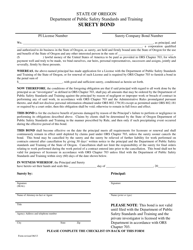

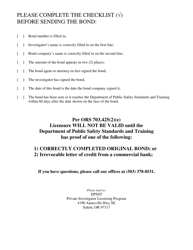

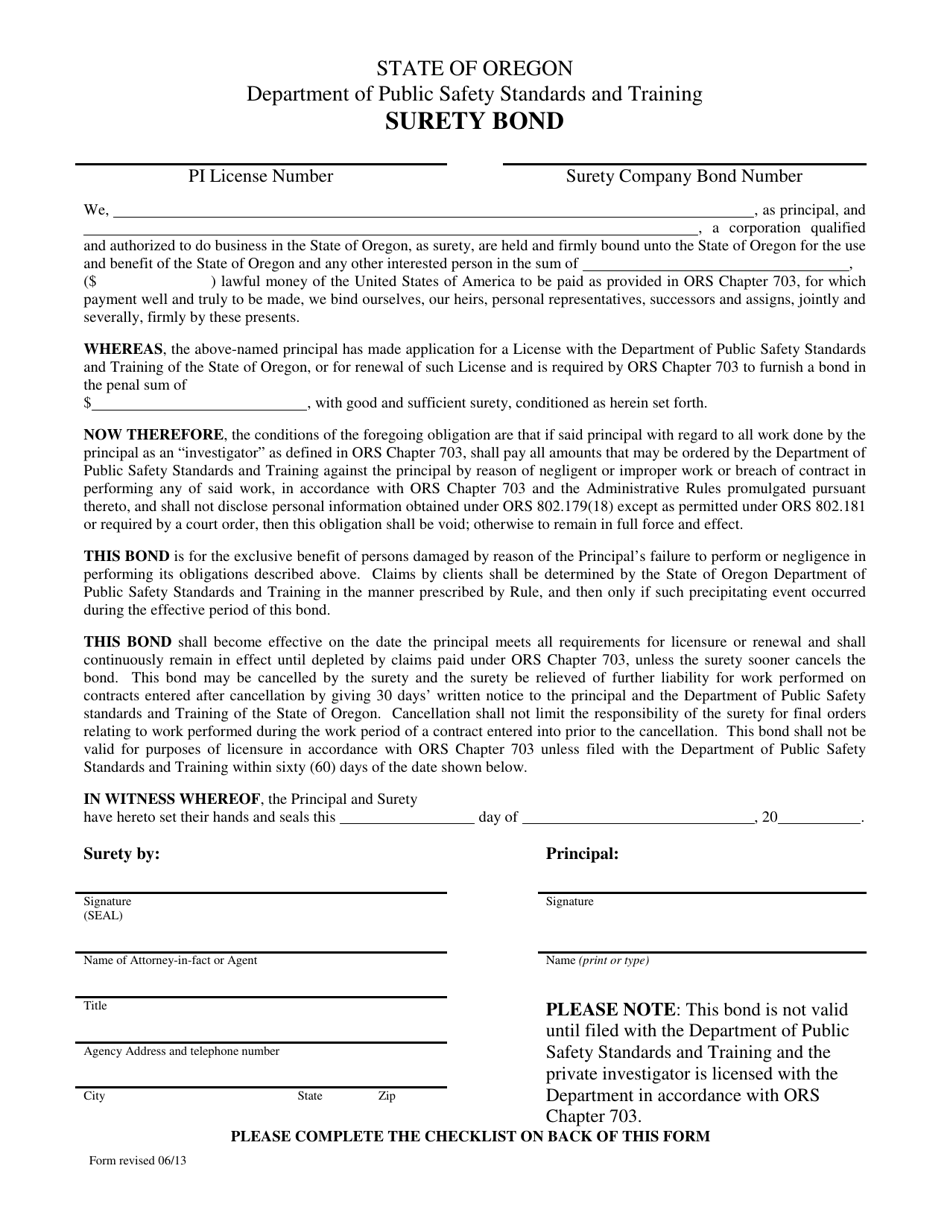

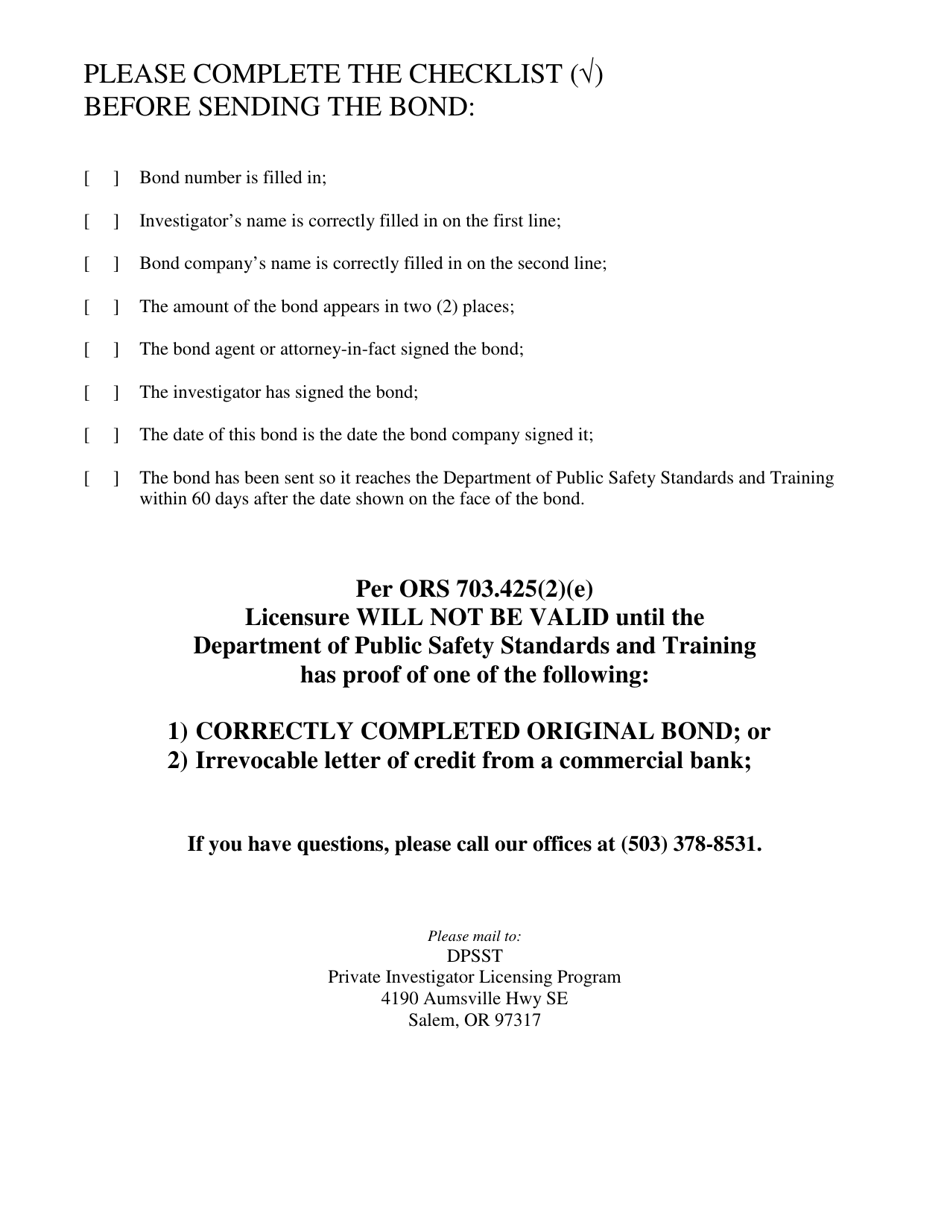

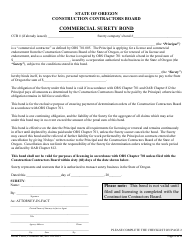

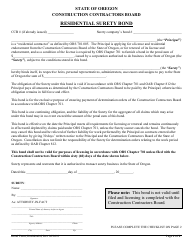

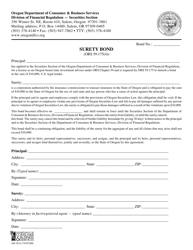

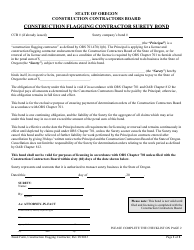

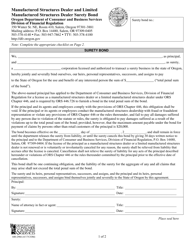

Surety Bond Form - Oregon

Surety Bond Form is a legal document that was released by the Oregon Department of Public Safety Standards and Training - a government authority operating within Oregon.

FAQ

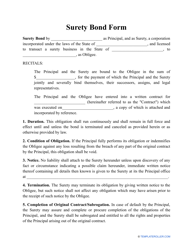

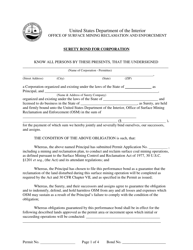

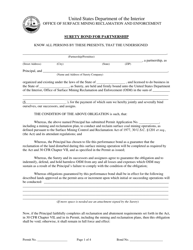

Q: What is a surety bond?

A: A surety bond is a legal contract between three parties: the principal (the person or business required to post the bond), the obligee (the individual or entity requiring the bond), and the surety (the company that provides the bond).

Q: Why would I need a surety bond?

A: You may need a surety bond if you are in a profession or industry that requires it for licensure or as a form of financial protection for clients or customers.

Q: Do I need a surety bond in Oregon?

A: The need for a surety bond in Oregon depends on the requirements of your specific profession or business. It is best to check with the appropriate licensing or regulatory agency to determine if a bond is required.

Q: How do I obtain a surety bond in Oregon?

A: To obtain a surety bond in Oregon, you will need to find a licensed surety bond provider in the state. They will guide you through the application process and provide you with the necessary bond form.

Q: What information is required to apply for a surety bond?

