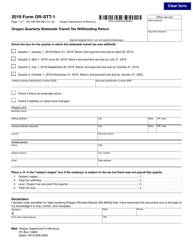

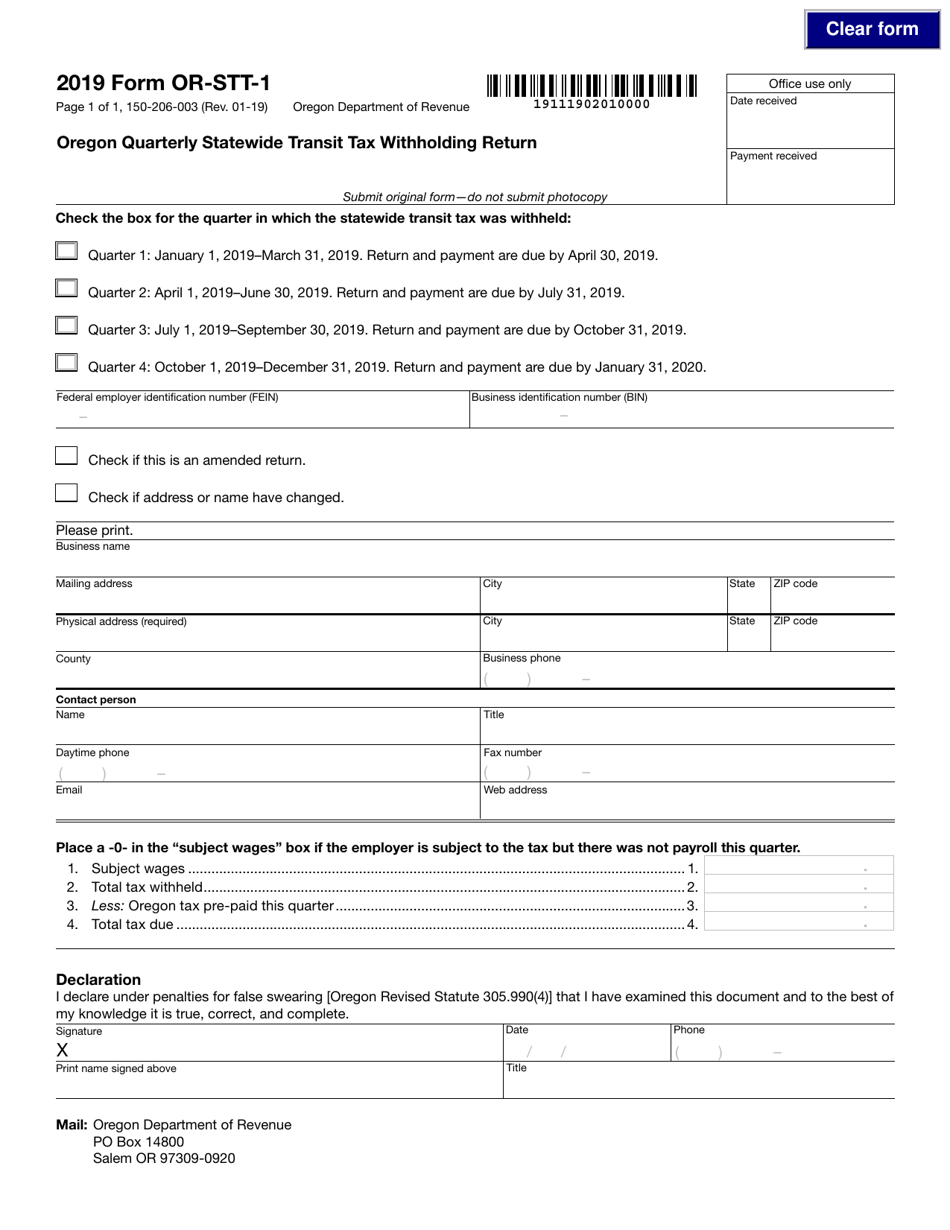

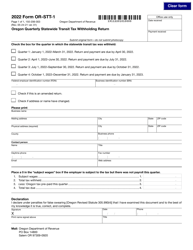

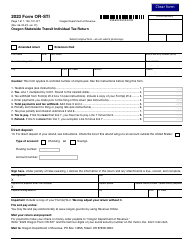

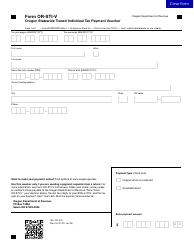

Form 150-206-003 (OR-STT-1) Oregon Quarterly Statewide Transit Tax Withholding Return - Oregon

What Is Form 150-206-003 (OR-STT-1)?

