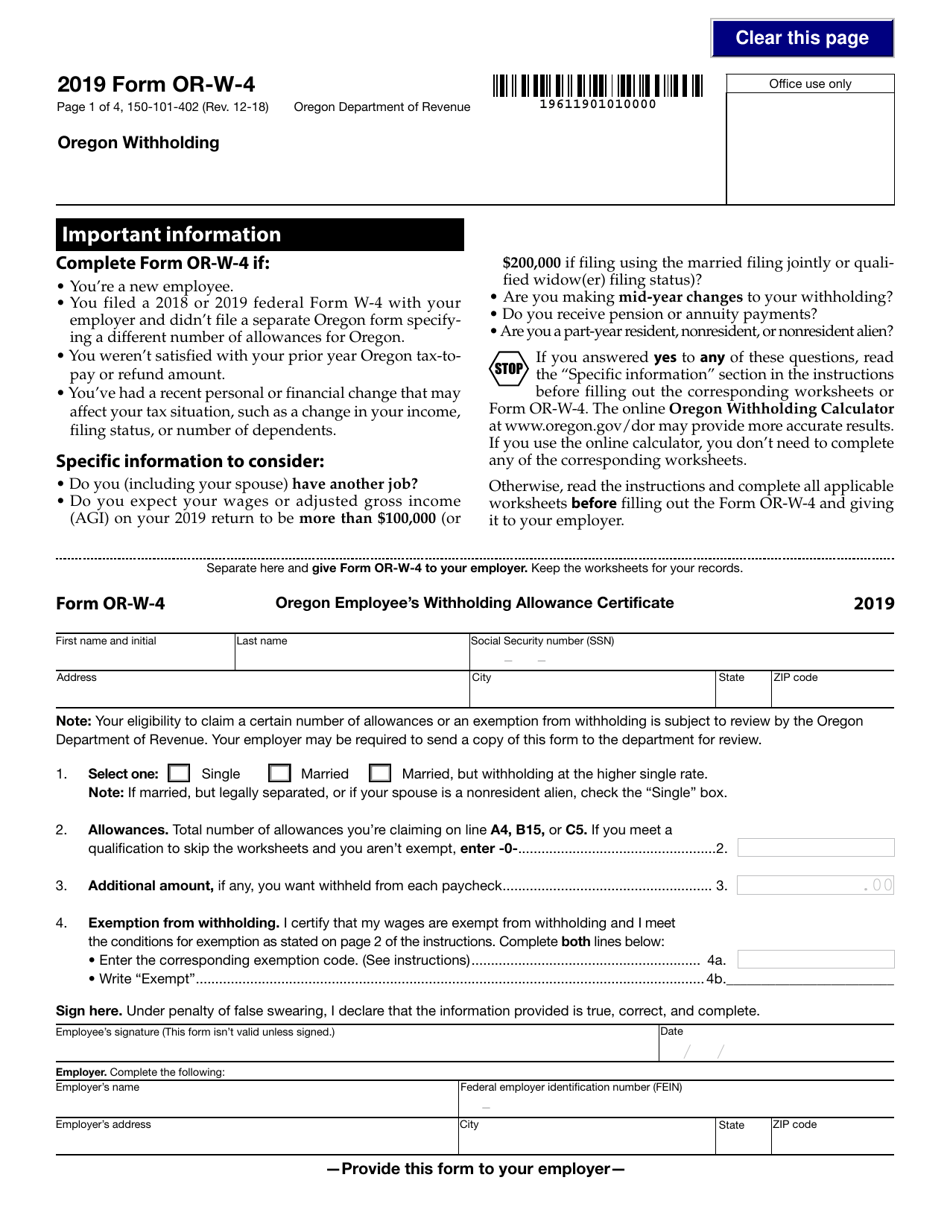

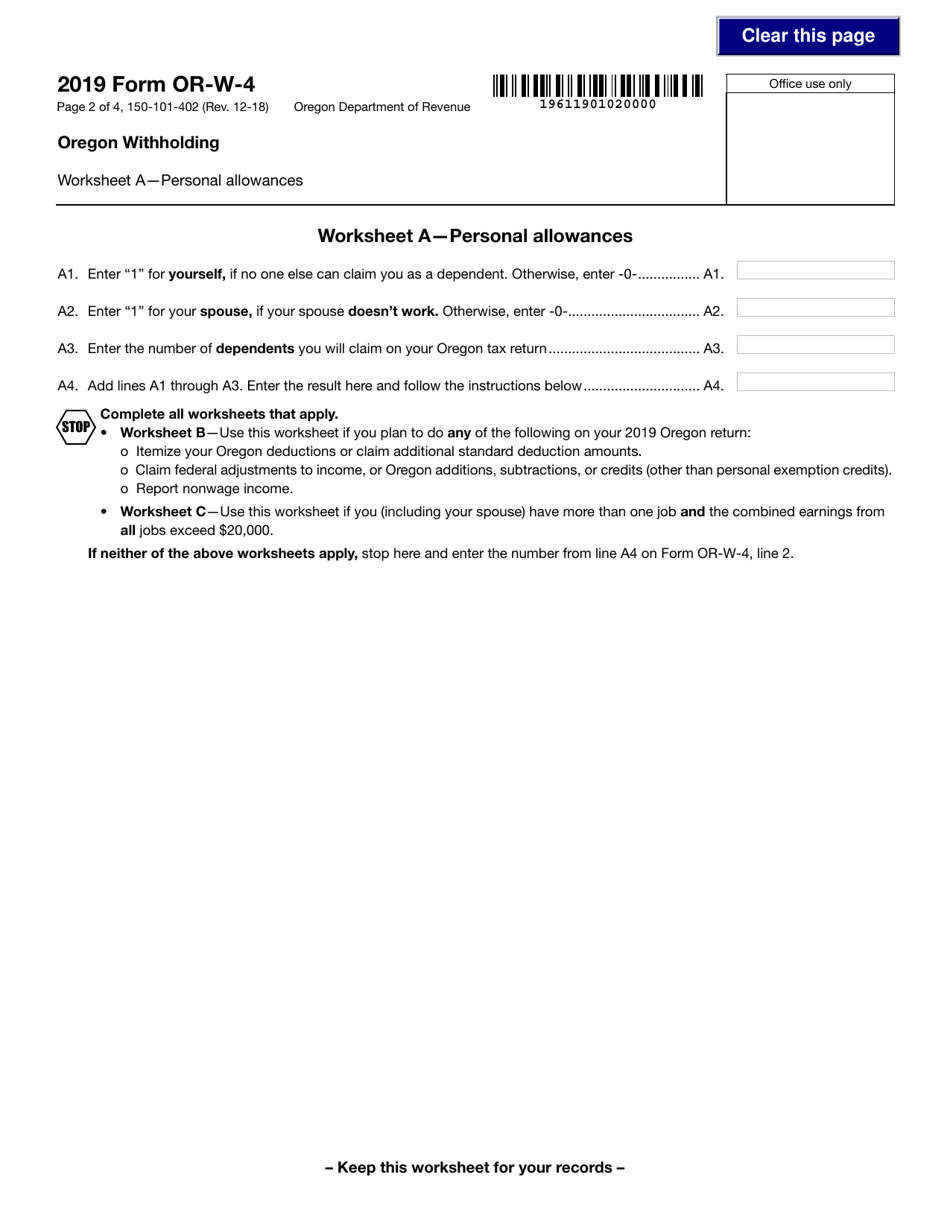

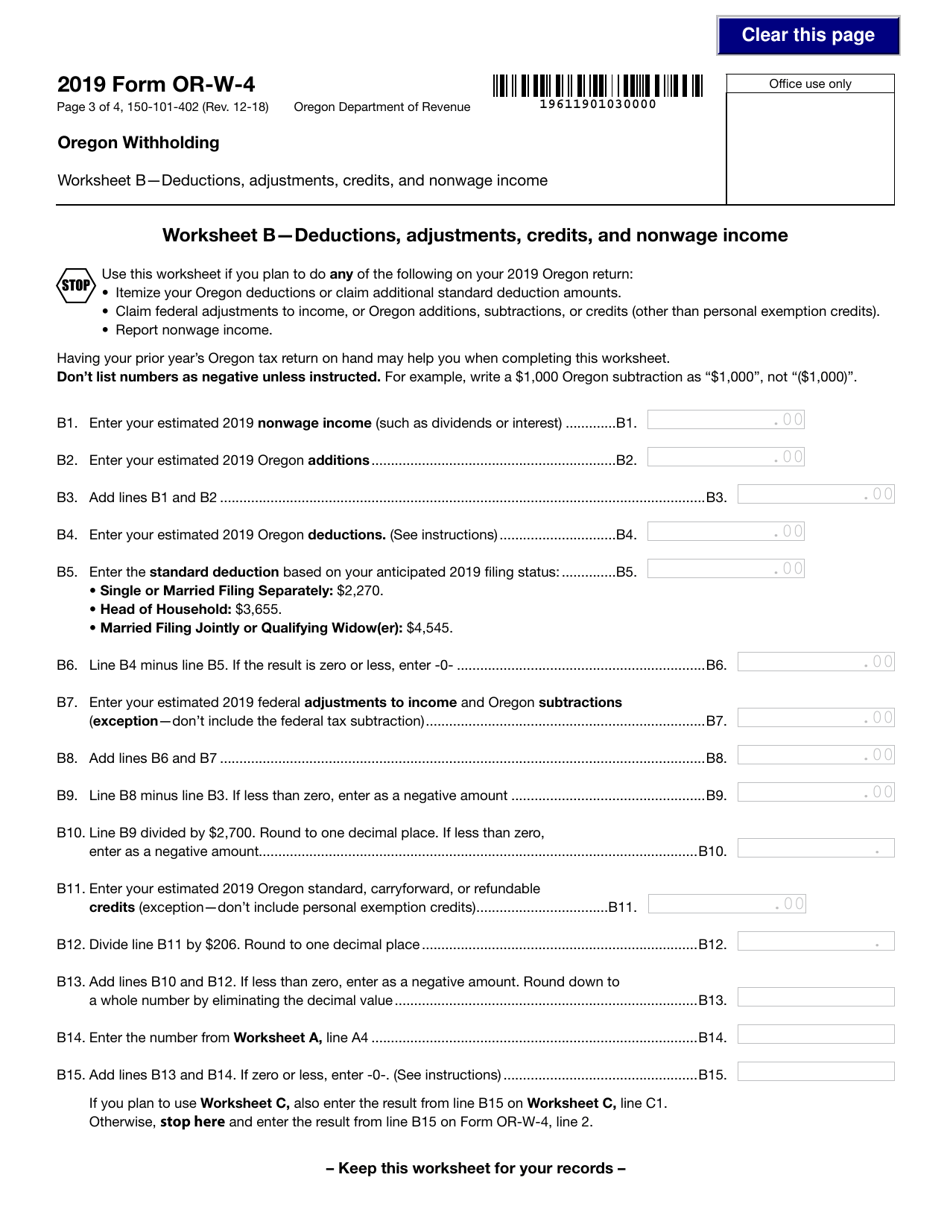

A: You must provide your personal information, including your name, social security number, and address. You also need to indicate your filing status and the number of allowances you are claiming.

Q: When should I submit Form 150-101-402 (OR-W-4)?

A: You should submit Form 150-101-402 (OR-W-4) to your employer as soon as possible after starting a new job or if you need to make changes to your withholding.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-402 (OR-W-4) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.