A: The information required to apply for a surety bond may vary depending on the type of bond and the specific requirements of your profession or business. Generally, you will need to provide personal and financial information, as well as details about your business or professional activities.

Q: How much does a surety bond cost in Oregon?

A: The cost of a surety bond in Oregon varies depending on factors such as the bond amount, the type of bond, and the applicant's credit history. It is best to request a quote from a surety bond provider to get an accurate cost estimate.

Q: How long does it take to get a surety bond in Oregon?

A: The time it takes to get a surety bond in Oregon can vary depending on the specific bond type and the individual circumstances of your application. It is recommended to start the application process well in advance of your desired effective date.

Q: Can I get a surety bond with bad credit?

A: It may be more difficult to obtain a surety bond with bad credit, but it is not impossible. Some surety bond providers offer options for applicants with less-than-perfect credit histories.

Q: Can I cancel a surety bond in Oregon?

A: Yes, a surety bond can generally be canceled in Oregon. However, the specific cancellation terms and process may vary depending on the bond type and the terms of the bond contract.

Q: What happens if I don't have a required surety bond?

A: If a surety bond is required for your profession or business and you do not have one, you may face consequences such as fines, license suspension or revocation, and legal liability for damages incurred by clients or customers.

Form Details:

- Released on June 1, 2013;

- The latest edition currently provided by the Oregon Department of Public Safety Standards and Training;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Department of Public Safety Standards and Training.