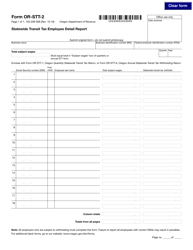

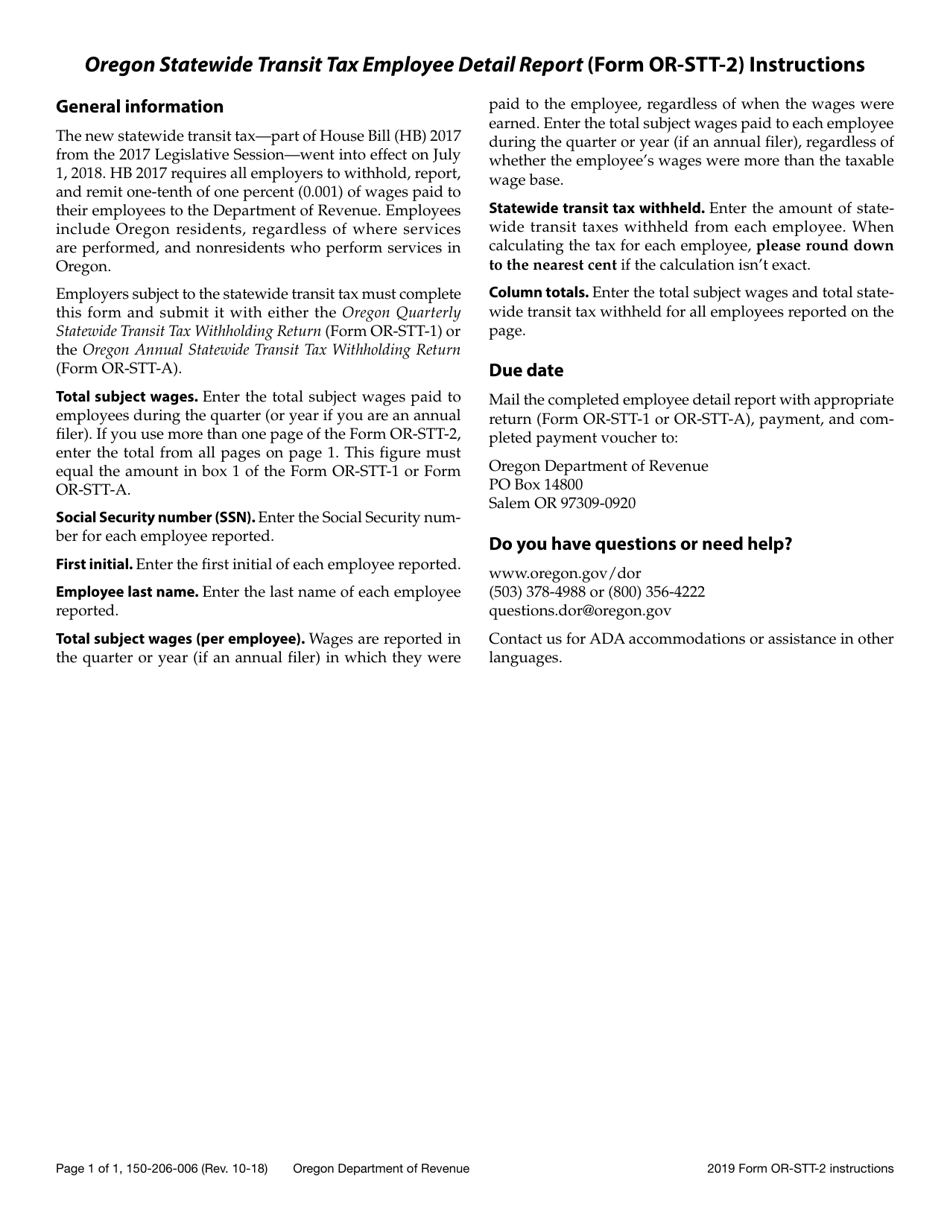

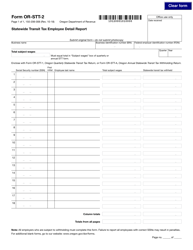

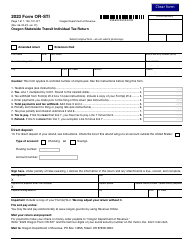

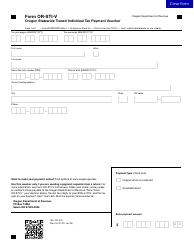

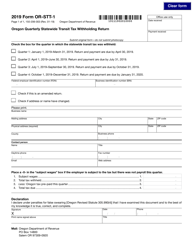

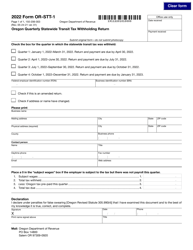

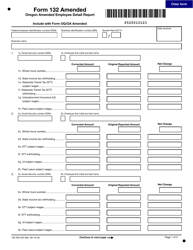

Form 150-206-006 (OR-STT-2) Statewide Transit Tax Employee Detail Report - Oregon

What Is Form 150-206-006 (OR-STT-2)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-206-006?

A: Form 150-206-006 is the Statewide Transit Tax Employee Detail Report for Oregon.

Q: What is the purpose of Form 150-206-006?

A: The purpose of Form 150-206-006 is to report employee details for the Statewide Transit Tax in Oregon.

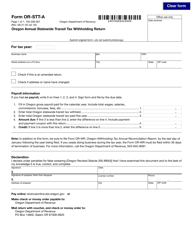

Q: Who needs to file Form 150-206-006?

A: Employers in Oregon who are subject to the Statewide Transit Tax must file Form 150-206-006.

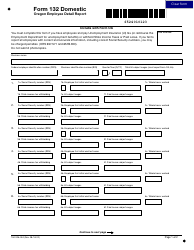

Q: What information is required on Form 150-206-006?

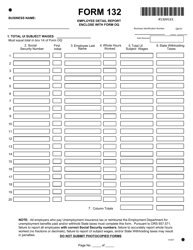

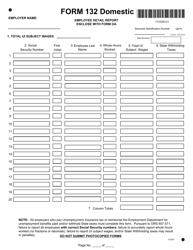

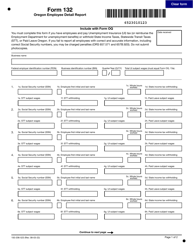

A: Form 150-206-006 requires the employer to report employee details, including names, Social Security numbers, wages subject to the Statewide Transit Tax, and amounts withheld.

Q: How often does Form 150-206-006 need to be filed?

A: Form 150-206-006 must be filed quarterly by the last day of the month following the end of the quarter.

Q: Is there a penalty for not filing Form 150-206-006?

A: Yes, there can be penalties for not filing Form 150-206-006 or filing it late. It is important to comply with the filing requirements.

Q: Are there any exceptions to filing Form 150-206-006?

A: Yes, certain employers may be exempt from filing Form 150-206-006. It is recommended to check with the Oregon Department of Revenue for specific exemptions and requirements.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-206-006 (OR-STT-2) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.