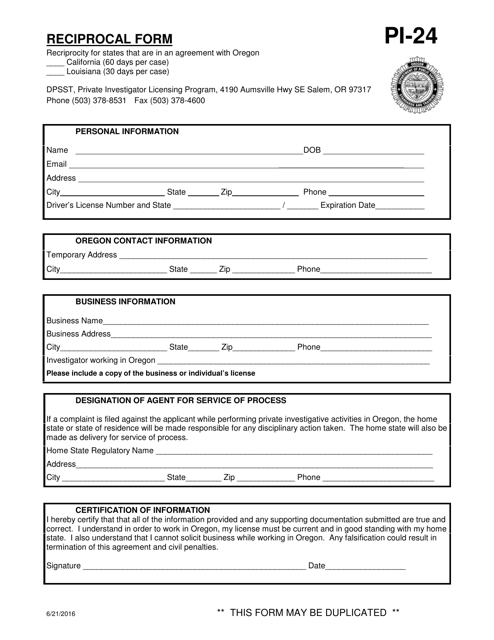

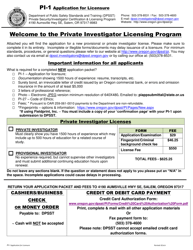

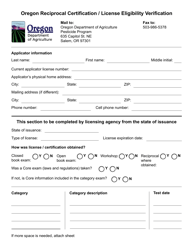

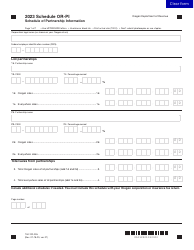

Form PI-24 Reciprocal Form - Oregon

What Is Form PI-24?

This is a legal form that was released by the Oregon Department of Public Safety Standards and Training - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PI-24?

A: Form PI-24 is the Reciprocal Form used in Oregon.

Q: What is the purpose of Form PI-24?

A: The purpose of Form PI-24 is to report reciprocal income tax withholding for residents of Oregon who work in other states that have a reciprocal agreement with Oregon.

Q: Who needs to file Form PI-24?

A: Residents of Oregon who work in states with reciprocal agreements with Oregon need to file Form PI-24.

Q: Which states have reciprocal agreements with Oregon?

A: The states that have reciprocal agreements with Oregon are California, Idaho, and Washington.

Q: What information is required on Form PI-24?

A: Form PI-24 requires information about the taxpayer's income, tax withheld, and the state where the work was performed.

Q: When is Form PI-24 due?

A: Form PI-24 is due on the same date as your Oregon Individual Income Tax return, which is typically April 15th.

Q: Is there a penalty for not filing Form PI-24?

A: Yes, there may be penalties for not filing Form PI-24 or for filing it late. It is important to file the form by the deadline to avoid penalties.

Form Details:

- Released on June 21, 2016;

- The latest edition provided by the Oregon Department of Public Safety Standards and Training;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PI-24 by clicking the link below or browse more documents and templates provided by the Oregon Department of Public Safety Standards and Training.