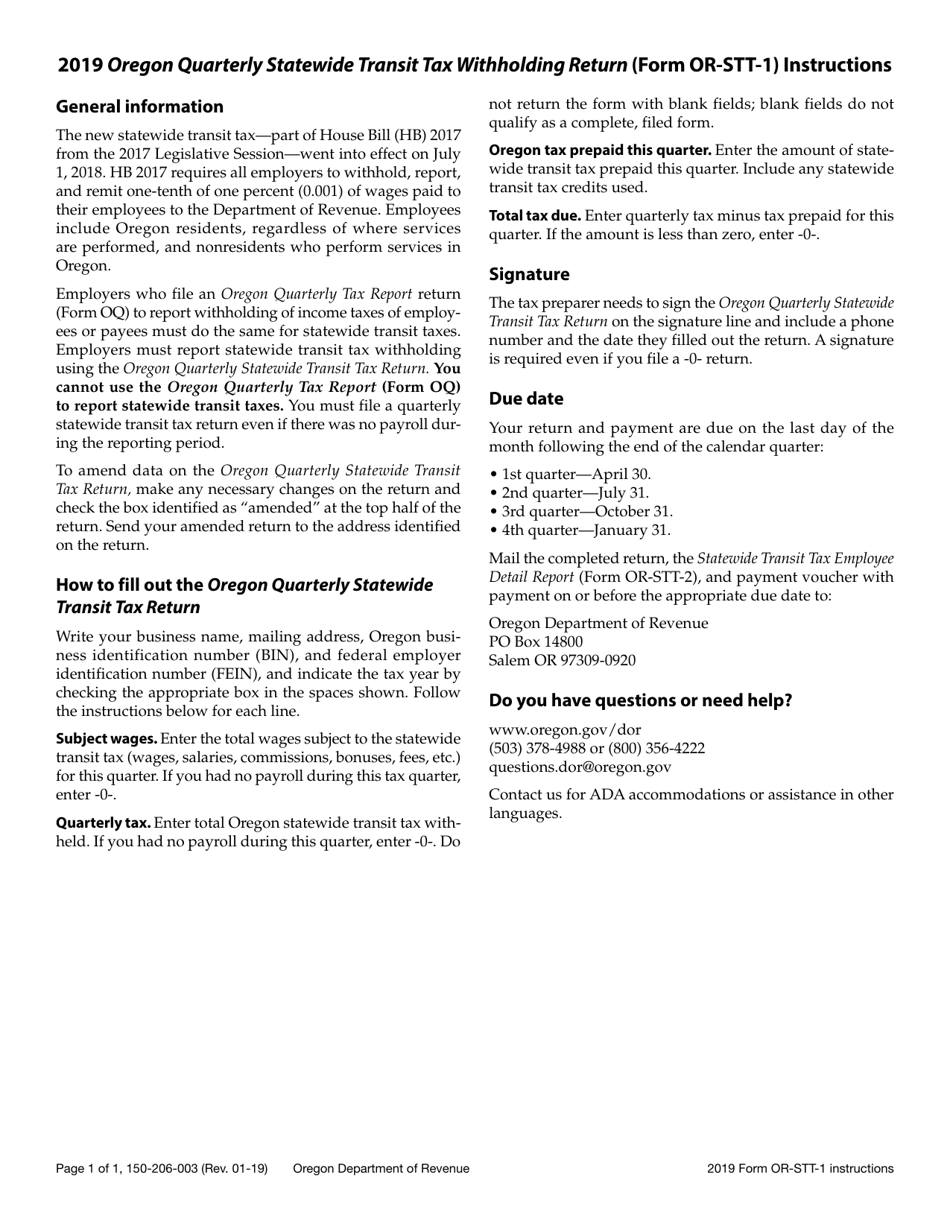

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

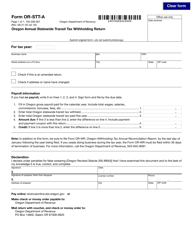

Q: What is Form 150-206-003?

A: Form 150-206-003 is the Oregon Quarterly Statewide Transit Tax Withholding Return.

Q: What is the purpose of Form 150-206-003?

A: The purpose of Form 150-206-003 is to report and remit the Oregon Quarterly Statewide Transit Tax withholding.

Q: Who needs to file Form 150-206-003?

A: Employers who have employees working in Oregon and are required to withhold the Statewide Transit Tax must file Form 150-206-003.

Q: When is Form 150-206-003 due?

A: Form 150-206-003 is due on a quarterly basis, with the due dates being April 30, July 31, October 31, and January 31.

Q: Is there a penalty for not filing Form 150-206-003?

A: Yes, there can be penalties for not filing or late filing of Form 150-206-003. It is important to timely file the form to avoid penalties.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-206-003 (OR-STT-1) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.